We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process. In this article we will try to understand what do we need to avoid for our Investing process and also to find out logical and realistic solutions.

If you seek people knowledge about investing, different person will come up with different suggestions. They would say, do this and do that etc. But, very few will say about what not to do. That’s why it will be a series about what we need to avoid.

Previously we have already discussed about:

In this article we will discuss about why you not use equity for short term investment. I have learnt an interesting concept about Sequence of Returns Risk, the risk related to equity Investing from beloved Pattu Sir. I will try my best to make you understand that. So, let’s start.

*******

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

Nowadays everyone is looking for ways to make their money work harder. Everyone has some needs and wants. For short term needs and wants, you have to dive into the world of short term investments.

Maybe you have hard that equity investments can be a quick and profitable way to grow your money. It’s true that short term equity investments can be very tempting. The returns in equity investments are often termed as CAGR or the growth rate of your Investments. Desire of getting high CAGR in a short period of time is undeniable.

But before you take decisions about investing in equity instruments for short term, let’s talk about the crucial concept or underline risk that often goes unnoticed – sequence of returns risk. So, let’s understand CAGR first and then sequence of returns risk.

What is CAGR?

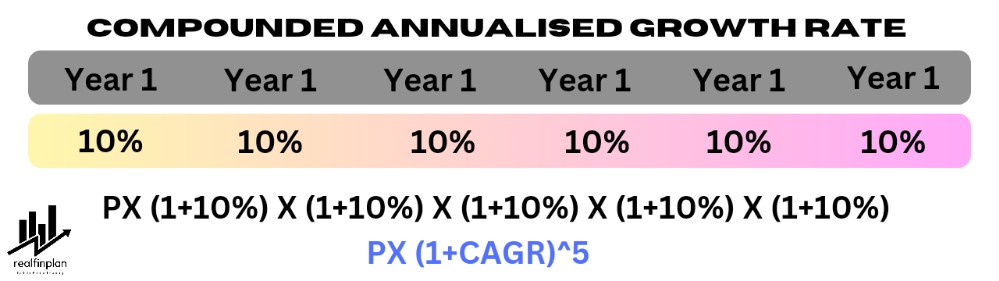

Suppose you have an investment that gives you 10% yearly return over 5 years. What’s the average return that you have got over these 5 years? What is the average year on year growth rate? You will say that it’s 10%. That’s the Compounded Annualized Growth Rate or CAGR.

Now, to get that CAGR, you take the principal amount P, multiply it by (1+10%) 5 times. So, Amount=Px(1+CAGR)^5. This CAGR in this case is 10%. It’s the geometric average or multiplicative average.

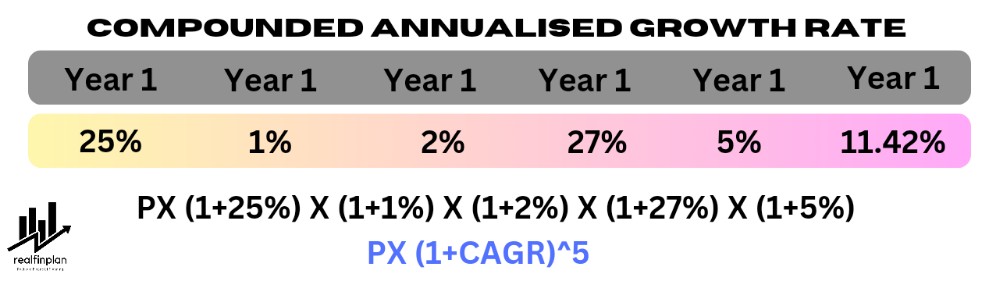

Now, suppose in another Investment gives you variable returns. 25% in the first year, 1% in the second year, 2% in the third year, 27% in the 4th year and 5% in the 5th year. What is the year on year growth rate?

You again can take the Principal P and multiply it by growth rate in different 5 years or you can equate it again with P X (1+CAGR)^5 and calculate the CAGR. In this case, you will get the multiplicative average of 11.42%.

Investment Planning: What Is Sequence of Returns Risk?

Sequence of Return risk refers to the danger of experiencing negative returns on your investments at the wrong time. It can happen at any point of the time period. Be it during the early years of your investment journey or when you need to access your investments to meet short term goals. This can severely impact your portfolio performance and you could suffer irreparable damage due to lack of time.

An Illustration: Volatile Compounding

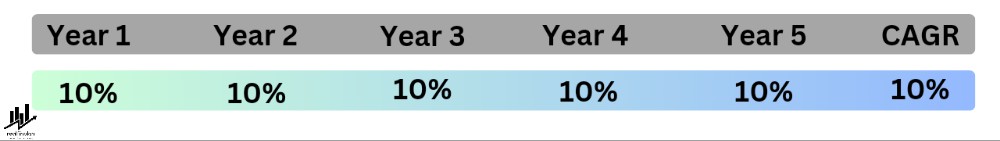

Again consider all 5 years with same returns of 10%. So the CAGR is again 10%

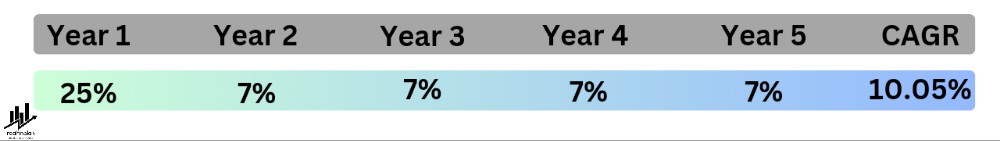

Now, suppose I invested in a very volatile instruments got a fantastic returns of 25% in the 1st year. Then I thought, I am happy with it, I am gonna quit now and invest the amount in a fixed income instrument. I will get a return of 7% for the rest of the years. Then my CAGR will be around 10%.

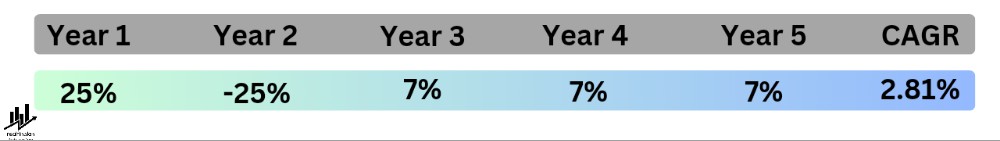

In second example, suppose I get that 25% in the 1st year. Then I became greedy and thought let’s stay with this volatile instrument for one more year. Second year I get -25%. Then I get panicked and quit and then I invest that in a fixed income instrument. I get 7% for the rest of the 3 years. My CAGR will only be about 3%.

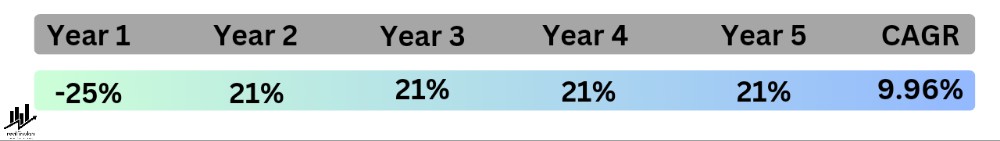

In third case, suppose I get -25% in the first year. If I want to get a CAGR of 10% at he end of 5 years, I must get a return of 21% every year for the rest of the 4 years. This is pretty much impossible and unrealistic. Right?

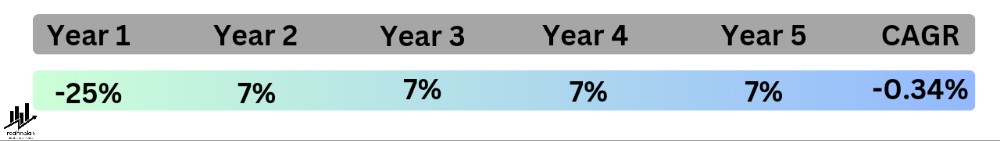

Last example: If I get -25% in the first year and I say that equity is not for me. I quit and invested the amount in fixed income instrument. I get 7% return yearly for the rest of the 4 years. My CAGR will be negative, -0.34%.

If you closely notice, you will see, if you get a bad year it’s not possible to recover within a short period of time. It takes a long time to recover from the big minus like -25%. Or you need to get higher returns to actually get your target return of 10% which is pretty much unrealistic.

That’s sequence of returns risk or timing luck. You get a good year, everything looks fine. But if you get a bad year, you will not have the time to recover within a short period of time. This is the primary reason you should avoid equity for short duration.

Learn more about Sequence of Returns Risk and how it can impact our financial well being in real, in our other article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

We have also discussed in that article that Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk. We have also discussed topics about Asset Allocation in our other articles:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Mistakes to avoid for Asset Allocation: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Why you should avoid equity for short term investment planning?

Equity investments offer the potential for higher returns in a relatively short period. Investors often appreciate the flexibility of short term equity Investments. They think they can enter and exit position with ease as per market conditions. While the rewards may seem awesome, short term equity investments are particularly vulnerable to sequence of returns risk.

Volatility

Equities are so risky for their price volatility. In the short term, stock prices can fluctuate wildly due to various factors. It can be economic news, company performance or market sentiment etc. If you need to cash out your investments when the market is down, you may end up with less money than you initially invested.

Lack of predictability

Short term investment goals often come with shorter time horizon. Equity don’t follow a predictable pattern in the short term. Yes, you may achieve substantial gains. But, there is also a probability that you suffer significant losses.

Timing risk

The sequence of returns risk enhances the importance of timing. It can easily happen that you start your short term investment journey and due to a market downtown you can experience losses early on. This can damage your financial goals.

Limited time Horizon

Short term goals typically have a shorter time Horizon. If you get one bad year, you will not have the luxury to recover within a short period of time. This can magnify the impact of negative Returns.

Thumb rule: to approach for short term investment planning

When it comes to investing, time horizon plays a crucial role. Short term investments involve holding assets for a brief period. On the contrary long term investments are held for many years, by giving your investments time, to grow substantially.

Equity can be a powerful tool for long term wealth accumulation. But they may not be the best choice for short term investment goals. The main reason is that, you may not have the luxury to recover from the damage created by sequence of returns risk.

To safeguard your short term investments, you need to avoid equity as investment vehicle. Remember, we should never run after returns. We need to achieve the target corpus. That should be our soul purpose of investing.

Always use safer investment products like Bank FD, Bank RD, liquid fund, money market fund or NSC or KVP etc. Or simply you can follow the following thumb rule:

- For Goals < 1 year – FD, RD and liquid fund.

- For 1 year < Goals < 3 years of goal – FD, RD, Liquid Fund, Arbitrage Fund and Money Market Fund.

- For Goals <= 5 years – FD, RD, Tax Saver FD, NSC, KVP, Liquid Fund, Arbitrage Fund, Money Market Fund and Ultra Short Term Bond fund.

Frequently Asked Questions (FAQs):

Can short term equity investments ever be a good idea?

Yes, everything has a probability of happening. Short term equity investments can be profitable for experienced investors or professionals with a high risk tolerance. However they are generally not recommended for retail investors.

Are there tax implications for short term equity Investments?

Yes short term capital gains are typically taxed at higher rate than long term gains. Be sure to consider the tax consequences while making any investment decisions.

Can I use equity for short term investments with no risk?

Well there is no such thing as risk free investment in equity. Equity always comes with a certain degree of risk and uncertainty. It’s volatile and unpredictable. So using equity for short term investment can be very risky.

How can I protect my short term investment from sequence of return risk?

Simple, just avoid equity related instruments for short term Investments.

Should I consult with a financial advisor for my short term Investments?

Yes, consulting with a financial advisor is always a good decision. Financial advisor can help you create a tailored investment strategy that aligns your short term goals and risk tolerance. But remember, always look for Fee-only Certified Financial Planners (CFP), not the commission based advisory services.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023