In this article, I will tell about how I started thinking about my financial planning and analysis, and how I completed my first Portfolio Review.

Previously, I discussed an accident that happened in 2016 and changed my life. I also talked about how I started my investment journey from scratch and began using various investment products such as RD, FD, NSC, and various Mutual Funds.

I would request the readers to complete the previous articles about my journey so that they can understand how my thought process of investing changes over time.

- Part 1: An Accident That Changed My Life: Learnt About Discipline, The Key To Financial Stability

- Part 2: How I Started My Investment Journey? 2018 – 2019: The Years Of Product-Based Approach

How did I shift towards a process-based approach from a product-based approach? So, let’s start with the beginning of my Financial Planning And Analysis.

****************

In realfinplan, we try to provide realistic, authentic, unbiased, and free educational content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

From the year 2019, I became crazy about mutual funds and wanted to taste all kinds of funds. So, I started SIPs with small amounts (some of those SIPs were as low as ₹100/m) in almost each and every category.

I knew was doing the wrong thing, but I wanted to do this. Also, I thought that had I enough time to make some mistakes and learn from them. I decided to observe the market for two years and get an idea about how these kinds of funds perform. The goal was to invest as much as possible, didn’t care about how I invested or where I invested.

By the end of December 2019, I had around 22 funds in my portfolio with maximum weightage in ELSS Funds, Parag Parikh Long Term Equity Fund, and Axis small cap fund.

Some of the Funds I had in my portfolio:

- Axis Midcap

- Axis small (ASC)

- Canara Robeco Small Cap

- Axis Long term equity – ELSS

- Parag Parikh Long Term Equity Fund

- Parag Parikh Tax saver (PPTS) – fund house bias

- Mirae Asset Tax Saver (MATS)

- ABSL 96 (Total 4 ELSS)

- Nippon India Gold fund

- HDFC Sensex Index Fund

- Motilal Oswal Nasdaq 100 index fund

- ICICI Equity Hybrid Fund

- Every kind of hybrid funds, forgot the names

- Some debt funds (Liquid, UST, Short terms, Banking & PSU etc.)

Corona Outbreak: 30% Absolute Loss In My Portfolio Value

Now in 2020, coronavirus outbreak in our country. My total Mutual Fund portfolio investment was ₹2.2L and it came down to ₹1.45L. That’s about a 35% reduction in total portfolio value and about 30% overall absolute loss with respect to my invested value.

I was so scared and had no idea about what to do. The situation was so scary. The market was going down and down and that too like a rocket.

Yes, I knew that the market would rebound from a certain level, but the situation was about a pandemic. Nobody was able to predict the market, even the ace investors of our country and the USA.

Simply, no one can predict the future. Always remember, that return is unknown and uncertain, so you should not run after it. That’s why I always say: Do not run after Returns, rather chase target Corpus.

- Read this concept in detail: Why You Should Not Run After Returns? Rather Chase Target Corpus!

During this time, one thing I did was right – I didn’t withdraw any amount after being panicked. I followed the “Never lose money” concept by Buffet Sir. Instead, I tried to pump money through some lumpsum along with my SIPs.

But, what about my portfolio? It was totally messed up with a lot of funds. Now it was clear to me that a Portfolio should be organized on the basis of financial planning and analysis. I needed to trim down my portfolio so that it looks organized to me.

I stopped some SIPs, waited for all the funds to turn green, and waited for the respective funds to fall under long-term capital gain. Thanks to the next bull run, I didn’t have to sell units at a loss.

I didn’t watch as many movies or something fun like that I used to do. In this year, I watched a lot of YouTube videos. I already followed a lot of channels to gain knowledge about mutual funds. Some of them were:

- InvestYadhna

- Labour Law advisor

- Parimal Ade

- Pranjal Kamra

- Freefincal (a little, due to this channel and InvestYadhna I began to feel good about index Investing)

- CA Rachana Ranade

I started investing in the UTI Nifty 50 index fund for large-cap exposure in my portfolio. This was after watching videos about index Investing on various channels, especially InvestYadhna. At that point in time, I found this InvestYadhna channel so interesting. Their thought process somewhat matching with mine when it comes to mutual funds investing.

During this time I also found freefincal. But I didn’t watch much because I didn’t find things interesting. Later I realised that the contents of freefincal were too mature to understand with my excited small brain.

My Revised monthly Investment after the shock of Corona Wave

- My RD

- ELSS – SIPs in 4 Funds (Mirae Tax, Parag Tax, Axis Tax, ABSL Tax)

- Parag Parikh Flexi Cap – SIP

- Axis Small Cap – SIP

- UTI Nifty 50 – SIP

- Motilal Oswal Nasdaq Index fund – SIP

- Some Debt Funds – SIP

Starting Of Direct Equity Or Stocks Investing

Now my hands were itching to invest in direct Equity or stocks too. But I need to prepare myself for that. So, started to learn about stock investing. For that purpose, another channel I was following a lot was – CA Rachana Ranade. In fact, I did two courses by CA Rachana Ranade (Free of Cost).

- Basics of Stock Market

- Fundamental Analysis of Stocks

Both were by CA Rachana Ranade. These courses are awesome for beginning stock market investing. Started to invest in small amounts slowly. The first stock was Tata Power.

A course of ₹760 that changed my thought process about investing

In the meantime, my wife got pregnant and maturity comes with responsibility. I started to think about investing differently.

InvestYadhna launched a bundle of Courses for a limited period of time:

- Financial Planning

- Mutual Funds

- Basics of Stock market

After watching the promotional video of the “Financial Planning And Analysis Course” for about 1 hour, I was stunned to know how important financial planning is. Now I started to think.

- Due to the coronavirus effect, it was clear to me that no matter what, everyone should have personal health insurance.

- Many individuals were losing their jobs. Many of us were getting a lower salary. So, there should be an emergency fund to challenge these kinds of situations.

- A lot of people died during that pandemic. A lot of families lost their breadwinners. So, no matter what everyone should have term insurance.

- It’s so much more difficult to do Retirement Planning and child education planning with respect to inflation.

Now I began to feel the need for basics.

- Emergency Fund

- Term Insurance

- Health Insurance

- Savings for basic needs in the future

- Deciding Financial Goals

At the end of 2020, I purchased the financial planning course (₹760 only) first. This course was a game-changer in my life. They touched all the basics of personal finance (not intensive planning with asset allocation, that’s why I called it basic) and provided some basic important calculators.

- Retirement calculator

- Education Goal Calculator

- Marriage calculator

- Home loan EMI calculator

- Vehicle calculator

- Wealth creation calculator

- Asset Allocation calculator

- Own Car vs Ola/Uber calculator

- Risk Profile Assessment calculator

I did a lot of thinking and made my own plan. Let’s cover that in my own way.

Covering basics

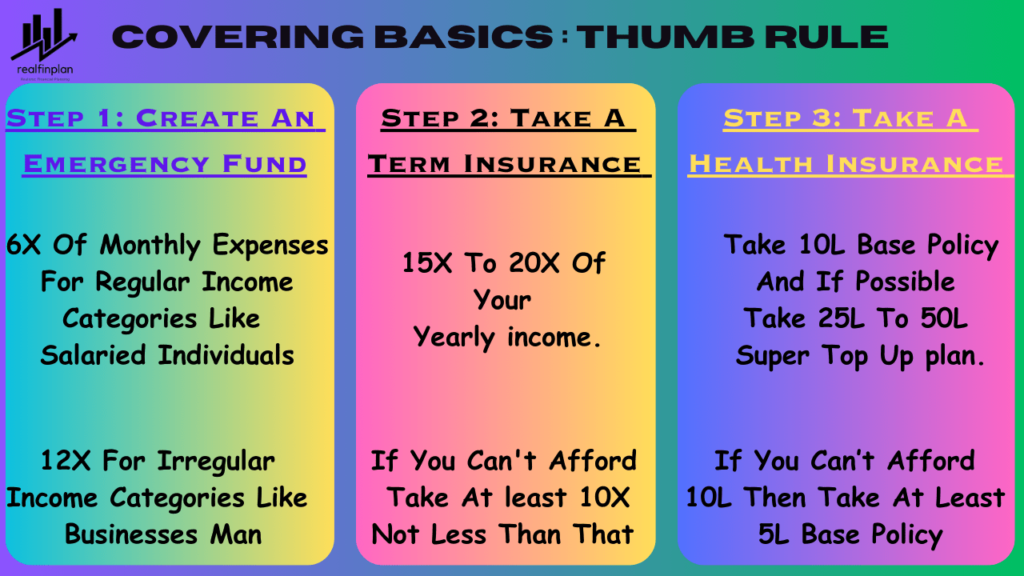

After taking this course I realized the importance of insurance for the first time. If one needs to mitigate financial risks, he or she needs to cover the basics first to secure the financial future. So, I sorted things as per my thought process starting with building an Emergency Fund.

- Emergency Fund – at least 6 months of expenses. (I was pretty much short of the target amount. All thanks to my investing gymnastics.)

- Took term insurance from HDFC LIFE = 5X of my Annual Income

- Took 5L health Insurance from HDFC ERGO

Learn more about the concept in our article: Covering Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future

The starting of Financial Planning And Analysis: Shifting Towards Process-based approach From Product Based Approach

I began to play with numbers in those calculators from InvestYadhna. My thought process began to change and started thinking about everything in a different way.

- First, identified my goals.

- Somewhat tagged my existing investment with them.

- Continued SIP in some funds and stopped further investment in some funds. The focus was more on organizing my investments.

Finding The Purposes: The goals

Listed down all my goals with respect to my “Needs” and “Wants”:

Immediate goals (1yr)

- Emergency fund – Need

- Delivery of my child – Need

- Some important home appliances – Need

- Jewellery for my wife on her birthday – Need

Short-term goals (1-3 yrs)

My father started building a house for me and my brother. I had to help him financially whenever it’s needed. Termed this “Home Decoration” as a goal. Dropped the idea of getting a flat for us as we are happy in Railway Quarters.

- House Decoration – Need

- Buying a Scooty – Want

Medium-term goals (4-7 yrs)

Dropped the idea of buying a car in the near future as it was a “want” not a “need”. Thought about delaying this goal by some years.

- Car – Want

- New Bike – Want

- Vacation – Need

Long-term goals (>10 yrs) – Need

- Child Education

- Child’s Marriage

- Retirement

Child Education became my top priority among long-term goals as it occurred to me as a daunting task due to high inflation (@ 10% inflation, after 18 years, the Cost of Education will be around 5 times what it’s present now).

- At that time, I assumed the Present cost – 15L and Educational inflation @10%. Then after 18 years, the value will be around 89L. That’s a huge amount I need to achieve.

Thought about using a part of matured RD (in 2021 ending) for this goal. Besides this, I thought about continuing my SIP in some funds for this. I thought about managing this goal first then thinking about other long-term goals.

Learn more about the concept of Goal-Based Investment Planning in our article: Investment Planning: Goal Based Investing Basics – Why Do We Need It?

Portfolio Review: Tagging investments with goals

I thought that my investment was too messy and I was totally confused about what to do and how to do it. So I decided to meet a CFP and fixed a meeting with him in my town. I learned a lot of new things during the 3 hours of conversation. It was free of cost.

But he didn’t entertain me much as he was into handling financial decisions on his own on behalf of his customers. He was trying to convince me to invest in active Large cap mutual funds instead of Index funds. Also, he would earn a commission by selling regular mutual funds. I felt it absurd to let others control my money and investment strategy and wasn’t ready for that.

So, I decided to do things by myself. Yes, it will not be easy. Yes, I will make mistakes. Yes, I will be confused. But I made myself mentally ready for that.

Now I started tagging my assets to my goals. A rough tagging was done which is as follows:

Emergency Fund

- Nippon India Liquid Fund – SIP

- The target was to reach 3X first and then try for 6X of my monthly Expenses

Delivery of my child

- My total EPF + EPS balance from my previous job (I was thinking about withdrawing this for 2 years but I was too lazy to do it. Luck favored and now after getting a purpose, I became active to get it done)

- Some liquid fund amount – ABSL Liquid Fund (Stopped any fresh investment)

Jewellery for my Wife

- Some % of my RD

Home appliances

- ICICI liquid fund – SIP

House Decoration

- ABSL Tax Relief 96 Fund (new investment was stopped) – with the ending of lock-in I can use this for my goal

- Some FDs I had

Vacations

- Parag Parikh Tax Saver Fund + Axis Long Term Equity Fund (New investment stopped)

- Why Equity for this goal? As this goal is away for about 4 years. Until my child becomes 4 years vacation is not happening.

Child Education

- Post-tax Return Expectation – 12% (Before taking the course, I didn’t know the concept of having a return expectation)

- Inflation – 10%

- Thought about using 70% of my RD after 1 year and investing the amount in my choice of equity mutual funds.

- Mirae Asset Tax Saver Fund – SIP. Why ELSS? To save tax also. Tax planning also comes under financial planning. I merged these two goals.

- Parag Parikh Long Term Equity Fund – SIP. Why this fund for this goal? Well, it’s a good performing fund with different kinds of portfolio and the portfolio overlap was less between these two funds.

Marriage Goal

- Post-tax Return expectations – 12%

- Inflation – 7%

- Axis Small Cap Fund – SIP

Retirement

- Inflation – 7%

- Post Tax Return expectations – 10% from NPS and 13% from equity MF

- UTI Nifty Index Fund – SIP

- Default NPS Contribution – For being a Central Govt Employee

- Didn’t plan about it much. As per my calculations, my NPS was doing good. Thought first I sort out Child Education planning then come to this

My NSC – I didn’t tag it with any goal. I kept it free as of then and maybe plan with it later in the year 2023 when it matures.

My Direct stock portfolio – I didn’t tag this too with any of my goals. It was new and I didn’t have the confidence to tag this for Goal Based Investment Planning.

What I started new?

- Started tracking my cash flow in a spreadsheet.

- Started tracking my expenses in a spreadsheet, no budgeting. Later shifted to an app for tracking expenses “Money Manager” by Realbyte (Still use this as it’s one of the simplest ones among many apps available. I have the pro version. One can use also Moneyfy App. This is also a great app)

- Started tracking my investment each month just in the back of my head

- Started “KUVERA” for my mutual fund investments. I felt most comfortable with this app

- Started investing in Direct Stocks slowly through Upstox

- Used thefundoo.com for checking portfolio overlap. It’s a fantastic tool to create a healthy portfolio.

- Used Value Research to compare mutual funds.

Read Author’s Journey here:

- Part 1: An Accident That Changed My Life: Learnt About Discipline, The Key To Financial Stability

- Part 2: How I Started My Investment Journey? 2018 – 2019: The Years Of Product Based Approach

- Part 4: My Portfolio Review 2021: A 39 Minutes Meeting With A CFP That Boosted My Confidence To Be A DIY Investor

- Part 5: How I Automated My Goal Based Investing in 2022? Simplified Things With a Mature Process-Based Approach

- Part 6: My Portfolio Review 2022: Simplified Automated Goal Based Investing