Welcome to realfinplan! This article will try to understand “Arbitrage Funds Vs Liquid Funds: Which one to choose and when to choose”. A few days ago, I was showing my portfolio to one of my friends. I use this kind of Mutual fund for my goal-based investing, my child’s education portfolio, and short-term goals.

As I hold arbitrage funds in my portfolio, he was curious about this mutual fund category and how and why to use it. We have already covered “all you need to know about arbitrage funds”, in our previous article:

- What Are Arbitrage Funds: Decoding 7 Important Concepts And Simple Ways To Use It Efficiently

- I will request the readers to complete the previous article first to get a proper idea about arbitrage funds and their investment strategy.

- Then come here to get an idea about how they differ from liquid funds.

Arbitrage funds are pretty much similar to liquid funds. But due to the tax efficiency and added volatility, more often they are called “Rich man’s liquid fund”. But remember, every category has its pros and cons. Your investment should be based on your investment goals. Which one to choose when? Let’s find out.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- We need to adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

**************

Table of Contents

Arbitrage Funds Vs Liquid Funds: Basic Differences

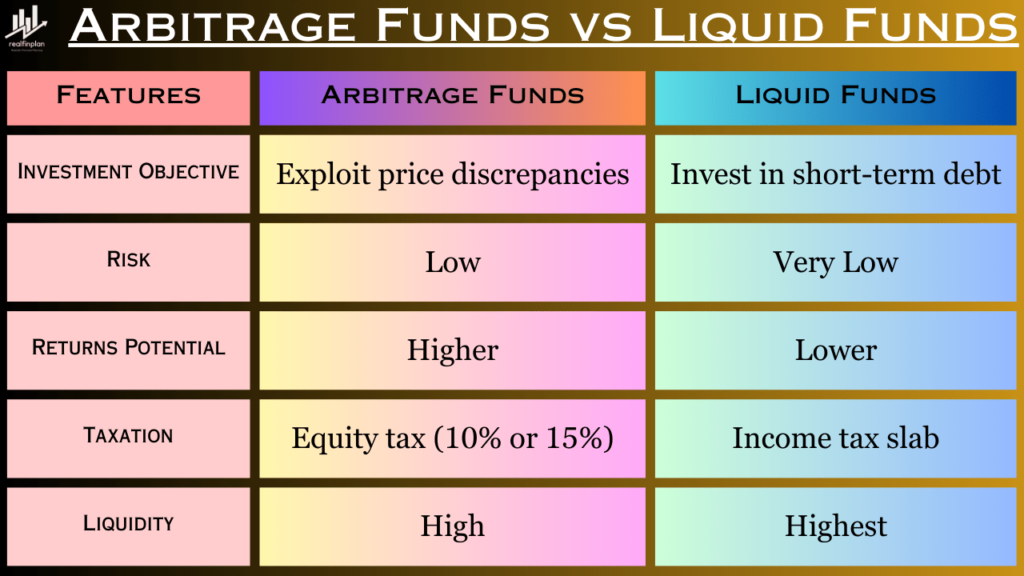

Deciding between Arbitrage Funds and Liquid Funds depends on your specific investment goals and risk tolerance. Here’s a breakdown of their key differences to help you choose:

Investment Objective:

- Arbitrage Funds aim to exploit price discrepancies between the cash and futures market of the same asset.

- Liquid Funds invest in low-risk, short-term debt instruments like commercial paper, certificates of deposit, treasury bills, and money market instruments (average maturity of up to 91 days).

Risk:

- Arbitrage Funds carry minimal price risk due to hedging. However, the equity market and bond exposure in the portfolio can lead to potential market-related fluctuations.

- Liquid funds invest in highly secure short-term debt instruments, making them the safest mutual funds for your money.

Returns:

- Arbitrage Funds can potentially offer higher returns than liquid funds due to exploiting arbitrage opportunities. But for simplicity, we should expect returns similar to liquid funds.

- Liquid funds offer lower but stable returns (around 4-6%) due to their focus on low-risk debt instruments.

Taxation:

- Arbitrage Funds are taxed as equity funds, with a long-term capital gains tax of 10% on gains exceeding INR 1 lakh. Short-term gains are taxed at 15% + cess.

- Liquid Funds are taxed at the investor’s income tax slab, which can be up to 30%.

Liquidity:

- Arbitrage Funds are highly liquid and allow investors to redeem their investments on any business day. However, they may have exit loads for investments redeemed within a short period.

- Liquid Funds offer the highest liquidity among mutual funds and allow instant redemption without any exit loads.

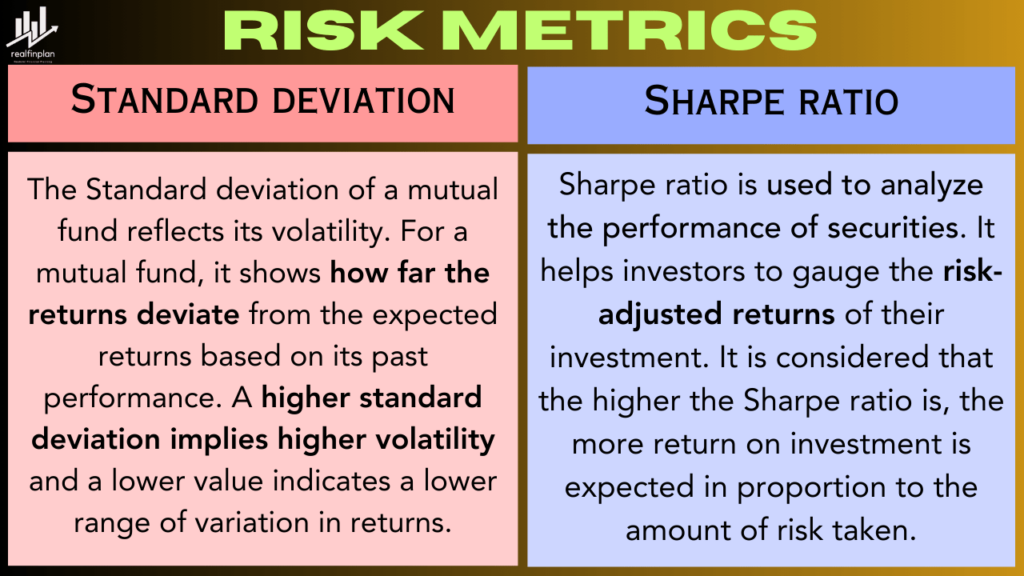

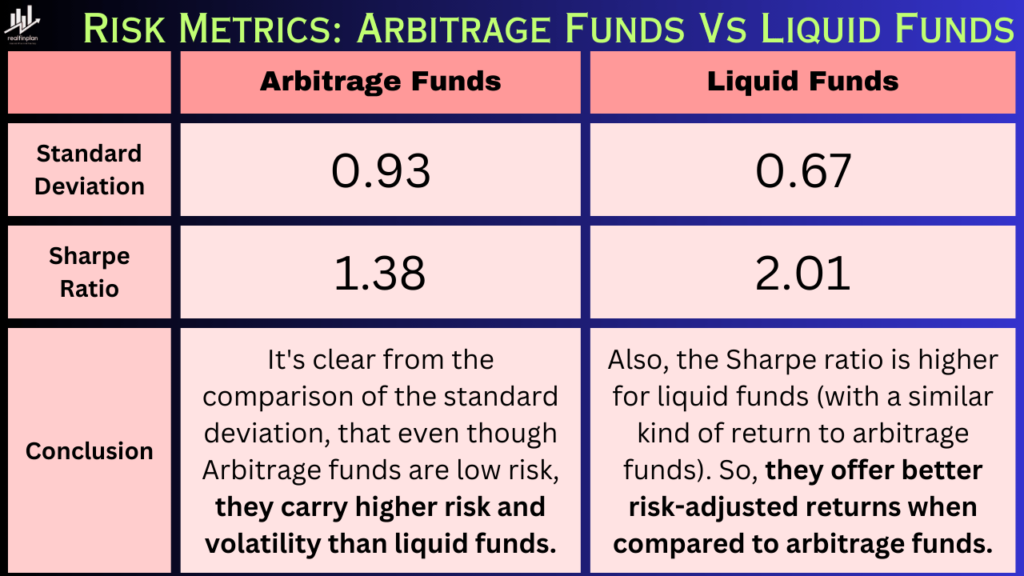

Arbitrage Funds Vs Liquid Funds: Risk-Adjusted Return

Arbitrage funds have the potential to deliver higher returns. However, higher returns are always accompanied by higher risk. Let’s look at what the risk metrics numbers tell us about the risks involved in both funds.

The following are category-level risk metrics for arbitrage funds and liquid funds (data source etmoney).

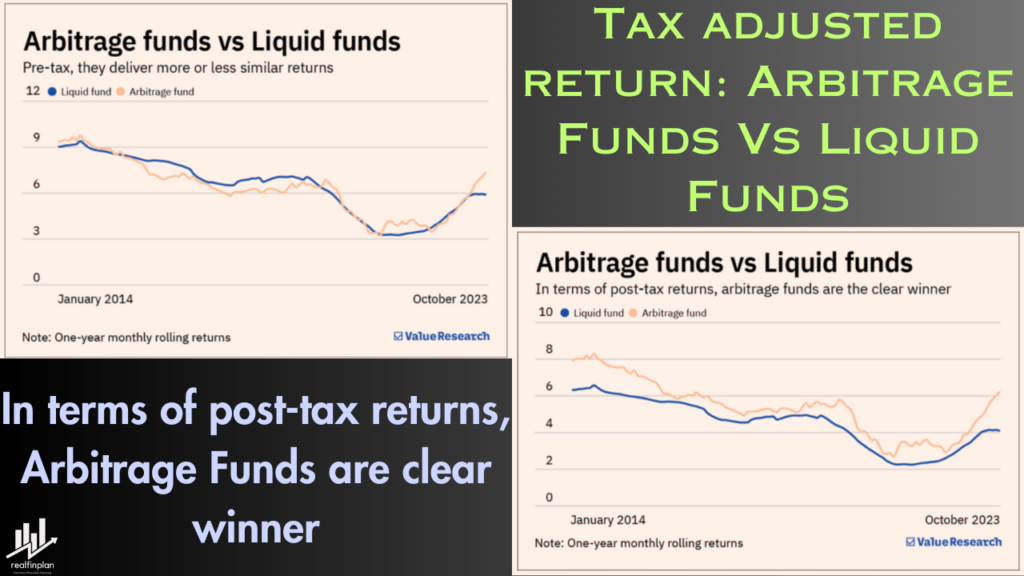

Arbitrage Funds Vs Liquid Funds: Tax-adjusted return

If you closely analyze both the arbitrage funds and liquid funds and you combine the risk associated with the investment strategy and the return potential, arbitrage funds are more or less similar to liquid funds.

But when you consider taxation, arbitrage funds are the clear winner due to lower short-term capital gains (15% as compared to higher tax slab of 20% or 30%) and long-term capital gains (10% for more than 1L as compared to higher tax slab of 20% or 30%).

You can look at the following chart to get an idea about this (source: value research):

Arbitrage Funds Vs Liquid Funds: Which is Better?

Every category has its pros and cons. But your investment should be based on your investment goals.

Arbitrage funds come with tax efficiency and low risk with the possibility of better returns.

- However, they are volatile as their investment strategy is connected to the equity market.

- They are also subjected to arbitrage opportunities available in the market.

This volatility may cause one-day, one-week, one-month, and even three-month returns to turn negative.

- So, if your time horizon is less than three months, it makes little sense.

- As per Morningstar, value research, etmoney, etc, the minimum investment horizon should be 6 months.

Post-tax returns are better for arbitrage funds than liquid funds. It makes them more tax-efficient for an investment period of more than 6 months or preferably more than 12 months.

So, try to invest in Arbitrage funds for 6 or more months for better returns and 12 or more months for maximizing tax efficiency.

Liquid funds invest in low-risk, short-term debt instruments.

- The average maturity of bonds is up to 91 days.

- The instruments are commercial paper, certificates of deposit, treasury bills, money market instruments, etc.

- So, they are the least volatile among all the mutual funds.

So, if you prefer liquidity with lower risk, and stable returns (without any significant risk of it being negative), always invest in liquid funds rather than arbitrage funds.

Our opinion:

With the higher volatility, does it make sense to invest in them to earn a little more than liquid funds (or similar)? Well, it depends on 3 factors:

- How much ideal money do you have? If you have a sizeable amount, then of course it makes sense.

- Which tax bracket do you fall under? If you fall in the 30% tax bracket, you can proceed with arbitrage funds.

- Your risk profile: You can have arbitrage funds in your portfolio if you can stomach short-term volatility.

Choose arbitrage funds if:

- You are comfortable with minimal price risk (i.e. daily price up-down or fluctuation in NAV due to market risk).

- You are seeking tax-free gain (or gain with lower tax implications) and are happy with a similar to that of liquid fund returns.

- You are investing for the short term (more than 6 months), not for immediate needs in the future (like emergency funds).

Choose liquid funds if:

- You prioritize higher liquidity and immediate access to your funds (like emergency funds).

- You want to build a short-term portfolio where you don’t care about higher returns and need lower risk and stability.

Frequently Asked Questions (FAQs):

Which fund is better for short-term goals?

If your goal is more than six months away, arbitrage funds are favorable due to low risk and lower tax implications.

Are Liquid Funds risk-free?

While Liquid Funds aims for stability, no investment is entirely risk-free. They are considered low-risk. But not risk-free. They can carry credit risk, but you can analyze them online and choose the funds that have bonds of high credit quality.

Can I switch between these funds easily?

Yes, both Arbitrage and Liquid Funds offer flexibility in switching, but consider exit loads and tax implications.

Which fund performs better during market uncertainties?

In volatile markets, Arbitrage Funds may perform better, providing a cushion against market fluctuations.

How quickly can I redeem Liquid Fund units?

Liquid Funds offer high liquidity, allowing investors to redeem units swiftly, usually within 24 hours. Insta-Redemption Liquid funds offer up to rupees 50,000 within 30 minutes. However, their expense ratio may be higher.

Check out our previous article on Arbitrage Funds:

I have read some excellent stuff here. Definitely value bookmarking for revisiting. I wonder how much effort you put to make the sort of excellent informative website.