Welcome to realfinplan! In this article, we will explore the pros and cons and help you decide whether Auto Sweep FD is a trap or not. We will also discuss some simple and smart ways that can help you stay ahead of the personal finance game.

If you are looking for a way to earn higher interest, must have heard that it’s very easy to earn 7 to 8% interest from your savings bank account.

Just get a sweep FD facility set up in your savings account – your money will be automatically transferred from your savings account to FD. And you will start earning if the interest on that money. Sounds like a smart way to save and invest, right?

- But what if I tell you that this is only 50% true?

- Can it be a trap that could cost you more than you gain?

- Let’s find out.

************************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, you can lay a foundation for your investing process through goal-based investing.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- We must adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

***********************

Table of Contents

Unveiling the Magic: How Auto Sweep FD Works

Imagine your savings account as a pond, and your fixed deposit (FD) as a well. An Auto Sweep FD acts like a bridge for automatic transfer. Any amount exceeding a set Threshold limit gets automatically “sweep-out” (hence the name) from the pond (savings account) to the well (FD).

- Example: You set a minimum balance of ₹10,000 in your savings account. Your salary of ₹25,000 gets credited. Then as ₹15,000 is above the threshold limit, this amount automatically gets swept into your linked FD, earning a higher interest rate.

The auto sweep facility also works in reverse.

- If you need to withdraw an amount exceeding the threshold limit from your savings account, the amount will “sweep in” or get transferred from your fixed deposit account to your savings account.

What are the benefits of the auto sweep facility?

Higher returns:

- The idle money earns higher FD interest instead of lying in the Savings account.

- For example, if the savings account rate is 3% and the fixed deposit rate is 6%, you can earn double the interest on the excess funds by using the auto sweep facility, as they say.

Flexibility:

- Some banks may allow you to choose the threshold limit for your savings account as per your preference. Generally, you can get a one-year or two-year FD rate in the Auto swipe facility. Some banks may give you the option to choose the tenure of the fund.

Liquidity:

- The auto sweep facility does not compromise the liquidity of your funds. You can access your money whenever you need it. No need to manually transfer funds at the time of need, or create new FDs. The magic happens automatically.

The Not-So-Magical Side: Auto Sweep FD Is a Trap? – Illustration of SBI MODs

The interest rate of FD depends on how much time you are making FD. Generally, if you make the FD for a long time, then you get a better interest rate. But what interest rate do you get for the FD in the Auto sweep facility?

FD Bucket Rates Risk:

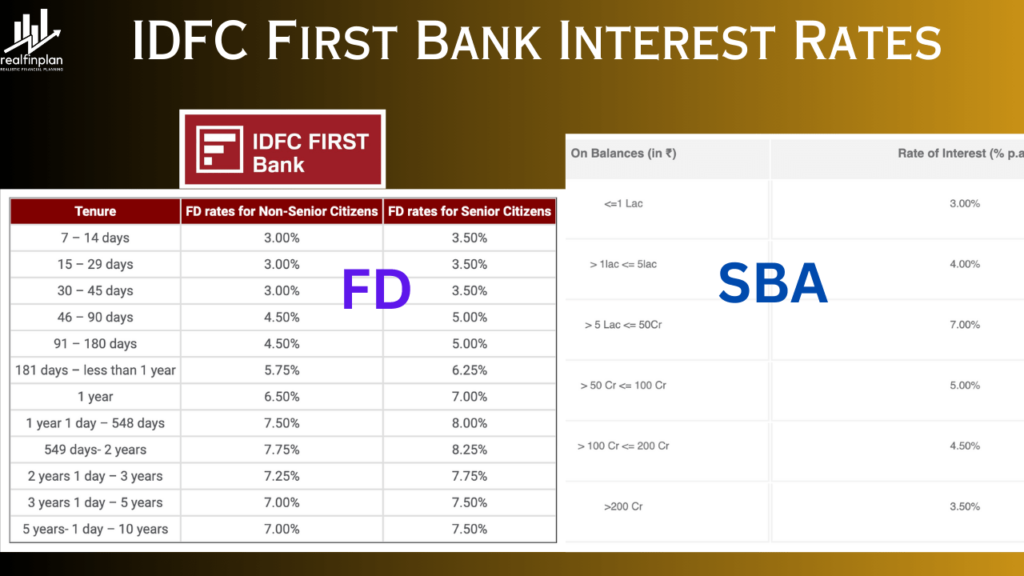

The point to be noted is that in some FD buckets, the FD rate of the banks can be less than the saving rate.

Like IDFC bank’s normal savings rate is between 4 to 5%, if you see the rates of their FD, there can be some buckets of interest rates even less than 4%. And if you withdraw your money before 30 days, then you may also suffer a loss.

Penalty:

Now, what if money from your savings account goes to the FD account by sweep out, and you need that money before one year? That means that money will sweep in before one year. In this case, some banks impose penalties and some banks don’t.

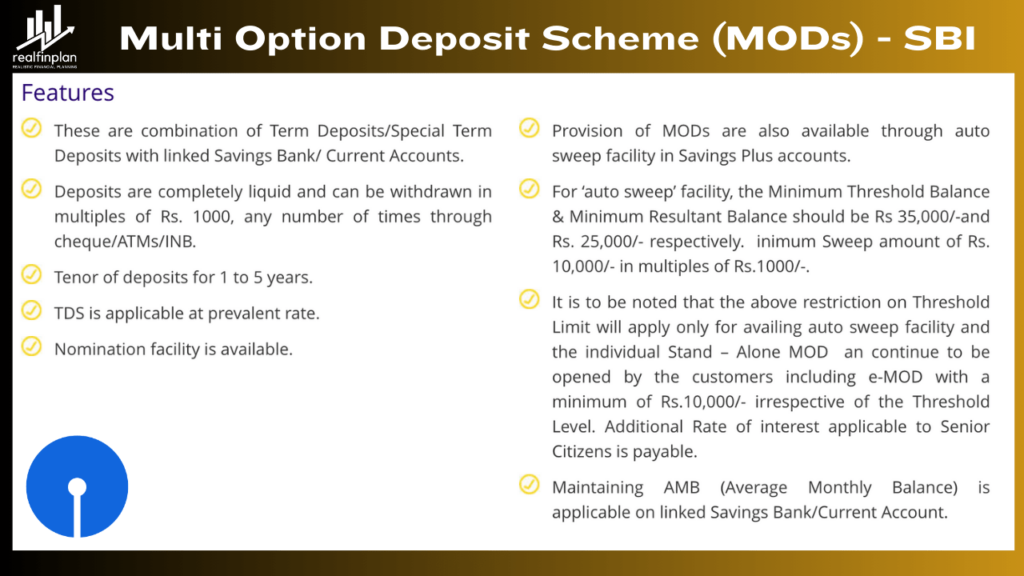

Let’s look at the Auto Seep facility of SBI. In SBI, the auto facility is known as the Multi Option Deposit Scheme (MODs).

- If you have a savings or current account in SBI, then you can avail this facility.

- You can activate the facility online or offline.

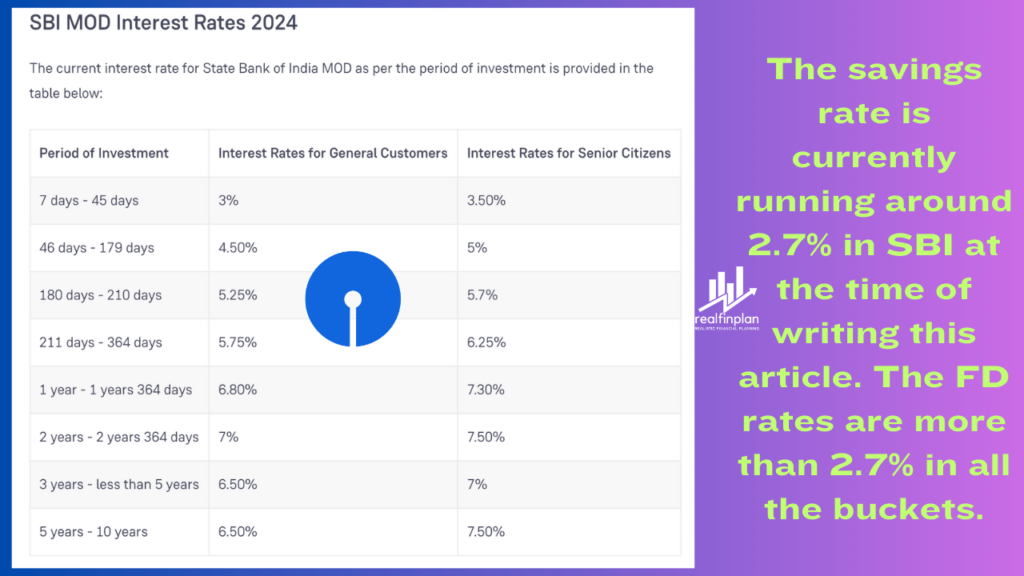

The savings rate is currently running around 2.7% in SBI at the time of writing this article. The FD rates are more than 2.7% in all the buckets. So it seems that there is a sense to take this facility, right?

The threshold limit for the sweep-out facility in SBI is ₹35,000. And you will have to make an FD of ₹10,000 to activate this facility.

- This means that as soon as your account balance crosses ₹35,000, you will reach the threshold limit, and the preparation for making your first FD will be done.

- As soon as the account balance reaches ₹45,000, immediately your FD of ₹10,000 will sweep out.

- Your savings account balance will again become ₹35,000 as soon as your FD of ₹10,000 is created.

- After that, as soon as the account balance is ₹36,000, the FD of ₹1000 will sweep out.

- And this process will keep repeating.

With a small amount, you get more flexibility. SBI also gives you the option to choose the tenure of the FD. You can choose anything from 1 year to 5 years.

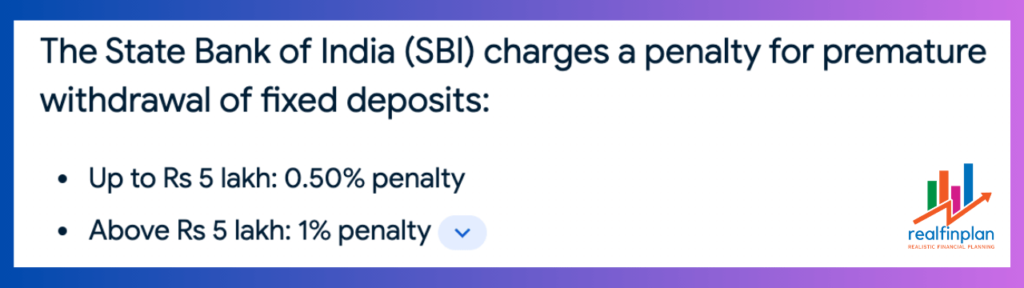

However, the SBI Auto facility has one major downside. If you sweep-in the money back into your account, you will have to pay a penalty.

- If you sweep the Money back before seven days, then you will get zero interest on that money.

- If your total fund amount is less than 5 lakhs then you will get a penalty of 0.50%.

Let’s understand this a little bit.

Suppose you choose the tenure of your sweep FD for 1 year. So if any FD breaks before one year, you will get 0.5% less interest than the FD on that money.

- So according to this chart, if you break your FD after 180 days, you will get 5.25% – 0.50% = 4.75% interest on that money.

If you have more than five lakhs in these sweep FDs, then you will get a penalty of 1%.

- If you withdraw that money within 40 days, you will get 3% – 1% = 2% interest on that money.

- That is less than the savings interest rate of 2.7%.

So SBI auto sweep facility is not beneficial for all conditions. You have to use it after analyzing the situation a little.

Taxation:

Now, let’s consider taxation. In savings account interest income, you get tax deductions up to ₹10,000 under section 80 TTA.

But there is no such benefit available on FD interest. You are taxed like your normal income, which could be as high as 20% to 30%. So if you include the tax component, our calculations will change a bit.

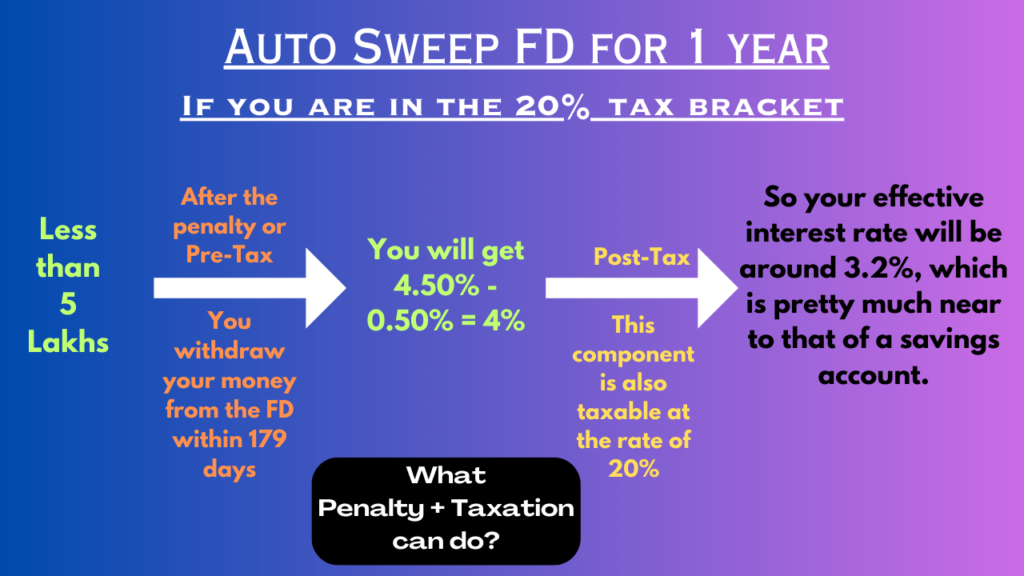

If you are in the 20% tax bracket, and you withdraw your money from the FD within 179 days, you will get 4.50% – 0.50% = 4% of the interest rate after the penalty.

- But, this component is also taxable at the rate of 20%.

- So your effective interest rate will be around 3.2%, which is pretty much near to that of a savings account.

Moreover, the bank will deduct TDS (tax deducted at source) on the interest earned on your sweep FD if it exceeds Rs. 40,000 per year (Rs. 50,000 for senior citizens). This will affect your cash flow and liquidity.

So, you have to take this facility a little thoughtfully. You have to check if it is suitable for you or not.

Auto Sweep FD Is a Trap? Only if you Misuse it – Use it wisely

The auto sweep facility can be a useful tool to manage your finances if you use it wisely. Here are some tips to make the most of it:

The Sweet Spot – Use it for Emergency Fund with Safety and Liquidity

The best way to use the auto sweep facility is to create an emergency fund where “Safety & Liquidity of your capital” is the top priority, not the return. In fact, you should never run after returns, rather chase target corpus!

- An emergency fund is a reserve of money that you can use in case of any unforeseen expenses or emergencies, such as medical bills, job loss, car repair, etc. An emergency fund should be equal to at least 3 to 6 months of your monthly expenses.

By using the auto sweep facility, you can create an emergency fund that is safe, liquid and earns a decent interest.

- You can set the threshold limit of your savings account as per your monthly expenses and let the excess funds get transferred to your sweep FD.

- This way, you can have easy access to your money in case of any emergency without breaking your sweep FD or paying any penalty.

Do not use it for investment purposes:

The auto sweep facility is not meant for investing your money for long-term goals.

- For example, if the inflation rate is 7% and the interest rate on your sweep FD is 6%, you will end up losing your purchasing power over time.

- It’s only a way to earn a slightly higher interest on your idle money in your savings account.

If you want to invest your money for long-term goals, you should look for other options that can offer higher returns and tax benefits, such as mutual funds, stocks, bonds, etc.

Compare the rates and charges:

Before opting for the auto sweep facility, you should compare the interest rates and charges offered by different banks.

- You should choose a bank that offers a high-interest rate on your sweep FD and no penalty or a low penalty for premature withdrawal.

- You should also check the minimum and maximum amount and tenure for the sweep FD and the frequency of the sweep-in and sweep-out transactions.

You should read the terms and conditions carefully and understand the implications of the auto sweep facility on your taxation and cash flow.

If you need regular access to your funds, the penalties and tax implications make it impractical. Stick to a savings account.

What are the alternatives to the auto sweep facility?

Due to the above disadvantages and limitations, you may want to consider some alternatives to Auto Sweep FD, such as:

Short-term fixed deposits:

These are fixed deposits that have a maturity period of up to one year. They offer higher interest rates than savings accounts and lower risk than longer-term FDs. However, they also have some disadvantages, such as:

- The interest earned is taxable as per your income tax slab rate.

- The bank may deduct TDS (tax deducted at source) on the interest earned on your FD.

- The bank may charge a penalty for premature withdrawal.

- The interest rate may change depending on the bank and the market conditions.

Liquid Funds:

These are debt mutual funds that invest in money market instruments with a maturity period of up to 91 days.

They offer higher returns than savings accounts sometimes similar to FDs, and lower risk than other debt funds.

Money Market Funds:

These are debt mutual funds that invest in money market instruments with a maturity period of up to one year.

They offer higher returns than savings accounts and may sometimes beat the FDs too, and slightly higher risk than liquid funds.

Liquid Funds and Money Market Funds have some advantages, such as:

- The interest earned is taxed only when you redeem the units.

- There is no penalty or almost no penalty for premature withdrawal, and you can redeem the units within one working day.

- The interest rate risk will be lower as the maturity period is on the lower side. So, it will fluctuate just a little due to market rate changes and can adjust quickly to the changing scenarios. This way they will provide some stability.

- If you go with AMCs that invest in bonds of higher credit quality (you can check that in value research), there will be low Credit Risk too.

While choosing the right alternative to Auto Sweep FD, you should consider the following factors:

Your investment horizon:

- How long do you want to invest your money? If you have a short-term goal, you may opt for short-term FDs or liquid funds.

- If you have a medium-term goal, you may opt for money market funds.

Your risk appetite:

- How much risk are you willing to take with your money? If you are risk-averse, you may opt for short-term FDs or liquid funds.

- If you are moderately risk-tolerant, you may opt for money market funds.

Your tax bracket:

- How much tax do you pay on your income? If you are in a higher tax bracket, you may opt for liquid funds or money market funds, as they offer tax efficiency.

- If you are in a lower tax bracket, you may opt for short-term FDs.

The Bottomline: Decide on your needs

The Auto Sweep FD isn’t a one-size-fits-all solution. Its effectiveness depends on your financial goals and spending habits.

It’s a Friend When:

- You have idle funds exceeding your minimum balance requirements.

- You prioritize safety and liquidity for your emergency fund.

- You’re a disciplined saver with minimal withdrawals.

- You understand the limitations and use it as a supplementary income source.

It’s a Trap When:

- You need regular access to your funds. The penalties and tax implications make it impractical. Stick to a savings account.

- You have short-term financial goals requiring high returns.

- You’re prone to impulsive spending.

- You seek aggressive growth through investments.

So, carefully assess your financial goals and risk tolerance before deciding whether Sweep FDs, Regular FDs, Liquid Funds, or Money Market Funds are the right fit for you. Consider consulting a fee-only financial advisor for personalized recommendations.

Frequently Asked Questions (FAQs):

How can I activate or deactivate the auto-sweep facility?

You can activate or deactivate the auto sweep facility by visiting your bank branch or using the online banking or mobile banking services of your bank.

You will have to fill out a form and provide the details of your savings account and fixed deposit account that you want to link or delink with the auto sweep facility.

You will also have to specify the threshold limit for your savings account and the tenure and interest rate for your fixed deposit account.

How will I know when the sweep-in or sweep-out transaction takes place?

You will receive a notification from your bank via SMS or email when the sweep-in or sweep-out transaction takes place. You can also check your account statement or passbook to see the details of the transaction.

Will the sweep-in or sweep-out transaction affect my credit score?

No, the sweep-in or sweep-out transaction will not affect your credit score. It is not a loan or a credit card transaction. It is just a transfer of funds between your own accounts.

************************

Get FREE educational content in YOUR MAIL BOX!

Please subscribe to our YouTube Channel here.

Hello my loved one I want to say that this post is amazing great written and include almost all significant infos I would like to look extra posts like this