Welcome to realfinplan! In this article, we will try to understand the common mistakes to avoid for Asset Allocation strategy.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

If you want to become financially stable and then wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat the Inflation. But before we invest in it, we need to consider the risk involved in it : Sequence of Returns Risk.

- This Sequence of Returns Risk (SRR) can damage your portfolio and your overall financial well being at any point of your investment journey. To challenge this SRR and to counter it’s effects, we need to adopt a proper strategy.

Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

- We have already discussed that in our previous article and I will request the readers to finish this article first and then come here: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It

To know more about Asset Allocation, please dive into our other articles:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

Today, we will discuss about the common mistakes to avoid for asset allocation strategy for our investment planning. So, let’s start.

*************

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

Common Mistakes To Avoid For Asset Allocation Strategy

There are a lot of things to consider for our investment planning. But, what I have learnt through my years of financial journey is that we need to avoid mistakes while doing it. Why?

Because, if we have less time for a particular goal, then we may not have the time to recover from the damage created by those mistakes. So, first we need to clear about what not to do and then think about what to do.

Here are some common mistakes we need to avoid when it comes to asset allocation strategy.

1. Not having a Plan

This is the most common mistakes individuals make. Before you start investing it’s important to have a clear plan.

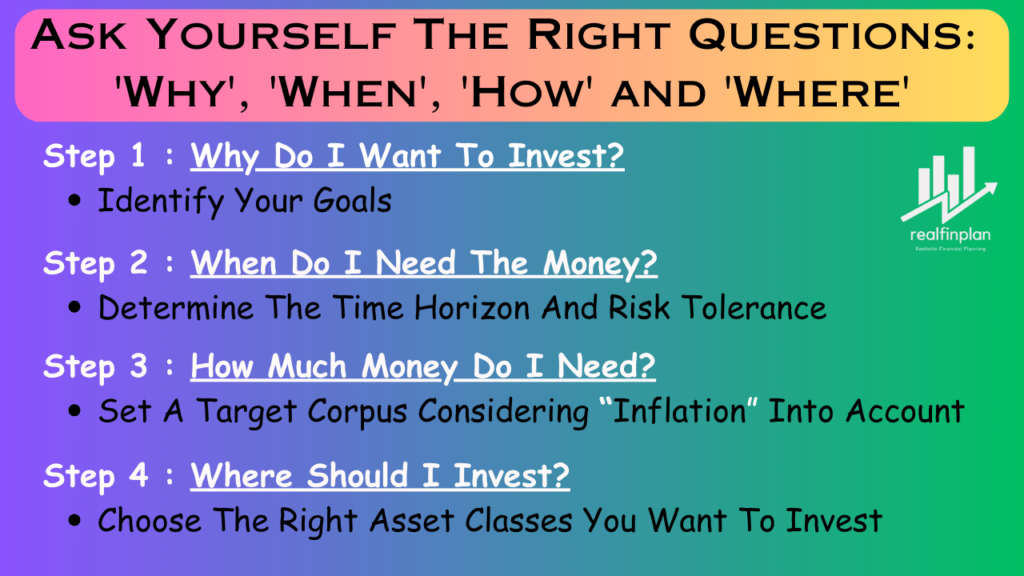

When it comes to investing, always have a plan before jumping onto strategy (Asset Allocation Strategy) or any investment product. Always make an outline for your planning. Please understand the ‘why’, ‘when’, ‘how’ and ‘where’ of investing.

- Why do you want to invest? Identify your goals

- When do you need the money? Determine the time horizon and risk tolerance

- How much money do you need? Set a Target Corpus considering Inflation into account

- Where to invest? Choose the right asset classes you want to invest

Now, that you have chosen the asset classes to invest in, you can determine the right asset allocation strategy for your goals.

2. Being too Aggressive or too Conservative

Asset allocation is neither only about returns nor only about risk. It’s so much crucial to strike a balance between risk and rewards for our investment planning.

- If you are too aggressive, you maybe taking on more risk than you are comfortable with. You could loose more money when there is a downward market swing.

- If you are too conservative, your portfolio may not grow as quickly as you need it to. You may not reach your financial goals.

3. Over Concentration

Putting too much of your money in a single asset class is always risky. If that asset class underperforms and continues to underperform for a longer period of time, then it can damage your overall portfolio.

Among the young earners, there is a trend that investing is only about equity. Most of them focus more on stocks and equity mutual Funds in general.

- But always remember only equity is not a strategy its mere a hope, testing your luck that “if” Equity can fetch higher returns, you “may” achieve your goal. It’s your money, it deserves better respect than that.

Always diversify your investments in various asset classes, adapt asset allocation strategy to be financially stable and secure.

4. Changing Asset Allocation Too Often

If you change your asset allocation too often, it can lead to higher transaction costs. Whereas, we should always keep our investment planning simple and cost effective.

- Also if you change the Asset application frequently, it may not align with your investment goals. That can be an obstacle for achieving financial goals.

5. Lack of review

As you start your financial journey, market and economical situations may change at any point of your journey. Also your financial situation and goals may change over time. As the goal progresses towards its deadline, any of your long term goal will become a short term goal.

- If you fail to review and adjust your asset allocation accordingly, it can result in an investment strategy that no longer aligns with your financial objectives.

6. Not Changing Asset Allocation at all

You always need to regularly review and rebalance your portfolio, at least once a year. If you fail to do so, it can lead to an unintended asset allocation that may not align with your investment goals.

As the goal progresses and market conditions change, your asset allocation can shift from your original plan.

- Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy, your plan.

- When there is a significant market swing (upward or downward), sell some winners and buy more of the under performing assets to maintain your desired asset allocation.

Always have a plan to reduce the equity allocation in a step wise manner to de-risk your portfolio.

- As the goal nears it’s deadline, you need to systematically increase your fixed income allocation to reduce the risk in the portfolio. So that, sequence of returns risk won’t be able to affect your portfolio much.

Following the right asset allocation + Rebalancing your portfolio when the asset allocation shift hits your tolerance limit + Step wise equity allocation reduction as the goal progresses towards its deadline – These 3 things are more than enough to enjoy a comparatively smoother financial journey to achieve your goals.

- Learn the concept in details: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Mitigate Sequence Of Returns Risk

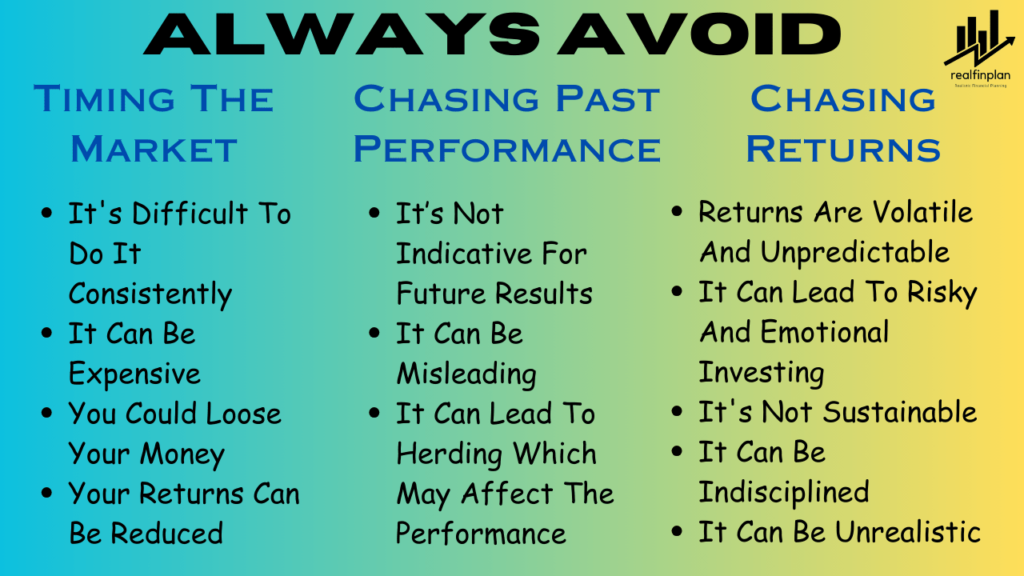

7. Trying to Time The Market

This is also one of the most common mistakes that individuals make: trying to “time the market” aka “buy the dip”. Please try to understand that it’s impossible to predict the nature and future of the market.

Here are some compelling reasons why you should not try to time the market:

It’s difficult to do it consistently:

The stock market is completely unpredictable. It’s comes with a certain degree of risk and uncertainty. Even professional investors have a hard time timing the market correctly. If you can do it for one or two times, it’s so hard to do it consistently.

It’s Expensive:

When you try to time the market, you may have to pay high trading commissions or other expenses and fees. This can eat into your profits.

You could loose money:

If you try to time the market and get it wrong, you could loose money. You may end up with less money than what you invested.

Reduced Returns:

A study by DALBAR (One of the leading financial services market research firm in USA) found that average investor under performs the stock market by about 2 to 3% per year.

- This is because most of the investors try to time the market and end up buying high and selling low.

- So, trying to time the market can lead you to buying high and selling low. This could reduce your returns over the long term.

Always remember, while timing the market: the risk of getting your timing wrong and losing your money is a “guarantee” but higher returns are just a possibility.

And we should never invest to get higher returns, but to achieve the target corpus for our goal. And for that, you will need a strategy – asset allocation strategy with regular rebalancing and a glide path.

So, when you developed an asset allocation strategy for yourself, you don’t need to do any investing gymnastics. The strategy will take care of everything:

- It will reduce your risk in your portfolio.

- It can enhance your risk adjusted returns.

- It will sail you towards achieving your financial goals.

Read the concept in details: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

So, whenever you have money to invest, just invest it, but as per your asset allocation. Don’t think too much and be at peace.

- For example, if you maintain an asset allocation of equity : debt = 60:40 you need to invest ₹10000 per month, invest ₹6000 in equity and ₹4000 in debt.

8. Chasing Past Performance

This is one of the most common mistakes we make. We always read the larger fonts of an advertisement regarding investment products like stocks, mutual funds etc. But we always overlook what is written in small fonts, the disclaimer.

Past performance is not indicative for future results:

Always remember that past performance is not a measuring tool for the future. Don’t be fooled into investing in an asset class or investment product, just because it has performed well in the past.

There are many factors that can affect the performance of an investment product. It can be due to change in market conditions, economic events and the specific investment strategy of the fund manager.

For example, a fund has outperformed the market over the last year or so.

- It can be due to the decision of fund manager and his strategy.

- May be a specific sector or industry (that was booming at the time) was in the portfolio of that fund.

So, the situation favored the strategy. When the market condition changes in future, the fund’s performance may suffer.

Past performance can be misleading:

It is important to consider the time period over which you measure the past performance of an investment product.

For example, that investment product has outperformed in the first year or so, maybe because of a rising market. Also, maybe the generated high returns were due to taking on a lot of risks. So, its performance may not be sustainable over the long term.

Chasing past performance can lead to herding:

It has also been seen that, when a fund performs so well and provides good returns, most of the investors pile into the same investment products.

- The AUM (Asset Under Management – the amount of money managed by the fund manager) increases suddenly and that can create a bubble.

- And at that point of time, the fund manager may not be able to manage that high AUM properly. As a result, a decrease in performance can be seen in that fund.

What should you do?

Just because an investment has done well in the past doesn’t mean that it will continue to do well in the future too.

Instead, focus on investing in those products or assets that you believe have the potential to perform well in the future. Past performance should never be the reason for a fund or stock to be in your portfolio.

Understand the investment philosophy of the fund manager, if possible read the fund document or do some fundamental analysis of the stock, analyze the track record. Now, if you have conviction to the fund management team’s thought process or a company’s business policy, choose that fund or stock.

Don’t test your luck, keep things simple and taste the flavor of Asset Allocation Strategy to be financially stable and secured.

9. Chasing Returns

We all do the same thing in our life, we run after products, best mutual fund, best performing fund, higher return potential stocks etc. We know that none can predict the future returns but still we chase it. It’s the very nature of human being. Just like running after mirage in a desert.

It’s pretty much natural to desire quick returns and high returns. Specially when you get so much noise in the name of information nowadays. But this approach can be risky and it can be counterproductive in the long run.

Here are some compelling reasons for not chasing Returns:

Returns are volatile and unpredictable:

The returns on any investment can fluctuate widely from year to year, especially for equity related instruments. Please try to understand that investment comes with certain degree of risk and uncertainty.

That’s why it is important to focus on your investment goals. So that you don’t get caught up in the short term ups and downs of the market.

Chasing Returns can lead to risky and emotional investing:

In an attempt to generate higher returns, most of the investors tend to invest in riskier assets, such as small cap stocks or emerging companies. However these kind of investments can also lead to larger losses.

It’s not sustainable:

Chasing returns can lead you to make impulsive investment decisions. This can lead to financial losses and you may regret later. So it’s may not be sustainable in the long run.

It can be Indisciplined:

Due to the involvement of impulsive investment decisions in order to generate higher returns, your investing process can be very much indisciplined.

It can be unrealistic:

Chasing returns can lead you to set some unrealistic expectations from your investments. This can hamper your over all financial well being if you don’t meet your expectations.

If you really wanna chase, then chase Target Corpus in lieu of returns.

- It will help you to adapt a strategy that aligns with your investment purpose or financial goals.

- Determining the Target Corpus involves a calculated approach, considering your risk tolerance and time horizon. So, chasing Target Corpus will provide sustainable financial growth.

- It will help you to manage your risk through diversification.

- It will help you to avoid emotional decisions during a market downturn.

- It will keep your investing process realistic and disciplined.

Read the concept in details in our other article: Why You Should Not Run After Returns? Rather Chase Target Corpus!

Frequently Asked Questions (FAQs):

What is the ideal asset allocation for me?

There is no secret recipe for deciding asset allocation. It depends on your financial goals, risk tolerance and investment horizon. You can consider following some thumb rules and if you think this as a daunting task, then it’s best to consult financial advisor to determine the right mix for you.

How often should I rebalance my portfolio?

Rebalancing should be done periodically. You should review your portfolio and rebalance it at least once a year. But if it seems too hectic to you, then set a tolerance limit and rebalance your portfolio when your asset allocation deviates significantly.

Can I use asset allocation for retirement planning?

Yes, definitely. Asset allocation is so crucial for retirement planning. It helps you to strike a balance between risk and return. So that, your retirement portfolio meets your income needs.

What should I do if my risk tolerance changes over time?

If your risk tolerance changes, it becomes so important to adjust your asset allocation accordingly. Generally as the goal progresses towards its deadline, your risk tolerance changes and your capability of taking risk reduces.

Always have an exit strategy by following a glide path with step wise reduction in equity allocation. If you find it difficult, consult with a financial advisor to make informed decisions.

Can asset allocation help me during market downturns?

Yes, definitely. Well diversified asset allocation can act as a cushion during the time of market downturns. It can reduce the risk of your portfolio. So that, you won’t incur significant losses.

Should I make changes to my asset allocation based on short term market news?

No. It’s generally not advisable to make changes based on short term market news. Once you have developed a strategy, just stick to it and think long-term perspective.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023