Welcome to realfinplan! In this article, we will try to understand how to manage financial risks and how many of them can challenge us significantly at any time. In today’s world, mastering personal finance is essential for achieving financial stability. Covering the basics and managing financial risks can help us secure our future so that we can make proper decisions about our money and overall financial well-being.

Why do we need to secure ourselves financially? Well, life is full of risks, needs, and wants. And most important of them are financial “risk” and “needs” (not wants, you can’t ignore the “needs” or delay them, especially long-term needs).

If you need to build a house you will need to have a strong foundation. Without a solid base, you won’t be able to protect your house.

- Similarly in personal finance, you need to cover your basics first, and manage your financial “risks”. Then only you can build the floors for your house i.e. build your wealth through Investments to meet financial “needs”.

In the field of personal finance, understanding and managing financial risks are critical for securing a stable future. Any unforeseen event can affect our financial well-being if we are not adequately prepared.

So, first, we will talk about risk management or covering the basics, and then later on we will discuss the important things about saving and investing to meet our needs and wants so that we can identify our goals and approach for investment planning.

Table of Contents

What are the main Financial Risks?

This article explores three significant financial risks that individuals and families may face: Emergency risk, Life risk, and Health risk. By understanding these risks and making good decisions we can build a strong financial foundation.

There are a lot of financial risks associated with our lives and the most important are Emergency risk, Life risk, and Health risk. They can give us significant challenges at any point in our financial journey.

- Emergency Risk: As the word suggests, an emergency can strike us at any time. It can be in the form of Job Loss, Income stoppage or reduction, underperforming business for some time, any medical crisis, or any kind of financial emergency.

- Life Risk: Life risk refers to the household’s financial instability when a key family member or the sole breadwinner dies.

- Health Risk: Health risk is the potential financial burden of medical expenses due to any illness or injury. Healthcare costs can be very significant, and without proper coverage, they can destroy our savings and lead to financial hardship.

3 Simple Steps To Manage Financial Risks

For a secure future, we need to manage those financial risks at any cost. In personal finance, the emergency fund, term insurance, and health insurance are the basics or foundations of financial security. These three things serve as a shield as they protect against unexpected events, expenses, and potential risks to our lives.

- Through the prudent use of emergency funds, life insurance, and health insurance, we can protect ourselves and our loved ones.

- We can be confident about being financially stable and fighting back in any crunch situation.

Now coming to the solution, the most important thing is that it should be simple to understand and adapt. The more simple it is, the easier it will be to control. Let’s try to understand each element and how to work on them to safeguard our financial future.

Step 1. Create An Emergency Fund: Your Financial Cushion against any emergency risk

As the word “Emergency” suggests, an emergency or risk can strike us at any time. So, what is emergency risk? Let’s take some scenarios into account.

- If you lose your job, how will you survive till you get a new job in this competitive world? How will you pay for your EMI till everything gets sorted?

- What will you do if you don’t have a regular income like a salaried person and your income stops or gets reduced due to any economic crisis?

- How will you manage everything if your business doesn’t do well for some time?

- If anything happens to any family member, a medical crisis occurs and you need to move here and there for treatment, how will you manage the expenses?

- Due to some road accident, you get injured and your bike or car is also damaged. How will you deal with the situation financially?

- If you have a high medical risk patient in your family (like diabetes, high BP, etc), how will you react when there is a crunch situation?

- If a natural disaster strikes you like a flood or cyclone, how will you survive until everything gets normal again?

- If you face sudden theft or repair in your house, how will you manage the situation?

- Suddenly, you get a call from your close family member who is sick. Now, you will have to travel on such short notice and you may have to help him or her financially too. How will you manage the expenses?

- If any other financial situation occurs without any plan, how will you manage that?

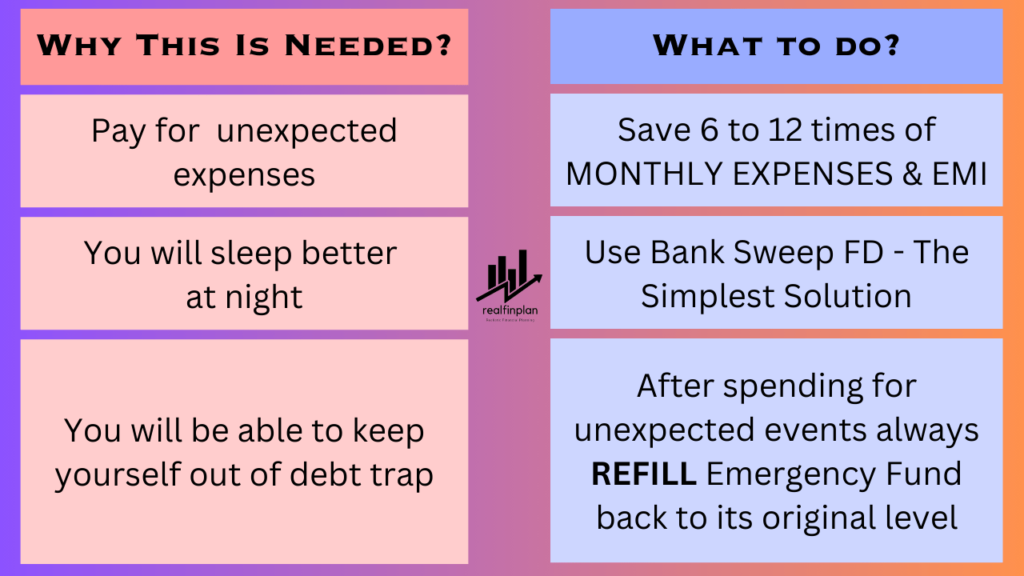

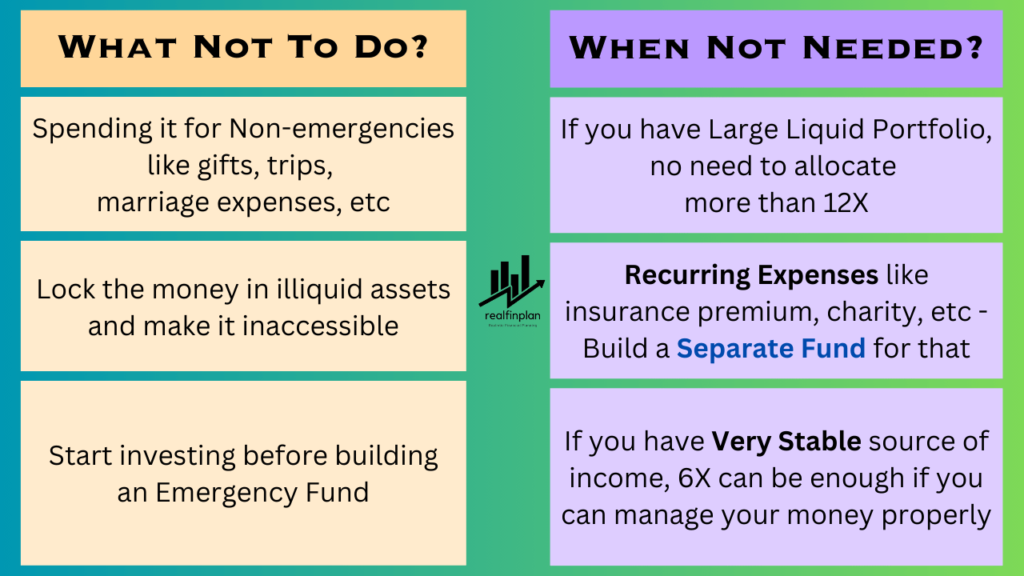

This is why you need to build an emergency fund. An emergency fund is the savings that is set aside for these kind of unexpected emergencies. Always keep in mind, that it should be fully liquid (like cash and cash equivalents, savings account, FD, etc) as it will be used in case of emergency.

If you have an adequate emergency fund, you won’t have to put your hands on long-term savings or go for “Debt or Loan” during difficult times. Your aim should be to save adequately for your emergency fund to ensure peace of mind and financial stability. An emergency fund is a part of everything you need to do before investing in financial goals.

An emergency fund is the savings that is set aside for unexpected emergencies. If you have an adequate emergency fund, you won’t have to put your hands on long-term savings or go for a “Debt” during difficult times.

- Your aim should be to save adequately for your emergency fund to ensure peace of mind and financial stability.

- More importantly, it should be fully liquid (like cash and cash equivalents) as it will be used in case of emergency.

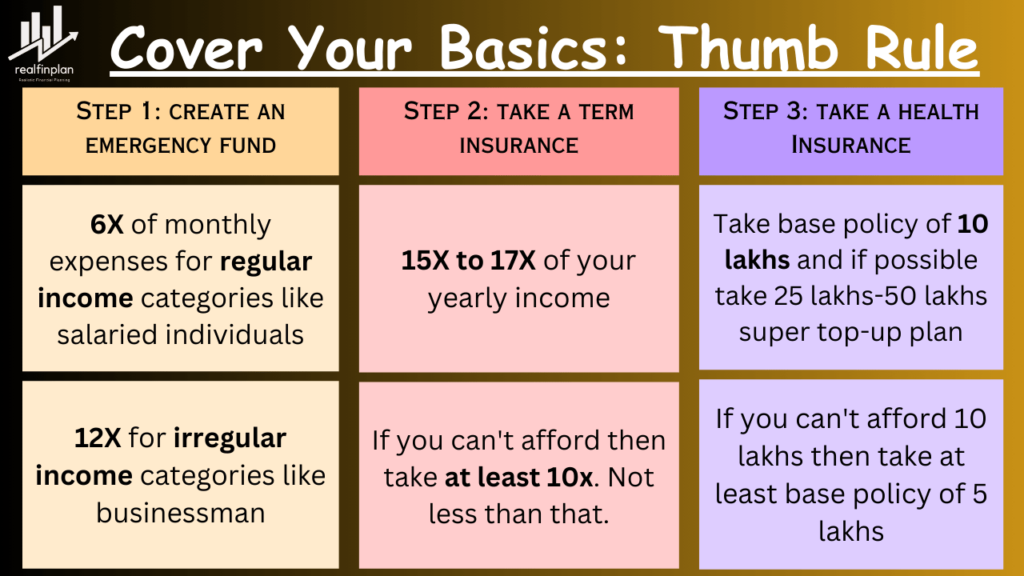

Thumb rule 6X of monthly expenses for regular income category (like salaried but they should try to stretch it towards 12X) and 12X for irregular category (like businessman).

- If you are just starting, try to save 3X initially, then 6X, then 12X, and so on.

- Simplest solution – Savings account with sweeping FD

Also, if interested, someone can explore the Insta-Redemption Liquid fund. It’s a kind of liquid fund offered by various Mutual Fund AMCs. Under this facility, investors can withdraw up to ₹50,000 or 90% of the investment amount on any given day through the IMPS facility. But honestly, it’s not “needed”. This is just for the information.

- We have a dedicated article and you can check it out to get comprehensive knowledge about an emergency fund: What Is An Emergency Fund? 3 Questions To Ask Yourself Before Spending Emergency Fund

Step 2. Take A Term Life Insurance: To Protect Your Loved Ones from life risk

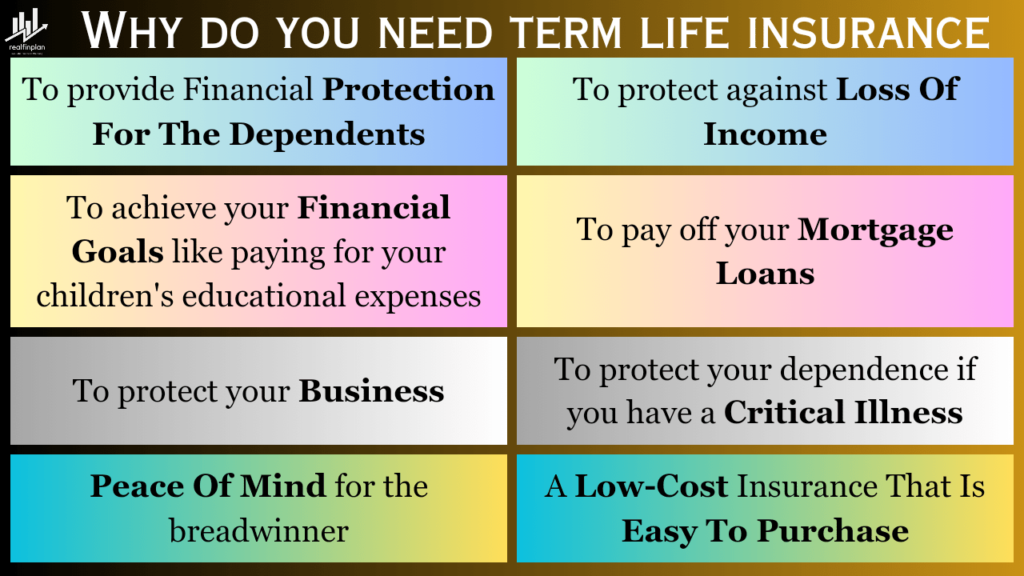

Life risk refers to the household’s financial instability when a key family member dies.

- If anything happens to you, what will be the situation of your family? How will they survive if you are the only earner?

- In this not-so-pocket-friendly world, how will they survive with daily, monthly, quarterly, and annual emergency expenses?

- What about your child’s education? What about your daughter’s marriage? What about your spouse’s expenses?

- Let’s say, you have a large secured loan, where you keep your assets (like a home for a home loan) as security to the loan provider (mortgage in Banks, NBFCs). How will your family handle such a situation when you are not there?

Term life insurance or Pure Vanilla Term Insurance offers coverage for a specific period. It’s a low-cost option that provides a death benefit to beneficiaries if the insured person passes away during the policy term.

If you have dependents who rely on your income then it’s the most important thing for you. It ensures that our loved ones are financially protected even in our absence. It will help them to maintain their lifestyle and meet important financial needs.

But always remember, you should never use any mixed product like ULIP, Endowment Policy, Whole Life Plans, Money-back plan, etc. The thing is financial planning has two main components. Insurance and investment.

To keep things simple we need to keep them separate as their purpose is different. If we mix them, things will be messy and we may not meet our needs and efficiently minimize our risks.

A low-cost pure term insurance policy is the best you can buy to cover life risk.

- Remember, don’t take term insurance beyond your retirement age, you don’t need it at that time. By the time you can create enough Retirement corpus to face any kind of financial emergency.

- Also, keep in mind that you need to buy the “regular premium”. It will be fixed for all the years of the term insurance period and will become lesser and lesser due to inflation.

Thumb Rule – 15X to 20X of your yearly income. But if you can’t afford it, at least choose 10X.

- All the insurance companies are more or less the same, in this competitive market all of their services are sometimes good or sometimes bad. No company has a 100% claim settlement ratio. So, don’t scratch your head all the time choosing the insurer, choose whichever you are comfortable with.

- Examples – HDFC Life, TATA AIA, LIC TECH term (it’s an online pure term plan from them), etc.

Step 3. Take A Health Insurance: To Safeguard Your Well-Being from Health Risk

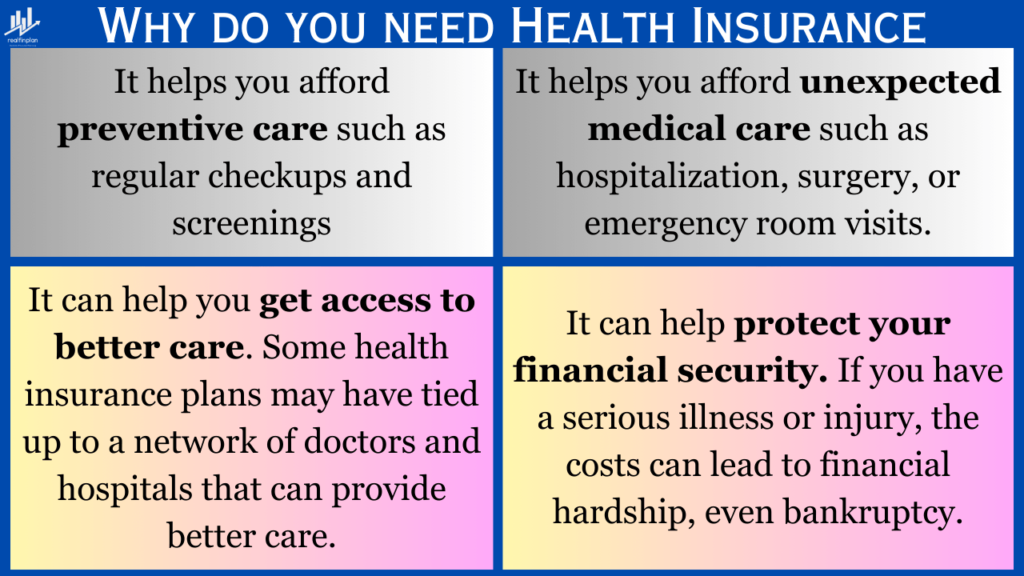

Health risk is the potential financial burden of medical expenses due to any illness or injury. Healthcare costs can be very significant, and without proper coverage, they can destroy our savings and lead to financial hardship.

- If an accident happens to you or your family, what will be the consequences, how will you manage that when it comes to money?

- If you need to go to hospitals and you have to undergo surgery, how will you manage the bills?

I have undergone a surgery (Laparoscopic cholecystectomy) back in 2021. It was 25K to 100K depending upon different locations and different hospitals. How did I manage such a situation?

I have failed because I didn’t take health insurance during the early days. Yes, I had medical insurance at that time. but the policy was new and it was under a waiting period. So I couldn’t use my health insurance policy in case of my surgery. Ultimately I did it in my hometown at 25K. And I had to pay from my pocket.

- But if I would go to different locations and different hospitals then it would be difficult for me to spend 100K then.

- More importantly, 25K is high enough to give a headache to many people.

- Remember it’s a simple and low-cost surgery. If it was a costly one then maybe all my savings would be drained out to meet the healthcare expenses.

- As you can see in my case, you should take health insurance as early as possible in your journey.

Health Insurance is one of the most important things in personal finance as medical expenses can be very scary. Health insurance plans cover medical costs for various treatments, hospitalizations, and surgeries.

It provides a shield when you face any financial burden due to any unexpected health issues. If you have the right health insurance coverage, then you can go for quality medical care without worrying about losing your savings or falling into debt.

Thumb Rule – Take 10L base policy and if possible 25L, 50L super top-up plan.

- If you can’t afford a 10L base policy then at least take a 5L base policy, if you have a no-claim year, it will get doubled.

- Take any insurer you are comfortable with. If you are not satisfied, you can port your policy to another company at the time of renewal.

- Examples – HDFC ERGO, Star Health, Care, etc.

The Combining Effect Of Financial Protection

Combining the power of an emergency fund, term insurance, and health insurance, we can create a robust financial protection strategy that will enable us to learn about managing risks for a secure future. Here’s how they work together:

Safety Net:

Emergency funds will help you to handle unexpected expenses. During any medical emergency, health insurance will cover medical bills. Term insurance provides financial support to the dependents if anything happens to the breadwinner.

Financial Flexibility:

If you have covered your basics, you will be able to focus on long-term financial goals without the constant worry of potential setbacks. You can invest confidently and plan for the future as you know that your unplanned financial expenses are covered.

Peace of Mind:

The knowledge that you are prepared for life’s uncertainties brings peace of mind. This emotional confidence can positively impact other aspects of your life. This can improve your productivity and overall happiness.

Conclusion

Financial risks are an integral part of life, but with proper planning and risk management, we can minimize their impact. The Emergency risk, Life risk, and Health risk can give us significant challenges.

But through the prudent use of emergency funds, life insurance, and health insurance, we can protect ourselves and our loved ones. We can be confident about being financially stable by managing these risks for a secure future.

Taking important steps today can safeguard your financial future and the peace of mind can provide you the ability to fight back in a crunch situation.

Remember, financial planning is not just about wealth accumulation or creation; it is also about ensuring financial flexibility and protecting what matters most to you.

Frequently Asked Questions (FAQs):

What if I can’t save 3 to 6 months’ worth of expenses?

Start with a smaller goal, like 1X, or 2X, and gradually work your way up. The key is to start building your fund, no matter how small the initial amount is.

Can I invest my emergency fund?

No. It’s best to keep your emergency fund in liquid and low-risk instruments, like cash and cash equivalents (Savings A/C or FD). You need to ensure that you can access the money quickly as it will be spent in case of emergencies.

Investing it in the stock market or any other volatile assets can be very risky. You should never take any kind of risk while managing your emergency fund.

What if I have multiple emergencies in a short period?

If you spend your funds due to multiple emergencies, focus on rebuilding it as soon as possible. Cut down on non-essential expenses and allocate funds when you have some extra income at some point in time.

How often should I review and adjust my emergency fund?

It’s a good practice to review your emergency fund annually or whenever there is a significant change in your financial situation, like switching your job or an increase in living expenses.

Can I use my emergency fund for planned expenses like a wedding or vacation?

No. The purpose of building an emergency fund is to counter any kind of unexpected or urgent expenses. For planned expenses, create a separate savings fund to avoid spending your emergency fund.

What if I have debt while building my emergency fund?

Continue making minimum payments on your debts while building your emergency fund. Once it’s established, focus on paying off debts more aggressively.

What is the main difference between term life insurance and whole life insurance?

Term Life insurance provides coverage for a specific term and you will not get any kind of return. It’s pure insurance and an expense, not any kind of investment product.

Whole life insurance offers coverage for a lifetime and also accumulates cash value over time. That means it’s a kind of mixed instrument that offers both insurance and investment. You will get returns too.

But always stay away from these kinds of mixed products. Why? These are high-cost, low-coverage, illiquid, complex products with negative to almost zero inflation-adjusted returns.

How can I determine the right coverage for my term Life Insurance policy?

To calculate the right coverage, always consider your family’s financial needs including debt, funeral expenses, educational costs, and daily living expenses. You can use a life insurance calculator to help with this.

I will recommend the insurance calculators available on the SEBI investors’ website. Bike clicking the link you can directly visit the insurance calculator page and calculate your right coverage.

Are medical exams required when applying for term Life Insurance?

In some cases, medical exams are required during the application process to assess your health conditions. However, not all policies require an exam. Please look into the insurance application policies of different insurance companies.

What should I look for when evaluating insurance companies for my Term Life Insurance policy?

When evaluating insurance companies, consider their financial stability, customer service reputation, claims processing efficiency, and claim rejection ratio.

Which insurance company should I choose for my term Life Insurance?

All the insurance companies are more or less the same, in this competitive market all of their services are sometimes good or sometimes bad. No company has a 100% claim settlement ratio.

So, don’t scratch your head all the time choosing the usurer, choose whichever you are comfortable with.

Can I change my coverage amount during the policy term?

Usually, you can’t change the coverage amount during the term. However, you can buy additional policies whenever you feel the need to increase your coverage amount.

Are Term Life insurance payouts taxable?

No. The death benefit from a term life insurance policy is typically tax-free. The beneficiaries receive the full amount.

Can I have multiple-term life insurance policies?

Yes, you can have multiple policies from different insurers. This can be useful if you have diverse coverage needs.

What does health insurance cover?

Health insurance typically covers medical expenses such as doctor visits, hospital stays, prescription drugs, preventive care, any surgery, etc.

Can I change my health insurance policy provider?

Yes, you can change. If you are not satisfied, you can port your policy to another company at the time of renewal.

Can I change my health insurance plan?

Yes, you can change your health insurance plan during the open enrollment period or at the time of renewal. You should change your health insurance plan if you experience a qualifying life event, like getting married or having a baby.

How can I find out which insurer is better for me?

You can usually check the insurance provider’s website to find out which company has tied up with more hospitals in your network area. Try to go with the insurance provider that has a higher no of quality network hospitals.

Look for an insurer with a good reputation, a wide network of healthcare providers, and a history of prompt claims processing.

How do I determine the right coverage amount?

Consider your medical history, budget, and family needs. It’s often wise to consult with an insurance agent for personalized advice.

****************

In realfinplan, we try to provide realistic, authentic, and free educational content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future. Now that you have finished the first one, understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Then, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.