Welcome to realfinplan! In this article, we will try to understand how to decide on Asset Allocation for a financial goal. What is asset allocation? It’s nothing but the key strategy for investment planning. So, we will approach step by step to create a robust strategy for achieving a financial goal.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

If you want to become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk.

This SRR can damage your portfolio and your overall financial well-being at any point in your investment journey. To challenge this SRR and counter its effects, we need to adopt a proper strategy. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

- We have already discussed that in our previous article and I will request the readers to finish this article first and then come here: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

To learn more about Asset Allocation, please dive into our other blogs:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- About Common Mistakes to Avoid: 9 Common Mistakes To Avoid For Asset Allocation Strategy

- About Some Tips and Tricks for Investment Planning: 9 Tips For Investment Planning To Avoid The Common Mistakes In Asset Allocation Strategy

****************

In realfinplan, we try to provide realistic, authentic, and free educational content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

How to decide On asset allocation for a financial goal?

We have already discussed that there is no secret recipe to determine the right asset allocation for you. But to make things easier, you can create a strategy by assessing your financial situation logically and step by step.

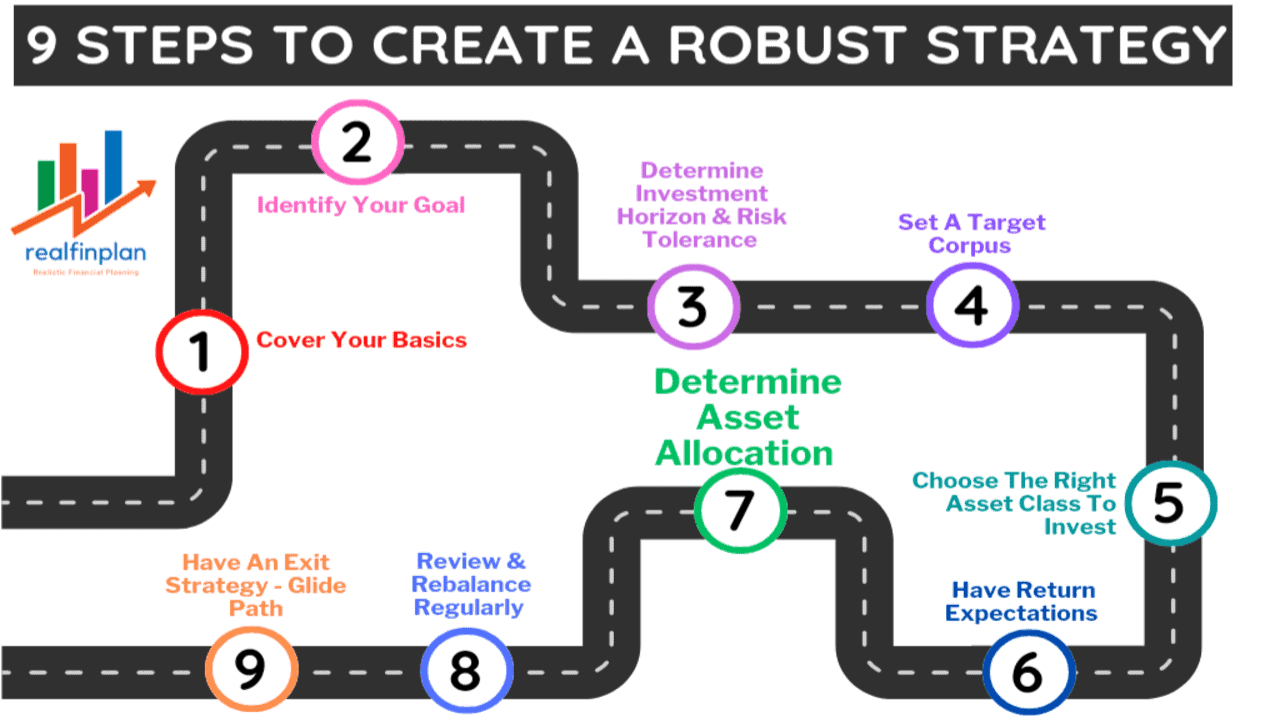

So, let’s discuss creating an asset allocation strategy with 9 simple steps.

Step 1: Cover Your Basics – Manage The Financial Risks To Secure Yourself

Why do we need to secure ourselves financially? Well, life is full of risks, needs, and wants. And most important of them are financial “risk” and “needs” (not wants, you can’t ignore the “needs” or delay them, we will give more focus on needs here, especially long-term needs).

If you need to build a house you will need to have a strong foundation. Without a solid base, you won’t be able to protect your house.

- Similarly in personal finance, you need to cover your basics first, and manage your financial “risks”. Then only you can build the floors for your house i.e. build your wealth through Investments to meet financial “needs”.

There are a lot of financial risks associated with our lives and the most important are Emergency risk, Life risk, and Health risk. They can give us significant challenges at any point in our financial journey.

- Emergency Risk: As the word suggests, an emergency can strike us at any time. It can be in the form of Job Loss, Income stoppage or reduction, underperforming business for some time, any medical crisis, or any kind of financial emergency.

- Life Risk: Life risk refers to the household’s financial instability when a key family member or the sole breadwinner dies.

- Health Risk: Health risk is the potential financial burden of medical expenses due to any illness or injury. Healthcare costs can be very significant, and without proper coverage, they can destroy our savings and lead to financial hardship.

For a secure future, we need to manage those financial risks at any cost. In personal finance, the emergency fund, term insurance, and health insurance are the basics or foundations of financial security. These three things serve as a shield as they protect against unexpected events, expenses, and potential risks to our lives.

- Through the prudent use of emergency funds, life insurance, and health insurance, we can protect ourselves and our loved ones.

- We can be confident about being financially stable and fighting back in any crunch situation.

Now coming to the solution, the most important thing is that it should be simple to understand and adapt. The more simple it is, the easier it will be to control. Let’s try to understand each element and how to work on them to safeguard our financial future.

Create An Emergency Fund: Your Financial Cushion

An emergency fund is the savings that is set aside for unexpected emergencies. If you have an adequate emergency fund, you won’t have to put your hands on long-term savings or go for a “Debt” during difficult times.

Your aim should be to save adequately for your emergency fund to ensure peace of mind and financial stability.

More importantly, it should be fully liquid (like cash and cash equivalents) as it will be used in case of emergency.

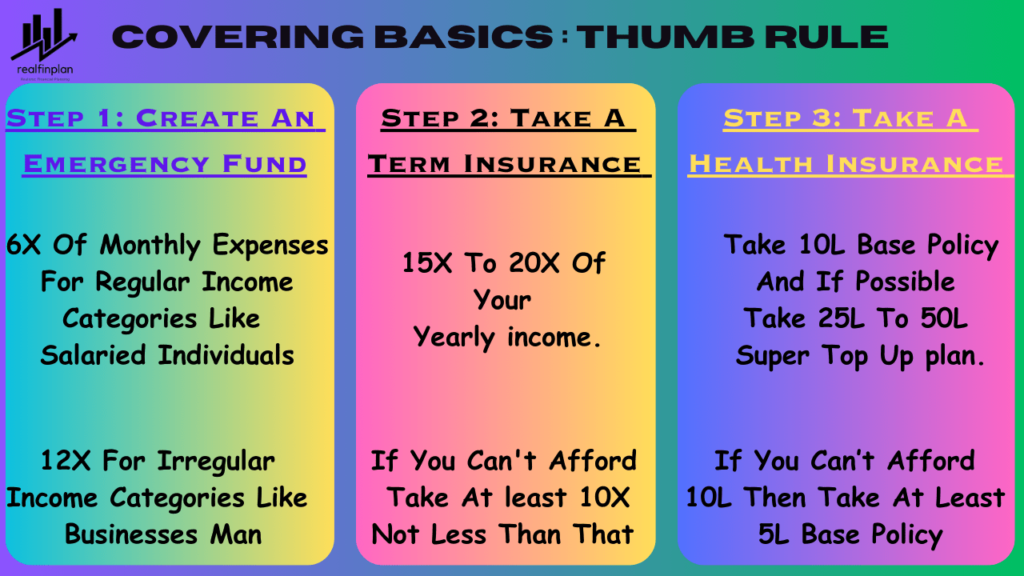

Thumb rule 6X of monthly expenses for regular income category (like salaried but they should try to stretch it towards 12X) and 12X for irregular category (like businessman).

- If you are just starting, try to save 3X initially, then 6X, then 12X, and so on.

- Simplest solution – Savings account with sweeping FD

Also, if interested, someone can explore the Insta-Redemption Liquid fund. It’s a kind of liquid fund offered by various Mutual Fund AMCs. Under this facility, investors can withdraw up to ₹50,000 or 90% of the investment amount on any given day through the IMPS facility. But honestly, it’s not “needed”. This is just for the information.

Take A Term Life Insurance: To Protect Your Loved Ones

Term life insurance or Pure Vanilla Term Insurance offers coverage for a specific period. It’s a low-cost option that provides a death benefit to beneficiaries if the insured person passes away during the policy term.

If you have dependents who rely on your income then it’s the most important thing for you. It ensures that our loved ones are financially protected even in our absence. It will help them to maintain their lifestyle and meet important financial needs.

But always remember, you should never use any mixed product like ULIP, Endowment Policy, Whole Life Plans, Money-back plan, etc. The thing is financial planning has two main components. Insurance and investment.

- Insurance is for minimizing the risk and Investments are for our future needs and wants.

To keep things simple we need to keep them separate as their purpose is different. If we mix them, things will be messy and we may not meet our needs and efficiently minimize our risks.

A low-cost pure term insurance policy is the best you can buy to cover life risk.

- Remember, don’t take term insurance beyond your retirement age, you don’t need it at that time. By the time you can create enough Retirement corpus to face any kind of financial emergency.

- Also, keep in mind that you need to buy the “regular premium”. It will be fixed for all the years of the term insurance period and will become lesser and lesser due to inflation.

Thumb Rule – 15X to 20X of your yearly income. But if you can’t afford it, at least choose 10X.

- All the insurance companies are more or less the same, in this competitive market all of their services are sometimes good or sometimes bad. No company has a 100% claim settlement ratio. So, don’t scratch your head all the time choosing the insurer, choose whichever you are comfortable with.

- Examples – HDFC Life, TATA AIA, LIC TECH term (it’s an online pure term plan from them), etc.

Take A Health Insurance: To Safeguard Your Well-Being

Health Insurance is one of the most important things in personal finance as medical expenses can be very scary. Health insurance plans cover medical costs for various treatments, hospitalizations, and surgeries.

It provides a shield when you face any financial burden due to any unexpected health issues. If you have the right health insurance coverage, then you can go for quality medical care without worrying about losing your savings or falling into debt.

Thumb Rule – Take 10L base policy and if possible 25L, 50L super top-up plan.

- If you can’t afford a 10L base policy then at least take a 5L base policy, if you have a no-claim year, it will get doubled.

- Take any insurer you are comfortable with. If you are not satisfied, you can port your policy to another company at the time of renewal.

- Examples – HDFC ERGO, Star Health, Care, etc.

Step 2: Why? Determine Investment Objective

Once you covered your basics, you must be ready to save and invest for your future financial needs and wants.

So, when you are ready to invest, try to find the answer by asking yourself. I have done this from the very beginning. This has led me to be a DIY Investor. But it will be best if you ask the right questions. The first question should be –

Why am I Investing?

When it comes to investing, you need to have a strategy and a plan. You need to think about things logically.

One day I met a young earner on Facebook. He was ready to invest around 30K-40K per month. He told me about 3 mutual funds and asked me whether his choices were good or not. He also asked about which mutual fund would give him the best return. I asked him, “Why do you need to invest?” He simply didn’t know. He just wanted to save and invest that much, that’s all.

It’s the start of your Investment Journey, don’t invest aimlessly. Yes, you are ready to invest and that’s “good”. But to make it “great”, you need to give your investment a purpose, and make it a goal.

- If you don’t have any Goal as of now or you can’t identify your goal, then your default goal should be “Retirement”.

- Think harder and look closer to your life. The moment you start earning, you need to think about your financial freedom.

- As you age, your ability to work will decrease. Eventually, at some point of time, you will have to retire, there will be no other option.

People just jump into mutual funds or stocks in the name of investing.

- What is the best mutual fund?

- What is the best stock to invest in?

- Which mutual fund gives a higher return?

- All of us need the best mutual funds, the best returns-giving mutual funds, and the best stocks.

But the thing is, investment products are just a part of Portfolio construction. Whether we will use mutual funds or stocks or PPF or NPS, i.e. the products should be the last thing to choose to build a portfolio. Portfolio construction is the last thing to do for an investment plan.

So, all you need is an investment plan, not a product. The investment plan is the process you follow. It is a bunch of products. And those products have different kinds of risks. Therefore, they fetch different kinds of returns. So, you need to strike a balance between risks and rewards.

- Diversification is the tool and asset allocation is the key for investing. These will help you to reduce the risks and increase the potential of maximizing the returns.

- To get the benefit of all these, first, you need to know why you are investing, you need to identify your goals. So that, you can align your investment plan as per your needs.

I have experienced the disadvantages of investing without any goal or any plan. I had no strategy and I was just investing aimlessly. When I was a child I remember, my father used to tell me, “An aimless man is like a ship without a radar”.

This is true for investing too. If you don’t have any goal, you will not have a strategy, it will lack direction and will result in impulsive decisions which can harm your financial well-being.

- So, establish specific goals – be it buying a new home or a new car, funding education, or retiring comfortably. Then you will have clarity about the time frame, money needed at that time, investment opportunities, etc.

Step 3: When? Determine Investment Horizon And Risk Tolerance

Once you are done with ‘Why’, your next right questions should be –

When Do I Need The Money?

This is so crucial for investment planning. There are a lot of factors that depend on this ‘When’.

This is crucial to determine how much “risk” you should take while investing. As per the time frame you can decide, whether you need to invest in equity or how much you need to invest in equity. Equity comes with a certain degree of risk and uncertainty aka Sequence of Returns Risk. So, you also need to counter that. That’s why you also need a strategy.

- Learn more about Sequence of Returns Risk in our other article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

The longer the ‘when‘, the risk-taking ability will be higher. If your time frame is shorter, your risk-taking ability will be lower and lower.

All the successful investors have a strategy in place. We all need to have a strategy when it comes to investing. But the thing is, you will only have a strategy when you know when to withdraw money from investments.

Remember, there is no such good or bad time for entry in market-related instruments. But there can be a good or bad time to withdraw from investments. That’s why there should be an exit strategy and that will be as per the tenure of the goal: Asset allocation Strategy with Rebalancing and a Glide Path.

Many investors don’t know about the time frame and don’t know when to exit. They just want to maximize the returns or reduce the risks.

- Most of the time, they just aimlessly invest to maximize the returns only, without understanding the risk associated with investment.

- This results in impulsive decisions which can wreak havoc on their financial well-being.

- That’s why I always suggest: Do not run after Returns. Rather chase Target Corpus!

This is why the ‘why’ is so important. If you know why you are investing, you will know when you need the money. Only if you know when you need the money, then only you can decide how much you need and where to invest.

Step 4: How? Set A Target Corpus For Your Goal

Once you are done with ‘When’, your next right questions should be –

How Much Money Do I Need? What Is A Target Corpus?

To find a corpus you need to assess your financial goals at first. Let’s say, you have a daughter. She is 2 years old. So, you have around 15 years in hand after that she will go to college. Why not 16 years? Well, you have to prepare before she turns 18, many enter college before attaining that age. Myself is an example.

In today’s time, the Present Cost of Graduation in a Private Engineering College is about ₹15L to ₹20L (including course, food, lodging, and other Educational expenses like projects and all).

If we take inflation @ 10%, graduation expenses of 20L will become around ₹84L in 15 years. That 84L is your target corpus. How did I get it? Simple, using the compounding formula.

Target Corpus = Present Cost (1+ Inflation %)^ Time Horizon

The thing is, you need that ₹84L at any cost, no matter how you get it, by investing in equity or debt or anything.

Yes, there is always an option to opt for a loan. But then why do you invest? So that you won’t have to opt for a loan. Right?

- So, the motive behind Investing should be to prepare ourselves financially at the time of need so that we don’t need an educational loan.

- You need to get the amount ready when she enters college, no matter whether you get a 8% or 10% or 18% return. All that matters is to achieve the CORPUS.

Step 5: Where? Choose The Right Asset Classes To Invest

Once you are done with ‘How’, your next right questions should be –

Where To Invest?

To build a healthy portfolio, we need different asset classes to invest. Why? Simple, because we need to diversify our investment. Diversification reduces the risk. In a market condition, if one asset performs poorly, the other one may perform better.

There are various asset classes like equity, debt, gold, real estate, etc. We have talked about them earlier. You can use them to diversify your investment. But remember,

- Over-diversification can hamper your financial well-being.

- It can also reduce the overall returns of your portfolio.

- The more asset classes you use to diversify your investments, the more it will increase complexity in your portfolio.

- It will result in difficulties in managing it and a high-maintenance portfolio.

And investing should be all about keeping things simple, straightforward, and low maintenance. Otherwise, your other aspects of life may be affected.

- Please understand: Why Investment Planning Should Not Be Complicated And High Cost?

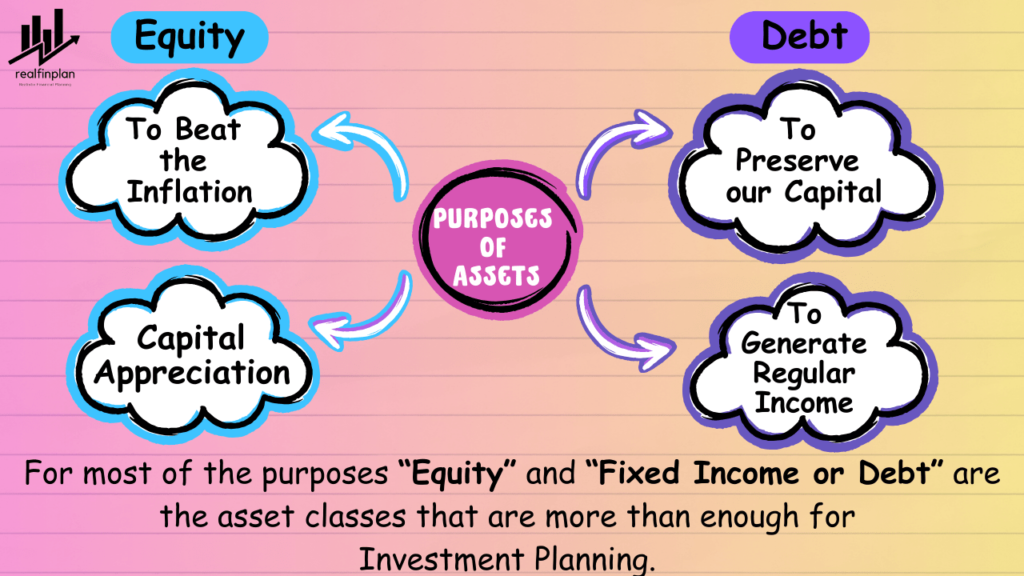

Understand: What should be the primary purposes for your investing?

- To achieve higher returns over the long term so that you can outpace the inflation. Equity is enough for this.

- To become wealthy through capital appreciation. Equity can serve this purpose.

- To preserve your capital in the event of a market downtown. Fixed income is enough for this.

- To generate a steady income stream during the withdrawal phase of retirement. A robust fixed-income portfolio can serve this purpose.

- To strike a balance between risk and returns by creating a balanced portfolio. A good mix of equity and fixed income can easily fulfill this purpose.

The Solution

We have already discussed the above-mentioned points while understanding the purposes of the asset classes. So, equity and fixed-income instruments are more than enough to fulfill the purposes of your goal-based investing.

Yes, you always can use Gold or Real Estate as asset classes besides Equity and Debt. But, you don’t “need” them for Goal Based Investment Planning.

- The simplest way to diversify your portfolio is to use two asset classes. One is “Equity” and the other is “Debt or Fixed Income”.

- These are more than enough to reduce the overall risks of your investment portfolio, to get optimal returns, to achieve financial goals, and to make your portfolio low maintenance to manage. So we will consider only these two asset classes for asset allocation strategy.

Step 6: Have Return Expectations From Your Portfolio

You should have a return expectation from equity and fixed income for the period of investment. Remember about the ‘Why’ and ‘When’? Almost every aspect of Investment planning depends upon the “when do you need the money”, i.e. the timeframe.

Now the fact is, returns are unknown and not in our hands. For a long-term financial goal of say 15 years, no one knows what the share market will do, or how the interest rate will be. If you think realistically, you will see the decreasing trend of interest rates and inflation numbers over time.

Things are now different from the previous decade. Basically, you don’t know about returns, be it equity mutual funds, stocks, PPF, or any other financial products or instruments. Then why do you want to run after it? Rather, you need to build a strategy to achieve your Corpus with practical and realistic return expectations from your investments.

Let’s Be Realistic

In our country, the rate of inflation is about 5% – 7%, and GDP growth is about 5% – 7%. If you add them, then you can expect 10% – 14% from equity over the long term. Anything above 14% is unrealistic.

- And if we consider tax, conservatively it can be about 2%. Then post-tax return will be around 12%. Remember, this 12% is the maximum.

- So, I will not talk about 15%, 18% returns, and all that.

If you are an aggressive investor, you can expect a 12% after-tax return from equity for above 10 years, but 10% will be better and reasonable I think. And 8% to 9% after tax return if the time period is below 10 years. You should not expect more than 6% post-tax return from fixed income.

So, if you expect 10% of post-tax returns from equity and 6% post-tax return from fixed income, and decide to have 60% equity in your portfolio, then:

Expected portfolio return = (10% X 60%) + (6% X 40%) = 8.4% (after tax)

Understand that, this 8.4% return expectation is for the first year and for the first few years. Asset allocation will change later when you start reducing equity allocation to de-risk your portfolio. When the Asset allocation changes, the expected portfolio return will also change. It will typically come down as the equity allocation will decrease.

You need to take all these into account, for all asset allocations, to calculate the monthly investment to be made to achieve the goal.

Step 7: Determine Asset Allocation – Follow Thumb Rules

What is the asset allocation Strategy?

Asset allocation strategy is the process of allocating your investments or dividing your portfolio among different asset classes. These can be Stocks or Equity, Debt or Fixed Income Instruments, Commodities like Gold, Real Estate etc.

Each asset class has its own unique risk and return profile. So if you diversify your portfolio among different asset classes, you can

- Reduce your overall portfolio risk

- Improve your Returns

- Increase your chances of achieving your financial goals

Our sole purpose should be to achieve our financial goals. For that reason, your investment strategy must align with your financial goals and risk tolerance with respect to the time horizon. Through asset allocation, you can tailor your strategy to your purposes or goals.

After you decide where to invest, in the Asset classes, you should ask these questions:

- How much should I invest in equity?

- How much should I invest in fixed income?

- What should be the percentage allocation of equity?

- What should be the ratio between the Asset classes?

If you decide that you will invest 50% in equity and 50% in fixed income or 70% in equity and 30% in fixed income. This is the Asset allocation. But how will you decide?

Thumb Rules:

There is no secret recipe to determine the perfect asset allocation for a particular goal. But to make things easier you can follow a thumb rule.

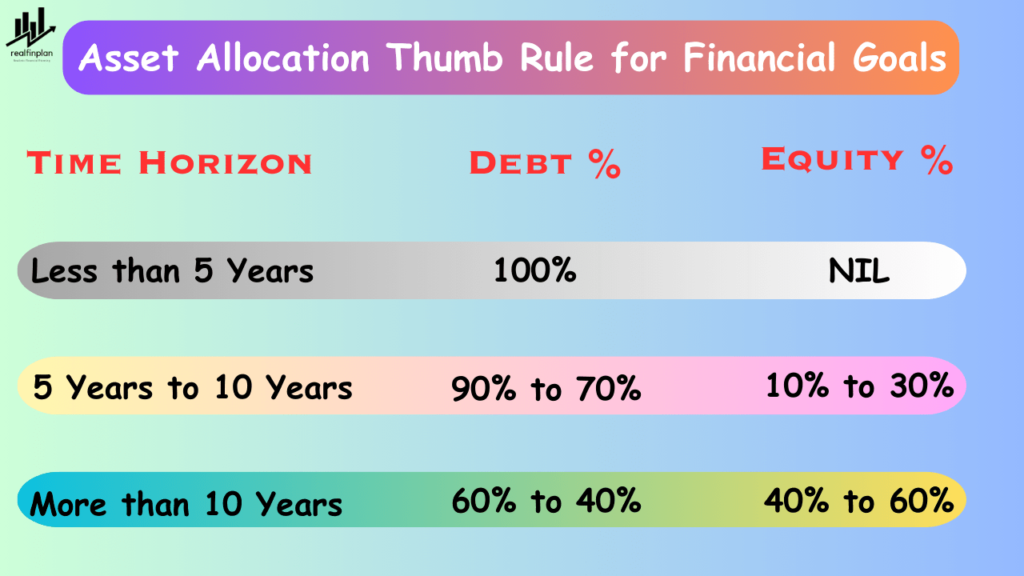

If you have a longer time horizon (more than 10 years) like retirement, child education planning, marriage planning for your child, buying a dream house, etc, those are at least 10-12 years away, you can afford to take on more risk in your portfolio. So, you can allocate a greater percentage of your assets to equity-related investment products. This is because equity has the potential to generate higher returns over the long term.

- Thumb rule – 60% to 40% in debt and 40% to 60% in equity (initial allocation)

But, if you have a shorter time horizon (5-10 years), you may need to be more conservative when it comes to investing. You need to allocate a greater percentage of your assets to fixed-income instruments, bonds, cash, etc.

- Thumb rule – 90% to 70% in debt and 10% to 30% in equity (initial allocation)

And, if your goals are short-term goals (Less than 5 years), you should avoid equity as an investment product for the short term. Read here: Why You Should Not Use Equity For Short Term? Sequence Of Return Risk

- Thumb rule – 100% in debt or fixed income

Mindset Clarity Regarding Thumb Rules:

Remember, these are personalized thumb rules and are based on Rolling Returns and Standard Deviations of a large cap-based index like Sensex or Nifty 50.

- Rolling Returns: The annualized returns of a mutual fund scheme or stock on multiple dates for a specific investment period are known as rolling returns.

- Standard Deviations: It’s a measurement of the risks and volatility of a stock or fund. In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values.

Likewise having return expectations from your portfolio, you should also have an expectation from the entire portfolio about how much it can fall and how long will it remain down.

It has been observed in the study (by beloved Pattu Sir) that, for 60% equity in the portfolio, you can expect at least a 60% to 65% fall and it may remain down for as long as 2 years.

- Remember this is about the whole portfolio, not the equity only.

- For 70% equity in the portfolio, there can be a fall of about 70% to 75%.

The more equity allocation in the portfolio, the more it will be risky as the standard deviation of your portfolio will be higher. If you use 60% equity allocation, the standard deviation will be around 10% or more.

- Simply, a higher equity allocation means a higher double-digit standard deviation.

- Higher standard deviations mean higher risk.

- And higher risk doesn’t necessarily mean higher returns all the time.

- Here the higher risk is a “guarantee”. But higher returns are just a possibility.

So, personally, I do not like a high double-digit standard deviation. I personally use 60% equity allocation for all of my long-term goals and I would suggest no more than 70%. I also think 50% equity is a pretty decent mix as suggested by Benjamin Graham’s 50% stocks and 50% bonds strategy.

Recognize that we have considered a large cap-based index fund. Had we included mid and small-cap indices, the volatility and standard deviation would have been much higher.

I think anything above 70% equity allocation will require a lot of maintenance, like frequent monitoring, taking some tactical calls, etc. I have some better things to do. I always prefer something that is low maintenance with reasonable risk and reasonable reward.

Also please remember, that these thumb rules are for initial asset allocation i.e. to start your investment journey. You cannot hold that much equity allocation when you need the money. Otherwise, it would be too risky if the market fluctuates too much. That’s why I always recommend: Asset Allocation Strategy with Regular Rebalancing and a Glide Path.

Use the flexibility of asset allocation strategy. It will empower you to rebalance your portfolio and follow a glide path to achieve your financial goal.

As the goal progresses and market conditions change, asset allocation can shift from your original plan. Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy and your plan.

- When there is a significant market swing (upward or downward), sell some winners and buy more of the underperforming assets to maintain your desired asset allocation. This way you can take advantage of the market condition.

Always have an exit strategy for achieving your goal. Without an exit strategy, you won’t be a successful investor. You should follow a Glide Path.

- You need to gradually de-risk your portfolio by reducing the equity allocation in a step-wise manner as the goal nears its deadline.

- You need to systematically increase your fixed income allocation to reduce the risk in the portfolio. So that, sequence of returns risk won’t be able to affect your portfolio much.

We have already discussed this concept in our previous article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Reduce It

Step 8: Review And Rebalance Your Portfolio Regularly

As the goal progresses and market conditions change, asset allocation can shift from your original plan. Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy and your plan.

- When there is a significant market swing (upward or downward), sell some winners and buy more of the underperforming assets to maintain your desired asset allocation.

There are two types of rebalancing:

Regular yearly rebalancing:

Theoretically, you should review and rebalance your portfolio at least once a year. If the corpus is too high you may need to review twice a year.

Let’s say, you start your journey with a 60:40 ratio (Equity : Debt). Now, after one year it becomes 62:38 or 58:42.

- You need to rebalance your portfolio to your desired asset allocation of 60:40.

- You will do this each year when you review your portfolio.

Threshold Rebalancing:

But when it comes to Rebalancing, regular yearly Rebalancing can be hectic for many people. So let’s not make it complicated. To keep things in low maintenance mode, you can set a threshold limit for your re-balancing.

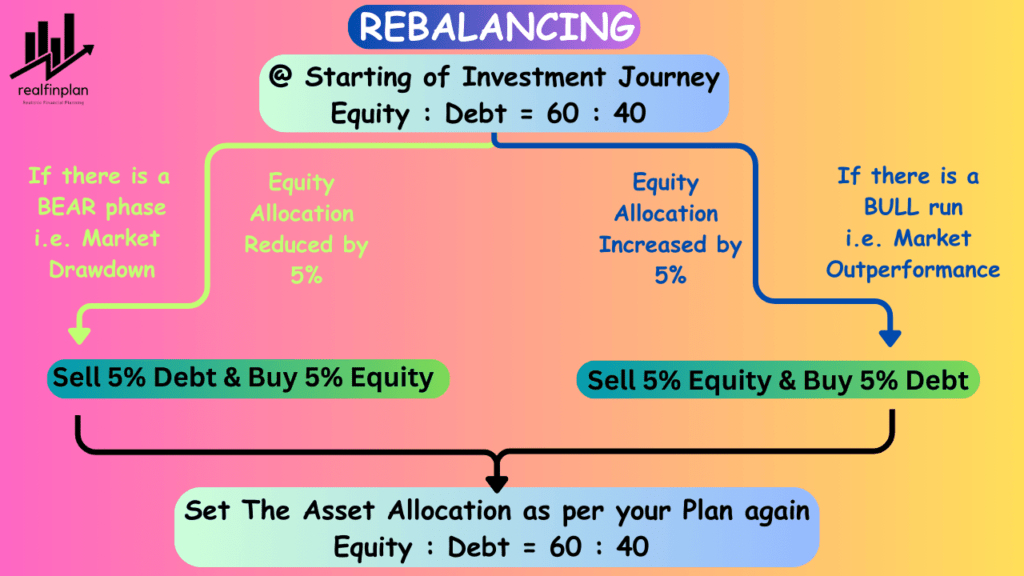

Let’s say, you start your journey with a 60:40 ratio (Equity : Debt). You will rebalance your portfolio back to 60:40 only if the equity allocation deviates by, say 4% or 5%.

- If, after one year it becomes 62:38 or 58:42. You do anything.

- Keep it as it is. If it becomes 54:46, you rebalance it to 60:40.

- But, please keep in mind that there will be tax implications and exit loads while rebalancing. That’s why threshold rebalancing is better as this typically occurs once in 2 to 4 years.

- Also, the threshold limit should be small. Anything more than 5% can decrease your equity allocation too much. That can also affect compounding.

If you will ask me I will say that my threshold limit is 5%. How does that work? Let’s take an example.

Suppose, you start your investment journey with an asset allocation of equity: fixed income = 60 : 40

Now, if there is a bear phase in the market and your equity allocation is reduced to say 55%, you can sell 5% of your debt component and buy 5% of equity. So that, your asset allocation remains the same.

Similarly, if there is a bull run in the market and your equity allocation is increased to 65%, you can sell 5% of your equity component and buy 5% of fixed income.

- You may have heard that you should book some profit when there is a bull run and you should invest more in equity when there is a bear phase in the market. If you adopt an asset allocation strategy, you won’t have to scratch your head for that.

- If your asset allocation deviates significantly from your actual plan, your rebalancing process will take care of that. That’s the beauty of adopting an asset allocation strategy.

Step 9: Have an Exit Strategy – The Glide Path

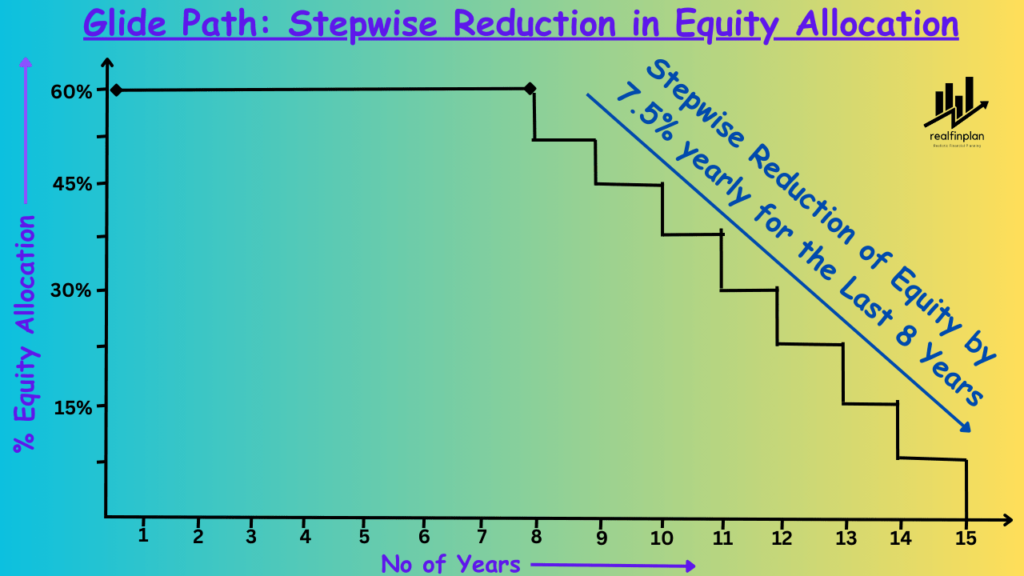

Remember, this 60:40 asset allocation is for the first year and for the first few years. You cannot hold that much equity allocation when you need the money, otherwise, it would be too risky if the market fluctuates too much.

Always have a plan to reduce the equity allocation in a step-wise manner to de-risk your portfolio. You need to systematically increase your fixed income allocation to reduce the risk in the portfolio, as the goal nears its deadline. So that, sequence of returns risk won’t be able to affect your portfolio much.

There is no secret recipe for determining how to follow a glide path. But we can follow a thumb rule to make things easier. I follow the following thumb rule for long-term (For goals having more than 10 years of time horizon) investment planning.

- Fix an initial asset allocation and keep it intact for 50% of the time period. During this time period, if your asset allocation shifts significantly or the change in asset allocation hits your threshold limit, don’t forget to rebalance.

- Then reduce the equity portion in a step-wise manner on a yearly basis for the rest of the time period.

For example, if your child’s education goal is about 15 years away, you can start your journey with 60% in equity and 40% in fixed income.

- After maintaining 60:40 for 7 years, you can gradually decrease the equity portion by 7.5 % each year for the last 8 years and make it zero when the goal is completed.

- Then you can spend the money freely when your child will go to college.

In this way, you can achieve your target corpus regardless of the market condition.

- Yes, through an asset allocation strategy, you will have to invest a little bit more than a portfolio with only equity. Why? With the reduction in equity allocation, the expected return from the overall portfolio will also reduce.

- But that’s what you will pay to enjoy a comparatively smoother ride to achieve your goal.

Resources To Stay Ahead Of The Goal-Based Investing Game

Use Calculators

Is there any free calculator available for calculations based on asset allocation? Yes, there are many financial calculators available in the market where you can put numbers and play with them to get an idea about how to create an asset allocation-based strategy.

However, I will recommend using the financial calculators available on the SEBI Investor website. Those are developed by my guru, the pioneer of DIY Investing in India, the calculator Baba, and our beloved professor Pattu Sir.

- By clicking the link, you can get to the page of 9 calculators. You can put numbers and play with them. There are also videos of Pattu Sir, about how to use those calculators.

If you want to have some calculations based on variable asset allocation, by clicking the following link, you can directly go to the variable asset allocation calculator’s page.

- There is also a video regarding how to use the calculator so that you can use it efficiently with free of cost.

Use Robo Advisor

You can also take advantage of automatic investment platforms and Robo Advisors. These are of low cost and charge lower fees than traditional financial advisors. The services can also simplify your investment process by creating and managing a diversified portfolio based on your goals and risk tolerance.

- I use the Robo-Advisory Template made by Pattu Sir’s Freefincal for my investment planning. I personally find it an excellent choice for those looking for a low-cost financial planning solution.

- This automatically takes care of the Asset Allocation Strategy with Regular Rebalancing and a Glide Path.

Seek Professional Advice If Needed

Investment planning doesn’t mean you have to do it alone. While some individuals prefer the do-it-yourself approach, others may benefit from Professional assistance.

If you find investment planning and reviewing too much, you can always consider consulting a financial advisor. But please don’t go for a commission-based financial advisory model or Mutual Fund Distributors (MFDs). That commission is never good for you, it can erode your hard-earned money on a regular basis. This is only good for the financial advisor.

It’s best to use a Fee-Only Certified Financial Planner (CFP). By clicking on the link, you can get the lists of fee-only financial advisors in our country.

- They work on the commission-free, fee-only model. So that you can have more of your hard-earned money, they charge reasonable fees and provide valuable guidance.

- Their sole purpose is to financially educate you. So that, you can be capable of making informed investment decisions by yourself.

Frequently Asked Questions (FAQs):

What if I can’t save 3 to 6 months’ worth of expenses?

Start with a smaller goal, like 1X, or 2X, and gradually work your way up. The key is to start building your fund, no matter how small the initial amount is.

Can I invest my emergency fund?

No. It’s best to keep your emergency fund in liquid and low-risk instruments, like cash and cash equivalents (Savings A/C or FD). You need to ensure that you can access the money quickly as it will be spent in case of emergencies.

Investing it in the stock market or any other volatile assets can be very risky. You should never take any kind of risk while managing your emergency fund.

What if I have multiple emergencies in a short period?

If you spend your funds due to multiple emergencies, focus on rebuilding it as soon as possible. Cut down on non-essential expenses and allocate funds when you have some extra income at some point of time.

How often should I review and adjust my emergency fund?

It’s a good practice to review your emergency fund annually or whenever there is a significant change in your financial situation, like switching your job or an increase in living expenses.

Can I use my emergency fund for planned expenses like a wedding or vacation?

No. The purpose of building an emergency fund is to counter any kind of unexpected or urgent expenses. For planned expenses, create a separate savings fund to avoid spending your emergency fund.

What if I have debt while building my emergency fund?

Continue making minimum payments on your debts while building your emergency fund. Once it’s established, focus on paying off debts more aggressively.

What is the main difference between term life insurance and whole life insurance?

Term Life insurance provides coverage for a specific term and you will not get any kind of return. It’s pure insurance and an expense, not any kind of investment product.

Whole life insurance offers coverage for a lifetime and also accumulates cash value over time. That means it’s a kind of mixed instrument that offers both insurance and investment. You will get returns too.

But always stay away from these kinds of mixed products. Why? These are high-cost, low-coverage, illiquid, complex products with negative to almost zero inflation-adjusted returns.

How can I determine the right coverage for my term Life Insurance policy?

To calculate the right coverage, always consider your family’s financial needs including debt, funeral expenses, educational costs, and daily living expenses. You can use a life insurance calculator to help with this.

I will recommend the insurance calculators available on the SEBI investors’ website. Bike clicking the link you can directly visit the insurance calculator page and calculate your right coverage.

Are medical exams required when applying for term Life Insurance?

In some cases, medical exams are required during the application process to assess your health conditions. However, not all policies require an exam. Please look into the insurance application policies of different insurance companies.

What should I look for when evaluating insurance companies for my Term Life Insurance policy?

When evaluating insurance companies, consider their financial stability, customer service reputation, claims processing efficiency, and claim rejection ratio.

Which insurance company should I choose for my term Life Insurance?

All the insurance companies are more or less the same, in this competitive market all of their services are sometimes good or sometimes bad. No company has a 100% claim settlement ratio.

So, don’t scratch your head all the time choosing the usurer, choose whichever you are comfortable with.

Can I change my coverage amount during the policy term?

Usually, you can’t change the coverage amount during the term. However, you can buy additional policies whenever you feel the need to increase your coverage amount.

Are Term Life insurance payouts taxable?

No. The death benefit from a term life insurance policy is typically tax-free. The beneficiaries receive the full amount.

Can I have multiple-term life insurance policies?

Yes, you can have multiple policies from different insurers. This can be useful if you have diverse coverage needs.

What does health insurance cover?

Health insurance typically covers medical expenses such as doctor visits, hospital stays, prescription drugs, preventive care, any surgery, etc.

Can I change my health insurance policy provider?

Yes, you can change. If you are not satisfied, you can port your policy to another company at the time of renewal.

Can I change my health insurance plan?

Yes, you can change your health insurance plan during the open enrollment period or at the time of renewal. You should change your health insurance plan if you experience a qualifying life event, like getting married or having a baby.

How can I find out which insurer is better for me?

You can usually check the insurance provider’s website to find out which company has ties up with more no of hospitals in your network area. Try to go with the insurance provider that has a higher no of quality network hospitals.

Look for an insurer with a good reputation, a wide network of healthcare providers, and a history of prompt claims processing.

How do I determine the right coverage amount?

Consider your medical history, budget, and family needs. It’s often wise to consult with an insurance agent for personalized advice.

What is the ideal asset allocation for me?

There is no secret recipe for deciding asset allocation. It depends on your financial goals, risk tolerance, and investment horizon. You can consider following some thumb rules and if you think this is a daunting task, then it’s best to consult a financial advisor to determine the right mix for you.

How often should I rebalance my portfolio?

Rebalancing should be done periodically. You should review your portfolio and rebalance it at least once a year. But if it seems too hectic to you, then set a tolerance limit and rebalance your portfolio when your asset allocation deviates significantly.

Can I use asset allocation for retirement planning?

Yes, definitely. Asset allocation is crucial for retirement planning. It helps you to strike a balance between risk and return. So that, your retirement portfolio meets your income needs.

What should I do if my risk tolerance changes over time?

If your risk tolerance changes, it becomes important to adjust your asset allocation accordingly. Generally, as the goal progresses toward its deadline, your risk tolerance changes and your capability to take risks reduces.

Always have an exit strategy by following a glide path with a step-wise reduction in equity allocation. If you find it difficult, consult with a financial advisor to make informed decisions.

Can asset allocation help me during market downturns?

Yes, definitely. Well-diversified asset allocation can act as a cushion during the time of market downturns. It can reduce the risk of your portfolio. So that, you won’t incur significant losses.

Should I make changes to my asset allocation based on short-term market news?

No. It’s generally not advisable to make changes based on short-term market news. Once you have developed a strategy, just stick to it and think long-term perspective.

What if I don’t have much knowledge about investments?

Consider Consulting Fee-Only Certified Financial Planner (CFPs). He can help you with a tailored investment plan as per your needs and risk tolerance. He can also help you make informed investment decisions.

Is it worth paying for a Financial Advisor’s expertise?

The value of a financial advisor depends on individual circumstances. If you really need personalized guidance and have a complex financial situation, the expertise of a financial advisor will justify the cost.