Welcome to realfinplan! In this article, we will try to understand the “Sequence of Returns Risk”. It’s one of the most important aspects of investing in equity and managing this is so crucial for investing success.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to achieve the Target Corpus of a particular goal not a target return. And to achieve that target Corpus you need to have a simple and cost effective investment planning.

We all know that equity has the potential to beat inflation. But, before we invest in it, we need to understand the risk involved and then try to find a solution.

We have already discussed about Sequence of Returns Risk in previous article: Why You Should Not Use Equity For Short Term? Sequence Of Return Risk

Today, we will discuss about how it can impact our investing process in real life, when we are planning to achieve the target corpus. I have learnt this interesting concept about Sequence of Returns Risk, the risk related to equity investing from beloved Pattu Sir. I will try my best to make you understand that. So, let’s start.

*******

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

What Is The Risk Involved In Equity Investing? Sequence Of Returns Risk

Many people ask in various Facebook groups, tell me the best mutual fund to invest. They give a list of mutual funds and ask, is this a good portfolio for my future? How much return can I expect from mutual funds in the next 10 or 15 or 20 years? Stop guys! We need to know the risk first, then try to find a solution, then only we should find the product.

Yes, equity comes with “volatility”, which can be our friend in financial journey to outpace inflation. But we need to consider that it comes with a certain degree of “risk” and “uncertainty”. Due to this nature of equity, we have to face the “sequence of return risk” or “timing luck”. The daily up-down of the market makes it risky to deploy money into equity. So, we need to understand the sequence of returns risk first, so that we can mitigate the effect of it in our financial journey.

Sequence of returns risk refers to the danger of experiencing negative returns on your investments at the wrong time. It can happen at any point of the time period. Be it during the early years of your investment journey or when you need to access your investments to meet your goals. This can severely impact your portfolio performance and you could suffer irreparable damage due to lack of time.

How Sequence Of Returns Risk Can Impact In Real Life? An Illustration !!!

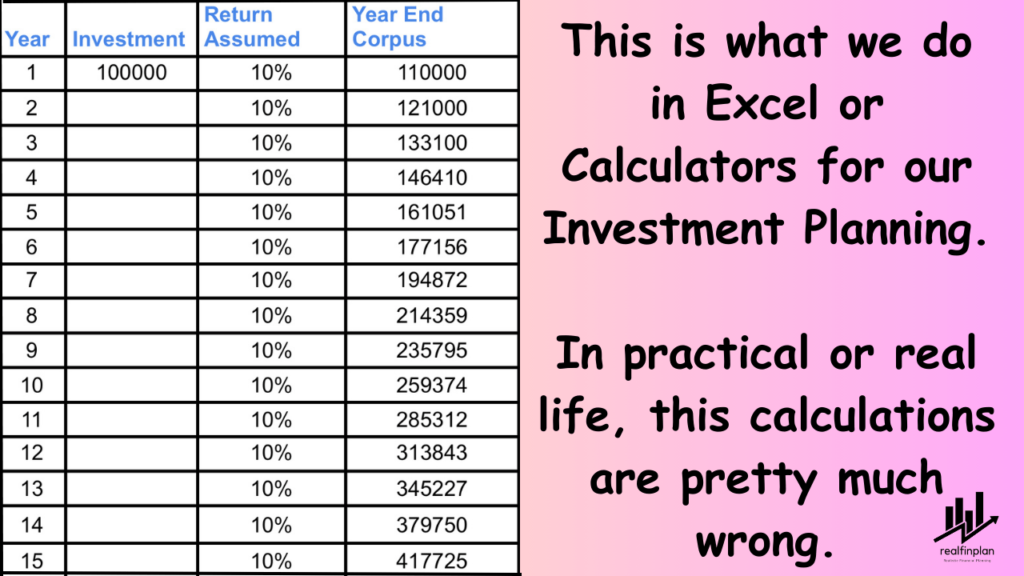

I have taken a Lumpsum Investment of 1 Lakh in this example. The calculation or the math will not work exactly for a systematic investment planning, but the idea and risk is similar. Here the time period of the investment is 15 years.

Now, I am assuming that after the time period of 15 years, this lumpsum of 1 L would have given me and annualized return of 10%. To determine what will be the Corpus, I will have to assume that I get a return of 10% each and every year. If I calculate the year end corpus of this 1L, it would have given me ₹4,17,725 or 4.18L after 15 years.

Of course, the whole point of these calculation to show you that, in practical and real life this assumption is very wrong. The sequence of returns risk affects our financial life the way we invest. Sometimes it can effect emotionally or mathematically and sometimes both. Let’s try to understand that.

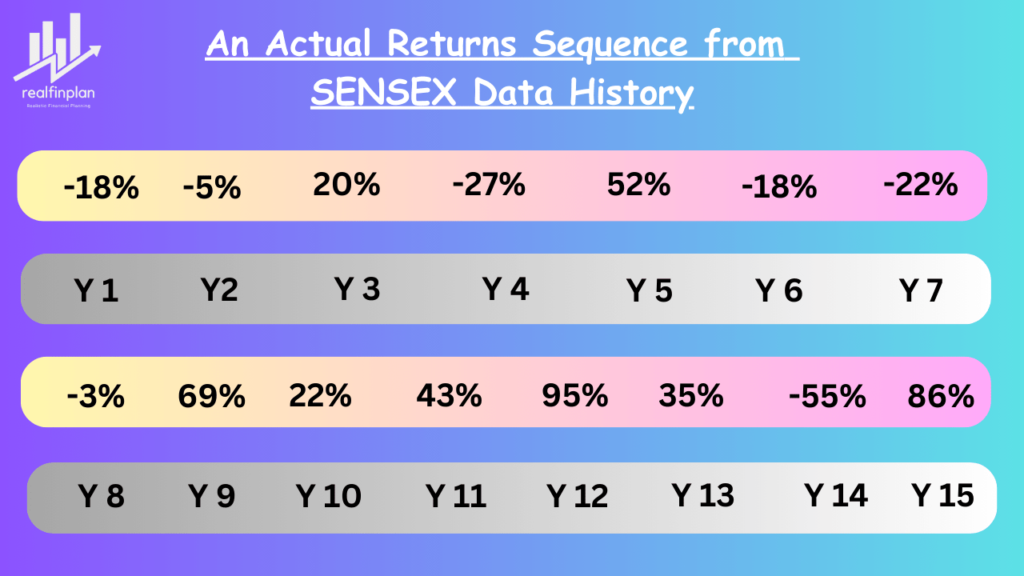

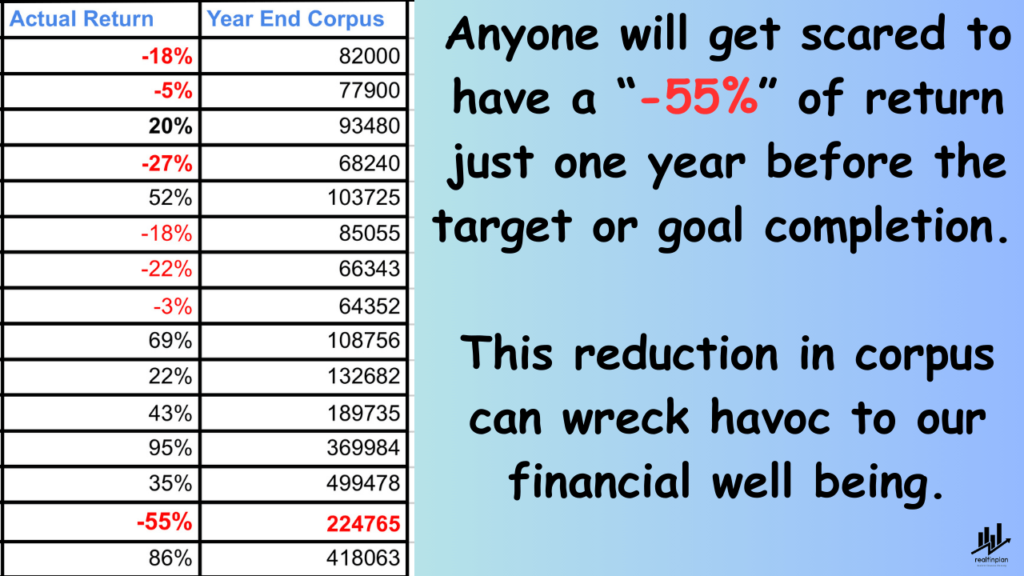

Now, instead of the 10% return, let’s take an actual return sequence of 15 years. This was actually witnessed in Sensex return (Data taken from freefincal by beloved Pattu Sir – Why am I taking data from there? Because I found freefincal is one of the most authentic research data source regarding personal finance).

- These are early returns year by year, but they are not actually from 1st January to December 31st. But these are some returns separated by a period of 365 days.

- The calculation of the target corpus and returns of individual years are as below :

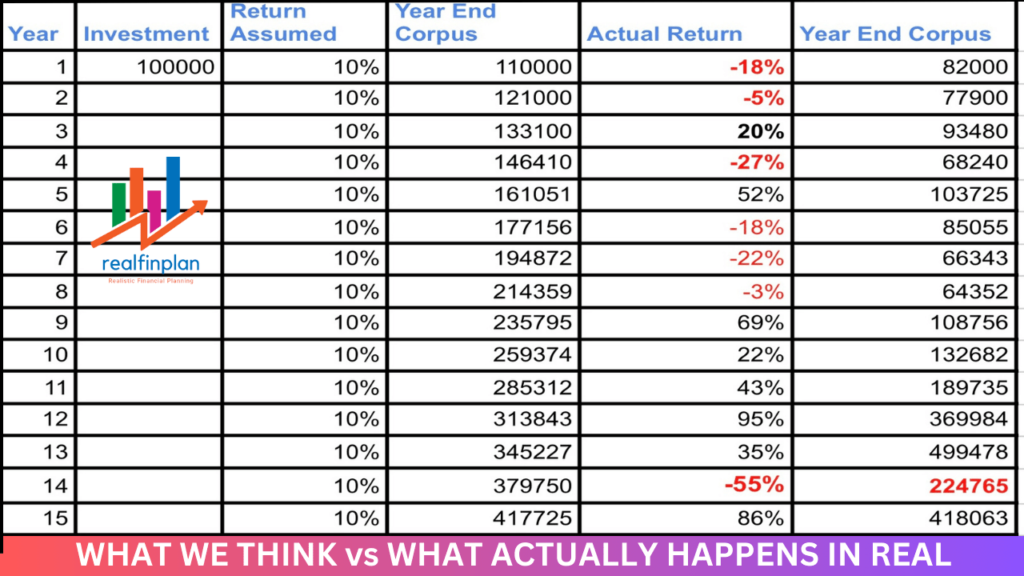

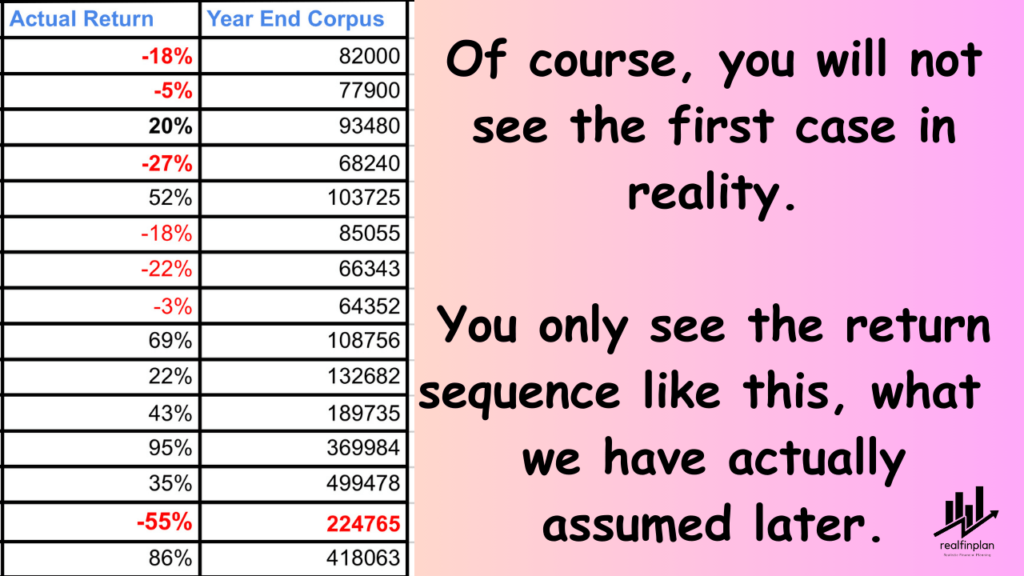

In the case where I assumed every year I will get same returns, I got ₹4,17,725. In the second case, I actually replaced that assumption by variable returns of -18%, -5%, 20%, -27%, 52% and so on (these are extremely fluctuating returns). Still I get the corpus about almost similar to ₹4,18,063 or ₹4.18 L. Why do you think this happened?

- If you take the compounded effect of these volatile annual returns, it gives you exactly the same returns of 10% per year after 15 years.

- This CAGR of 10% is the multiplicative average of the actual assumed return sequence of Sensex we used.

Please closely look at the table, after putting ₹100000, you will see -18% return in the first year. How many people will say that he would remain invested as he believes in equity and everything will be alright? Most of them will run away from equity.

- And again after one year you see a return of -5% resulting the reduction in corpus to ₹77,900. What do you think about that situation? The truth is, most of the people who remained invested with some hope, will ultimately run away.

So, please recognize there is a huge difference between what we think about returns and what actually happens in reality. What we we do in calculators for an investment planning, is just nothing but simple compounding.

But in real life, there is nothing like that, we have to face the volatile compounding, sequence of returns risk. That’s why there is a lot of difference between what you do in a Excel sheet or in a calculator and what you actually see and go through emotionally and behaviorally.

Again look at the 14th year in the table. Anyone will get scared, even I will also get scared, if I have a -55% of return just one year before the target or goal completion. From 5L, my corpus gets reduced to 2.24L.

- Just imagine the situation. How is this possible for a person to actually remain emotionally strong at that point of time? How many would say that he would hold on for one more year, market will recover and everything would be alright? That’s just bogus.

Please recognize that this sequence of returns risk can affect the portfolio at any point of time. And that’s why you never know whether these things will give you your expected return of 10%. We have chosen a sequence of return which gave us 10% ultimately, and that’s why they are matching.

But when you are going through these ups and downs, first it will be very hard for you to manage this emotionally. Secondly, there is no guarantee that this will give me double digit return. This is the sequence of returns risk when you are accumulating a Corpus.

Why Investing Is Not Only About Equity?

Those who think investing is only about equity, let me tell you it’s just a hope, testing your luck, not a strategy. Any uncertain downward swing can be very dangerous for your portfolio. It’s your money and you need to protect that.

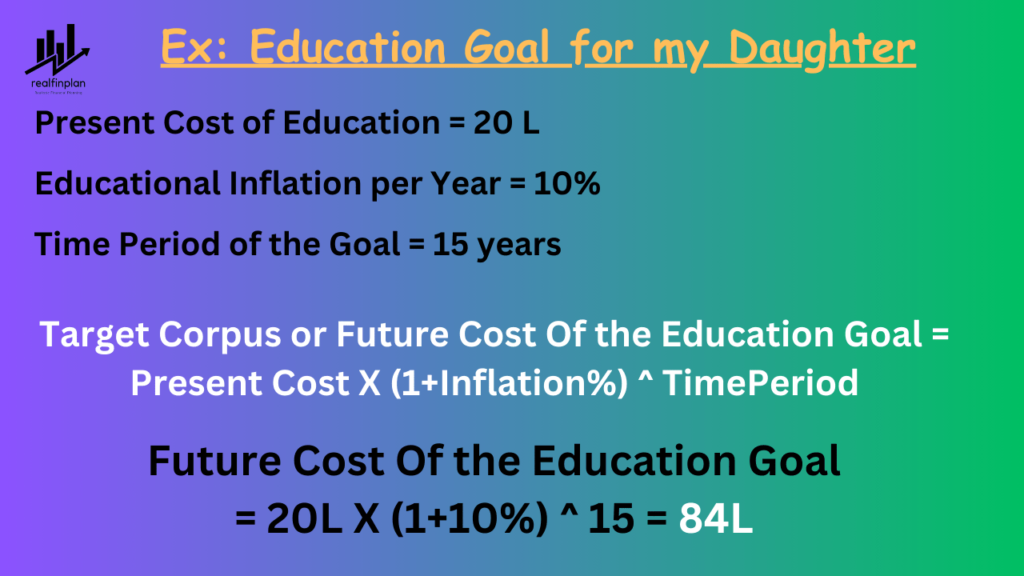

- When the corona hit, my equity mutual fund portfolio was down from 2.2L to 1.5L. That’s around a 30% loss. No one can say about what will happen after 15 years. Let’s take an example of education plan for my daughter.

No matter what my target Corpus is, I will have to achieve this. That should be the soul target of my investing journey, so that her expenses can be done easily without taking any loan. But if anything bad happens at that point of time, like happened during the coronavirus outbreak, the situation can be very different.

If I invest all my money in equity only, then a -30% downside swing can sweep away around 25L from my target Corpus of 84L. The total corpus in hand will be around 60L. That’s pretty much less than my target. Right?

Yes, then I may have to go for an educational loan to fund the college expenses. But then why did I invest? The main purpose was not to take a loan, right? Then my purpose will not be fulfilled.

- Will it matter then, what % return I get?

- Will it matter then, whether I invested in a large cap or small cap or mid cap or any index fund?

- Will it matter then, whether we had 2 to 3 funds or 7-8 funds?

- Will it matter whether I have invested through SIP or Lumpsum?

- Will it matter whether I bought units when the market was down or high?

No, nothing will matter. All that matters is that whether we can achieve the target CORPUS. Once our money is in equity, it is exposed to the sequence of return risk, no matter what’s the mode of the investment, be it SIP or Lumpsum or lumpsum in staggered way.

So, you need to ensure that you can achieve that target CORPUS. You can’t just leave your money on luck or hope. You have to protect your wealth. It’s your money, it deserves better treatment and respect than that. You have to provide downside protection to your portfolio. You need to keep the loss % significantly low when there is any market drawdown.

We have heard all the goody goody things about stock market or equity investing about giving stellar returns.

But remember, returns are unknown and uncertain, so you should never not run after it. Read this concept in details: Goal Based Investing: What To Avoid? Part 1 – Why You Should Not Run After Returns? Rather Chase Corpus!

Simply, you cannot control equity. The out performance of your portfolio is not in your hand, it will be taken care of by equity itself.

- Whereas, providing downside protection is in your hands. Why not to try it and mitigate the risk in equity investing? Now, how to do that, how to control the drawdown of your portfolio, how to provide downside protection? Well, here comes Asset allocation strategy.

What’s The Solution? 3 Steps To Mitigate Sequence Of Returns Risk

No matter how far your goal is, you should never invest only in equity. When it comes to investing, you need to have a proper strategy. Invest with an asset allocation strategy with regular rebalancing and decreasing equity allocation percentage as the goal nears its deadline.

Step 1: Adapt Asset Allocation Strategy. How It Helps To Reduce Risk? An Example

You may have heard the phrase – “Don’t put all your eggs in one basket”. That means you should never invest all your money in a single asset class. Always diversify your investment in different asset classes. Why? Simple, because different asset classes tend to perform differently under different market conditions.

- For example, when the stock market is down, bonds and fixed income instruments tend to perform better. So if you have a mix of assets in your portfolio, you can provide a cushion to your portfolio. You can reduce your lost percentage significantly.

Diversification is the key to risk management in your investment planning and Asset Allocation strategy is the best weapon to counter the risk associated with Equity investing aka “Sequence of Returns Risk”. You should spread your investments across different asset classes. This will minimize your risks. The idea is simple: Do not rely on a single investment to achieve your financial goals.

Now how will you diversify your investment? How many asset classes will you use? After you decide the asset classes to use, what will be the percentage allocation of a particular asset class? – That’s Asset Allocation.

There are various asset classes like equity, debt, gold, real estate etc. We have talked about them earlier. You can use them to diversify your investment. But remember, over diversification can hamper your financial well being. The more number of asset classes you use to diversify your investments, the more it will increase complexity in your portfolio. It will result in difficulties to manage it. Please understand : Why Investment Planning Should Not Be Complicated And High Cost?

- The simplest way to diversify your portfolio is to use two asset classes. One is “Equity” and other is “Debt or Fixed Income”.

- These are more than enough to reduce the overall risks of your investment portfolio and to make it low maintenance to manage. So we will consider that for asset allocation.

Learn the concept in our other article: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

To know more about Asset Allocation, please dive into our other articles:

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Mistakes to avoid for Asset Allocation: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Now, let’s take an example of an investment of 1 Lakh.

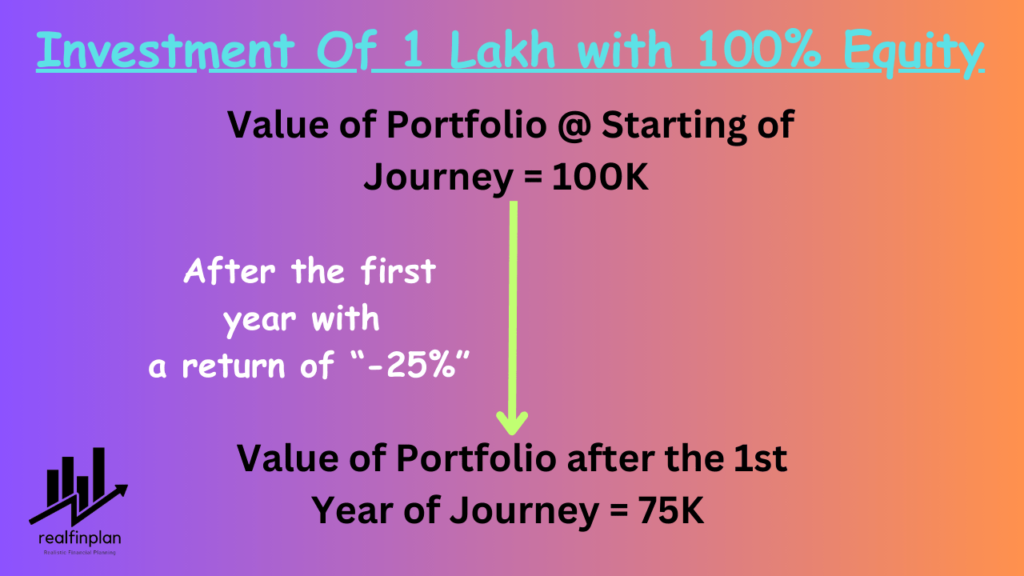

If you put 1L in equity and in the very first year you get a return of -25%, your corpus will be reduced to 75K.

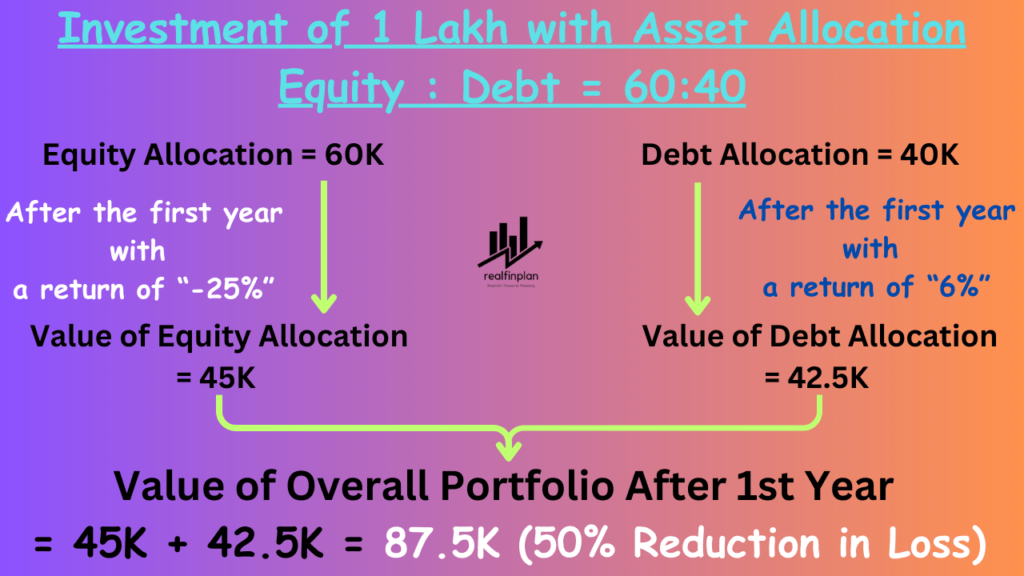

If the goal is equal to or more than 15 years away, you can easily start your journey with 60% equity and 40% fixed income. This 60:40 allocation is largely accepted, tried and tested. In that case, your one lakh will be invested as 60K in equity and 40K in fixed income.

- Now again, think about the first year where you get a return of -25% in equity. The value of 60K in equity will be reduced to 45K.

- But the remaining 40 K will be increased at rate of 6% per year (assumption). And the value of your fixed income will be increased from 40K to 42.5K.

- Ultimately your portfolio value will be 45K + 42.5K = 87.5K and overall portfolio return will be -12.5%.

- See that’s 50% reduction in your loss. Just by following asset allocation you can provide the downside protection to your portfolio. Just by putting 40% of your money in fixed income, you can significantly reduce your loss percentage in your portfolio.

Step 2: Rebalance Your Portfolio Regularly. What Is Rebalancing?

As the goal progresses and market conditions change, your asset allocation can shift from your original plan. Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy, your plan. When there is a significant market swing (upward or downward), sell some winners and buy more of the under performing assets to maintain your desired asset allocation.The idea is to move your money from high performing asset class to an under performing one.

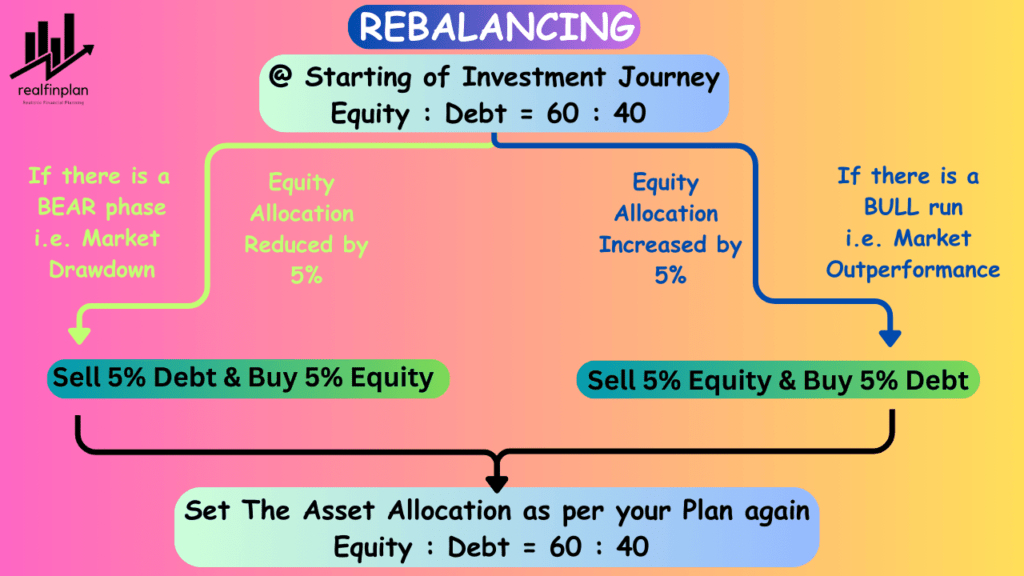

Theoretically you should review and rebalance your portfolio at least once a year. But that can be hectic for many people. So let’s not make it complicated. To keep things in low maintenance mode, you can set a tolerance limit for your re-balancing. If you will ask me I will say that my tolerance limit is 5%. How does that work? Let’s take an example.

Suppose, you start your investment journey with a asset a location of equity : fixed income = 60 : 40

Now, if there is a bear phase in the market and your equity allocation is reduced to say 55%, you can sell 5% of your debt component and buy 5% of equity. So that, your asset allocation remains the same.

Similarly, if there is a bull run in the market and your equity allocation is increased to 65%, you can sell 5% of your equity component and buy 5% of fixed income.

- You may have hard that you should book some profit when there is a bull run and you should invest more in equity when there is a bear phase in the market. If you adopt an asset allocation strategy, you won’t have to scratch your head for that.

- If your asset allocation deviates significantly from your actual plan, your rebalancing process will take care of that. That’s the beauty of adopting an asset allocation strategy.

Step 3: Have An Exit Strategy – Follow A Glide Path. What Is A Glide Path?

Remember, this 60:40 asset allocation is for the first year and for the first few years. You cannot hold that much of equity allocation when you need the money, otherwise it would be too risky if the market fluctuates too much.

Always have a plan to reduce the equity allocation in a step wise manner to de-risk your portfolio. You need to systematically increase your fixed income allocation to reduce the risk in the portfolio, as the goal nears it’s deadline. So that, sequence of returns risk won’t be able to affect your portfolio much.

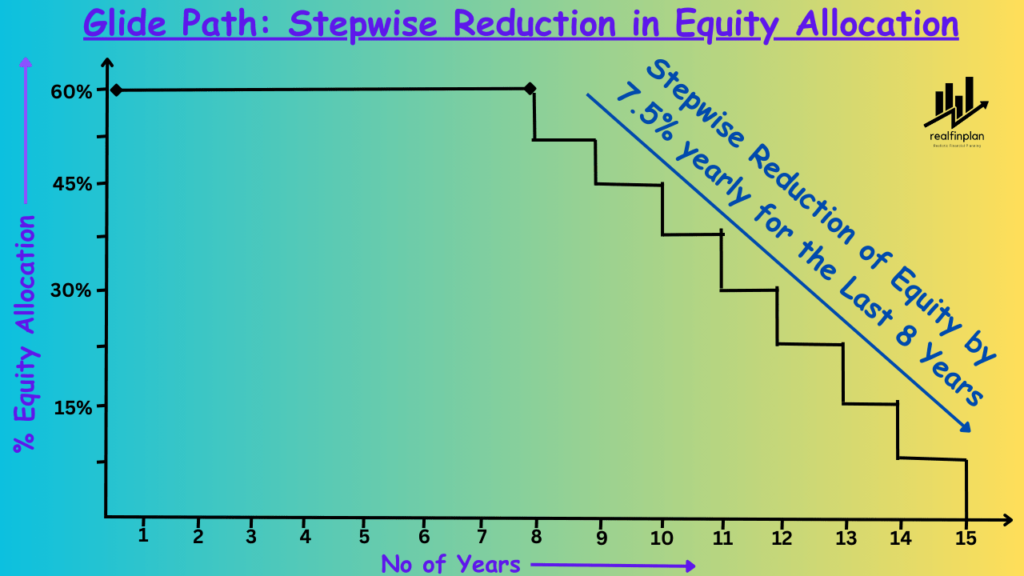

- There is no secret recipe for determining how to follow a glide path. But we can follow a thumb rule to make things easier. I follow the following thumb rule for long term (For goals having more than 10 years of time horizon) investment planning.

- Fix an initial asset allocation and keep it intact for the 50% of the time period. During this time period, if your asset allocation shifts significantly or the change in asset allocation hits your tolerance limit, don’t forget to rebalance.

- Then reduce the equity portion in a step wise manner on yearly basis for the rest of the time period.

For an example, if your child education goal is about 15 years away, you can start your journey with 60% in equity and 40% in fixed income. After maintaining 60:40 for 7 years, you can gradually decrease the equity portion by 7.5 % each year for the last 8 years and make it zero when the goal completes. Then you can spend the money freely when your child will go to college.

In this way, you can achieve your target corpus regardless of the market condition. Yes, through asset allocation strategy you will have to invest a little bit more than a portfolio with only equity. Why? With the reduction in equity allocation, the expected return from the overall portfolio will also reduce. But that’s what you will pay to enjoy a comparatively smoother ride to achieve your goal.

Conclusion

We have seen in previous article and this article also that, sequence of returns risk can not only damage our portfolio but also can wreck havoc to our financial well being. Asset allocation strategy is the perfect weapon to challenge this sequence of returns risk.

It acts as your financial bodyguard. It enables you to diversify your investment which works as a safety net. By spreading your investments across different asset classes, you can reduce the impact of poor returns in any one area. When one asset class underperforms, another may shine. This will help to balance your portfolio and maintain financial stability.

Always keep in mind, asset allocation strategy is not about getting higher returns. It’s about getting optimal potential gains without compromising the consideration of the risk associated with your investment. If your basics are covered and you have identified your goals, by adopting regular rebalancing and a glide path in asset allocation strategy, you can make a roadmap to your financial stability and security.

- For example , a young investor may lean towards more aggressive Investments. But someone nearing retirement may prefer a conservative approach. It’s all about finding the right balance for you.

- By following an asset allocation and decreasing the percentage of equity allocation as per your goal timeline, you can set things perfectly as per your goal.

Remember, it’s personal finance. It’s more personal than finance. Your financial journey is unique. So, your strategy should reflect your individual goals. Again I am saying –

“No matter how far your goal is, you should never invest only in equity. When it comes to investing, you need to have a proper strategy. From the very first day, invest with an asset allocation strategy with decreasing equity allocation percentage as the goal nears its deadline.“