Welcome to realfinplan! In this article we will try to learn the very basics of Goal Based Investment Planning and why is it needed for our financial planning. We will try to cover important topics related to it one by one. So, this is gonna be a series of contents. But the first things first. Let’s get to know about goal based investment planning and why I feel, it’s the key strategy to control your financial planning.

******

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers to read the previous two articles and then come here. It will be easier for you to understand things.

Table of Contents

Converting Needs To Goals: Asking The Right Questions – ‘Why’ & ‘When’?

So, when you are ready to invest, try to find the answer by asking yourself. I have done this from the very beginning. This has led me to be a DIY Investor. But you should ask the right questions. The first question should be –

Why am I Investing?

When it comes to investing, you need to have a strategy, a plan. You need think about things logically. One day I met a young earner in Facebook. He was ready to invest around 30K-40K per month. He told me about 3 mutual funds and asked me whether his choices were good or not. He also asked about which mutual fund would give him the best return. I asked him, “Why do you need to invest?” He simply didn’t know. He just wanted to save and invest that much, that’s all.

It’s the starting of Investment Journey, don’t invest aimlessly. Yes, you are ready to invest and that’s “good”. But to make it “great”, you need to give your investing a purpose, make it a goal.

- If you don’t have any Goal as of now or you can’t identify your goal, then your default goal should be Retirement.

- Think harder and look closer to your life. The moment you start earning, you need to think about your financial freedom.

- As you age, your ability to work will decrease. Eventually at some point of time, you will have to retire, there will be no other option.

People just jump into mutual funds or stocks in the name of investing.

- What is the best mutual fund?

- What is the best stock to invest?

- Which mutual fund gives higher return?

- All of us need the best mutual funds, best returns giving mutual funds, best stocks.

But the thing is, investment products are just a part of Portfolio construction. In fact, whether we will use mutual funds or stocks or PPF or NPS, i.e. the products should be the last thing to choose to build a portfolio. And Portfolio construction is the last thing to do for an investment plan.

So, all you need is an investment plan, not a product. Investment plan is the process you follow. It is a bunch of products. And those products have different kinds of risks. Therefore, they fetch different kinds of returns. You need to strike a balance between risks and rewards.

- Diversification is the tool and asset allocation is the key for investing. These will help you to reduce the risks and increase the potential of maximizing the returns. To get the benefit of all these, first you need to know why you are investing, you need to identify your goals. So that, you can align your investment plan as per your needs.

I have experienced the disadvantages of investing without any goal or any plan. I had no strategy and I was just investing aimlessly. When I was a child I remember, my father used to tell me, “An aimless man is like a ship without a radar”. This is true for investing too. If you don’t have any goal, you will not be having a strategy, it will lack direction, will result in impulsive decisions which can harm your financial well being.

- So, establish specific goals – be it buying a new home or a new car, funding education or retiring comfortably. Then you will have clarity about time frame, money needed at that time, investment opportunities etc.

Once you are done with ‘Why’, your next right questions should be –

When Do I Need The Money?

This is so much crucial for investment planning. There are a lot of factors which depend on this ‘When’.

This is crucial to determine how much “risk” you should take while investing. As per the time frame you can decide, whether you need to invest in equity or how much you need to invest in equity. Equity comes with a certain degree of risk and uncertainty aka Sequence of Returns Risk. So, you also need to counter that. That’s why you also need a strategy.

- Learn more about Sequence of Returns Risk and how it can impact our financial well being in real, in our other article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

The longer the ‘when‘, risk taking ability will be higher. If your time frame is shorter, your taking ability will be lower and lower.

All the successful investors have a strategy in place. We all need to have a strategy when it comes to investing. But the thing is, you will only have a strategy when you know about when to withdraw money from investments.

Remember, there is no such good or bad time for entry in market related instruments. But there can be good or bad time to withdraw from investments. That’s why there should be an exit strategy and that will be as per the tenure of the goal : Asset allocation Strategy with Rebalancing and a Glide Path.

- Read the concept of Asset Allocation and how it reduces the risk and enhance your return potential in details in our other article: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Also read about: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Many investors don’t know about time frame and don’t know when to exit. They just want to maximize the returns or reduce the risks.

- Most of the times, they just aimlessly invest to maximize the returns only, without understanding the risk associated with investment. This results in taking impulsive decisions which can wreck havoc to their financial well being.

- That’s why I always suggest : Do not run after Returns. Rather chase Target Corpus !

This is why the ‘why’ is so important. If you know why you are investing, you will know when you need the money. Only if you know when you need the money, then only you can decide where to invest.

The Two most important long term goals we should be serious about

There can be many long term goals. It can be buying a new home or flat for you, Education or marriage of your son or daughter, your retirement etc. But, it depends on person to person. Different person’s needs can be different. That’s why it is personal finance. For me, the followings are the most important long term financial goals.

Retirement – When you won’t be working or after you retire, how will you spend your life maintaining the lifestyle you lead? When we are young, we have the ability to work. But as we age, at some point of time Retirement becomes inevitable. You can get a loan for a mobile, a car, a house, a land or bike etc. But you won’t get any loan for your retirement life. There is no other option. More importantly inflation eats up the purchasing power of money. So, you have to think about your retirement considering inflation.

- You have to think about how much corpus you need to live life the way you leave now, to maintain the present lifestyle. And that “CORPUS” should be your soul target to achieve, not the return, no matter what the goal is or how far your goal is.

Child Education – If your son or daughter will go to a Private Institution for higher education, how will you provide the education related expenses? I have seen the impact of educational inflation in my life. I have done engineering (B Tech) from a private engineering college in Kolkata, my semester fees was 23.5K. But when I was in my second year, the newcomers had to pay 40.5K per semester. So, you see the price hike of the course is absurd. Same goes for IITs too. It almost doubles in the very next year.

Yes, there is an option for an education loan. But for me, as I did my engineering without any education loan, I would always try my best so that my daughter won’t have to opt for it. It’s my perspective about child education. Others may think differently, they may be right from their perspective. I respect that and let’s not argue about that. Let’s take it as a financial goal.

- If we project today’s cost of education considering the related inflation (at least 10%, higher the better), we can get the future cost after certain period of time. That cost will be the target CORPUS which we need to achieve.

Why Goal Based Investment Planning Is The Key Strategy?

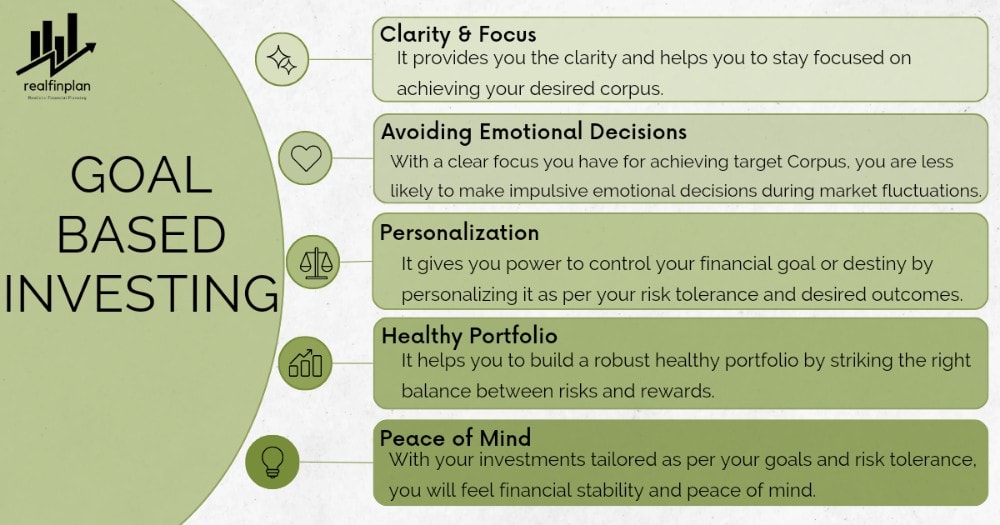

Clarity & Focus

As of now in our country, we have so many options available for investing. We have around 10K+ mutual funds, 5K+ stocks, 50+ insurance companies, 100+ banks and other financial institutions. Due to these too many choices, most of the investors face dilemma while investing. Moreover, if you are in social media for seeking advice, you will get a lot of noises in the name of information. This makes things worse not better. As a result, investor start asking the wrong questions.

- What is the best mutual fund?

- What is the best stock to invest?

- Which mutual fund gives higher return?

- What is the best insurance policy?

- Is it the right time to invest?

Goal based investing provides you the direct connection between your investments and your needs. This provides you the clarity and helps you to stay focused on what you really need. You need to take inflation into consideration and project current cost of a goal to a CORPUS, you need to achieve that no matter what. Your soul focus should be on corpus.

Avoiding Emotional Decision

Investing can be very emotional, specially during market downturns. If you have clarity about your needs and Investments, you will be pretty much focused towards achieving your desired corpus. This will enable you to adapt long term perspective and to be committed to it. With the clear vision you have, you are less likely to make impulsive decisions during short term market volatility which can hamper your financial well being.

Personalization

Remember, personal finance is more about personal than Finance. Personalization is the key of investment planning, it is so crucial for long term success. Different person has different needs at various stages of life. We all have different risk tolerance and desired outcomes. By aligning your investing with your goal, you can customize your investment planning. You can ensure that your strategy revolves around what truly matters to you. That’s why you should not use equity for short term investment planning.

Healthy Portfolio

Goal based investing helps to build a healthy investment portfolio. Your portfolio is the vehicle for your financial journey. Investment Portfolio should not be Complicated and High Cost. You need to build it in such a way it can strike a balance between risk and rewards throughout the time horizon. For investing, diversification is the tool and asset allocation is the key. These will help you to minimize your risk and maximize your potential for returns. To take advantage of all these things, you need to align your investments with your goal, give it a purpose with a strategy.

Peace of Mind

When your investments are tailored as per your goals and risk tolerance, you will feel the financial stability. You will always find yourself in a better position to face any financial storm. You will make sound decisions that align your goals and purposes. This will ensure that you are not investing just for the sake of return percentage, but for the dreams come true. Thus, through goal based investing you can achieve financial peace of mind.

I have got these advantages since I am following Goal Based Investment Strategy. When I am writing this, I don’t know how the market is doing, I don’t need to track it everyday. I have a personalized strategy in place with a healthy portfolio and a clear focus to achieve the corpus needed. This helps me to be committed to what I really need. It keeps me cool and helps me not to make any impulsive decision during sudden market movement. Yes, I will do my review as per my schedule and course correct if needed. But that’s low maintenance and just once a year. That’s all. Thus goal based investing also brings me peace of mind.

Conclusion

Goal based investing is not just a strategy, it’s more of a mindset shift. Traditional investment methods often focus on chasing market trends and aiming higher returns. But they lack personalization which is crucial for long term success.

Goal based investing gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process. It gives you power to control your financial goal or destiny by personalizing it. It also allows you to align your investments with your dreams like habit a dream house or retire happily. Every goal has it’s unique financial requirements and timelines. Through goal based investing you can get clarity, a vision, a purpose as per your goal. You can easily customize your strategies accordingly and achieve financial stability and success.

If you are aimlessly investing or not investing or not following goal based investment planning, you should do it immediately. Sit down and think what you plan for your future. Sit down with your spouse or other family member, note down your goals.

Fantastic blog! Enjoyed and learned many things. Summary I can conclude,

The aimless investment is just to fetch more money and is risk in itself. Planning(goal based) —> execution(disciplinary)—>success(subjective).