We have already discussed earlier that Goal-Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process. In this article we will try to understand what do we need to avoid for our Investing process and also to find out logical and realistic solutions.

If you seek people’s knowledge about investing, different people will come up with different suggestions. They would say, do this and do that, etc. But, very few will say about what not to do. That’s why it will be a series about what we need to avoid.

Previously we have already discussed about:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short Term? Sequence Of Return Risk

In this article, we will discuss about why investment should not be complicated and high cost. So, let’s start.

*******

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

In the world of personal finance, we all have one common goal. To secure a stable financial future and to grow our wealth. And that involves careful planning and decision making. Individuals often overlook the crucial aspects of the simplicity and the cost associated with investment planning.

Whether you are new to the world of investments or a pro, you need to keep this on your radar when it comes to investment planning. Here we will explore the importance of simple & low cost investment planning and why it matters to the general public.

Why Investment Planning Should Not Be Complicated?

Clarity in Objectives

If your investment plan is simple and straightforward, it becomes easier to define your financial objectives. You will have more clarity about what to do and how to do, to achieve your goals, whether it’s saving for retirement, buying a home or funding your child’s education.

Stick to the plan

If an investment plan is too complicated, it can be difficult to stay on track. It will be more difficult if you are not a financial expert. Simple investment plan is easier to understand and follow. It can help you to stay disciplined and reach your financial goals.

Avoid Noise

In this digital world we have access to huge amount of financial information. Yes, we all know that Knowledge Is Power. But too much information can lead to analysis paralysis. You need to avoid noises in the name of information, so that you can focus on what matter most to your goals. So, you need to keep your investment strategy simple and straightforward, so that you can filter out these noises.

Risk Management

If you invest in a complex product, you are more likely to make mistakes or misunderstand the product. Complex investment portfolios can be very challenging to manage. It means you are taking on more risk in your investment planning. A simple product is less risky because it is easier to understand and manage.

Time and Money

It takes time and money to research and manage complex investment products. The more complicated it is, will be harder to manage. A simple investment plan can save you both the time and money. You can then invest them in other areas of your life.

Regular Reviews

You need to review your portfolio and goal progress regularly, at least once a year. But it should be less time consuming, so that you won’t have to spend days or weeks for it. Your investment planning and the portfolio should be simple enough, so that you can easily review your goals progress and Portfolio within an hour or so.

Reduced Stress

Complicated investment strategies often lead to stress and anxiety. Simplicity in financial planning is so crucial. It allows you to make informed decisions without any panic. It helps you to have a relaxed approach to your financial future.

Why Investment Planning Should Not Be High Cost?

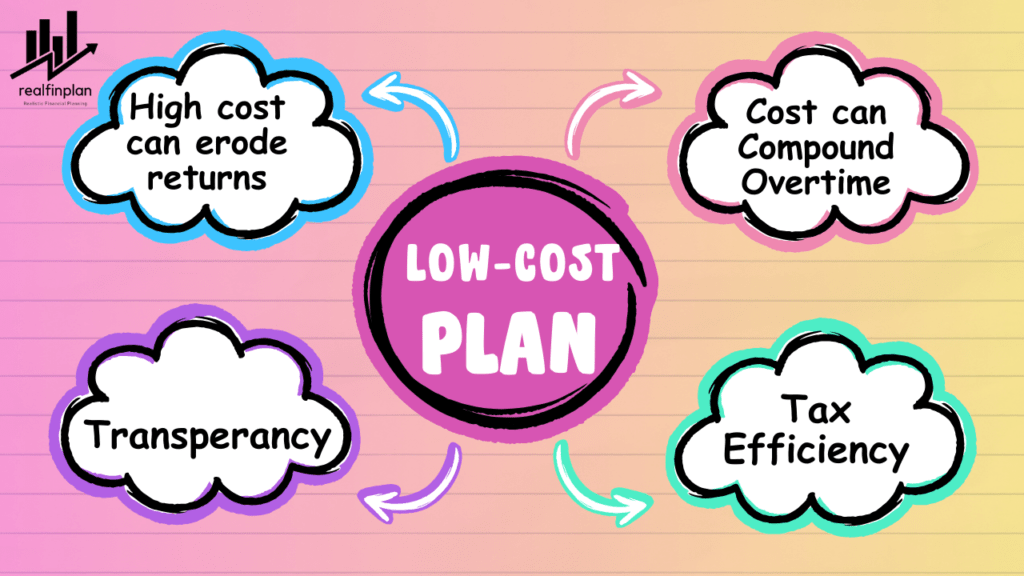

High cost can erode returns

The higher the cost of an investment, the lower the returns that investors will ultimately receive. This is because the high cost and fees eat the profits that investors make.

- Let’s take that you invest ₹1,00,000 and pay and annual fee of 1%, you are actually giving away ₹1000 every year. Over a decade that will be ₹10,000 and over several decade it can amount to tens of thousands of rupees.

Low cost investment planning helps you to keep more of your hard earned money in your pocket.

Cost can compound overtime

The longer and investment is held, the more cost will erode Returns. This is because the cost are incurred each year and they are compounded overtime.

- For example, an investment earns 10% in a year for 10 years, but the fees are of 2% each year. Then the net return will be around 6% after 10 years.

Transparency

Many investment products have complex fees structure. The charges involved these kind of products can be complicated and difficult to understand. If we take an Insurance Plan, it has various charges like Premium Allocation Charges, Administrative Charges, Mortality Charges beside some normal charges.

- Low cost investment products, such as index fund, typically have simpler and transparent fees structure. This means they are easier to understand. This transparency can help you to make more informed investment decisions.

Tax efficiency

Most of the complex investment products come with higher costs. They are harder to understand. Having them in portfolios makes it challenging to manage. Due to this, you are more likely to make mistakes through emotional decisions during any market downtown. This not only includes higher charges and fees for buying and selling, but also comes with higher tax implications.

- Low cost investment products like index funds are simple and transparent in nature. It makes easier to understand and manage things. So, you are more likely to avoid any emotional decisions during sudden market movement. These eventually reduces charges he is an tax implications.

9 Steps to approach for Simple & Cost Efficient Investment Planning

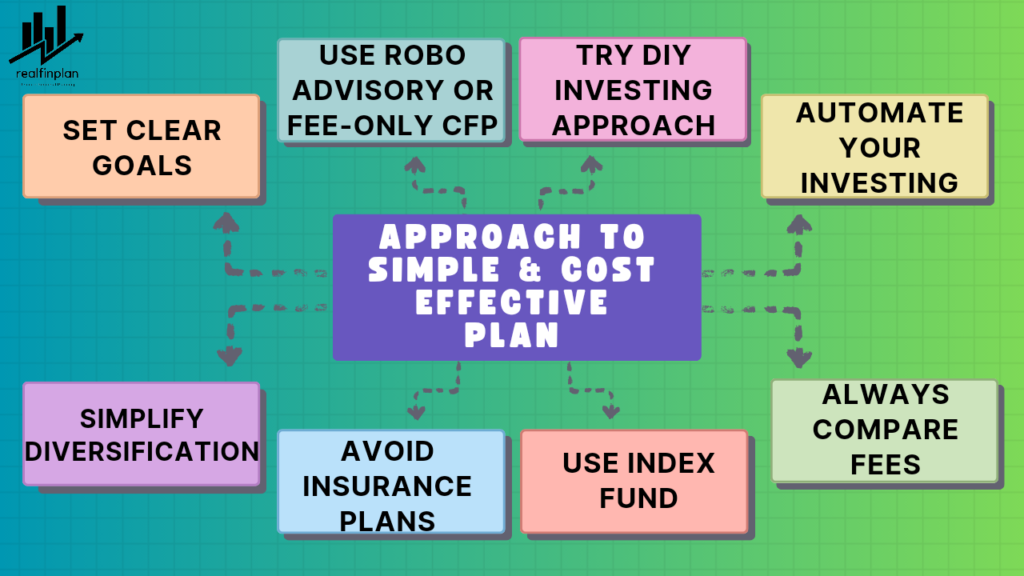

1. Setting Clear Goals

The journey of investment planning should begin with a clear and well defined objective, starting with “Why am I investing?” and “When do I need the money?”. Setting clear investment goals is the cornerstone of successful planning. Without well defined objectives or goals your investment strategy can become aimless and potentially costly.

2. Simplicity in Diversification

Diversification is the key to risk management in your investment planning and Asset Allocation strategy is the best weapon to counter the risk associated with Equity investing aka “Sequence of Returns Risk”.

Learn more about Sequence of Returns Risk and how it can impact our financial well being in real, in our other article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

- We have also discussed in that article that Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk. To know more about Asset Allocation, please dive into our other articles:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Mistakes to avoid for Asset Allocation: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Now, coming to the diversification again. Always remember: Don’t put all your eggs in one basket. You should spread your investments across different asset classes. This will minimize your risks and will ensure that your financial goals don’t depend on single Investment.

There are various asset classes like equity, debt, gold, real estate etc. You can use them to diversify your investment. But remember, over diversification can hamper your financial well being. The more number of asset classes you use to diversify your investments, the more it will increase complexity in your portfolio. It will result in difficulties to manage it.

The simplest way to diversify your portfolio is to use two asset classes. One is “equity” and other is “debt”. These are enough to reduce the overall risks of your investments and to make it low maintenance to manage your portfolio.

- Read the concept of different asset classes in our other article: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

3. Fees comparison

Before you commit to any investment, it’s pretty much essential to compare fees and expenses across different options. If you are using any investment platform or any investment vehicles, please pay close attention to expense ratios, management fees and any other hidden charges that may impact your overall returns.

Some investment platforms may lure you in with low fees, but then hit you with additional costs later on. To avoid this, research thoroughly and choose platforms with transparent fee structures.

4. Avoid Mixed Products

Mixed products like Insurance policies are too costly due to various charges. These involves various charges like Premium Allocation Charges, Administrative Charges, Mortality Charges beside some normal charges. There can be various hidden charges that are complicated to understand. We should always avoid them for our investment planning. You should use purely investment products like Saving Account, FD, RD, Mutual Funds, Stocks, Bonds etc.

5. Cost Efficient Investment Vehicles – Index Funds

The cost of index mutual funds are the lowest in the category. Index fund is the best low cost inflation beating asset. More importantly you will eliminate under-performance risk and fund manager risk by choosing index funds. Generally these kind of funds come with ‘no exit load’. That makes it more cost effective. If you are a pro you can go with ETFs too (Exchange Traded Funds), but it’s little bit complex than index fund. If you ask me, I will pick Index Funds any day just because it’s simpler than ETFs.

- Also always invest through direct plan in Mutual Fund. The regular plans have higher expense ratio, about 2 to 5 times of the index funds or more than that. Regular plans will eat up your wealth.

6. Automated Investing

Set up automatic contributions to your investment account from your bank account, like setting up SIPs. It ensures discipline and consistency in investing and also take advantage of rupee cost averaging.

7. DIY Investing

If you are comfortable with managing your investments consider a do-it-yourself (DIY) approach. This will help you to keep things low cost. Also, this approach allows you to have full control over your portfolio and overall personal finance.

8. Robo Advisory

You can also take advantage of automatic investment platforms and Robo Advisors. These are of low cost, charge lower fees than traditional financial advisors. The services can also simplify your investment process by creating and managing a diversified portfolio based on your goals and risk tolerance.

- I use Robo-Advisory Template made by Pattu Sir’s Freefincal for my investment planning. I personally find it as an excellent choice for those looking for a low cost financial planning solution.

9. Fee-Only Professional Advice

Low cost investment planning doesn’t mean you have to do it alone. While some individuals prefer the do it yourself approach, others may benefit from Professional assistance.

If you find investment planning and reviewing too much, you can always consider consulting a financial advisor. But please don’t go for a commission based financial advisory model or Mutual Fund Distributors (MFDs). That commission is never good for you, it can erode your hard earned money on a regular basis. This is only good for the financial advisor.

It’s best to go with a Fee-Only Certified Financial Planner (CFPs). By clicking on the link, you can get the lists of fee-only financial advisors in our country. They work on commission free, fee only model. So that you can have more of your hard earned money. They charge reasonable fees and provide valuable guidance. Their soul purpose is to financially educate you. So that, you can be capable of making informed investment decisions by yourself.

My Thoughts

For investment planning, the most important thing is that it should be simple enough so that anyone can do that without scratching their head. Remember the idea of being the simplest one in the movie Inception? The more simple the idea is, the more it will be effective. It will always be in your control and easy to manage which results in low maintenance.

Investment planning should be straight forward, so that we can minimize unnecessary expenses and keep it cost effective. High fees can eat up our returns over time. If my purpose is fulfilled (let’s say return of 12% over a period of time) with lower cost simple product A then I don’t need to go for high priced product B which may fetch us higher return (let’s say 15%) with higher cost and complexity.

- Yes, you always can choose product B but you don’t “need” it. Just because a product can deliver higher return, you should not go for it until and unless you understand the cost and risk associated with it.

- You need to strike a balance between risks and rewards considering the costs.

If you take a lot of time to identify your goal or to build a portfolio, then your other aspects of life may affect. This happened with me. Previously, I did a lot of gymnastics with my Investments. It took me about 5 years to get things sorted and put my investment in auto-pilot mode. I messed up my portfolio as I invested without any goal.

Goal based investing forced me to simplify things and that’s why I am in a better position now. I can understand my investments better, make proper decisions.

After I simplified my portfolio with low cost investment products, my investment journey has become boring and low maintenance. Now it takes me about 30 minutes to review my Portfolio, that too once in a year.

So, the idea should be to go for a simple, low cost, low maintenance “need” based solution. If you think only about finance all the time and get into complicated things with high maintenance, then congratulations, you have successfully wasted your life. Be free and do whatever you like. Save your time and be productive.

So, to counter the financial risks, first you need to cover your basics and to achieve financial needs and wants, we need simple and cost effective investment planning.

Frequently Asked Questions (FAQs)

Is investing only for the wealthy? Can I start with a small investment and keep it simple?

- No investing is not limited to the wealthy. Anyone can start investing with small amounts of money. It’s all about creating a habit of saving and investing and making smart investment choices. Simple Investment plans can be tailored to any budget.

What’s the minimum amount to start investing?

- You don’t need a fortune to start investing. Many investment platforms allow you to begin with ₹500. Some mutual funds also offers SIP with as low as ₹100. Start small and gradually increase your investment over the time to improve your financial situation.

Can low cost investments still provide good Returns? Can I simplify my investments without sacrificing Returns?

- Yes, simplicity can co-exist with good Returns. Many low cost investment can offer excellent returns, specially when you combine it with a well thought out investment strategy. Low cost investment options, such as index funds can deliver competitive Returns with reduced costs and risks.

Are there any downside to low cost investment planning?

- Low cost investments are generally are good option. But they may not always be the best choice for your specific goals and risk tolerance. It may limit your access to some investment opportunities that comes with higher fees.

- But remember it’s always essential to strike a balance that aligns with your financial goals, considering your financial circumstances and investment horizon.

How do I know if my investment plan is too complicated?

- If you find it challenging to understand your Investments or constantly worry about market fluctuations, buying and selling frequently, having a lot of funds from same category aimlessly, it may be a sign that your plan is too complex.

Can I switch to low cost investments if I already have high cost ones?

- Yes, you always can. However, you should always consider the potential tax implications and exit fees associated with your current investment. If you can’t decide things on your own, then consult a financial advisor to create a seamless transition plan.

How often should I review my investment portfolio?

- You should review your investment portfolio regularly to ensure that it aligns with your goals and risk tolerance. Many financial experts recommend reviewing your portfolio at least once in a year or whenever significant live changes occur.

What if I don’t have much knowledge about investments?

- Consider Consulting Fee-Only Certified Financial Planner (CFPs). He can help you with a tailored investment plan as per your need and risk tolerance. He can also help you make informed investment decisions.

Is it worth paying a Financial Advisor’s expertise?

- The value of a financial advisor depends on individual circumstances. If you really need personalized guidance and have a complex financial situation, the expertise of a financial advisor will justify the cost.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023