We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process. In this article we will try to understand what do we need to avoid for our Investing process and also to find out logical and realistic solutions.

If you seek people knowledge about investing, different person will come up with different suggestions. They would say, do this and do that etc. But, very few will say about what not to do. That’s why it will be a series about what we need to avoid. So, let’s start.

******

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

Investment Planning: Why, When and How?

What should be our soul target for Investing? This is not just a mere question, it’s more of a Investment Philosophy. Many investors are obsessed with returns. Everyone wants the best. They just keep asking generic questions:

- Which is the best return giving mutual fund?

- Which cap funds give best returns are in the long term?

- Which cap will give higher returns?

- How can I get 15% return to achieve 1Cr in 15 years by investing ₹15K/m?

- Can I get rich by investing in Small cap funds by getting higher returns?

- How much return can I get in the next 10 years, 15 years, 20 years?

Yes, return should be a parameter to evaluate goal based investing but not the most important. You need to think it logically step by step when it comes to investing.

- Step 1: Why do you need to invest? – The Goals.

- Step 2: When do you need the money? – The Time-frame. We have already covered these two.

- Step 3: How much money you need? – The Corpus

Investment Planning: What Is A Corpus?

To find a corpus you need to assess your financial goals at first. Let’s say, you have a daughter. She is 2 years old. So, you have around 15 years in hand after that she will go to college. Why not 16 years? Well, you have to prepare before she turns 18, many enters the college before attaining that age. Myself is an example. In today’s time, Present Cost of Graduation in Private College Engineering is about ₹15L to ₹20L (including course, fooding, lodging, other Educational expenses like project and all that).

- If we take inflation @ 10%, graduation expenses of 20L will become around ₹84L in 15 years. That 84L is your target corpus. How do I get it? Simply just using the compounding formula.

- Corpus or Future Value = Present Cost (1+ Inflation %)^ Time Horizon

The thing is, you need that ₹84L at any cost, no matter how do you get it, by investing in equity or debt or anything. Yes, there is always an option to opt for a loan. But the motive behind Investing should be to prepare ourselves financially at the time of need, so that we don’t need an educational loan. You need to get the amount ready when she enters college, no matter whether you get 8% or 10% or 18% return. All that matters is to achieve the CORPUS.

Investment Planning: Why Corpus Should Be The Soul Target Of Investing?

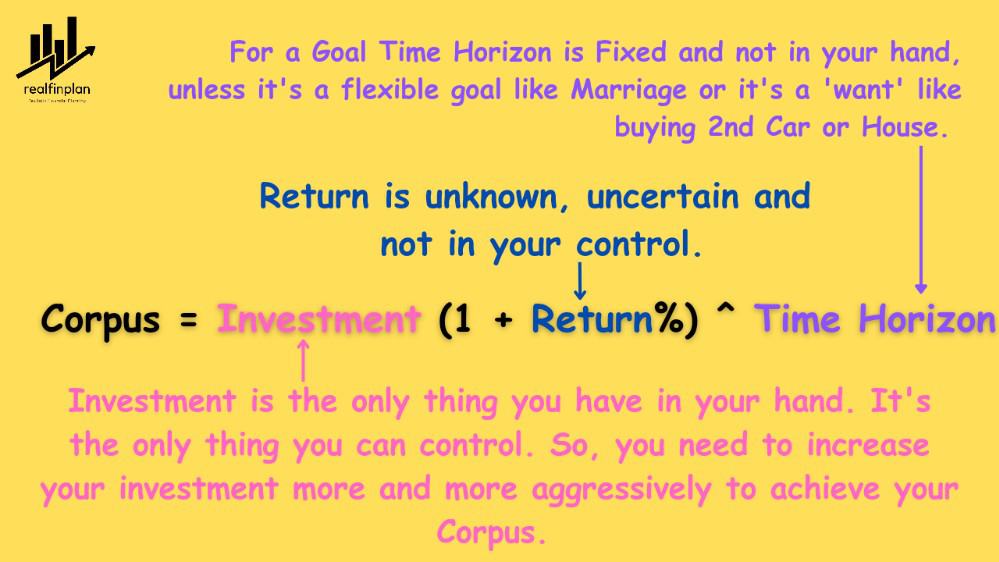

Now the fact is, returns are unknown and not in our hand. Throughout these 15 years, no one knows how share market will do, how the interest rate will be. If you think in a realistic way, you will see the decreasing trend of interest rate and inflation numbers over the time.

Things are now different from the previous decade. Basically, you don’t know about returns, be it equity mutual funds or stocks or PPF or any other financial products or instruments. Then why do you want to run after it? Rather, you need to build a strategy to achieve your Corpus with a practical return expectations from your investments.

Let’s be realistic. In our country the rate of inflation is about 5% – 7% and GDP growth is about 5% – 7%. If you add them, then you can expect 10% – 14% from equity over the long term. Anything above 14% is unrealistic.

- And if we take tax in consideration, conservatively it can be about 2%. Then post tax return will be around 12%. Remember, 12% is the maximum.

- So, I will not talk about 15%, 18% returns and all that.

Now, let’s consider scenarios of achieving the corpus of 84L in this case.

Let’s keep things disciplined. Take a monthly investment or let’s say the common name, SIP of 15K/m.

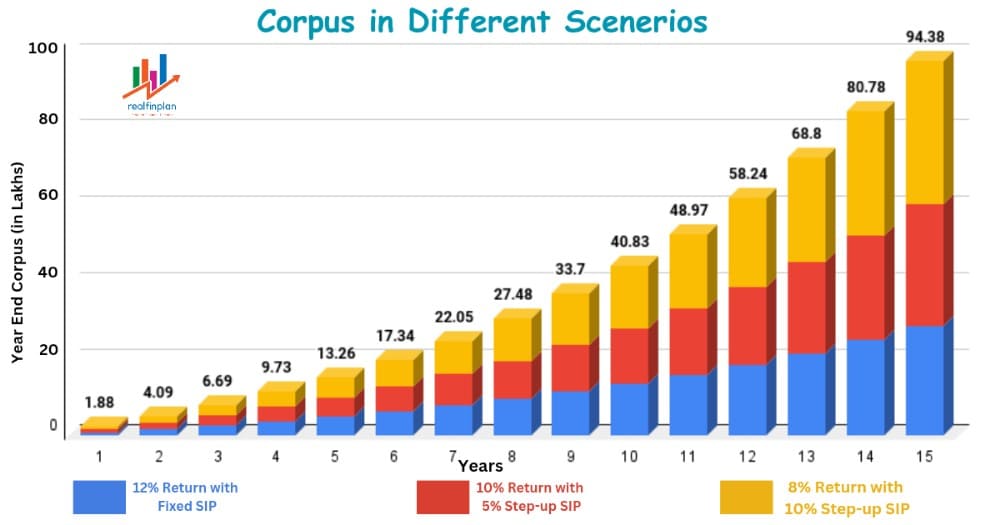

- A fixed SIP of 15K/m, post tax return @12% will get you to around 71L.

- SIP of 15K/m with 5% increase annually, post tax return @10% will get you to around 79L.

- SIP of 15K/m with 10% increase annually, post tax return @8% will get you to around 94L.

This is simple math. An increasing SIP gets you higher corpus. If you see the chart, you can see from the 2nd year on-wards you will have higher corpus. Yes, in the 3rd case, by the end of 15 years, you will be investing much higher (around 57K/m) than the fixed SIP of 15K. But that’s should be your soul purpose, to increase your investment along with the increase in income over the time.

You see, if you invest just to get a return, you may not get the amount you need when it’s time. Investing less or chasing higher returns is not an option. Investing with a discipline and increasing it consistently are all that matters.

What’s The Solution To Achieve The Corpus? Aggressive Investing

We all read about the compounding, solved many problems during exams, used the equation of compounding a lot. Then why not to apply in real life?

The toughest part of investing is not choosing investment products, but investing enough. It is so childish to assume higher returns and invest less. Most of individuals get lured by the promise of higher returns in short period. But this can lead to risky and impulsive decisions which can damage their portfolio. They tend to overlook other aspects of investment planning. You won’t be able to achieve the corpus with this kind of mindset.

Why you should try to Increase your monthly investment at least 10% Annually?

All you need to do is to invest more and more aggressively. You should try to invest as much as possible, increase your regular investment at least 10% annually. Why?

Let’s get to a round figure for your corpus. Take it 1CR. Assuming post tax return 10% yearly. Then you need:

- Fixed SIP – ₹25000/m

- Increasing SIP @ 10% – ₹14000/m

You can achieve your goal with half the initial amount with an increasing SIP. So, you can target higher amount with lower initial contributions. The idea simple. Your income will increase with the time, you need to increase your investment in parallel. Then only your wealth will grow.

What is Aggressive Investing?

Simply you need to be disciplined, consistent and aggressive when it comes to investing, no matter how you invest or using which method, be it SIP or Lumpsum or Lumpsum in staggered way or whatever. It doesn’t matter which mutual funds or stocks or NPS/PPF/EPF or any other instruments you choose. You just need to be critically disciplined and aggressive when it comes to investing.

Remember, aggressive investing is not about taking more risk or putting your money in higher risk and high volatile products like mid cap or small cap funds and stocks. It’s not a hope that these kinds of high risk products will fetch higher return to get you enough money. Aggressive investing is investing more and more aggressively “without thinking about the return“. So that you can meet your needs, achieve your dreams. Don’t invest just for the sake of some numbers of return, but for the dreams come true.

Why You Should Not Run After Returns? Rather Chase Target Corpus

It’s pretty much natural to desire quick returns and high returns. Specially when you get so much noise in the name of information nowadays. But this approach can be risky and it can be counterproductive in the long run. If you really wanna chase, then chase corpus in lieu of returns. Here are some reasons to follow that:

Aligning With Financial Goals

We have seen earlier, creating a target Corpus requires assessment of your financial goal. It can be like buying a home, funding education, retire happy etc. This process ensures that your investment plan and strategy is aligned with your goal. It will provide a clear road map for your investment journey to achieve your goal.

Financial Growth

Chasing returns often involves higher risks. You tend to invest in volatile assets like equity mutual funds, small cap funds, stocks etc. More that that, most of the time chasing returns involves impulsive decisions during sudden market fluctuations. This can result in financial losses and can damage your portfolio.

On the other hand, building a target Corpus involves calculated approach, considering your risk tolerance and time horizon. If you chase it, you will need a strategy. That strategy will provide sustainable financial growth as it will help you to minimize substantial losses.

Avoiding Emotional Decisions

Emotions can play a significant role in investment decisions. Chasing returns can lead to impulsive decisions on temporary market trends.

If you give priority to the target Corpus, you will be focused on long term objectives. It will reduce the influence of short term market fluctuations.

Diversification And Risk Management

Chasing returns often involves concentration of investments. That too in potentially high returns giving or high-yield assets. This lack of diversification exposes you to higher risks resulting reduction in portfolio stability.

Whereas, building a target Corpus encourage you to diversify your investments across different asset classes. This reduces overall risk of your portfolio enhancing the stability of the portfolio. Diversification is the key to risk management in your investment planning and Asset Allocation strategy with rebalancing and a Glide Path is the best weapon to counter the risk associated with Equity investing aka “Sequence of Returns Risk”. We have already discussed this concept in our other articles:

Learn more about Sequence of Returns Risk and how it can impact our financial well being in real, in our other article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

We have also discussed in that article that Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk. To know more about Asset Allocation, please dive into our other articles:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Mistakes to avoid for Asset Allocation: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Long Term Financial Security

The primary purpose of investing is to secure your financial future. Chasing returns can offer temporary high gains due to high risk. But it also means it could also lead to significant financial losses. It can hamper your long term financial security.

Rather, you should prioritize a target Corpus. It will ensure your commitment towards your goal. Focusing on target Corpus provides a more balanced approach and secure path to achieve financial security.

Conclusion

We all do the same thing in our lives, we run after products, the best mutual funds, best-performing funds, higher-return potential stocks, etc. We know that none can predict future returns but still, we chase it. It’s the very nature of human beings. Just like running after a mirage in a desert. I have done this for 4 years. You can get an idea here: how I started my investment journey aimlessly. Eventually I realized that nobody knows if you chase return, where will you be in the next 15 years or so.

But if you shift your focus to create the target Corpus, you will be able to align your investments with your goals and risk tolerance. By following a proper strategic approach, you can create a road map to financial security. If you are critically disciplined towards investing, you will surely be somewhere around your corpus. And if you are consistent about increasing your investments, you can out-pass the corpus too.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023