Welcome to realfinplan! In this article, we will try to understand “Limited Pay vs Regular Pay Term Insurance”. Due to high cost, inflation impact, and the burden of high premiums, Limited Pay Term Insurance can be a financial setback.

Whenever someone asks me about something related to personal finance, I always suggest him/her – Cover the Basics first: 3 Simple Steps To Manage Financial Risks For A Secure Future. So that individuals can secure their financial future.

But, why do you need to secure yourself financially? Well, life is full of risks, needs, and wants. The most important of them are financial “risk” and “needs” (not wants, you can’t ignore the “needs” or delay them).

If you need to build a house you will need to have a strong foundation. Without a solid base, you won’t be able to protect your house.

- Similarly in personal finance, you need to cover your basics first, and manage your financial “risks”. Then only you can build the floors for your house i.e. build your wealth through Investments to meet financial “needs”.

There are a lot of financial risks associated with our lives and the most important are Emergency risk, Life risk, and Health risk. They can give us significant challenges at any point in our financial journey.

But through the prudent use of emergency funds, life insurance, and health insurance, we can protect ourselves and our loved ones. We can be confident about being financially stable by managing these risks for a secure future.

- Previously, we have covered the concept of an Emergency Fund in detail. You can check it out: What Is An Emergency Fund? 3 Questions To Ask Yourself Before Spending Emergency Fund

If you seek people’s knowledge about financial planning, different people will come up with different suggestions. They would say, do this and do that, etc. But, very few will say about what not to do. That’s why it will be a series about what we need to avoid.

Previously we have already discussed the following:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023

In this article, we will discuss why you should avoid Limited Pay Premium Plans for buying Term Life Insurance. So, let’s start.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

What is term life insurance?

Term Life insurance, also known as Term Insurance or Pure Vanilla term insurance, offers coverage for a specific period. But why pure vanilla?

- Because it’s the purest form of insurance.

- The sole purpose of term insurance is to mitigate life risk, that’s it.

It’s a straightforward and low-cost option.

- It only pays out in the event of death and does not have any savings component like other types of insurance.

- That’s why the cost of a term insurance policy is pretty much low compared to its potential benefits.

- You pay an affordable fixed premium, for a fixed period to the insurance company.

For that, the company provides a death benefit to beneficiaries, if the insured person passes away during the policy term.

- But how much will the beneficiaries get? The insurance company provides your beneficiaries with a predetermined sum – called the sum assured. So that your dependents are financially protected.

Term life insurance is the most affordable and efficient way to secure your family’s financial future.

What are Regular Pay and Limited Pay term insurance?

When you have decided to buy term insurance, one of the key decisions you need to make is the premium payment option. There are two main options:

Regular Pay Premium Mode: In this option, you pay a fixed amount of premium for the entire policy term.

Limited Pay Premium Mode: In this option, you pay the premium for a limited number of years, typically 5, 10, 15, or 20 years.

- After that, your coverage continues till the end of the policy duration without any further payment of premium.

Limited Pay Vs Regular Pay Term Insurance: Illustrations on Why You Need To Avoid The 1st One

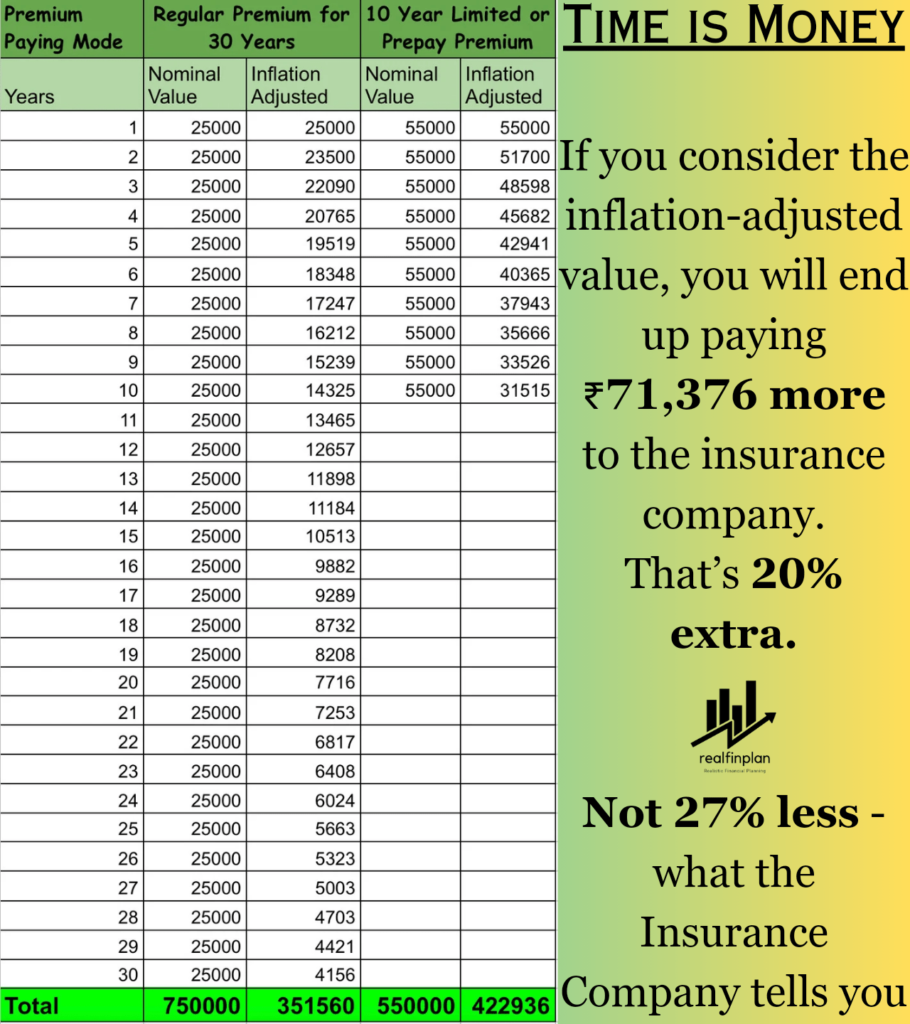

A friend of mine was discussing with me before buying term insurance. He had seen the famous banner of insurance companies: “Pay in 10 years and save 30%”. He is 30 years old and was searching for term insurance of 1CR till age 60. He did some research and found out that:

For Regular Pay, he would have to pay around 25K per year for the next 30 years. So, the total premium paid will be 7.5 lakhs.

For a Limited pay of 10 years, he would have to pay around 55K per year for the next 10 years. So, the total premium paid will be 5.5 lakhs.

So, if he chooses a limited pay option, he will have to pay less premium of 2 Lakhs. That’s a significantly lower payment. A 27% less. Why not choose the limited pay option?

Yes, what he said was true. But that’s in terms of the “aggregate of money paid” and that’s not the right way to decide things when it comes to financial planning.

- We will consider 3 scenarios. Let’s clear the real concept.

Scenario 1: Time Value of Money – Inflation Adjusted NPV

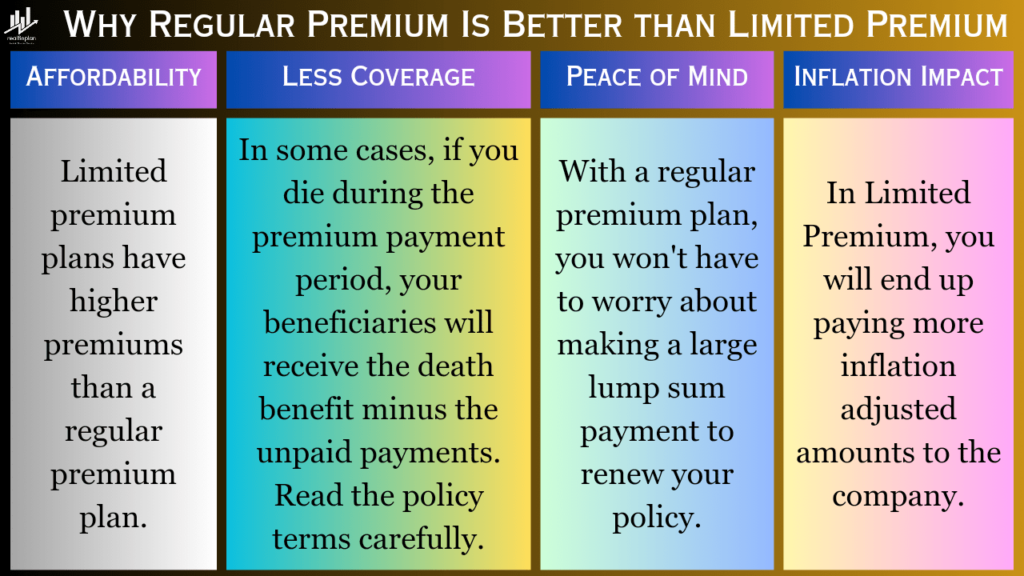

Everything is looking great for the above example, right? But you are missing something here. There is a concept called the time value of money. It’s based on the fact that the value of money depreciates over time.

- So, ₹100 today or not equivalent to ₹100 years down.

- “A bird in the present is worth two in the future”. Any amount of money you pay early in life has more value than the same amount you pay later.

- Inflation is the culprit for that. So, we all need to consider it whenever we make any significant financial decision.

To understand the time value of money, we will use a calculation called the NPV or the Net Present Value. We will consider the inflation-adjusted value of the premiums paid.

But, how? Let’s look at the table

- Inflation @ 6% is taken for the calculation.

- That means your value of money will decrease by 6% per year.

- All the calculations are done in Google Sheets.

If you consider the inflation-adjusted amount or the NPV @ 6%, for a limited premium mode, you pay ₹4,22,936. And for a regular premium plan, you pay ₹3,51,560.

- So, in the end, you pay ₹71,376 more to the insurance company.

- That’s 20% extra, not 27% less what the insurance companies tell you.

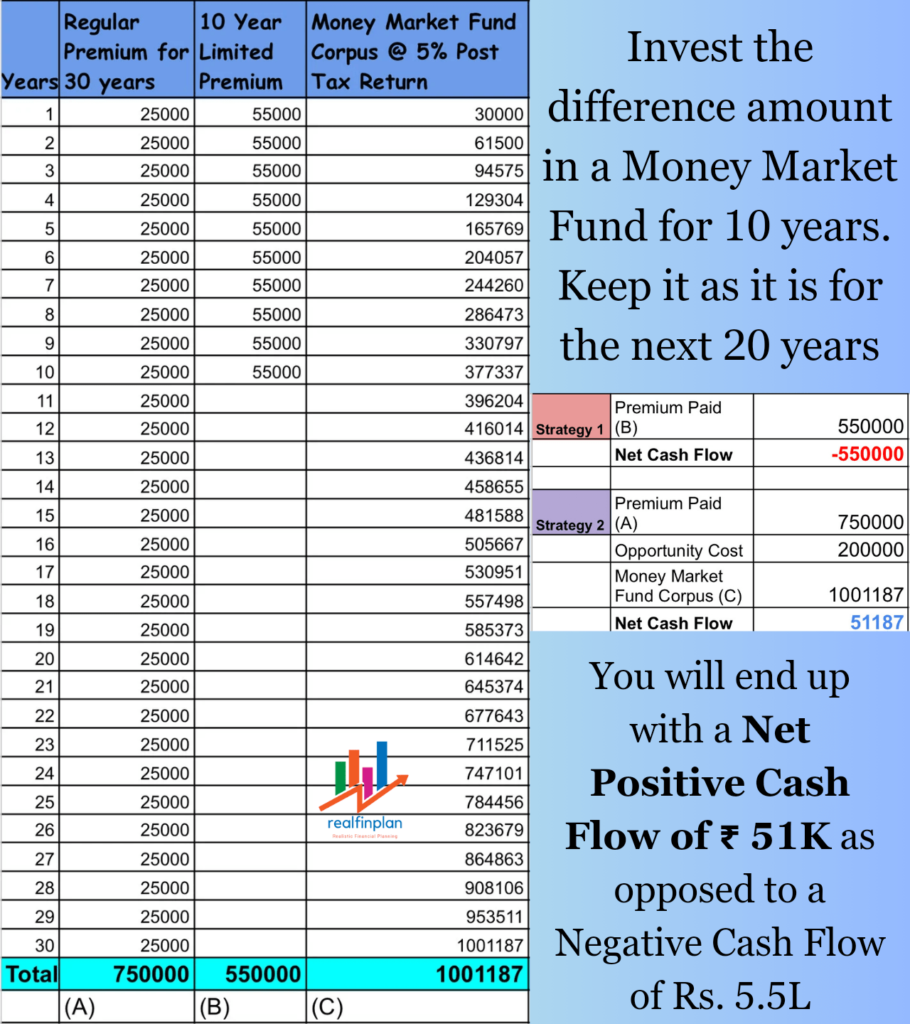

Scenario 2: Limited Pay vs (Regular Pay + Money Market Fund)

For a limited pay term insurance, you will pay a total amount of 5.5 lakhs in the example. That’s 2 lakhs less than a regular pay term insurance. Let’s call this amount of 2 lakhs an opportunity cost.

Strategy 1: Choose the 10 years Limited premium payment option

Strategy 2: Choose the regular premium payment option and put the difference in the premiums (₹30,000 in this example) in a Money Market Debt Mutual Fund for the first 10 years and leave it as it is till your policy term ends.

- Post-tax returns expectations for calculations: 5%

Why did I choose this mutual fund?

- It’s easier for the calculation than using individual FDs each year.

- The Risk in this kind of mutual fund is pretty much lower in the debt mutual fund category (The liquid fund has the lowest risk).

- The Return Potential is similar to that of a Bank FD.

- It’s one of the simplest products among debt mutual funds.

Now, look at the table.

For Strategy 1: Premium Paid = ₹5,50,000.

- Net Cash Flow = (-) ₹5,50,000

For Strategy 2: Premium Paid = ₹7,50,000. Opportunity Cost = ₹2,00,000 & Fund Corpus = ₹10,01,187

- Net Cash Flow = ₹51,187

So, the net result is that, if you go with the regular premium option and invest the “difference amount”, you will have a net positive cash flow of ₹51,187 compared to that of a limited premium option with a negative cash flow of ₹5,50,000.

Scenario 3: Limited Pay vs (Regular Pay + Money Market Fund with SWP)

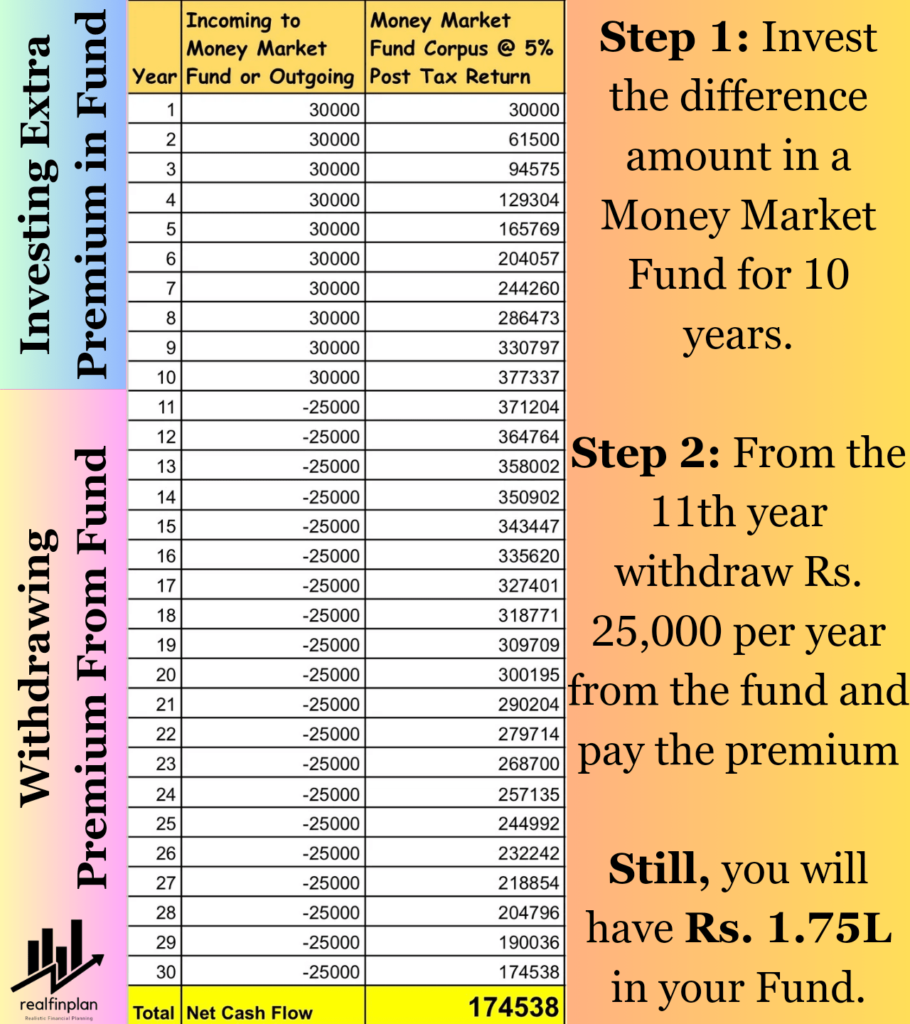

Choose the regular premium payment option and put the difference in the premiums (₹30,000 in this example) in a Money Market Debt Mutual Fund for the first 10 years.

After 10 years, start paying the premium (₹25,000 in this example) for the rest of the 20 years with a systematic withdrawal plan (SWP) from that money market debt mutual fund.

- Post-tax returns expectations for calculations: 5%

Now, look at the table:

So, the net result is that, if you go with Regular Pay + Money Market Fund with SWP, you will have a net positive cash flow of ₹1,74,538.

Summary:

You have seen in all the cases, the regular premium is the clear winner. Insurance companies will never show you this real picture. But what will they do? They will offer a “discount”. Because it’s always better for the insurance company if they get money from you earlier.

- They mean business.

- They will use and invest the money to increase their revenue or pay the bonus for endowment plans, money-back plans, guaranteed income plans, whole-life plans, etc.

- There is no advantage for you. More importantly, you will pay more inflation-adjusted amounts to the company.

- In the case of the unexpected life event of death, your dependents will get the same sum assured. That too with a much lesser premium paid in the case of a regular premium plan. So, again it is a loss for you.

The regular premium payment is the best option for buying term insurance. Because it’s low-cost, and fixed throughout the whole policy term. All the other kinds of premium paying options are complicated and misleading. Always keep things simple when it comes to Personal Finance.

- Buy the regular premium plan. It will be fixed for all the years of the term period.

- That inflation impact will ensure that ultimately you pay the least amount to the insurance company.

When to consider limited pay premium term insurance?

There are a few cases where limited pay term insurance may be a good option:

- If you want to get the payment liability off your chest quickly, you can select the limited pay option.

- If your income is very unstable and uncertain, like self-employed professionals, sports personnel, performance artists, businessmen, etc. If you are unsure about your ability to pay the premiums for the full policy duration, you should opt for the limited pay option.

- If you have a family history of serious illness, you may have a short career span. For that reason, if you want to make sure that your life insurance coverage is in place for as long as possible, you can go for the limited pay option.

- If you want to buy an ultra-long-term policy that is beyond your retirement age, you can choose the limited pay option. Then you won’t have to carry the financial burden of paying premiums in your post-retirement life.

(It’s not recommended to buy term insurance beyond the retirement age. But remember, it is personal finance. So, this is more personal than finance. Someone may need the term insurance beyond the retirement age as per his or her financial situation.)

But for most people, regular premium payment will be the best option!

Conclusion:

While the regular premium payment is the best option for buying term insurance, limited pay can be a good option for you in certain circumstances (as discussed earlier). So, before you jump to a conclusion or make a decision, it’s better to consult with a financial or insurance advisor.

But, don’t forget to ask your financial advisor to do an NPV calculation for all your options to get a clear picture of the cost associated with the different options available. Then choose the best option that fits all your requirements.

If you have any further questions related to regular pay or limited pay term insurance, you can send an email about the query to the author by visiting the Contact Us page.

- Also, there is a fantastic forum by Beshak where you can post Insurance-related queries and get answers from experienced persons and insurance experts.

Frequently Asked Questions (FAQs):

can I switch between limited and regular pay?

It varies between policies. Some allow switches, while others don’t. Check with your insurance provider for flexibility options.

what happens if I miss a payment?

In general, limited pay and regular pay often have grace periods (For annual regular premium payments – the grace period is 30 days). You will be notified through SMS and email. If you make payment within grace periods, then all is okay. But if you fail to make your payment, your life insurance policy will lapse.

can I adjust the coverage midway?

It depends on the policy. Some allow adjustments. But it’s crucial to understand the impact on premiums and benefits.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023