In this article, I will share how I did my first Portfolio Rebalancing while reviewing my financial situation in Dec 2023. Every year, in December I review my portfolio. I believe in discipline, so I try to be disciplined.

If you regularly review your portfolio, you can get yourself back on your financial track and you will feel the financial stability. During the last 4 portfolio reviews, every year I learned something new. This year, for the first time I rebalanced my education portfolio.

Previously, I discussed an accident that happened in 2016 and changed my life. I also talked about how I started my investment journey from scratch and began using various investment products such as RD, FD, NSC, and Mutual Funds.

Additionally, I shared my thoughts on how a financial planning course shattered my preconceived notions about personal finance and led me to reorganize my planning. I did my first portfolio review in 2020.

I also talked about how a meeting with a CFA (Certified Financial Advisor) boosted my confidence to be a DIY (Do It Yourself) Investor, where I shared my 2nd portfolio review in 2021.

Then I talked about how I automated my goal-based investing approach in 2022. I also shared the small details of 29 Financial Planning And Analysis Resources I Used Throughout My Journey.

I would request the readers to complete the previous articles about my journey so that they can understand how my thought process of investing changes over time.

- Part 1: An Accident That Changed My Life: Learnt About Discipline, The Key To Financial Stability

- Part 2: How I Started My Investment Journey? 2018 – 2019: The Years Of Product-Based Approach

- Part 3: A Course Of ₹760 On Financial Planning And Analysis That Forced Me To Shift Towards Process-Based Approach: My First Portfolio Review 2020

- Part 4: My Portfolio Review 2021: A 39 Minutes Meeting With A CFP That Boosted My Confidence To Be A DIY Investor

- Part 5: How I Automated My Goal Based Investing In 2022? Simplified Things With A Mature Process-Based Approach

- Part 6: 29 Financial Planning And Analysis Resources I Used Throughout My Journey: Boosted Me To Make My Goal-Based Investing Simple & Effective

So, let’s get to my portfolio review of Dec 2023.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

Basics:

Emergency Fund:

- Savings Account

- FD in that Savings Account holding Bank

Term Insurance :

- 10X of annual income when I took

- HDFC Life – 5X

- TATA AIA – 5X

Health Insurance:

- HDFC ERGO – 10L

Portfolio Review: Short-Term Goals (up to 5 years):

For short-term goals I use

- Arbitrage Funds – 2

- Liquid funds – 2

- Money Market funds – 1

- FDs

- Conservative Hybrid Fund – 1

- Ultra Short-Term Fund (for >3 years)

I always use different funds for different goals. Also, I love to do some investing gymnastics to gather some knowledge. That’s why I have too many debt funds in my portfolio.

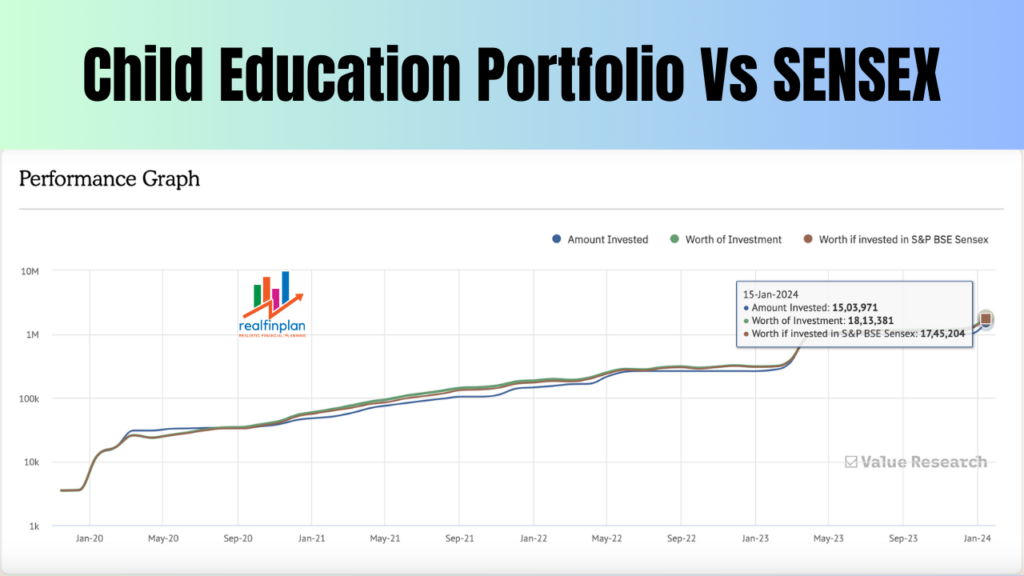

Portfolio Rebalancing: Child Education Portfolio (14 years away)

This was the toughest job for me. I was stuck at this. But all thanks to the Goal-Based Portfolio Management Course and the Robo Advisory Tool, everything is in autopilot mode now.

In NOV 2021 the ratio was 100% equity. I was Investing only in equity. I had an RD and I put 70% of the matured amount in equity funds.

I need an asset allocation strategy. So, I shifted some funds from equity to debt and added some of my NSC (which will mature in Nov 2023) to make the ratio right. It took me about 3 months to get everything on track as planned.

For Equity, I stopped fresh investment in active funds. Also, chose the UTI Low Volatility index fund and ICICI SENSEX index fund to invest in from now on(60:40).

- Why not just a simple Nifty 50 index fund, which is the simplest thing to do? Well, I like the concept of this particular factor-based index as it is the simplest of all. Also, the focus is to have low volatility in my portfolio and that’s why I invest 60% of the amount in this index fund.

- The Remaining 40% I invest in the ICICI SENSEX fund.

- Mirae asset tax saver fund is more or less like a Sensex index fund with a little downside performance. Also, it has a lock-in, so I have to keep it and treat it as an index hugger. I may use this for rebalancing purposes.

- Got rid of the other 2 active funds (Parag flexi + Axis small) and invested in index funds

- Yes, I have made some mistakes and that’s why I invested in so many funds for a goal, but it was my learning period. But I have no regrets, at least I tried something.

For Debt, I was so confused. First, I chose a gilt fund (ICICI) to invest in. Then I thought about having a conservative hybrid fund also. Then I felt that I had 15 years +. So, I can go with PPF.

- At last, I opened PPF for my wife. I will also open a minor PPF and invest in it. And I chose an Arbitrage fund for Rebalancing purposes.

- PPF + Arbitrage – looks simple

- The gilt fund is not needed now. Later on, whenever I get a chance I will think about that

- When the NSC matures, will invest the amount in PPF.

My last year’s asset allocation was: Equity:Debt = 65:35

After the recent Bull Run, the asset allocation became Equity:Debt = 69.7 : 30.3. I sold the 9.7% of equity and moved it to Debt. Now my asset allocation is: Equity:Debt = 60:40.

- I kept the active fund (in my portfolio) for rebalancing purposes, so sold some units of the Mirae Asset Tax Saver Fund and moved it to Debt.

If you read my portfolio review of 2020, 2021, and 2022, you will see that I started with 100% equity. But within a few years I have realized that, no matter how far your goal is, you should never invest 100% in equity. 100% equity is not a strategy, it’s like a hope. You should invest with an asset allocation strategy, with regular rebalancing, and a glide path.

Finally, I adjusted my asset allocation to 65:35. I was waiting for some kind of opportunity, to reach my target allocation of 60:40. Luckily, the recent bull run helped me. 😀

Equity Mutual Fund: (Weight – 60% & XIRR – 28.96%)

- UTI Low Volatility Index – weight 62.60% – XIRR – 43.58%

- ICICI SENSEX index – weight 9.58% – XIRR – 29.84%

- Mirae tax saver – weight 27.82% – XIRR – 18.41%

- Don’t go for the XIRR, except the ELSS, the other 2 are recent investments, a little over 1 year.

Debt Instruments : (Weight – 40%)

- PPF – weight 40%

- Arbitrage (Nippon) – Weight 60% – XIRR 8.4%

- My NSC matured and I have invested the amount in PPF and Arbitrage Fund.

14 years to go (For Calculation Purposes)

- Inflation – 11%

- PTRE from Equity – 9%

- PTRE from Debt – 6%

- Step up – 10%

- Plan – Continue to invest @ 60:40 = Equity:Debt

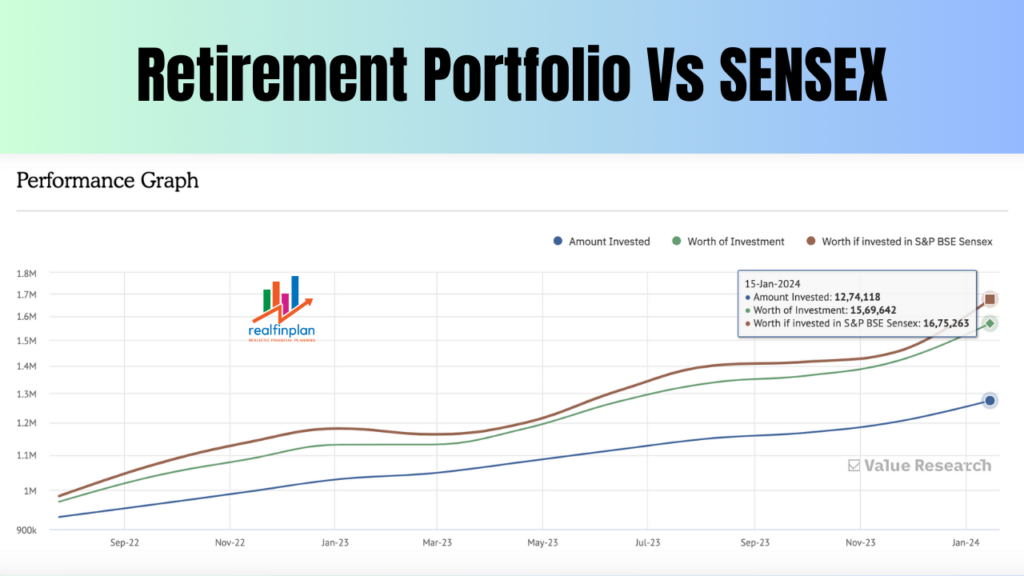

Portfolio Review: Retirement (29 years away):

Equity:Debt = 50:50

Equity Mutual Fund Portfolio: (Weight – 1.5%)

Previously I had these Equity Mutual funds in my portfolio:

- UTI Nifty Index Fund

- UTI Midcap 150 Quality 50 Index Fund

This year I changed my funds. I stopped further investments in those funds and I kept them goal-free. They are not tagged to any of my goals, maybe in the future I use them for another goal. From now on, I have started monthly investments in

- Motilal Oswal Midcap 150 Index Fund (Weight – 1.5%)

- These are recent investments, so XIRR doesn’t matter

Deposit: (Weight – 2.5% & XIRR – 6%)

- It’s a Co-operative Society Deposit.

NPS: (Weight – 96% & XIRR – 16.7%)

I opted for Moderate Auto choice (HDFC PFM) in June 2022 – Since then XIRR – 16.7%

- HDFC (E-Equity) – 50% – XIRR – 26.18%

- HDFC (C-Corporate Bonds) – 30% – XIRR – 7.63%

- HDFC (G-Gilt or Govt Bonds) – 20% – XIRR – 8.75%

- Upto 35 years of age – max equity allocation 50% – Rebalancing happens once a year (Birth Date)

- From 36th years of age, equity will reduce by 2% each year till 55 years of age and it will come down to 10% at 55 years of age

Why Moderate Auto Choice?

I have around 29 years for this goal. So, I have time. Being a central government employee, NPS is mandatory and is my most disciplined instrument with a great Investing CAGR of more than 10% on average since mid-2016.

- Also, for a moderate auto choice scheme, I won’t have to do anything, no human intervention.

- The equity will systematically reduce with yearly Rebalancing.

- The only risk is that an HDFC (Equity) fund may or may not be able to beat an index fund. But it doesn’t matter to me.

- For now, my overall NPS is like a balanced hybrid fund and will be a conservative hybrid fund with a gilt majority at later stages. So, I am okay with it.

29 years to go (For Calculation Purposes)

- Inflation – 7% before & 6% after

- PTRE from equity – 10%

- PTRE from NPS – 8%

- Step up – 10%

- Plan – Increase the equity Mutual Fund allocation as per my capabilities.

Milestones

- Your Retirement Planning can be set on auto-pilot —— Now it’s on autopilot mode as per calculation in Robo Advisory Tool

- You can live off Your Net Worth for a certain number of years

- If you were to retire today the current corpus would last for (years) – 3 years

- If you were to retire as intended you would be financially independent for (years) – 5 years

Others:

My Direct Stock portfolio – I didn’t tag this with any of my goals. It’s still new and I don’t have the confidence to tag this for Goal-Based Investment Planning. Previously, I was investing through Upstox. Then I started to use Zerodha for direct stock investing. My stock portfolio is still an experiment as of now. But, in the future, I may tag these stocks with my Retirement Portfolio.

Read the Author’s journey here:

- Part 1: An Accident That Changed My Life: Learnt About Discipline, The Key To Financial Stability

- Part 2: How I Started My Investment Journey? 2018 – 2019: The Years Of Product-Based Approach

- Part 3: A Course Of ₹760 On Financial Planning And Analysis That Forced Me To Shift Towards Process-Based Approach: My First Portfolio Review 2020

- Part 4: My Portfolio Review 2021: A 39 Minutes Meeting With A CFP That Boosted My Confidence To Be A DIY Investor

- Part 5: How I Automated My Goal Based Investing In 2022? Simplified Things With A Mature Process-Based Approach

- Part 6: 29 Financial Planning And Analysis Resources I Used Throughout My Journey: Boosted Me To Make My Goal-Based Investing Simple & Effective

Magnificent beat I would like to apprentice while you amend your site how can i subscribe for a blog web site The account helped me a acceptable deal I had been a little bit acquainted of this your broadcast offered bright clear idea