The Pension Fund Regulatory and Development Authority (PFRDA) announced the introduction of the NPS Systematic Lump Sum Withdrawal Facility (SLW). The PFRDA proposed to provide the option of phased withdrawal from NPS after the subscriber attains 60 years of age.

NPS may be a controversial financial product but also a trendy scheme. Being a central government employee, I have NPS by default. So, I always try to gather information and learn new things about NPS. Previously we have covered the introduction of Penny Drop Verification in NPS (October 2023).

Today, let’s get to know about the details of NPS Systematic Lump Sum Withdrawal.

****************

In realfinplan, we try to provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

Whatever we will discuss here will be true for the Tier-I account. For the Tier-II account, we will discuss at the end.

What are the existing NPS withdrawal rules?

After the age of 60 years, an NPS subscriber has the following options:

Option 1: Normal Exit

In this option, the subscriber has to buy an annuity for at least 40% of the accumulated Corpus.

- The annuity earned or the so-called “pension” will be taxable as per the Tax slab.

The rest of the Corpus, i.e. 60% can be withdrawn in one shot.

- The 60% withdrawal will be tax-free.

Option 2: Extension Of Withdrawal Age To 70 years With Contribution

In this option, the subscriber can continue to invest normally and also can get tax benefits as usual.

- This can be a smart choice for those people who don’t need the NPS Corpus immediately after 60 years of age. Why?

- Because an annuity purchased at age 70 will offer a higher interest rate.

- Also, the total taxable income at the age of 70 may be lower for some people.

Option 3: Different choices without further contribution

There are two things to consider for NPS when a subscriber attains 60 years of age.

- An annuity is to be purchased for 40% of the accumulated Corpus.

- Lump Sum payout to be taken for the rest of the Corpus (60%).

In this option, a subscriber has three different choices, through which he or she can purchase an annuity and take a lump sum payout.

Choice 1:

Subscribers can defer lump sum payout by a maximum of 10 years “and” annuity payout by a maximum of 3 years.

After the period, the annuity must be purchased and the lump sum must be withdrawn.

Choice 2:

Subscribers can defer lump sum payout by a maximum of 10 years, “or” annuity payout by a maximum of 3 years.

After the period, the annuity must be purchased and the lump sum must be withdrawn.

Choice 3:

Subscribers can enjoy phased withdrawal of lump sum amounts to age 70 with a minimum withdrawal of 10% each year.

But if you opt for choice 3, then you will have to purchase the annuity immediately after the age of 60. You can’t defer the annuity payout.

Note: For all three choices, the annuity earned is taxable as per the Tax slab and the lump sum withdrawal is tax-free.

What is the problem with option 3 and choice 3?

As per the earlier rules: “If withdrawn annually, the subscriber has to initiate the withdrawal request each time and the request has to be authorized as the case may be”, as per the latest draft released by PFRDA.

What is The NPS Systematic Lump Sum Withdrawal Facility (SLW)? Modification of Option 3

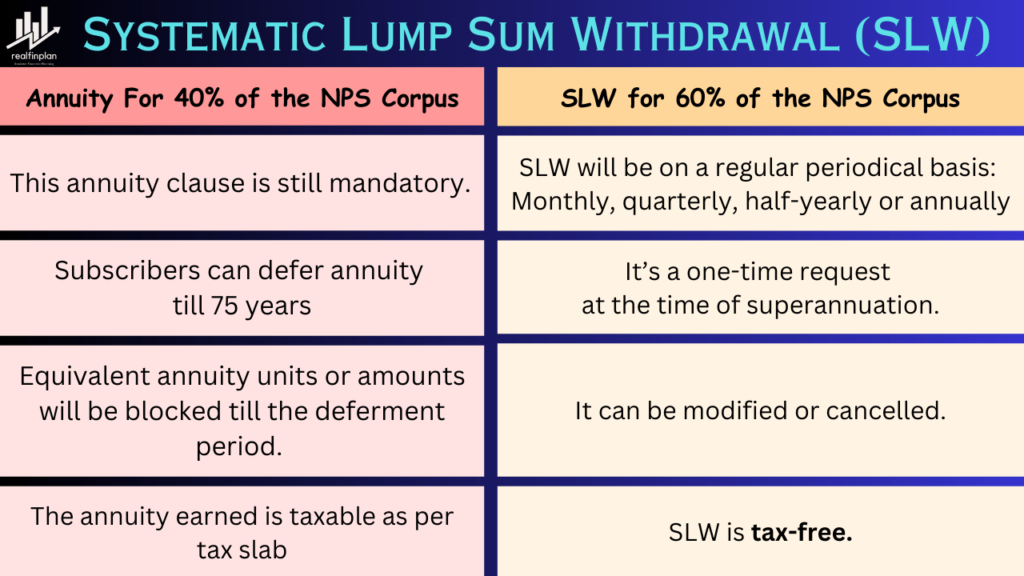

According to the proposed new rule, subscribers can withdraw up to 60% of their accumulated Corpus through the SLW for a period of up to 75 years of age.

With this SLW facility, the subscriber has the option to withdraw the desired amount systematically at regular periodic intervals or in a phased manner. This is similar to a Systematic Withdrawal Plan (SWP) under mutual funds.

This systematic withdrawal can be done on a regular periodical basis:

- Monthly, quarterly, half-yearly or annually.

- Subscribers will have to choose the mode of withdrawal at the time of their usual retirement or superannuation.

- So it’s an automatic withdrawal with a one-time request (previously it was about multiple requests).

- The lump sum withdrawal (max 60%) is tax-free. So, the SLW is also tax-free.

Note: Regarding Annuity

The subscriber will have to buy an annuity for the 40% of the accumulated Corpus in NPS. This annuity clause is still mandatory. The SLW will be applicable only for the lump sum portion.

Subscribers can either opt for annuity immediately after superannuation or defer annuity till 75 years

- In case of deferment, equivalent annuity units or amounts (40% of the total Corpus) will be blocked till the deferment period.

- After the period is over, the amount will be transferred to the concerned Annuity Service Provider (ASP) for annuity policy issuance.

One-time e-mandate creation for SLW

To enjoy the benefits of systematic lump sum withdrawal subscribers will have to create a one-time e-mandate. Subscribers will have to select:

- Frequency – monthly, quarterly, half-yearly, and annual

- Amount or units

- Start date

- End date – will be derived based on total Corpus, amount, frequency, and start date

- If the subscriber keeps the “end date” blank, the SLW will be triggered at a predefined frequency till the Corpus is available or till 75 years of age

- After attaining 75 years, units or amounts available will be redeemed. The balance amount will be transferred to the subscriber’s bank account

Key things to keep in mind for Processing of SLW

OTP authentication:

To avail SLW facility, the subscriber will have to log in with eSign, then there will be dual-factor OTP authentication (a separate functionality for SLW)

- There will be no nodal office authorization required.

Penny drop verification:

While setting up SLW, the bank account of the subscriber will be verified through a penny drop process.

- After successful penny drop verification, SLW will be executed.

- Any drop verification charges or other billing charges will be recovered from the lump sum amount.

Change of bank account details:

If a subscriber wishes to change the bank account in which funds are getting credited, he or she will have to update the new bank details with penny drop verification.

- But remember there may be a gestation period of 30 days for any type of withdrawal after bank details change.

Start of SLW:

SLW will start at least 30 days after the creation of the mandate in the system.

- If the subscriber opts for monthly withdrawal on the 5th of every month, the amount will be credited to the bank account on the 5th of every month.

- If the selected date is a non-settlement day, then the request will be processed on the next settlement day.

In case of insufficient balance:

If there is insufficient balance in the lump sum portfolio on the scheduled date of SLW, then withdrawal will be executed only for the available amount.

- Then the corpus value will be zero.

- All the remaining SLW requests will be auto-canceled.

Modification and cancellation:

Facilities to “modify” and “cancel and redeem” will be provided in the login. So after setting up an SLW, it can be modified or cancelled anytime.

- In case of cancellation, the eligible balance can be redeemed and the amount will be transferred to the bank account.

- Appropriate and regular alerts will be sent to the subscriber on set up, modification, or cancellation of SLW through SMS and email.

Scheme preferences:

During SLW, subscribers can opt for Scheme Preference or PFM change.

- However, it will be applicable only for the lump sum portion.

- The annuity portion (if not withdrawn and purchased) will remain as per the existing scheme choice, no changes can be made

In case of the demise of the subscriber:

In case of the demise of the subscriber during the SLW, the associated nodal office or POP will have to initiate a death withdrawal request. In that case, the entire Corpus will be paid to the nominee.

If the annuity is not withdrawn, then the nominee or legal heir will have to mandatorily opt for annuity withdrawal in case of government sector subscribers.

- However, the annuity will be optional in the case of non-government subscribers.

SLW for Tier-II account

The steps are more or less similar as in the case of tier 1.

But unlike tier 1, contributions shall be allowed in tier 2 accounts along with SLW.

In case the sufficient balance is not available on the SLW date, then redemption will not be executed on that day. The system will re-attempt the request on the next cycle.

Aur Tire 2 accounts, the SLW can be availed at any point of time i.e. even before attaining the age of 60 years. Why?

- Because one can make withdrawals from Tire 2 accounts anytime i.e., there is no lock-in period.

Conclusion:

All the above information is kind of a gist of what PFRDA has decided regarding NPS. Now, it’s time for my opinion.

What are the schemes offered by NPS?

Central Government Default Scheme:

Pension Fund Manager (PFM) – SBI, LIC & UTI Central Government Scheme

- This scheme is kind of a hybrid scheme. What does that mean?

- It consists of both the asset class – Equity and Debt

The funds invest the amount

- Upto 15% in equity

- The rest of the amount is in Gilt (government bonds) and Corporate bonds with Gilt majority.

- The funds act like Conservative Hybrid Funds

The other pension schemes from different PMSs are

- E – invests in Equity – The schemes are simply Largecap-oriented Equity Mutual Funds

- C – invests in Corporate Bonds – These are like Debt Funds – Corporate Bonds Funds

- G – invests in Government Bonds – These are Debt Funds – Gilt Funds

These are for all individuals and also for Govt employees who have opted for this voluntarily (or we can say switched from the central government default scheme to other schemes). You can choose the % allocation of different schemes (E, C, G) and then invest in NPS.

What are the risks involved in these schemes?

All the schemes are risky for sure as all three components (Equity, Gilt, and Corporate Bonds) are market-related products and all of them are prone to market-related risk.

- Sequence of Returns Risk – Due to equity

- Credit Risk and Interest Rate/Duration Risk – Due to Corporate Bonds

- Interest Rate/Duration Risk – Due to Gilt

Please recognize that Corporate Bond Funds and Gilt Funds are the riskiest funds among the Debt Mutual Funds category.

So, you always have to keep in mind while opting for SLW that, the corpus is still market-linked. Due to these risks, depending on the market conditions the Corpus may deplete faster because of the continuous withdrawals.

What can be a solution?

It would be better for PFRDA to introduce a separate asset class, such as the Money Market asset class. But why the Money market?

- Because Money market funds are the least riskiest debt mutual funds. They invest in money market instruments whose maturity period is up to 1 year. So, there will be lower interest rate risk or credit risk (provided that PFM will invest in financially sound companies).

- It can be treated as a cash component due to its low-risk nature.

This can be done only for the retiree. Subscribers can shift a portion of the lump sum in money market class and initial systematic withdrawal from the component. This will ensure that Corpus does not deplete that much faster.

My thoughts:

If a retiree has “enough” assets elsewhere, then his/her reliance on the NPS Corpus may not be high. Then you may afford to keep the lump sum in the NPS and gradually withdraw from it by opting for SLW.

The SLW is a new step and it’s in the right direction. It will be most useful for those who have saved a large enough Corpus so that they can leave the money in NPS and save on tax (as the amount withdrawn through SLW is tax-free).

- With the NPS SLW facility, a subscriber can withdraw as necessary (due to the flexibility of modification and cancellation) and pay no tax.

- But remember this is a luxury option. It will only be possible when you have enough liquid assets elsewhere.

It will be better if the SLW is done from a money market-like asset pool instead of Long Term Gilt or Corporate Bonds. Long-term bonds (Gilt or Corporate and forget the equity) are volatile due to credit risk and interest rate risk.

- If there are poor returns due to any economic events and if these poor returns continue for some extended period (which is pretty much possible), the Corpus can deplete faster due to continuous withdrawals.

So, if it’s not modified then the retiree will have to be financially well educated to understand all kinds of risks associated with the accumulated Corpus and systematic withdrawal. So, invest in yourself and educate yourself financially.