NPS withdrawal rules changed after the release of a recent circular of PFRDA dated October 25, 2023, successful penny drop verification, along with name matching, is required for exit or withdrawal processing requests and updating subscriber bank account details.

NPS may be a controversial financial product but also a trendy scheme. Being a central government employee, I have NPS by default. So, I always try to gather information and learn new things about NPS. Let’s discuss the recent changes.

****************

In realfinplan, we try to provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

NPS Withdrawal Rules Change: Introduction Of Penny Drop Verification

The Pension Fund Regulatory and Development Authority (PFRDA) has made instant bank account verification mandatory at the time of withdrawal or exit from the National Pension System (NPS) scheme.

- This is being done to ensure timely credit of NPS funds to the bank account of subscribers.

The verification of the bank account will be done via the penny drop method, according to an Economic Times report.

As per the PFRDA circular dated October 25, 2023, “The penny drop verification has to be necessarily successful with the name matching, for processing the exit or withdrawal requests, and also for modifying the subscriber’s bank account details.”

What is a penny drop verification?

Penny drop verification is a method used for validating a bank account instantly. It’s a way to verify the bank account details of an individual or business.

It generally involves depositing a small amount of money, usually ₹1, into the account.

Why this type of verification?

This is necessary to ensure that the account is genuine.

- The process authenticates the customer’s bank account.

- It also confirms that the account is active.

- It also helps to establish whether the provided account details belong to the same customer.

- It verifies if the provided IFSC code is correct.

- A determines the transfer modes like NEFT, IMPS, etc supported for the bank account.

Possible reasons for failure in Penny drop verification

- Name mismatch

- Invalid account number

- Invalid account type

- Invalid or wrong IFSC code

- Account dormant or frozen

- Account is inactive

- Account closed

- Account does not exist

- IFSC code changes due to account transfer

- Credit freeze

My penny drop verification has failed. What will be the process of withdrawal or exit from the NPS scheme?

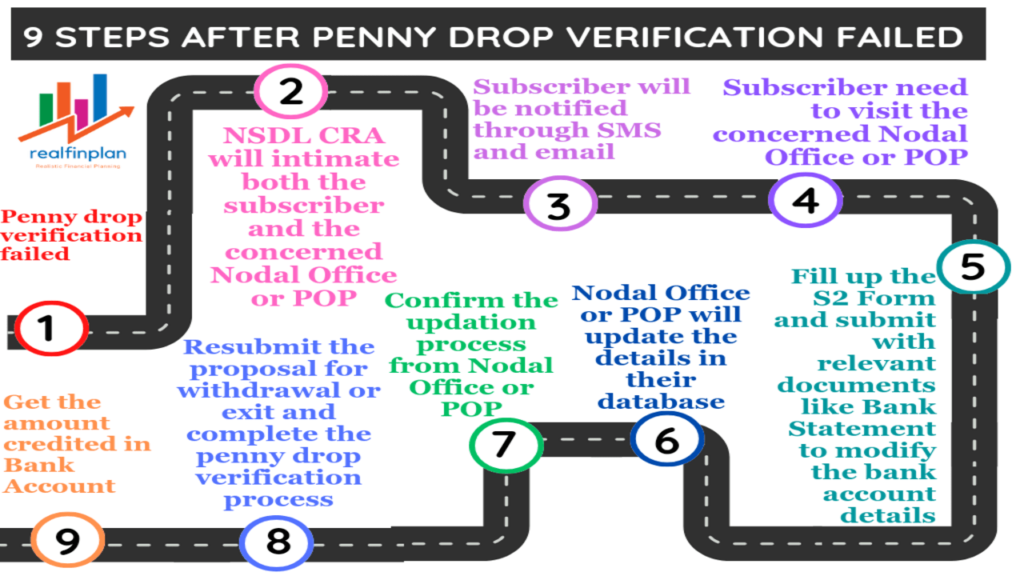

As per the PFRDA, if the credit rating agency (NSDL CRA) fails to verify the penny drop during the verification process of the bank account:

- No request for exit or withdrawal or altering the subscriber bank account data will be permitted.

CRA will inform both the subscriber and the concerned nodal office or POP.

- CRA will send communications to the subscriber on the mobile number and email on the penny drop failure.

- CRA will also advise the subscriber to contact the nodal officer or POP (whoever is applicable to the subscriber).

- Simultaneously, the CRA will send communication to the concerned nodal office or POP intimating the failure of Penny drop verification. This will be done regardless of the reason behind the failure of Penny drop verification.

After the intimation process is completed, the subscriber can approach the concerned nodal office or POP for modification in bank account details.

- The subscriber will have to fill up the “S2 form” and submit it to the nodal officials.

After that, the processing of the exit or withdrawal can be taken up including re-verification of the bank account through penny drop verification.

In the case of the government sector (such as for Central Government employees), the withdrawal request proceeds are to be credited to the salary bank account of the subscriber, vide circular no PFRDA/2015/27/EXIT/2 dated 12th November 2015.

Advantages of the penny verification method in NPS:

Previously, if you submitted any withdrawal or exit request, the amount was to be credited to the account that was in the database of CRA. You won’t have to go through any verification process.

But from now on, you will have to verify the bank account. If it’s verified by CRA (it’s an instant verification process), then only the withdrawal amount will be credited to the bank account.

So, there is an extra layer of security in the withdrawal or exit process from NPS schemes.

Disadvantages of the penny verification method in NPS:

There are not many disadvantages as such. But if you think from the subscriber’s point of view, then it can be hectic at times.

If there is wrong or insufficient data in the database of NSDL CRA (it can be due to negligence of the subscriber or nodal officials or any other cause), then the subscriber will have to visit the nodal office or POP a few times to rectify or modify the bank account details. It cannot be done online or through the OTP verification process.

But if you follow the above-mentioned steps, you will be able to modify the bank account details with less stress.

Note:

If your penny drop verification fails, the CRA will conduct adequate verification and additional due diligence processes before executing the exit or withdrawal requests.

The above discussed is applicable across other retirement products i.e. NPS, APY, and NPS Lite for all types of exits or withdrawals as well as modifications in subscribers’ bank account details.