Welcome to realfinplan! In this article, we will try to understand “Term Insurance with Return of Premium (TROP)”. Due to high cost, inflation impact, and mixing insurance and investment, Term Insurance With Return Of Premium (TROP) can be a complete waste of money.

Whenever someone asks me about something related to personal finance, I always suggest him/her – Cover the Basics first: 3 Simple Steps To Manage Financial Risks For A Secure Future. So that individuals can secure their financial future.

But, why do you need to secure yourself financially? Well, life is full of risks, needs, and wants. The most important of them are financial “risk” and “needs” (not wants, you can’t ignore the “needs” or delay them).

If you need to build a house you will need to have a strong foundation. Without a solid base, you won’t be able to protect your house.

- Similarly in personal finance, you need to cover your basics first, and manage your financial “risks”. Then only you can build the floors for your house i.e. build your wealth through Investments to meet financial “needs”.

There are a lot of financial risks associated with our lives and the most important are Emergency risk, Life risk, and Health risk. They can give us significant challenges at any point in our financial journey.

But through the prudent use of emergency funds, life insurance, and health insurance, we can protect ourselves and our loved ones. We can be confident about being financially stable by managing these risks for a secure future.

- Previously, we have covered the concept of an Emergency Fund in detail. You can check it out: What Is An Emergency Fund? 3 Questions To Ask Yourself Before Spending Emergency Fund

If you seek people’s knowledge about financial planning, different people will come up with different suggestions. They would say, do this and do that, etc. But, very few will say about what not to do. That’s why it will be a series about what we must avoid.

Previously we have already discussed the following:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

In this article, we will discuss why you should avoid Term Insurance with a Return of Premium for buying Term Life Insurance. So, let’s start.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

What is term life insurance?

Term Life insurance, also known as Term Insurance or Pure Vanilla term insurance, offers coverage for a specific period. But why pure vanilla?

- Because it’s the purest form of insurance.

- The sole purpose of term insurance is to mitigate life risk. That’s it.

It’s a straightforward and low-cost option.

- It only pays out in the event of death and does not have any savings component like other types of insurance.

- That’s why the cost of a term insurance policy is pretty much low compared to its potential benefits.

- You pay an affordable fixed premium, for a fixed period to the insurance company.

For that, the company provides a death benefit to beneficiaries, if the insured person passes away during the policy term.

- But how much will the beneficiaries get? The insurance company provides your beneficiaries with a predetermined sum – called the sum assured. So that your dependents are financially protected.

Term life insurance is the most affordable and efficient way to secure your family’s financial future. But when you survive the policy term – you don’t get anything back.

- That’s the only disadvantage of term insurance.

- It’s also one of the biggest reasons why we try to stay away from it.

- We think that if we don’t die then our money spent for a pure term insurance is wasted.

- We feel more secure if we put our money in plans that give us some returns. Most of us are stuck in the “returns” and “money back” mindset.

Maybe that’s why insurance companies came up with term insurance with return of premium (TROP).

What is Term Insurance With Return Of Premium (TROP)?

A TROP is nothing but a term insurance plan that gives you a maturity benefit.

- If you survive the policy term, you get a refund of all premiums you have paid with some exclusions.

- In the case of your unfortunate demise during the policy term, your nominee will be given the coverage amount.

What is returned?

- All the base policy premiums that you paid during the entire policy term, are paid back to you.

- Additional underwritten premiums (extra charges based on medical reports, health, habits, et cetera) are usually returned to you.

- Modal loading premiums (extra charges when you choose other modes instead of an annual payment mode) are also returned to you.

What is not returned?

- GST on the premiums is not returned. Why? Because taxes are paid to the government.

- Riders’ premiums are not returned. There can be exemptions too. But that depends upon the insurance provider.

- Some insurance plans may not give you the underwriting premiums. Read the policy documents carefully.

Difference between Pure Term Insurance & TROP

The basic differences between pure term insurance and term insurance with return of premium are given below:

| Features | Pure Term Insurance | Term Insurance With Return Of Premium |

|---|---|---|

| Premiums | Pocket Friendly | Relatively Higher |

| Death Benefits | Sum Assured | Sum Assured |

| Maturity Benefits | NIL | If you outlive the policy term – you get back all the premiums you have paid (minus all the taxes). |

Term Insurance with Return of Premium Vs. Pure Term Insurance: An Illustration on Why to Avoid TROP

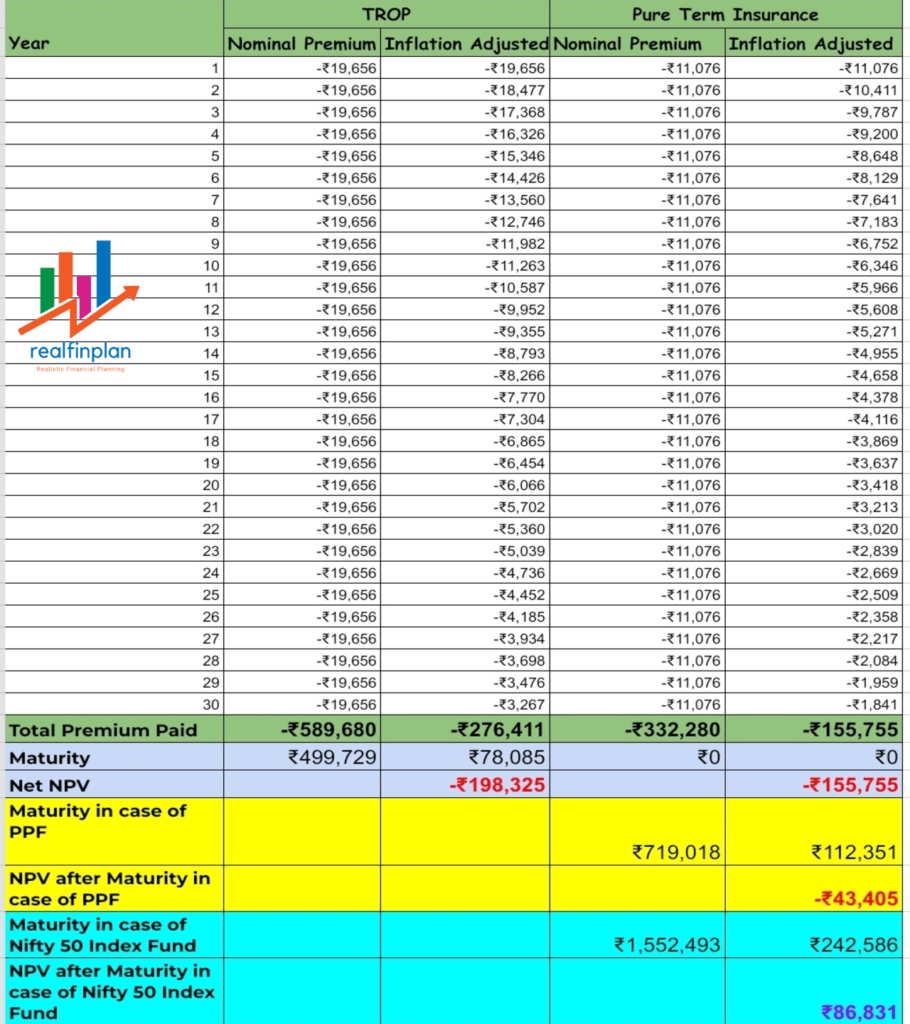

To compare term insurance with return of premium (TROP) with pure term insurance, we have obtained insurance quotes from the policy bazaar. The quotes are for a 30-year-old salaried male, non-smoker, with a regular premium payment plan for 1CR coverage, until the age of 60.

- For the Pure term insurance plan, the premium is ₹11,076/year.

- For TROP, the premium is ₹19,656/year from the same insurance company.

- The difference in the premium is ₹8580/year

If you live until 60:

- In the case of the TROP, all the premiums, apart from the 18% GST, are returned after 30 years.

- This amount will be = (30* ₹19,656 /1.18) = ₹5 Lakhs

- The “1.18” factor adjusts for the GST which is not returned.

Time Value of Money – Inflation Adjusted NPV

Everything is looking great for the above example, right? At least we get our money back. But you are missing something here.

There is a concept called the time value of money. It’s based on the fact that the value of money depreciates over time.

- So, ₹100 today or not equivalent to ₹100 years down.

- “A bird in the present is worth two in the future”. Any amount of money you pay early in life has more value than the same amount you pay later.

- Inflation is the culprit for that. So, we all need to consider it whenever we make any significant financial decision.

To understand the time value of money, we will use a calculation called the NPV or the Net Present Value. We will consider the inflation-adjusted value of the premiums paid and the returns.

In our NPV calculation, we have assumed an inflation rate or discount rate of 6%. We will compare 4 situations here:

- Buying TROP for ₹19,656

- Buying Pure Term Insurance for ₹11,076

- Buying Pure Term Insurance for ₹11,076 and investing the difference amount of ₹8,580 in PPF (assumed post-tax return = 6%)

- Buying Pure Term Insurance for ₹11,076 and investing the difference amount of ₹8,580 in a Nifty 50 index fund (assumed post-tax return = 10%)

Now, if you live until 60

- In the case of TROP, the return amount is ₹5 Lakhs

- In the case of pure-term insurance, the return amount is ₹0

- In the case of pure-term insurance + PPF option, the PPF corpus grows to ₹7.19 Lakhs

- In the case of pure-term insurance + Nifty 50 Index Fund option, the Nifty 50 Index Fund corpus grows to ₹15.5 Lakhs

- Now, look at the inflation-adjusted NPV (with a discount rate of 6%) values in the table, to get a clearer picture of the reality.

| If you live until 60 | TROP | Pure Term | Pure Term + PPF | Pure Term + N50 Index |

| Total Premium Paid | –₹5,89,680 | – ₹3,32,280 | – ₹3,32,280 | – ₹3,32,280 |

| Total Premium Paid (NPV) | – ₹2,76,411 (A) | – ₹1,55,755 (C) | – ₹1,55,755 (E) | – ₹1,55,755 (G) |

| Maturity Benefit | ₹4,99,729 | ₹0 | ₹7,19,018 | ₹15,52,493 |

| Maturity Benefit (NPV) | ₹78,085 (B) | ₹0 (D) | ₹1,12,351 (F) | ₹2,42,586 (H) |

| Net Benefit (NPV) | – ₹1,98,325 (A+B) | -₹1,55,755 (C+D) | -₹43,405 (E+F) | ₹86,831 (G+H) |

You can check out the following Excel calculation image for a detailed picture of the above table.

In the case of Pure Term + Nifty 50 Index Fund, the NPV comes as a positive number.

- In all other cases, the NPV is a negative number.

Why? Because, when you don’t die, the insurance company benefits, not you.

However, with the TROP, the NPV is most negative. Therefore, all the other cases are good except for that TROP.

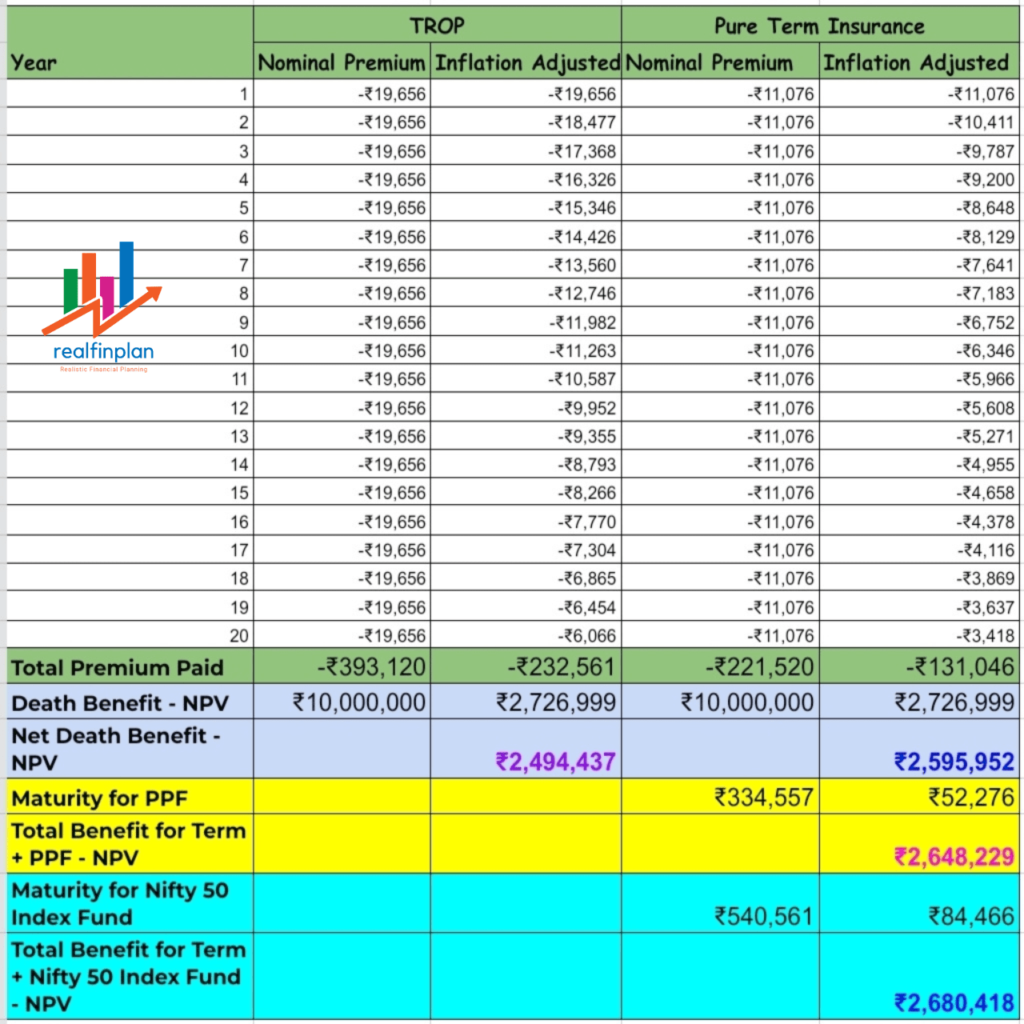

Now, if you die at 50

- In the case of TROP, you get the sum assured of 1CR. But you won’t get the premium back as the premium is returned, only if you do not die.

- In the case of pure-term insurance also, you get the sum assured of 1CR.

- In the case of pure-term insurance + PPF option, you get the sum assured of 1CR + the PPF corpus of ₹3.35 Lakhs

- In the case of pure-term insurance + Nifty 50 Index Fund option, you get the sum assured of 1CR + the Nifty 50 Index Fund corpus of ₹5.4 Lakhs

- Now, look at the inflation-adjusted NPV (with a discount rate of 6%) values in the table, to get a clearer picture of the reality.

| If you die at 50 | TROP | Pure Term | Pure Term + PPF | Pure Term + N50 Index |

| Total Premium Paid | – ₹3,93,120 | – ₹2,21,520 | – ₹2,21,520 | – ₹2,21,520 |

| Total Premium Paid (NPV) | – ₹2,32,561 (A) | – ₹1,31,046 (C) | – ₹1,31,046 (E) | – ₹1,31,046 (G) |

| Death Benefit | ₹1,00,00,00 | ₹1,00,00,00 | ₹1,00,00,00 | ₹1,00,00,00 |

| Death Benefit (NPV) | ₹27,26,999 (X) | ₹27,26,999 (X) | ₹27,26,999 (X) | ₹27,26,999 (X) |

| Maturity Benefit | ₹0 | ₹0 | ₹3,34,557 | ₹5,40,561 |

| Maturity Benefit (NPV) | ₹0 (B) | ₹0 (D) | ₹52,276 (F) | ₹84,466 (H) |

| Net Benefit (NPV) | ₹24,94,437 (A+X+B) | ₹25,95,952 (C+X+D) | ₹26,48,229 (E+X+F) | ₹26,80,418 (G+X+H) |

You can check out the following Excel calculation image for a detailed picture of the above table.

The NPV is again higher in all other cases except for the TROP. It’s basically a waste of money. So, stay away from TROP.

If you want to discontinue your TROP Plan during the policy term

You may find the premium too high after knowing the time value of money concept. Or you may have found a better plan. Then you can discontinue or “surrender” your policy during the policy term or continue the policy without paying further premiums, technically called “reduced paid-up”.

| Discontinue the Policy and get the Surrender Value | Continue the policy on a reduced paid-up basis without further Premiums |

|---|---|

| You will receive the applicable surrender value. You can use the money for further investments. | If you pass away during the policy term, your nominee will receive the death benefits. But, it will be reduced proportionately. |

| Every insurance company determines a surrender value factor. It’s based on how many years the policy was active. (This surrender value factor may be across insurance companies and their products) | Reduced Death Benefits = (Total premiums paid/Total premiums payable) x Sum assured |

| Surrender Value = Surrender value factor x Total premiums paid | If you outlive the policy term, you will receive the total premiums paid by you. |

Conclusion

If you ask for my honest opinion, TROP plans are not a great investment avenue. On paper, the insurance companies refund your premiums which can look good. But actually, you don’t get any returns. It’s a complete waste of money. The above illustration is a classic example of a financial disaster done by mixing insurance and investment.

In reality, you need to get out of the “returns” and “money back” mindset. You need to understand the real purpose of insurance. The thing is financial planning has two main components. Insurance and investment.

- Insurance is for minimizing the risk and Investments are for our future needs and wants.

It is recommended that you consider investing in a pure-term insurance plan. And use the additional money (you would pay for a TROP plan), to invest in pure investment products like FD, PPF, mutual funds, etc. By opting for a pure-term life insurance plan and separate investment products, you can get potentially higher returns and more comprehensive insurance coverage.

Check out our other “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One