Welcome to realfinplan! In this article, we will try to understand “The 50/30/20 Rule” and how this thumb rule can simplify your budget and transform your financial landscape.

Do you ever feel like your budget is pretty much a mess? Do you feel lost and overwhelmed when it comes to budgeting? Are you tired of bills piling up, temptations lurking, and financial stability going out of reach?

- If so, then you are not alone. But fear not, the 50/30/20 Rule is a simple yet powerful framework that can help you take control of your spending and achieve financial stability.

This blog post isn’t about just another budgeting tip. It’s about organizing your relationship with Money. It will provide you with a clear route map to navigate your finances with confidence and purpose. So, keep calm and settle in, because we are about to simplify your budget and unlock your saving potential.

Let’s start!

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, you can lay a foundation for your investing process through goal-based investing.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- We must adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

*************

Table of Contents

What is the 50/30/20 Rule?

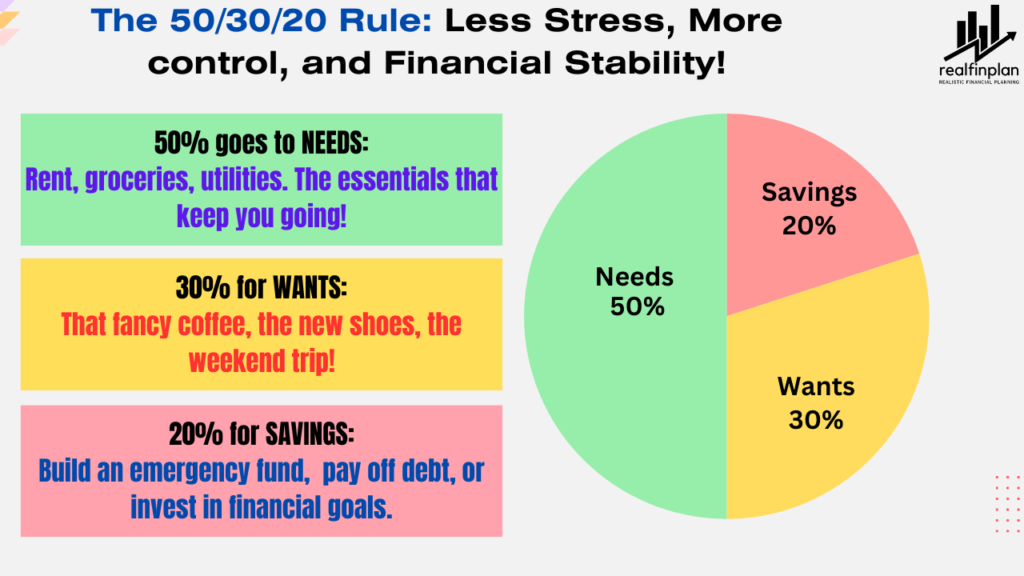

Senator Elizabeth Warren popularized this rule in her book, All Your Worth: The Ultimate Lifetime Money Plan. The rule is to split your post-tax income into three categories of spending: 50% on needs, 30% on wants, and 20% on savings and financial goals. Here is the breakdown:

50% Needs:

These are the non-negotiables, the essential expenses without which you absolutely can’t survive in this world. Half of your after-tax income should be allotted to cover your basic needs.

The examples of your basic needs can be as follows:

- Rent or mortgage payments

- Essential bills (electricity, water)

- Groceries

- Car payments, or transportation costs

- Relevant insurance like Term life insurance and health insurance

- Healthcare costs

- Minimum debt payments

If you are spending more than 50% of your income on your needs, you will have to either cut down on your wants or try to downsize your lifestyle. The first thing to do is to analyze your situation and distinguish what is essential and what is not. Then you may have to change your lifestyle a bit.

- It can be in the form of a smaller home or a more modest car.

- Maybe you will have to use public transport more.

- You may have to cook at home more often, rather than eating out.

- Cut down any Gym subscription – you can choose free hand exercise till the essentials get sorted.

- Unsubscribe from any TV subscription like Netflix, Prime Video, Hotstar, etc.

30% Wants:

Wants are everything you spend money on that is not absolutely essential for your survival. This is your “fun money” category, the things you enjoy, but not necessarily need.

This category also includes the upgrade decisions you make.

- It can be choosing a costlier meal instead of a less expensive food item,

- Buying an Audi instead of a more economical Tata Motors,

- Or watching TV with a subscription to streaming services rather than watching Cable TV.

Basically, wants are those for which you spend a little extra money to make your life more enjoyable and entertaining. This can be:

- New unnecessary clothes or accessories like handbags or jewelry

- Tickets to sports events or musical concerts

- Holiday or vacation time Socializing costs, like eating out, cinema, etc.

- The latest electronic gadget (especially an upgrade over a fully functioning prior model)

- Ultra high-speed Internet beyond your streaming needs

20% Savings:

Finally, this is where you prioritize your future. Try to allocate 20% of your net income towards savings goals, starting with building an Emergency fund equal to 6 to 12 months of your monthly expenses. After that, focus on your retirement and meeting other financial goals. Examples of savings can be:

- Creating an emergency fund

- Retirement Planning Making

- PF or NPS contribution

- Investing in Mutual Funds or Stocks

- Setting aside some funds to buy some physical property in the future

- Making debt payments aggressively to become debt-free as early as possible.

Why is the 50/30/20 Rule so effective?

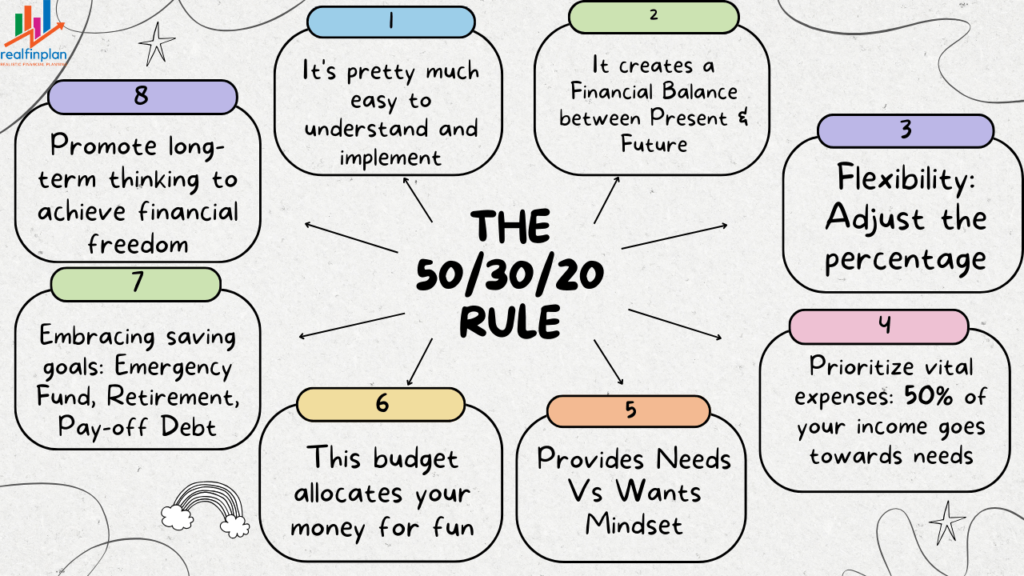

Simplicity:

This rule offers a straightforward framework for budgeting. It’s pretty much easy to understand and implement, even if you are not a finance freak. You don’t need any complicated spreadsheets or formulas. All you need is three clear categories to track and manage.

Create Financial Balance:

If you use a budget, you can manage your money in a balanced way. This budget rule ensures that your basic needs and wants are covered, and you are actively saving for the future. So, you are taking care of today while building a brighter tomorrow.

Flexibility:

This rule is a guide, not a strict formula. You can easily adjust the percentage based on your circumstances and priorities.

Prioritize vital expenses:

You can make sure that you are not taking on too much debt by giving the basics top priority. As per the rule, 50% of your income goes towards needs, and that’s a sizeable amount. So this rule makes sure your essentials are more likely to be met.

Provides Needs Vs Wants Mindset:

When you go through your expenses, you will analyze whether the expense is a need or a want. This is so crucial for personal finance. If you can distinguish between needs and wants, you will naturally develop a mindset to make smarter financial decisions in the future.

This budget allocates your money for fun:

Most of us think that a budget means cutting back and not being able to have any fun. The beauty of the 50/30/20 Rule is that there is room for your wants and desires. This will help you stick to your budget without feeling like you are missing out on something.

Embracing saving goals:

By allocating 20% of your income to savings, you can build a foundation for your financial stability and create wealth for a prosperous future. Starting with setting up an emergency fund, you can also prepare for retirement, pay off debt, invest in other financial goals like child education, buying a home, etc.

Promote long-term thinking:

If you are consistent on that “20%”, you can accumulate money and invest the same to meet long-term financial objectives. Consistency can result in increasing your ability to save more than 20%, then you may be able to achieve financial freedom at some point in your journey. This will provide you and your family with a sense of security as you approach retirement.

How to Get Started with the 50/30/20 Rule? The 5 Steps

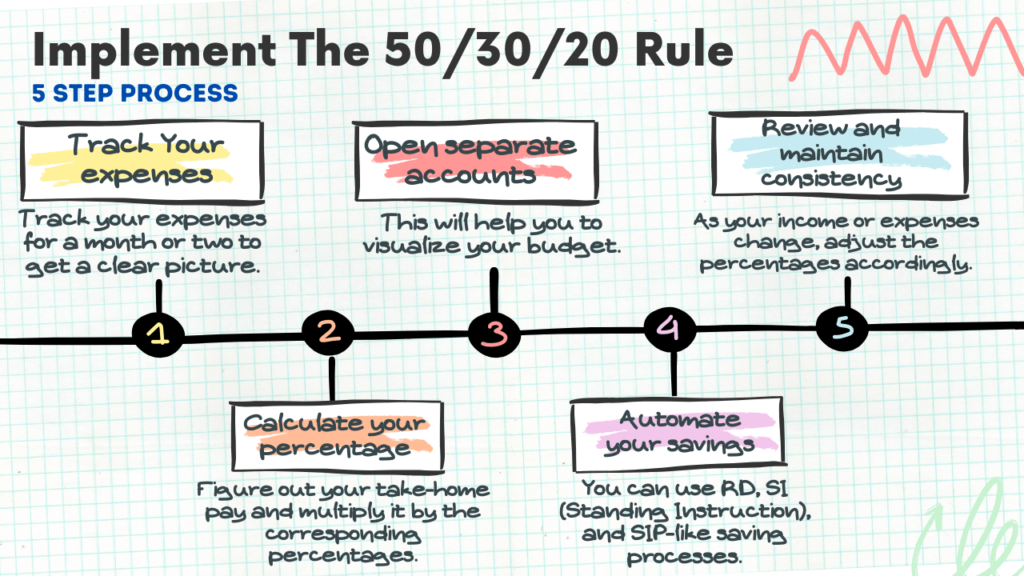

Step 1: Track your expenses

Before you start allocating your income into different buckets, you need to understand where your money goes. Track your expenses for a month or two to get a clear picture. You can use budgeting apps, spreadsheets, or even a notebook.

Break down your expenses into three categories: Needs, Wants, and Savings. This will provide the groundwork for a better understanding of your spending pattern.

Step 2: Understand your income and calculate your percentage

This is based on what your income is. Get your post-tax income for calculation and multiply it by the corresponding percentages.

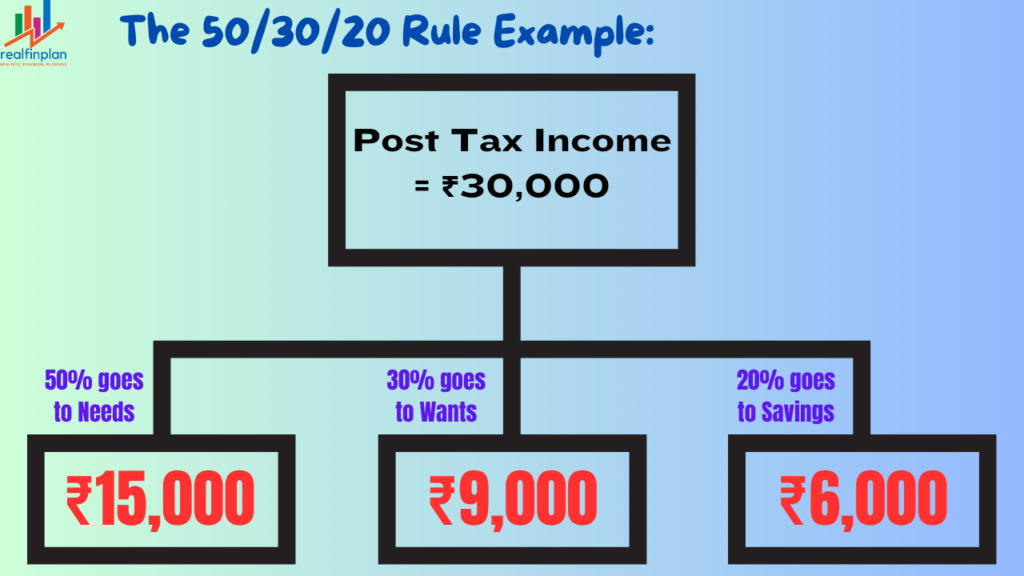

For example, if your monthly income is ₹30,000, then 50% for your needs would be ₹15,000, 30% for your wants would be ₹9,000, and 20% for savings/debt would be ₹6,000.

Step 3: Open separate accounts

Consider setting up separate bank accounts or separate financial instruments (like mutual funds, stocks, bonds, etc) for each category. This will help you to visualize your budget and avoid dipping into your savings or impulsive buys.

Step 4: Automate your savings

Set up automatic transfers to your savings and debt repayment accounts, things will be simpler. You can use RD, SI (Standing Instruction), and SIP-like saving processes. This will ensure that your debts are reduced and funds increase steadily and without manual labor.

Step 5: Review and maintain consistency

This is not a hard-and-fast rule that you will have be maintain all the time. Just kick-start your journey. As your income or expenses change, adjust the percentages accordingly. Just be critically disciplined, in whatever you do.

Is there any free calculator available for the 50/30/20 Rule?

Yes, there are many free spreadsheets available online. You can use them to implement this rule. I will suggest the Barefoot Minimalists 50/30/20 Rule Calculator. It’s free to use, and more importantly, you can customize the spreadsheet as per your needs.

Click on the link, you will be directed to their website. They have an entire blog on how to use the calculator. Download it and give it a try, see if it can help you.

Be Smart and go beyond the basics to hack your Badget:

Use Budgeting tools:

Apart from the above calculator, you can also use apps to track your expenses. It’s easier to get things done with mobile nowadays. I can recommend the following apps:

- Money Manager App by Realbyte – Simple, detailed, tons of features like Connect PC. I use this to track my expenses and get an idea. I never use the budget section. But with this app, you can set up a budget for each category. It’s easy and helpful. Though I have the premium version, it’s completely free of cost (with ads).

- Moneyfy – The UI is nice and simple. The premium version is much lower than the previous one.

Master the meal plans:

Ditch the takeout! Planning your meals saves you cash and calories. So, make a list, and stick to it! Avoid impulse buys at the supermarket, it’s a budget buster.

DIY solutions:

Skip the pricey repairman! Learn basic DIY skills like fixing leaks, sewing buttons, or changing lightbulbs. YouTube is your free teacher!

Find budget-friendly alternatives:

Look for ways to save on needs (cooking at home, negotiating bills) and find cheaper alternatives (game nights at home instead of movie nights) for your wants.

Entertainment shuffle:

Skip the expensive movie tickets! Host game nights, borrow books from the library, or explore free outdoor activities. The fun doesn’t have to break the bank!

Embrace minimalism:

Declutter your life and all your spending. Less stuff often means less money spent.

Challenge yourself:

Once you are comfortable with this basic framework, try reducing your wants and increasing your savings.

- Do a subscription audit! Cancel those unused gym memberships or streaming services you forgot about. Every little bit adds up.

Set Financial Goals:

Whenever you save money, first ask the “Why”. Why do you want to save? Don’t be aimless. Yes, you are ready to save and that’s “good”.

- But to make it “great”, you need to give your saving a purpose, and make it a goal. This will motivate you to stick to your budget and make smarter financial decisions.

Systematic Increase of the “20%”:

If you are consistent on that “20%”, you can accumulate money and invest the same to meet long-term financial objectives. Consistency can result in increasing your ability to save more than 20%. And consistent increase in saving and investing will lead you to financial freedom.

You can set up a “yearly increase” in your monthly savings. It can be as low as 3 to 5%. The idea is to build a mindset for step-up. If your monthly saving rate is ₹10,000. Then after one year, with a 5% step up it will be ₹10,500/month.

- If you asked me, a 10% yearly step-up is a great “target” to feel financial stability and peace of mind (though it can be tough to maintain it consistently).

But always remember, no matter what, a small step toward a systematic increase in the saving rate can help you achieve financial stability or financial freedom.

Seek financial education support from experts:

Read books, listen to podcasts, watch YouTube videos, and learn about personal finance and investing. Don’t be afraid to ask for help. Find online resources to keep you motivated. Talk to a financial advisor if needed.

The Bottom Line

Yes, saving is difficult. Life can give us a lot of challenges in our financial journey. But if you can follow the 50/30/20 Rule, you can have a plan for how you manage your income. If the expenditure on wants is more than 30%, you can find ways to reduce them to direct funds to more important areas like building an Emergency fund and retirement.

Always remember, this rule is not a strict one. Customize it as per your need. If you live in a highly expensive city, you may think that being able to save 20% is unrealistic. On the other hand, if you plan to retire early, 20% savings might not be enough. So adjust everything as per your situation.

Frequently Asked Questions (FAQs):

Can I adjust the percentages based on my situation?

Yes, you can modify the percentages in the 50/30/20 rule based on your circumstances and priorities. Adjusting the percentages can help you tailor your strategy.

What if my income varies each month?

No worries! Calculate the percentages based on your monthly income. It’s all about proportion.

Is the 50/30/20 rule suitable for small incomes?

Yes! The rule adapts to all income sizes. It’s about balance, not the size of your income.

Is the 50/30/20 rule suitable for debt repayment?

The 50/30/20 rule can be a helpful starting point for debt repayment, but it’s not always the perfect solution. Focuses on paying off the smallest debts first, providing quick wins and motivation. Then pay off the loan with the highest interest rates to save money in the long run.

Can the 50/30/20 rule be used for long-term financial planning?

Yes, the 50/30/20 rule can be used to save for long-term goals. Allocate a portion of the 20% to savings specifically for your long-term goals, such as a down payment on a house, education funds, or investments. The rule is intentionally meant to bring focus to savings.

How Can I Budget Effectively Using the 50/30/20 Rule?

To budget effectively using the 50%, 30%, 20% rule:

1. track your expenses,

2. prioritize essential needs,

3. be mindful of wants, and

4. consistently allocate savings or debt repayment within the designated percentage.

Is an emergency fund really that important?

Absolutely. An emergency fund is your financial safety net. Life happens, and it pays to be prepared! Read my article here:

What Is An Emergency Fund? 3 Questions To Ask Yourself Before Spending Emergency Fund

Get FREE educational content in YOUR MAIL BOX!

Please subscribe to our YouTube Channel here.