Welcome to realfinplan! In this article, we will try to discuss some tips and tricks to avoid the common mistakes in Asset Allocation strategy.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

If you want to become financially stable and then wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved in it: Sequence of Returns Risk(SRR).

This SRR can damage your portfolio and overall financial well-being at any point in your investment journey. To challenge this SRR and counter its effects, we need to adopt a proper strategy. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

- We have already discussed that in our previous article and I will request the readers to finish this article first and then come here: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Reduce It

To know more about Asset Allocation, please dive into our other articles:

- About Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- About Common Mistakes to Avoid: 9 Common Mistakes To Avoid For Asset Allocation Strategy

****************

At realfinplan, we try to provide realistic, authentic, and free educational content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover your basics to secure yourself financially, then to understand the Basics of Saving and Investing.

- Second to identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

9 Tips To Avoid The Common Mistakes In Asset Allocation Strategy

Today, we will discuss some important tips and tricks. So that we can avoid mistakes while planning for our financial well-being. So, let’s start.

1. Always Have a Plan with a Strategy

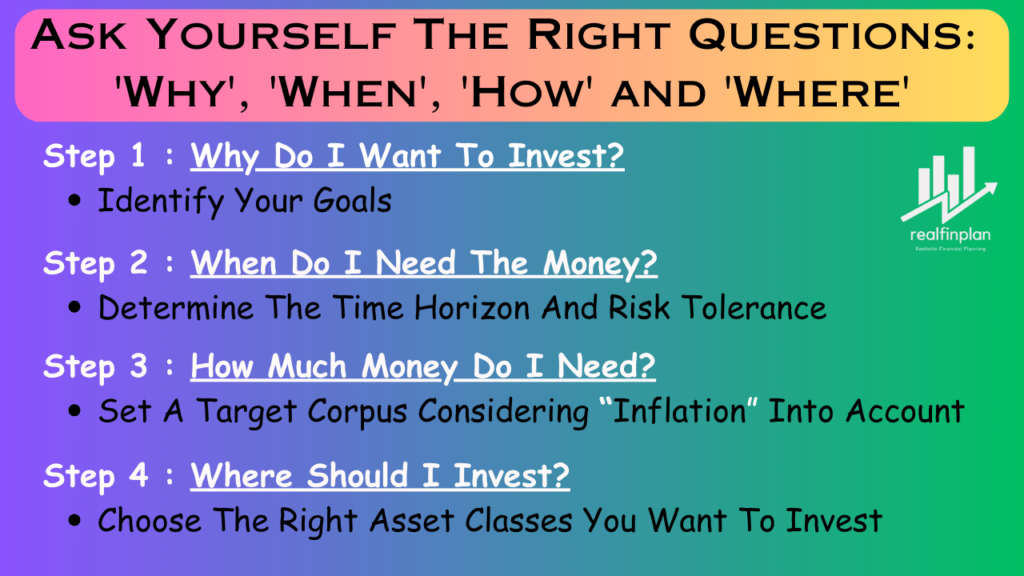

When it comes to investing, always have a plan before jumping onto a strategy (Asset Allocation Strategy) or any investment product. Always outline your planning. Please understand the ‘why’, ‘when’, ‘how’, and ‘where’ of investing.

- Why do you want to invest? Identify your goals

- When do you need the money? Determine the time horizon and risk tolerance

- How much money do you need? Set a Target Corpus considering Inflation into account

- Where to invest? Choose the right asset classes you want to invest

Now, that you have chosen the asset classes to invest in, you can determine the right asset allocation strategy for your goals.

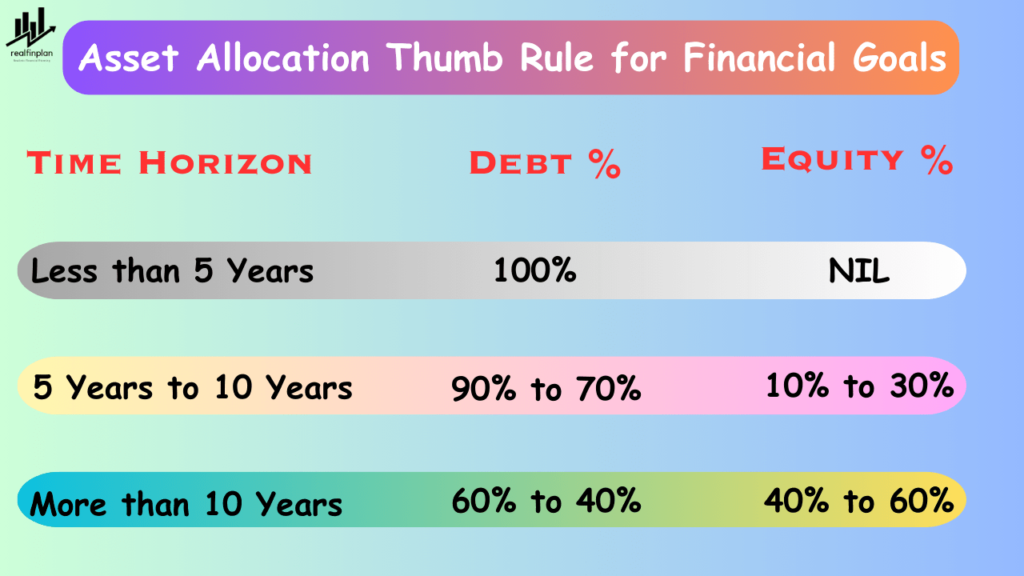

There is no secret recipe to determine the perfect asset allocation for a particular goal. But to make things easier you can follow a thumb rule.

Following the right asset allocation + Rebalancing your portfolio when the shift hits your threshold limit + Step-wise equity allocation reduction as the goal progresses toward its deadline – These 3 things are more than enough to enjoy a comparatively smoother financial journey to achieve your goals.

- We have already discussed previously that in our article and I will request the readers to clear the concept in detail: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Mitigate Sequence Of Returns Risk

2. Review and Rebalance your Portfolio Regularly

As the goal progresses and market conditions change, asset allocation can shift from your original plan. Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy and your plan.

- When there is a significant market swing (upward or downward), sell some winners and buy more of the underperforming assets to maintain your desired asset allocation.

There are two types of rebalancing:

Regular yearly rebalancing:

Theoretically, you should review and rebalance your portfolio at least once a year. If the corpus is too high you may need to review twice a year.

Let’s say, you start your journey with a 60:40 ratio (Equity : Debt). Now, after one year it becomes 62:38 or 58:42.

- You need to rebalance your portfolio to your desired asset allocation of 60:40.

- You will do this each year when you review your portfolio.

Threshold Rebalancing:

But when it comes to Rebalancing, regular yearly Rebalancing can be hectic for many people. So let’s not make it complicated. To keep things in low maintenance mode, you can set a threshold limit for your re-balancing.

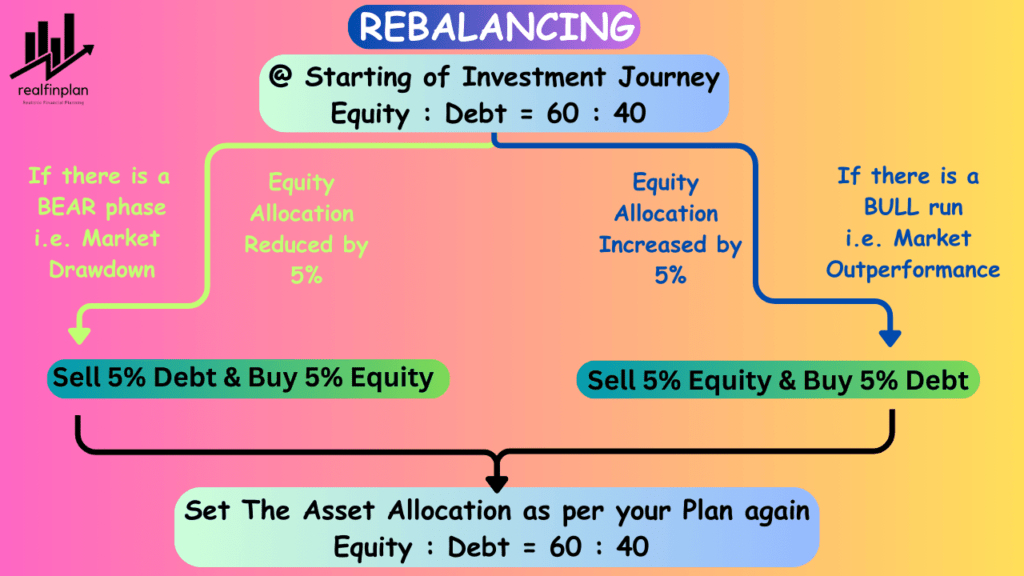

Let’s say, you start your journey with a 60:40 ratio (Equity : Debt). You will rebalance your portfolio back to 60:40 only if the equity allocation deviates by, say 4% or 5%.

- If, after one year it becomes 62:38 or 58:42. You do anything.

- Keep it as it is. If it becomes 54:46, you rebalance it to 60:40.

- But, please keep in mind that there will be tax implications and exit loads while rebalancing. That’s why threshold rebalancing is better as this typically occurs once in 2-4 years.

- Also, the threshold limit should be small. Anything more than 5% can decrease your equity allocation too much. That can also affect compounding.

If you will ask me I will say that my threshold limit is 5%. How does that work? Let’s take an example.

Suppose, you start your investment journey with an asset allocation of equity: fixed income = 60 : 40

Now, if there is a bear phase in the market and your equity allocation is reduced to say 55%, you can sell 5% of your debt component and buy 5% of equity. So that, your asset allocation remains the same.

Similarly, if there is a bull run in the market and your equity allocation is increased to 65%, you can sell 5% of your equity component and buy 5% of fixed income.

- You may have heard that you should book some profit when there is a bull run and you should invest more in equity when there is a bear phase in the market. If you adopt an asset allocation strategy, you won’t have to scratch your head for that.

- If your asset allocation deviates significantly from your actual plan, your rebalancing process will take care of that. That’s the beauty of adopting an asset allocation strategy.

3. Have an Exit Strategy – Follow a Glide Path

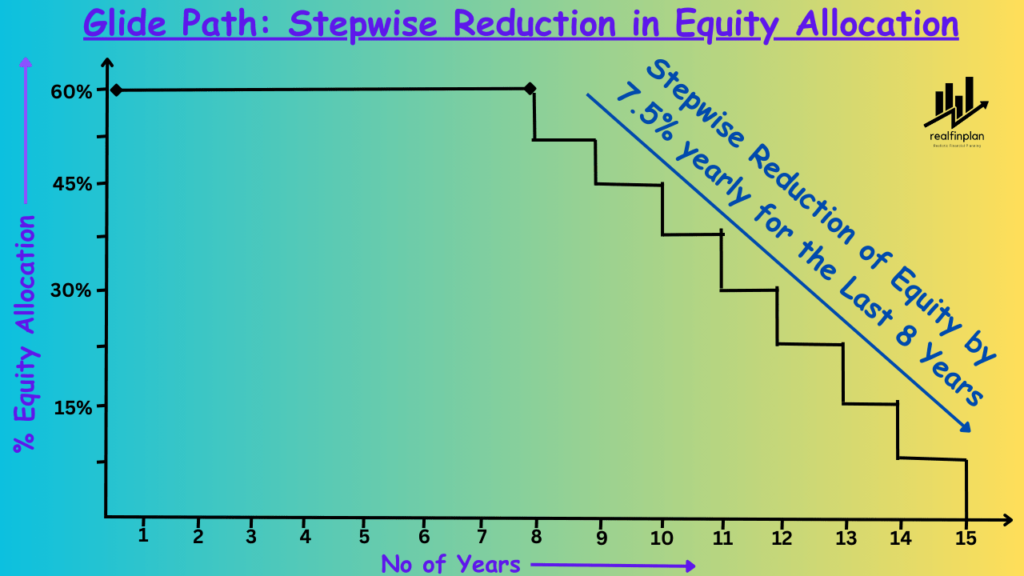

Remember, this 60:40 asset allocation is for the first year and for the first few years. You cannot hold that much equity allocation when you need the money, otherwise, it would be too risky if the market fluctuates too much.

- Always have a plan to reduce the equity allocation in a step-wise manner to de-risk your portfolio. You need to systematically increase your fixed income allocation to reduce the risk in the portfolio, as the goal nears its deadline. So that, sequence of returns risk won’t be able to affect your portfolio much.

- There is no secret recipe for determining how to follow a glide path. But we can follow a thumb rule to make things easier. I follow the following thumb rule for long-term (For goals having more than 10 years of time horizon) investment planning.

- Fix an initial asset allocation and keep it intact for 50% of the time period. During this time period, if your asset allocation shifts significantly or the change in asset allocation hits your threshold limit, don’t forget to rebalance.

- Then reduce the equity portion in a step-wise manner on a yearly basis for the rest of the time period.

For example, if your child’s education goal is about 15 years away, you can start your journey with 60% in equity and 40% in fixed income.

- After maintaining 60:40 for 7 years, you can gradually decrease the equity portion by 7.5 % each year for the last 8 years and make it zero when the goal is completed.

- Then you can spend the money freely when your child will go to college.

In this way, you can achieve your target corpus regardless of the market condition. Yes, through an asset allocation strategy, you will have to invest a little bit more than a portfolio with only equity. Why? With the reduction in equity allocation, the expected return from the overall portfolio will also reduce. But that’s what you will pay to enjoy a comparatively smoother ride to achieve your goal.

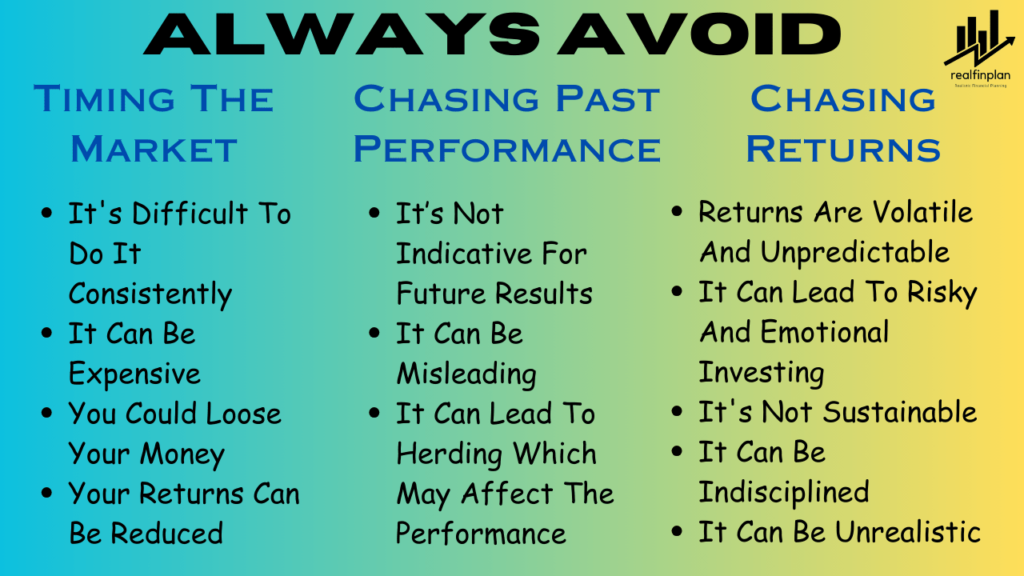

4. Don’t try to Time the Market

Trying to time the market or buying the dip is not a strategy it’s like hope or testing your luck that if the timing favors your luck, it may fetch you higher returns.

Always remember, while timing the market: the risk of getting your timing wrong and losing your money is a “guarantee” but higher returns are just a possibility.

And we should never invest to get higher returns but to achieve the target corpus for our goal. And for that, you will need an asset allocation strategy with regular re-balancing and a glide path. So, whenever you have money to invest, just invest it, but as per your asset allocation.

- For example, if you maintain an asset allocation of equity : debt = 60:40 you need to invest ₹10000 per month, invest ₹6000 in equity and ₹4000 in debt.

5. Don’t chase past performance and returns

Always remember that past performance is not a measuring tool for the future. Don’t be fooled into investing in an asset class or investment product, just because it has performed well in the past.

- Instead, focus on investing in those products or assets that you believe have the potential to perform well in the future. Past performance should never be the reason for a fund or stock to be in your portfolio.

- Understand the investment philosophy of the fund manager, if possible read the fund document or do some fundamental analysis of the stock, and analyze the track record. Now, if you have conviction about the fund management team’s thought process or a company’s business policy, choose that fund or stock.

- Don’t test your luck, keep things simple and taste the flavor of Asset Allocation Strategy to be financially stable and secure.

It’s pretty much natural to desire quick returns and high returns. Especially when you get so much noise in the name of information nowadays. But this approach can be risky and it can be counterproductive in the long run.

- Returns are volatile and unpredictable

- Chasing Returns can lead to risky and emotional investing

- It’s not sustainable

- It can be indisciplined and unrealistic.

If you really wanna chase, then chase Target Corpus in lieu of returns.

- It will help you to adopt a strategy that aligns with your investment purpose or financial goals.

- Determining the Target Corpus involves a calculated approach, considering your risk tolerance and time horizon. So, chasing Target Corpus will provide sustainable financial growth.

- It will help you to manage your risk through diversification.

- It will help you to avoid emotional decisions during the market downturn.

- It will keep your investing process realistic and disciplined.

6. Don’t let your Emotions get the best of you

It is so important to stay calm and disciplined when it comes to investing. Do not get panicked when there is a market downturn, don’t sell equity at that time. And never chase hot stocks or sectors or mutual funds. Remember these things are not strategies, they won’t give you better results.

- When you have an asset allocation strategy in place, all you need is patience with discipline and consistency, the key to financial success or stability or security anything you like to call it.

7. Use calculators

Is there any free calculator available for calculations based on asset allocation? Yes, there are many financial calculators available in the market where you can put numbers and play with them to get an idea about how to create an asset allocation-based strategy.

However, I will recommend using the financial calculators available on the SEBI Investor website. Those are developed by my guru, the pioneer of DIY Investing in India, the calculator Baba, and our beloved professor Pattu Sir.

- By clicking the link, you can get to the page of 9 calculators. You can put numbers and play with them. There are also videos of Pattu Sir, about how to use those calculators.

If you want to have some calculations based on variable asset allocation, by clicking the following link, you can directly go to the variable asset allocation calculator’s page.

- There is also a video regarding how to use the calculator so that you can use it efficiently with free of cost.

8. Use Robo Advisor

You can also take advantage of automatic investment platforms and Robo Advisors. These are of low cost and charge lower fees than traditional financial advisors. The services can also simplify your investment process by creating and managing a diversified portfolio based on your goals and risk tolerance.

- I use the Robo-Advisory Template made by Pattu Sir’s Freefincal for my investment planning. I personally find it an excellent choice for those looking for a low-cost financial planning solution. This automatically takes care of the Asset Allocation Strategy with Regular Rebalancing and a Glide Path

9. Seek Professional Advice if needed

Investment planning doesn’t mean you have to do it alone. While some individuals prefer the do-it-yourself approach, others may benefit from Professional assistance.

If you find investment planning and reviewing too much, you can always consider consulting a financial advisor. But please don’t go for a commission-based financial advisory model or Mutual Fund Distributors (MFDs). That commission is never good for you, it can erode your hard-earned money on a regular basis. This is only good for the financial advisor.

It’s best to use a Fee-Only Certified Financial Planner (CFPs). By clicking on the link, you can get the lists of fee-only financial advisors in our country.

- They work on the commission-free, fee-only model. So that you can have more of your hard-earned money, they charge reasonable fees and provide valuable guidance.

- Their sole purpose is to financially educate you. So that, you can be capable of making informed investment decisions by yourself.