Welcome to realfinplan! In this article, we will try to use a simple free “TROP Vs Pure Term Insurance Calculator” to determine.

We have already discussed that due to high cost, inflation impact, and mixing insurance and investment, Term Insurance With Return Of Premium (TROP) can be a complete waste of money. Please go through the following article to understand the whole concept:

Today, we will provide a calculator where you can play with numbers to get an idea of how bad the TROP can be.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

- If you want to become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- To challenge this Sequence of Returns Risk and counter its effects, we need to adopt a proper strategy. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

******************

Table of Contents

How to use the calculator? An Example

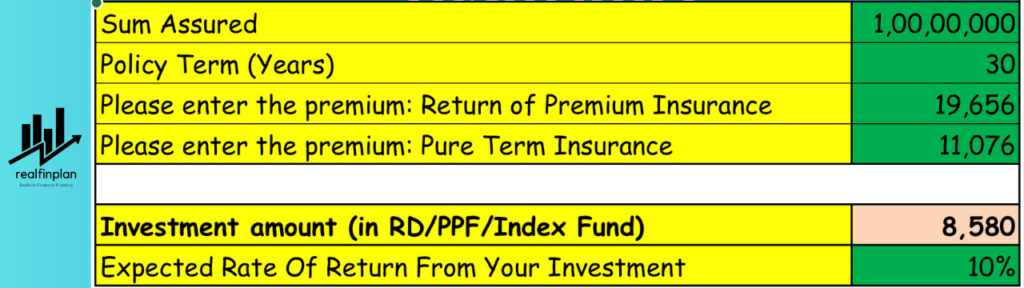

To compare term insurance with return of premium (TROP) with pure term insurance, we have obtained insurance quotes from the policy bazaar. The quotes are for a 30-year-old salaried male, non-smoker, with a regular premium payment plan for 1CR coverage, until the age of 60.

- For the Pure term insurance plan, the premium is ₹11,076/year.

- For TROP, the premium is ₹19,656/year from the same insurance company.

- The difference in the premium is ₹8,580/year

In our calculation, we will compare 3 situations here:

- Buying TROP for ₹19,656

- Buying Pure Term Insurance for ₹11,076 and investing the difference amount of ₹8,580 in PPF (assumed post-tax return = 6%)

- Buying Pure Term Insurance for ₹11,076 and investing the difference amount of ₹8,580 in a Nifty 50 index fund (assumed post-tax return = 10%)

Basically, you will have to put 5 things in the Excel sheet (provided in this article) to get a clear picture of the Survival Benefits and Death Benefits you can get through both options (TROP & Pure term Insurance).

- Sum assured

- Policy term (Years)

- Premium of TROP

- The premium of pure-term insurance

- Expected rate of return from your investment (in FD/RD/PPF/ Index funds) – Ex: 5% for FD/RD, 6% for PPF, 10% for Equity Mutual funds

- You can see the photo below to get an idea.

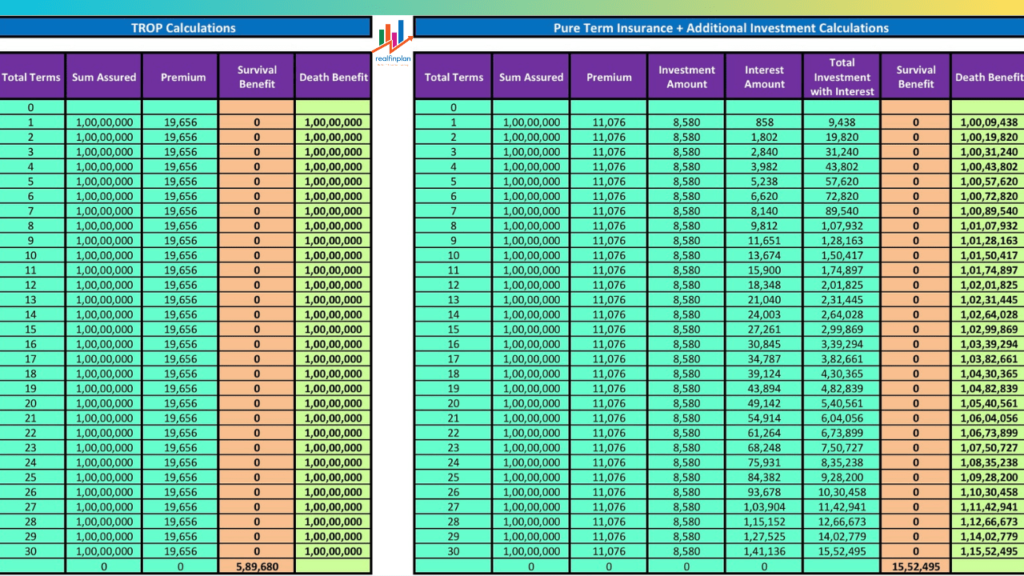

Once you enter all the above details in the calculator, you will get the TROP calculations on the left-hand side, and the pure-term insurance along with the additional investment calculations on the right-hand side.

You will also able to know what is the survival and death benefits for both TROP and pure-term insurance options. The survival benefits are highlighted in light orange color. The death benefits are highlighted in light green color.

Now, if you live until 60

In the case of TROP, the return amount is ₹5 Lakhs. Why not ₹5,89,680?

- Because 18% GST on the premiums is not returned as taxes are paid to the government.

In the case of pure-term insurance + PPF option, the PPF corpus grows to ₹7.19 Lakhs

In the case of pure-term insurance + Nifty 50 Index Fund option, the Nifty 50 Index Fund corpus grows to ₹15.5 Lakhs. The image of this calculation is shown below.

In all the above 3 cases, the death benefits are the same as ₹1CR. So, our suggestion will be to go ahead and buy a pure term insurance policy with a premium of ₹11,076/year and invest the difference of premium of ₹8,580 in a pure investment product like FD, RD, PPF, Index funds, etc.

Download TROP Vs Pure Term Insurance Calculator

You can use various online calculators to compare pure term insurance and term insurance with the return of premium. You can download the Excel Calculator below and play with some numbers and get an idea about how much you can lose through TROP:

Conclusion

If you ask for my honest opinion, TROP plans are not a great investment avenue. On paper, the insurance companies refund your premiums which can look good. But actually, you don’t get any returns. It’s a complete waste of money. The above illustration is a classic example of a financial disaster done by mixing insurance and investment.

In reality, you need to get out of the “returns” and “money back” mindset. You need to understand the real purpose of insurance. The thing is financial planning has two main components. Insurance and investment.

- Insurance is for minimizing the risk and Investments are for our future needs and wants.

It is recommended that you consider investing in a pure-term insurance plan. And use the additional money (you would pay for a TROP plan), to invest in pure investment products like FD, PPF, mutual funds, etc. By opting for a pure-term life insurance plan and separate investment products, you can get potentially higher returns and more comprehensive insurance coverage.

Check out our “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 4: 7 Key Reasons To Avoid Insurance Plans For Investment Purposes

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023

Usually I do not read article on blogs, however I would like to say that this write-up very compelled me to take a look at and do it! Your writing style has been amazed me. Thank you, very nice article.