Welcome to realfinplan! This article will try to understand “What are Arbitrage Funds, how fund managers use arbitrage opportunities, and all its important aspects”. A few days ago, I was showing my portfolio to one of my friends. I use this kind of Mutual fund for my goal-based investing, my child’s education portfolio, and short-term goals.

As I hold arbitrage funds in my portfolio, he was curious about this mutual fund category and how and why to use it. So, let’s find out.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- We need to adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

*********************

Table of Contents

1. What are arbitrage funds?

The arbitrage fund category has seen a lot of investor interest in the last few years, especially after the forgettable 2020 market crash due to the coronavirus outbreak. The inflow of investment in this category pushed up the assets under management (AUM) for the arbitrage fund category over the 1 lakh crore mark.

But, having said this it would not be incorrect to assume that most investors do not understand this category enough. So in this article, we will try to understand how they work, the risks involved, the return potential, and when and how to use them. So let’s begin.

What is Arbitrage?

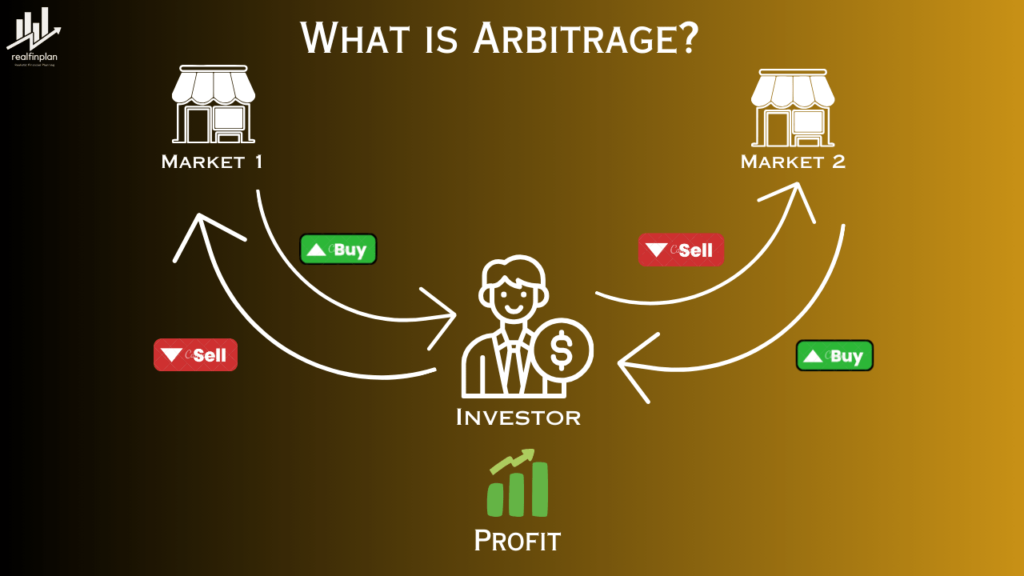

Arbitrage opportunities are based on the principle that a product is available at two different prices in two different markets. You buy and sell the same product in different markets for a profit. That’s the essential idea of arbitrage opportunities.

Let’s say you are a grocery shopkeeper and you sell a packet of cookies for MRP of ₹45 to your customers. But to make some profit, you must be able to get this packet of cookies @ ₹40 from the wholesaler.

So, the packet of cookies is available @ ₹45 in the “retail market” and it’s also available @ ₹40 in the “wholesale market”. That’s the arbitrage or profit of ₹5.

The word arbitrage refers to the practice of buying something in one place and selling it somewhere else where the price is higher. In doing so the person conducting the arbitrage, aims to make a profit from this transaction.

- More importantly, he does so without changing any part of the items itself.

- It can be a Stock, currency, commodity, or any other traditional item.

- The fund manager uses the price difference between the cash and the future market to generate returns.

The mechanism sounds complex, right? But it’s pretty much straightforward. Once you understand the cash market and future market.

Cash Market: It’s also known as the spot market. Transactions involve the immediate purchase and delivery of assets like stocks, bonds, commodities, etc.

- For instance, when you buy shares on the NSE, your account account is debited with funds, and your transaction is settled on the spot.

Futures Market: As the name suggests, it’s a market where you can buy the deals or the right to buy or sell an asset at a predetermined price on a future date.

- The price of an asset in the futures market may be higher or lower than the cash market.

- So there is a price difference.

- An arbitrage trade is to capitalize on that price difference.

Portfolio Construction of Arbitrage Funds

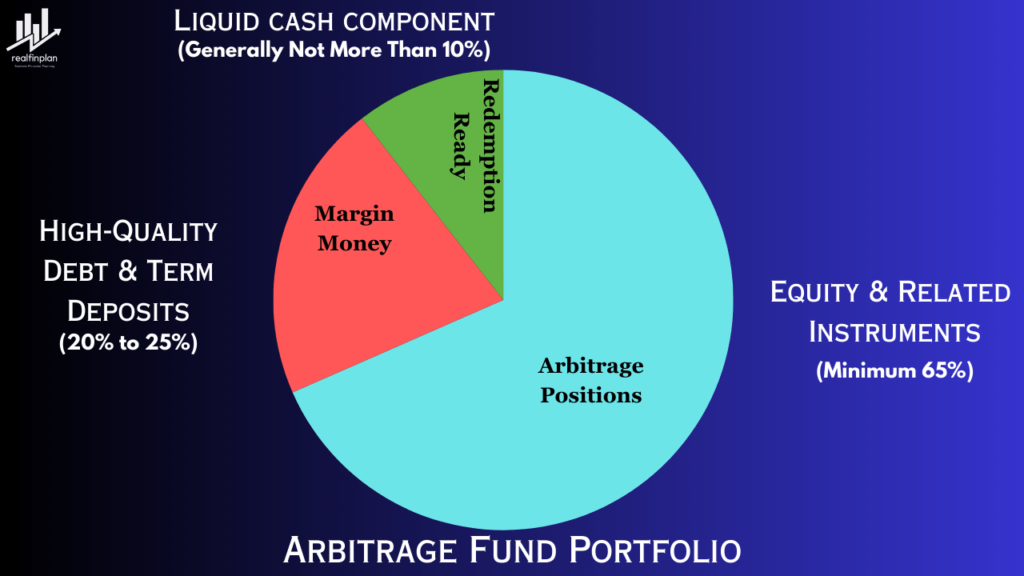

Arbitrage funds keep at least 65% of the portfolio in equity and related instruments on which they take arbitrage positions. They have a hybrid fund-like construct with a very decent portion of high-quality debt/bond and cash instruments.

This is done for two reasons.

- Firstly, money is kept as margin money which is the collateral, that is to be invested in bonds or to be kept with the Bank in the form of FDs and term deposits. This comes about 20% to 25%.

- Secondly, some money is kept in liquid form (cash and cash-equivalents) which is generally not more than 10%. This is done to take care of any redemption pressure.

So, the essence of the fund may be equity but the composition of the fund has a hybrid fund feeling to it. That’s why the SEBI classified it under the hybrid fund category rather than the equity fund.

2. How do arbitrage funds work?

Characteristics of Arbitrage Funds:

- There are simultaneous buy and sell transactions

- The same security is transacted

- The activity happens in two different markets

Cash-And-Carry Arbitrage:

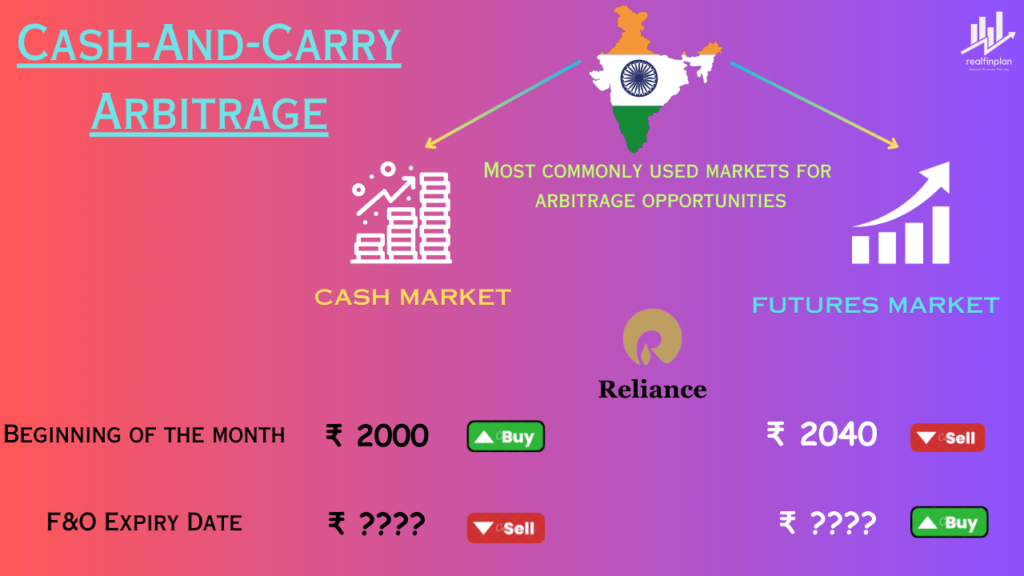

Let’s understand this with an example. India has a cash market and it also has a futures market. Typically, the futures market operates at a premium to the cash one.

For instance, the security we are dealing with is Reliance Industries. 1 share of Reliance Industries is available at ₹2000 in the cash market and ₹2040 in the futures market.

Since there needs to be a simultaneous buy and sell, we shall buy one share of reliance in the cash market at ₹2000 at the beginning of the month and simultaneously sell it in the higher-priced futures market at ₹2040.

On the last day of F&O expiry, the cash market and the futures market generally converge, i.e. become the same and that’s when these funds close the loop by reversing their positions.

- They sell in the cash market and they buy from the futures market.

This method is also called cash-and-carry arbitrage. This is among the most commonly used methods for arbitrage funds.

Now that the flow of the transactions is clear let’s extend our example over three possible scenarios

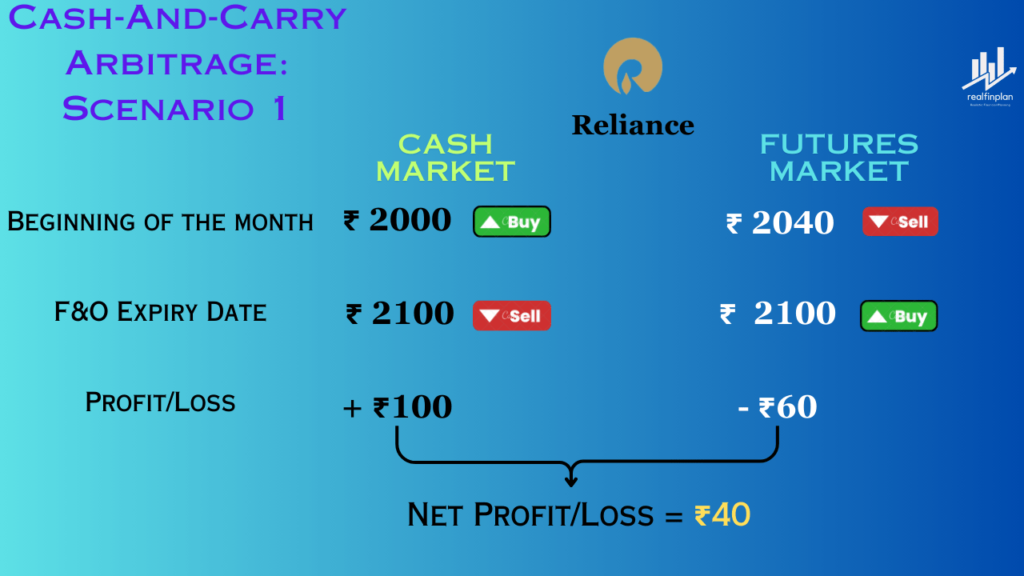

Scenario 1: The share price has gone up so say reliance goes up to ₹2100.

In that case, we have made ₹100 of profit in the cash market. However, we have lost ₹60 in the futures market giving us a net profit of ₹40.

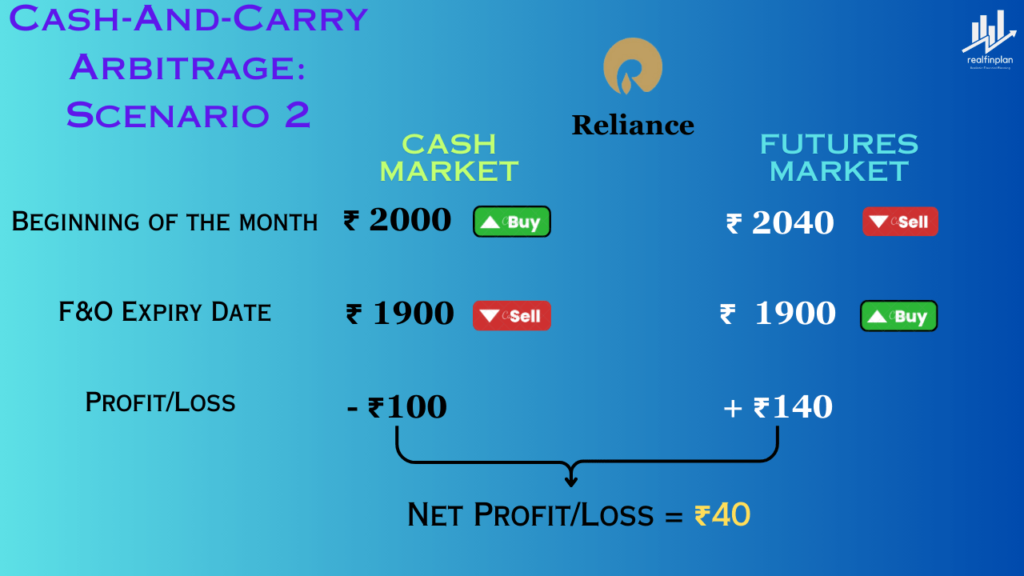

Scenario 2: Now, the price has fallen and one share of reliance is down to ₹1900.

In this case, we make a loss of ₹100 in the cash market but make a profit of ₹140 in the futures market which again gives us a net profit of ₹40.

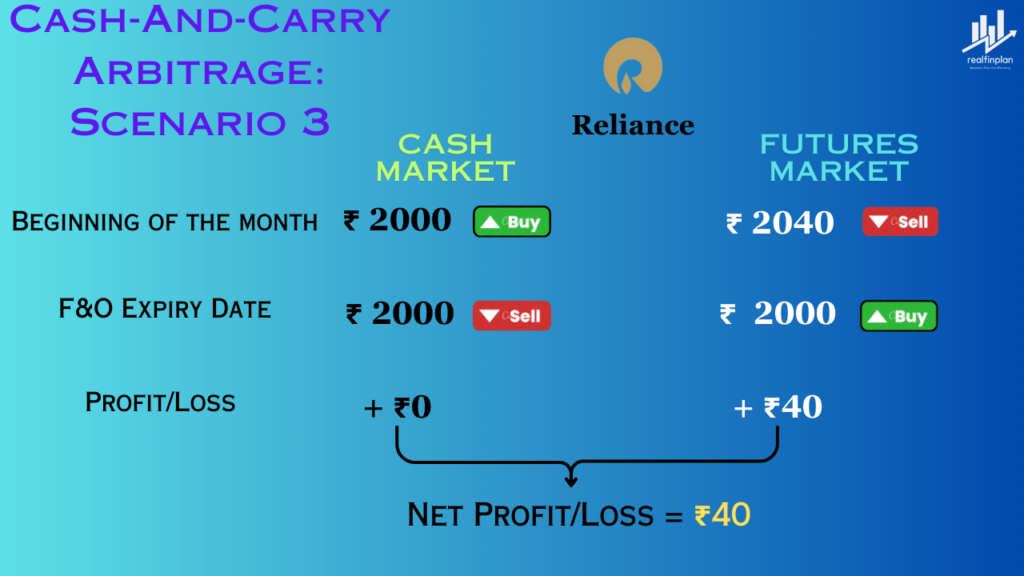

Scenario 3: Here, we assume that the share price remains the same as it was at the beginning of the month, that is at ₹2000.

In this case two we see that the price difference in the cash and futures market gives us an advantage of ₹40.

So, if we look at the arbitrage strategy, it gives us a fixed spread, which is ₹40 in our illustration. This is what the arbitrage fund houses are trying to do – they try to lock in the profits irrespective of how the price moves.

But having said this, waiting for the expiry is not the only strategy that the fund manager opts for.

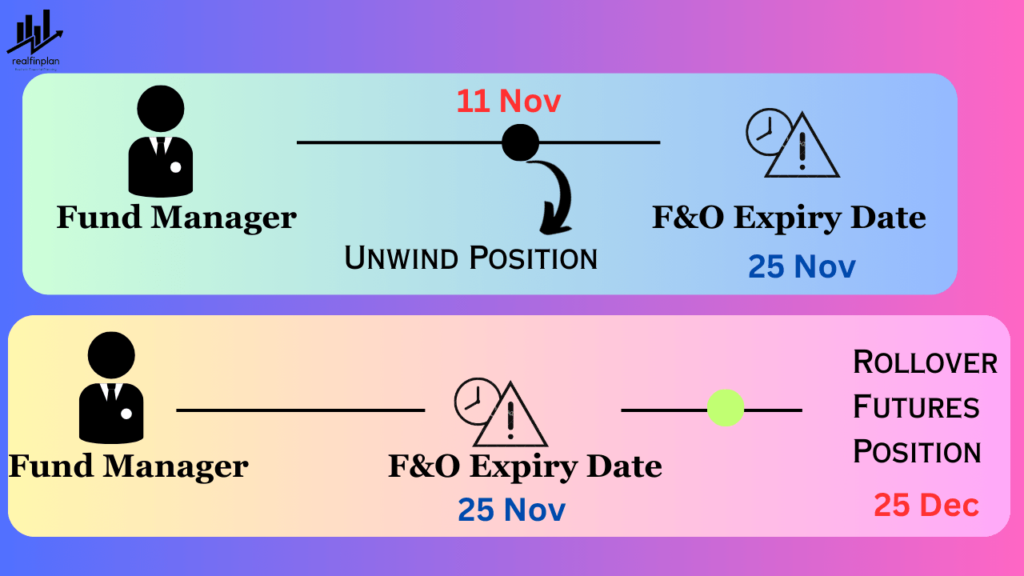

- For instance, in some cases, fund managers unwind their cash/spot and futures positions even before the expiry. If an opportunity presents itself to generate higher returns before the date of expiry, the fund manager seizes the opportunity.

- If the price differential for the subsequent month’s maturity still exists, in that case, many fund managers look to roll over the futures position to capture the available opportunity.

While the cash-and-carry approach is the most commonly used arbitrage technique. There are a few more strategies that fund houses are known to apply in different capacities.

Exchange Arbitrage:

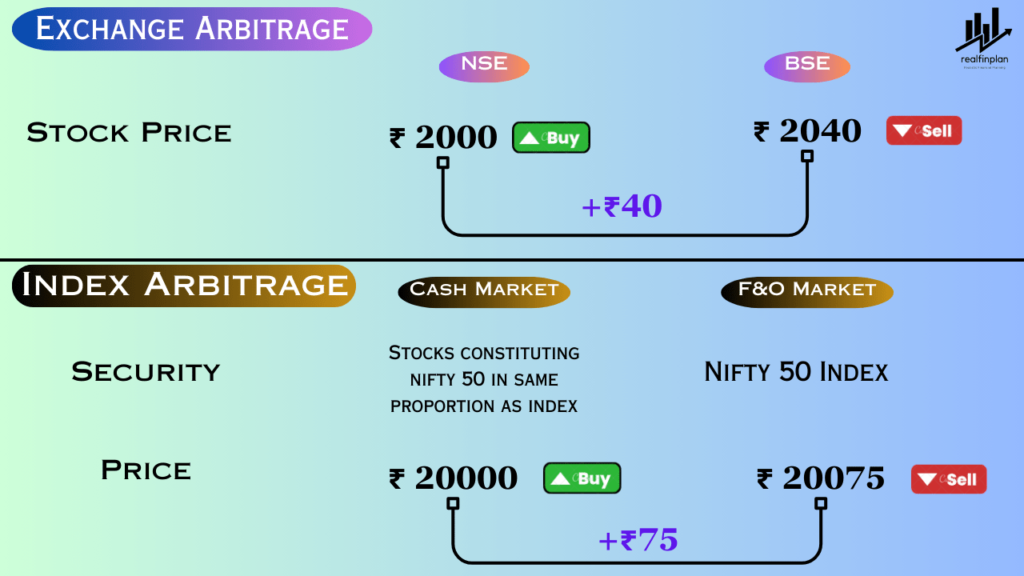

One of these alternative approaches is the exchange arbitrage which occurs when the price of a particular security is different across two stock exchanges (NSE and BSE).

When a situation like that happens, it requires buying stock at the lower price exchange and selling it on the higher price exchange to book the available profit.

Index Arbitrage:

Yet another technique is the index arbitrage. Here the fund manager looks to exploit the difference in the index value and the individual prices of its constituent stocks.

For instance, the fund manager might find that the nifty 50 index is priced at a premium in the Futures market (F&O) when compared to buying up the individual stocks at the spot or cash market. This is also a form of arbitrage as the fund management team looks for visible profits by taking very minimal risk.

3. What are the risks of investing in arbitrage funds?

One of the most interesting factors of an arbitrage fund is that it’s a low-risk investment option. If you think from the fund manager’s perspective, he doesn’t have to spend hours analyzing a company fundamentally to make an investment decision.

- He tries to identify the price difference in stocks or securities between the cash market and the futures market.

- He just needs to seize the opportunity to capitalize on the price difference.

Reduced Arbitrage Opportunities:

You can see, that the performance of an Arbitrage fund depends on the Arbitrage opportunities available in the market. The volatility works in favor of the arbitrage funds. The more volatility (or price difference) in the market, the more arbitrage opportunities will be available.

But, when the markets are trading flat, the arbitrage opportunities will reduce. Also as the popularity of arbitrage funds grows, competition increases, it leads to fewer and smaller opportunities. In such scenarios, arbitrage funds may generate below-average returns.

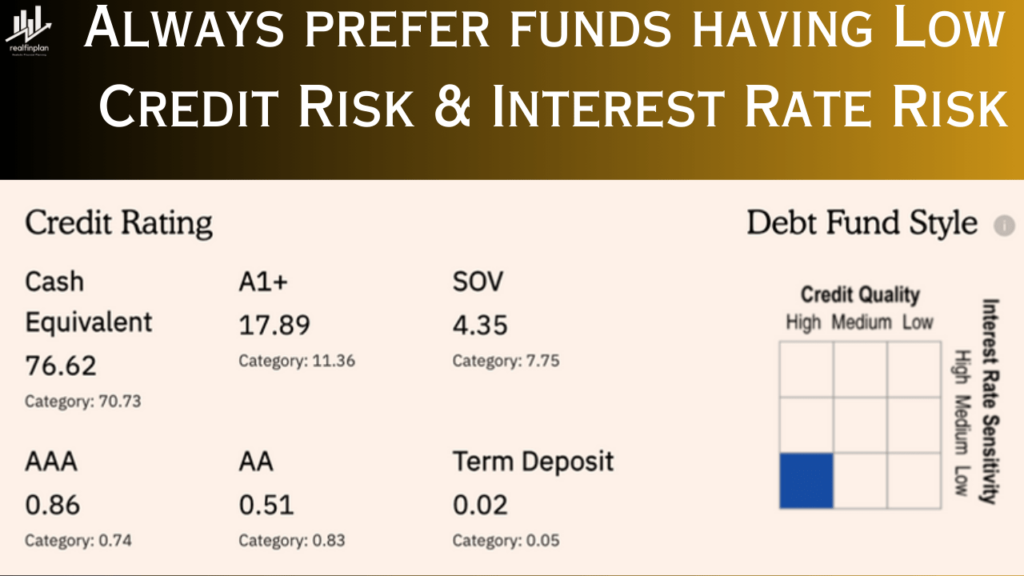

Credit Risk:

Arbitrage funds are hybrid funds and invest a small portion of their assets in debt. If the purchased bonds are not of good quality and default, it can negatively impact the NAV of the fund. So, there are always credit risks with arbitrage funds.

Interest Rate Risk:

As they hold some debt securities, changes in interest rates could impact the value of these securities, leading to minor fluctuations in the fund’s returns.

- If interest rates rise, the value of existing bonds may fall, leading to losses for the fund.

Fund Manager risk:

Arbitrage strategies consist of some complex algorithms. So there should be efficient execution systems to grab the opportunities and get an advantage from that.

So the fund’s performance depends on the skills of the fund manager. If the manager is unable to identify and exploit Arbitrage opportunities effectively, it could lead to losses.

4. What about arbitrage funds returns?

Arbitrage funds in India offer relatively stable and low-risk returns compared to other types of mutual funds. Historically, they have delivered consistent returns in the range of 5% to 7% annually. That too with a lower volatility than the broader market. Some funds may exceed 8% in certain years (but that will not happen always).

Average Returns:

- Past 1 year: Around 6%-7%

- Past 3 years: Around 5%-7%

- Past 5 years: Around 5%-7%

5. What about arbitrage funds taxation?

Arbitrage funds are one of those hybrid mutual funds, which are taxed at par with equity mutual funds. Why? Because arbitrage funds in India use over 65% of their assets for equity arbitrage trades. Here is how they are taxed:

| Holding Period | Gain Type | Tax Rate |

|---|---|---|

| Less than 12 months | Short-term capital gains (STCG) | The gains are taxed at 15% plus applicable surcharge and cess. |

| More than 12 months | Long-term capital gains (LTCG) | The gains are taxed at 10% (for gains exceeding Rs. 1 Lakh) |

6. When To Use Arbitrage Funds?

Parking short-term funds:

Suppose you have surplus funds for the short-term (6 months to 12 months, or, preferably more than 12 months) and are looking for better returns than traditional savings accounts. Then arbitrage funds can be a good choice.

As these come with lower risk and stable returns like liquid funds, they can be ideal for short-term investments for those who don’t mind a little bit of volatility in their portfolio.

Invest for short-term goals:

Due to the low-risk and stable returns-giving nature, these funds can be good options to achieve short-term goals (less than 5 years).

Any investor can create a short-term portfolio with arbitrage funds besides any other short-term investment instruments (like FD, RD, Money Market funds, and Liquid Funds).

Invest for long-term goals:

Due to comparatively lower returns, many can ignore this kind of funds for long-term goals. However, they can be used wisely to optimize overall portfolio returns while managing risk. But how?

If you have a long-term goal like child education planning or retirement planning, you should always invest with an Asset Allocation Strategy with Regular Rebalancing and a Glide Path. You can use an arbitrage fund as a debt component of your portfolio.

- If you face a significant market downturn and your portfolio shifts from your original asset allocation with a % increase in the debt component, you can easily rebalance your portfolio by moving the required amount from that arbitrage fund to equity funds.

- As the LTCG from arbitrage funds can be tax-free if held for more than 12 months, you can enjoy tax-free rebalancing and portfolio risk reduction at the same time.

7. How to use Arbitrage Funds efficiently?

Always Remember:

- Arbitrage funds are not risk-free, although they carry minimal risk compared to other equity funds and some debt funds.

- You should not expect higher returns from an arbitrage fund. The return potential potential is similar to that of a liquid fund.

- As an arbitrage fund holds a certain amount of bonds, there will always be credit risks and interest rate risks.

- Arbitrage opportunities may not be always present. The spread between the cast and futures market affects the overall return of an arbitrage fund.

Choose the Right Fund:

Research different arbitrage funds and compare their performance, expense ratios, and exit loads. Opt for funds with a consistent track record and a low expense ratio.

Once you select your fund, check the bond portfolio of that arbitrage fund. If the credit rating of the bond is high and the interest rate risk is minimal, you can go ahead with that fund.

You can check the value research debt matrix of the SBI Arbitrage Fund for this purpose. I have this fund in my portfolio. See the debt fund style chart. The bond portfolio has high credit quality with low-interest rate sensitivity. If you’ve chosen a fund that matches the following style, you can go ahead.

Try to enjoy tax-free gain:

As arbitrage funds are taxed similarly to equity funds, if you hold your units for more than 12 months, the gain will fall under long-term capital gain (LTCG).

- And up to 1 lakh, the LTCG is free. So, try to utilize the one lakh cap and enjoy tax-free returns from arbitrage funds.

Diversify your portfolio:

Don’t rely solely on arbitrage funds. Whether you investing for short-term goals or long-term goals, always diversify your portfolio with other asset classes (like debt funds, and equity funds) to manage risk and optimize overall returns.

Don’t forget to rebalance:

If you are into goal-based investing with an Asset Allocation Strategy with Regular Rebalancing and a Glide Path, don’t forget to rebalance your portfolio when you see the opportunity. If the equity market is down significantly, shift your money from the arbitrage fund to equity funds with tax-free gain.

Conclusion

Arbitrage funds are low-risk, tax efficient, stable returns giving, and high on liquidity investment products. These characteristics make it unique and interesting. Those investors who love some adventure can try to include this category in their portfolio. If we summarize the above said things, choose arbitrage funds if:

- You can stomach the short-term volatility associated with arbitrage funds (i.e. daily price up-down or fluctuation in NAV due to market risk).

- You are in a high tax bracket (20% or 30%) and are seeking tax-free gain (or gain with lower tax implications) and are happy with a similar to that of liquid fund returns.

- You are investing for the short term (more than three months), not for immediate needs in the future (like emergency funds).

Frequently Asked Questions (FAQs):

What makes arbitrage funds unique?

Arbitrage funds are low-risk, tax efficient, stable returns giving, and high on liquidity investment products. They stand out due to their strategy of exploiting price differences for consistent returns, offering investors a distinctive approach to wealth creation.

Can beginners invest in arbitrage funds?

Absolutely. Arbitrage funds can be suitable for beginners seeking a balanced and low-risk addition to their investment portfolio.

Are arbitrage funds completely risk-free?

While they aim for risk-free returns, market dynamics, and unforeseen events can introduce an element of risk. Also, they hold some amounts of bonds in their portfolio. So, they come with credit risk and interest rate risk.

How do arbitrage funds perform in volatile markets?

Arbitrage funds often perform well in volatile markets, providing a level of stability and consistent returns that can be attractive to investors during market fluctuations.

Is liquidity a significant concern with arbitrage funds?

Yes, liquidity is a consideration, particularly in less liquid markets. It’s essential to assess the fund’s ability to execute transactions swiftly. You can go with consistent performers and with a sizable AUM to avoid liquidity risk to a certain extent.

Can arbitrage funds be part of a diversified investment portfolio?

Certainly. The versatility of arbitrage funds in handling various asset classes makes them an excellent addition to a diversified investment portfolio.

How often do arbitrage opportunities arise?

Opportunities vary, but skilled fund managers are good at identifying them regularly, making arbitrage funds a dynamic investment choice.