Welcome to realfinplan! In this article, we will try to understand about what are asset classes (Equity, Debt, Gold & Real Estate) and what are their purposes for investment planning.

We have already discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, the momentum in investing. If you are critically disciplined, through goal based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal not a Target Return. And to achieve that target Corpus, you need to have a “need” based Simple And Cost Effective Investment Planning.

If you want to become financially stable and then wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat the Inflation. But before we invest in it, we need to consider the risk involved in it : Sequence of Returns Risk.

- This Sequence of Returns Risk can damage your portfolio and your overall financial well being at any point of your investment journey. To challenge this and to counter it’s effects, we need to adopt a proper strategy.

Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

- We have already discussed that in our previous article and I will request the readers to finish that article first and then come here. So, that you can understand things easily: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Mitigate Sequence Of Returns Risk

Today, we will discuss about what are asset classes and which ones we need to embrace the best strategy for investment planning, Asset Allocation Strategy. So, let’s start.

***********

In realfinplan, we try to provide realistic, authentic and free educational contents, so that individuals can control their own finance by themselves. I will request the readers

- First to Cover Your Basics To Secure Yourself Financially, then to understand Basics of Saving and Investing.

- Second to Identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

Always Have A Plan Before Jumping Onto Strategy Or Products

When it comes to investing, always have a plan before jumping onto strategy (Asset Allocation Strategy). Please understand the ‘why’, ‘when’, and ‘how’ of investing first.

- Why do you want to invest? Identify your goals

- When do you need the money? Determine the time horizon and risk tolerance

- How much money do you need? Set a Target Corpus considering Inflation into account

Now, that you have cleared the concept of ‘why’, ‘when’, and ‘how’, you need to know where to invest? Choosing the right asset classes you want to invest. Let’s dive into that.

What Are Asset Classes?

Different asset classes are like the different ingredients for your financial recipe. Like different ingredients for a dish, each asset class has its unique characteristics. Think of them as different flavors that you can combine to create your perfect investment dish.

Asset classes are groups of investments that share similar characteristics. They also behave in similar ways when it comes to the risks associated and potential returns.

Understanding the different asset classes and why do they matter, is so crucial for diversification, risk management and enhancing optimal potential gains.

Why Different Asset Classes Matter?

Risk Management

Using different asset classes allow you to spread your investment across different categories. It will reduce the impact of a poor performing asset on your overall portfolio.

Diversification

Different asset classes reacts differently to market conditions. Diversifying your investments across different asset classes can lead to more stable returns.

Return Potential

Each asset class has its unique risk and return profile. If you include different asset classes in your portfolio you can maximize your returns while managing the risk.

Long Term Goals

Using different asset classes can help you align your investments with your financial goals. Whether it’s saving for retirement or funding your child’s education. You can tailor your strategy by using various asset classes as per the time horizon and your risk tolerance.

Liquidity Management

Asset classes vary in terms of liquidity. So understanding the liquidity of various investment products can help you balance your needs for access to the funds. This will enable you to achieve your financial goals more comfortably.

For example, PPF (Public Provident Fund) account has a locking period of 15 years. Whereas SSY (Sukanya Samridhi Yojana) account has a locking period of 21 years.

- So it’s always better to use a new PPF account for child education purpose, as your PPF account can be fully liquid when your child enters college (if your child education goal is at least 15 years away).

- SSY can be used as a fixed income component for the marriage of your child or your retirement portfolio.

Similarly, if you want to retire around your 50s (most of the corporate employees try to be financially independent by this age), it’s always better to use a mixed portfolio of equity mutual funds and EPF or Gilt fund rather than a NPS account. Why?

- Because NPS has a huge locking period – when the subscriber reaches 60 years of age.

- Moreover, after attaining 60 years of age, your money will not be fully liquid. You will get only 60% of the total amount and 40% of the matured value will be locked for annuity purpose.

- And if you want to use your NPS corpus before 60 years of age, 80% of your money will be blocked for annuity purpose.

- So, for them, having NPS is like creating a liquidity crunch situation unnecessarily.

Tax Efficiency

Different asset classes have different tax implications. So, a strategic allocation among different asset classes can help you to maximize your tax liabilities.

________________________________________________

Now, let’s understand the most common 4 different asset classes and their purposes for investment planning.

Equity : Your Ticket To Ownership

Direct equity or stocks represent ownership in a company. When you are buying a stock, you are buying a piece or a portion of that company. When that company progresses economically and fundamentally, the share price goes up and you get the “gains”. Sometimes companies can provide you some portion of the “profit” earned by them, in the form of dividends.

As things depend on the performance of the company and other various local or global economical factors, equity are generally considered to be one of the riskiest asset class. But they also have the potential to generate higher returns over the long term.

Examples:

Direct Equity – Stocks

Equity Mutual Funds – Index Funds, ELSS, Large Cap, Flexi Cap, Midcap, Small cap or any kind of other Equity Mutual Funds

Some Hybrid Funds – Aggressive hybrid fund, Multi Asset Allocation Fund and Dynamic Asset Allocation Fund.

- Though these are hybrid funds by definition and categorization. But these kinds of funds generally have a significant amount of equity in their portfolio (more than 50%).

- So, their risk and return potential is more or less similar to that of a normal diversified equity funds.

- That’s why we should always treat them as pure equity funds for simplicity of our investing process.

Purpose:

Equity is “needed” to BEAT the INFLATION and for Capital Appreciation. Equity can give you double digit returns if you remain invested for a long time (> 10 years). So, to beat inflation, to let the money work for you, you need equity in your portfolio.

- But due to Sequence of Returns Risk, it’s too volatile and 1-2 months’ bear phase can eat up all the earned money of you. In the goal completion year, a 30% negative return can reduce a corpus of 1CR to 70L.

- You can’t put all your money in equity. Then you are leaving your investment in luck. Your hard earned money deserves better respect than that.

- What you earn by investing in equity, you need to protect that. And that’s why you need an asset allocation strategy.

Debt or Fixed Income : The Lender’s Game

As the name suggests, this asset class is all about debt or loan. When you deposit your money in a bank, you are simply giving loan to the bank to run their business. When you buy a bond, you are lending money to the issuer of the bond. The issuer can be government, a company or any other entities. But why are you giving them loan or lending money?

Because in exchange, you get regular interest payments and the return of your principal at maturity. Debt instruments are generally considered to be less risky than equity due to the involvement of “interest”, not gain or profit. But the fixed income instruments come with lower potential returns, when we compare it with equity.

Examples:

- Cash & Cash Equivalents – Cash, Savings Account, Deposit Account (Fixed / Recurring)

- NSC, KVP

- PPF, EPF, NPS

- Liquid Fund

- Money Market Fund

- Ultra Short Term Fund

- Corporate Bond Fund

- Gilt Fund

Some Hybrid Funds – Conservative hybrid fund, Arbitrage Fund etc.

- Though these are hybrid funds by definition and categorization. But these kinds of funds generally have a significant amount of debt or similar kind of instruments in their portfolio (at least 65%).

- So, their risk and return potential is more or less similar to that of a debt fund.

- That’s why we should always treat them as pure debt funds for simplicity of our investing process.

Purpose:

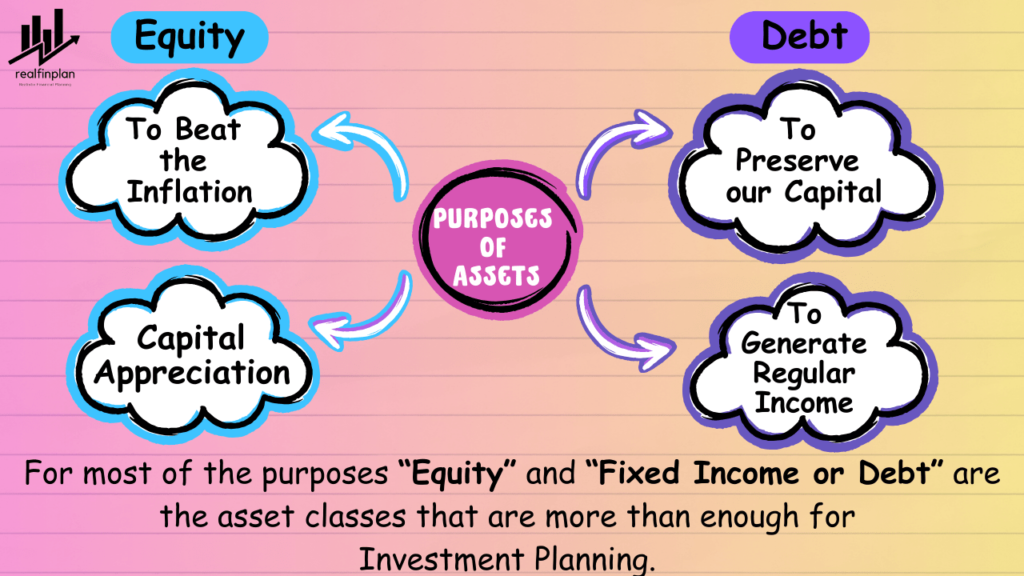

Debt is “needed” for PRESERVATION of CAPITAL and also for Generating Regular Income in withdrawal phase of retirement. For most of the purposes, equity and debt are more than enough for asset allocation. So we will consider that for asset allocation.

- Remember, the upside performance of your portfolio is not in your hand. It will be taken care of by equity itself. But, you need to manage the drawdown of your portfolio due to risks related to equity – Sequence of Returns Risk aka Timing Luck by providing debt in counter.

- So, you should use the debt component to protect your wealth. It will give downside protection to your portfolio volatility.

Gold : Betting On Commodity

Example

- Physical Gold

- Gold Mutual fund

- SGB – Sovereign Gold Bond

Purpose:

Gold can be used for hedging (a way of protecting oneself against financial loss). But, for Goal Based Investment Planning, it’s “not needed”. By following a good asset allocation strategy with “equity” and “debt”, we can easily protect and grow our wealth.

- The idea is to keep things simple. The more the asset classes, the more it will be difficult to manage your corpus.

- There is a fantastic research based article in freefincal by our beloved professor Pattu Sir on Gold has Equity like risk and returns like debt: Gold vs Equity (Sensex) 40 year return and risk comparison. So, it’s not needed for goal based investment planning. You can invest in less risky instruments (debt) and get that kind of return.

- You can buy Sovereign Gold Bond (SGB), Gold Coin etc for the purpose of buying gold. That will serve the purpose of hedging. From an investment perspective, it’s not needed.

Real Estate : Tangible Properties

Example

- Plot

- Home/flat

Purpose:

For residential purpose and wealth creation purpose or generating a passive income, it’s good to invest in real estate. But it’s not needed for goal based investment planning. You can read another article by Pattu Sir for this purpose: Five reasons why I will never invest in real estate

- It’s a illiquid asset. So, it can be very difficult to sell your real estate investment quickly.

- To sell a flat to fund your child’s education expenses is much more difficult than handling mutual fund units.

Equity & Debt : Why These 2 Asset Classes Are Enough For Your Investment Planning?

There are various asset classes like equity, debt, gold, real estate etc. We have talked about them earlier. You can use them to diversify your investment. But remember,

- Over diversification can hamper your financial well being.

- It can also reduce your overall returns of your portfolio.

- The more number of asset classes you use to diversify your investments, the more it will increase complexity in your portfolio.

- It will result in difficulties to manage it and a high maintenance portfolio.

And investing should be all about keeping things simple, straight forward and low maintenance. Otherwise, your other aspects of life may get affected.

- Please understand : Why Investment Planning Should Not Be Complicated And High Cost?

Understand: What should be the primary purposes for your investing?

- To achieve higher returns over the long term so that you can outpace the inflation. Equity is enough for this.

- To become wealthy through capital appreciation. Equity can serve this purpose.

- To preserve your capital in the event of a market downtown. Fixed income is enough for this.

- To generate a steady income stream during the withdrawal phase of retirement. A robust fixed income portfolio can serve this purpose.

- To strike a balance between risk and returns by creating a balanced portfolio. A good mix of equity and fixed income can easily fulfill this purpose.

The Solution

We have already discussed about the above mentioned points while understanding the purposes of the asset classes. So, for goal based investing purpose equity and fixed income instruments are more than enough to fulfill the purposes of your investing.

Yes, you always can use Gold or Real Estate as asset classes beside Equity and Debt. But, you don’t “need” them for Goal Based Investment Planning.

- The simplest way to diversify your portfolio is to use two asset classes. One is “Equity” and other is “Debt or Fixed Income”.

- These are more than enough to reduce the overall risks of your investment portfolio, to get optimal returns, to achieve financial goals and to make your portfolio low maintenance to manage. So we will consider only these two asset classes for asset allocation strategy.

To know more about Asset Allocation, please dive into our other articles:

- About the Essence of Asset Allocation in our financial journey: What Is Asset Allocation? 3 Key Reasons Why You Should Adapt This Strategy For Investment Planning

- Mistakes to avoid for Asset Allocation: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Frequently Asked Questions (FAQs):

What is the safest asset class for investment?

The safest asset class is cash and cash equivalents. They are highly liquid and have low risk. It can be a reliable choice for creating an emergency fund and preserving capital.

What is the safest investment product in our country?

PPF is the safest investment product in India. It has sovereign guarantee, that means backed by government. Even court can’t touch your PPF investment if there is legal proceedings.

Are there any tax benefits associated with certain asset classes?

Yes, some asset classes and investment products may offer great tax advantages. It is essential to research about different investment products and asset classes before investing. Also you can consult with a tax professional or financial advisor to understand how specific asset classes can impact your tax liability.

Can I invest in multiple asset classes at once?

Yes definitely. In fact it is encouraged to diversify your investments across various asset classes. This can help you to reduce your risk and optimize your returns.

But please remember, over-diversification can reduce your overall portfolio returns and hamper your financial well being. It can also result in difficulties managing your portfolio and to maintain asset allocation as per your plan.

What’s the main difference between stocks and real estate as investment options?

Stocks represent ownership in companies, while real estate involves owning physical properties.

Stocks tend to offer liquidity and potential for higher returns. While real estate offers income through rent and property appreciation.

How do I determine the right asset allocation for my portfolio?

There is no secret recipe to determine the right asset allocation for your portfolio. It depends on the “why” and the “when” – your financial goals and the time horizon and your risk tolerance.

You can do it yourself through your own research and by following some thumb rules, or you can consider working with a financial advisor to develop a customized investment strategy for your needs.

Are there any asset classes I should avoid?

The suitability of asset classes varies from person to person. It is essential to access your own financial situation and decide which ones to avoid.

If you ask me, I will choose equity and fixed income over gold and real estate any day. Why? Just because of the simplicity, clarity and liquidity offered by equity and fixed income.

If you find this difficult then you can always consult with a financial advisor to make inform decisions.