Welcome to realfinplan! In this article, we will try to understand “what is an emergency fund”. We will also discuss why you need it, how much you need it, where to keep it, steps to build it, and all the other important aspects that revolve around an Emergency Fund.

Whenever someone asks me about something related to personal finance, I always suggest him/her – Cover the Basics first: 3 Simple Steps To Manage Financial Risks For A Secure Future. So that individuals can secure their financial future.

But, why do you need to secure yourself financially? Well, life is full of risks, needs, and wants. And most important of them are financial “risk” and “needs” (not wants, you can’t ignore the “needs” or delay them).

If you need to build a house you will need to have a strong foundation. Without a solid base, you won’t be able to protect your house.

- Similarly in personal finance, you need to cover your basics first, and manage your financial “risks”. Then only you can build the floors for your house i.e. build your wealth through Investments to meet financial “needs”.

There are a lot of financial risks associated with our lives and the most important are Emergency risk, Life risk, and Health risk. They can give us significant challenges at any point in our financial journey.

Today, we will delve deeper into Emergency Risk and find realistic ways to mitigate it. So, let’s start.

****************

In realfinplan, we try to provide realistic, authentic, unbiased, and free educational content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

What Is An Emergency Fund?

As the word “Emergency” suggests, an emergency or risk can strike us at any time. So, what is emergency risk? Let’s take some scenarios into account.

- If you lose your job, how will you survive till you get a new job in this competitive world? How will you pay for your EMI till everything gets sorted?

- If you don’t have a regular income like a salaried person and your income stops or gets reduced due to any economic crises, what will you do?

- How will you manage everything if your business doesn’t do good for some time?

- If anything happens to any family member, a medical crisis occurs and you need to move here and there for treatment, how will you manage the expenses?

- Due to some road accident, you get injured and your bike or car is also damaged. How will you deal with the situation financially?

- If you have a high medical risk patient in your family (like diabetes, high BP, etc), how will you react when there is a crunch situation?

- If a natural disaster, like a flood or cyclone, strikes you, how will you survive till everything gets normal again?

- If you face sudden theft or repair in your house, how will you manage the situation?

- Suddenly, you get a call from your close family member who is sick. Now, you will have to travel on such short notice and you may have to help him or her financially too. How will you manage the expenses?

- If any other financial situation occurs without any plan, how will you manage that?

This is why you need to build an emergency fund. An emergency fund is the savings that is set aside for these kind of unexpected emergencies. Always keep in mind, that it should be fully liquid (like cash and cash equivalents, savings account, FD, etc) as it will be used in case of emergency.

If you have an adequate emergency fund, you won’t have to put your hands on long-term savings or go for “Debt or Loan” during difficult times. Your aim should be to save adequately for your emergency fund to ensure peace of mind and financial stability. Basically, an emergency fund is a part of everything you need to do before investing in financial goals.

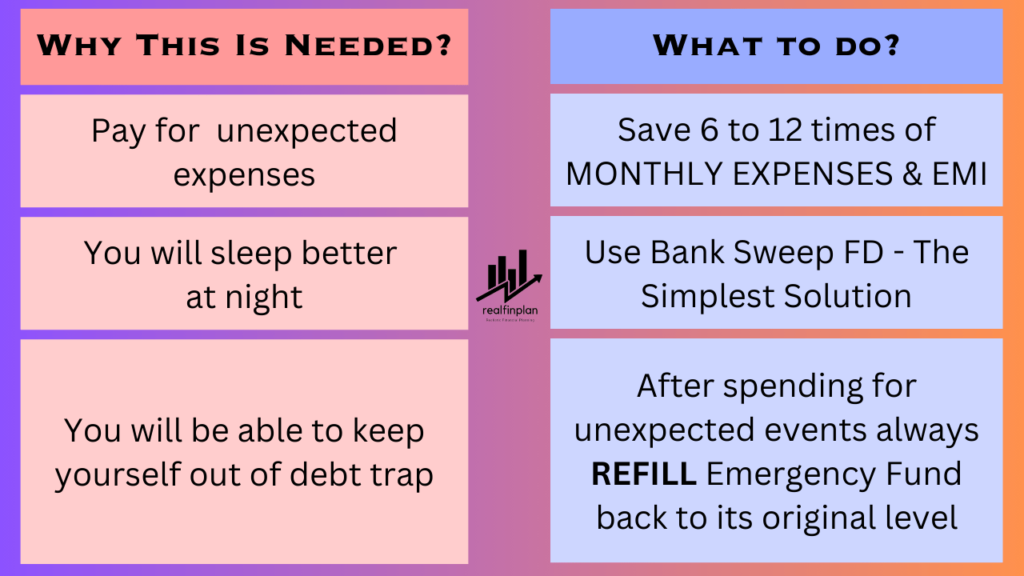

Why You Need An Emergency Fund

Financial Security

If you have an adequate emergency fund, it will provide you with a safety net in case of life’s unexpected events. It prevents you from relying on high-interest loans or credit cards. It saves you from financial stress and provides security.

peace of mind

Knowing that you have a financial cushion in place allows you to sleep better at night. You will be ready to face any kind of financial crisis. You can easily bounce back from a crunch situation without worrying about money.

Protection against debt

If you don’t have an emergency fund, unexpected life events, and expenses can lead you to debt accumulation or to use a credit card at high interest rates.

This can lead to a cycle of debt or loans that’s hard to break free from. An emergency fund acts as a protective shield, keeping you out of the debt trap.

opportunities for investment

If you have an emergency fund in place, you can confidently explore different investment opportunities. It can grow your wealth over time, knowing that your basic needs are covered.

How To Approach For Building An Emergency Fund?

Before building an emergency fund, know your expenses (not income), which include some mandatory expenses, such as:

- Food, Bills & utilities (electricity, mobile, internet), and basic day-to-day personal and family expenses.

- School fees and other related costs for children.

- Transportation costs: Fuel, bike or car maintenance, ride-sharing, etc.

- Housing: Rent or EMI

- Healthcare: Doctor visits and Basic Medicine expenses

- Personal Care: Beauty Parlour, Saloon, Basic Cosmetics, etc.

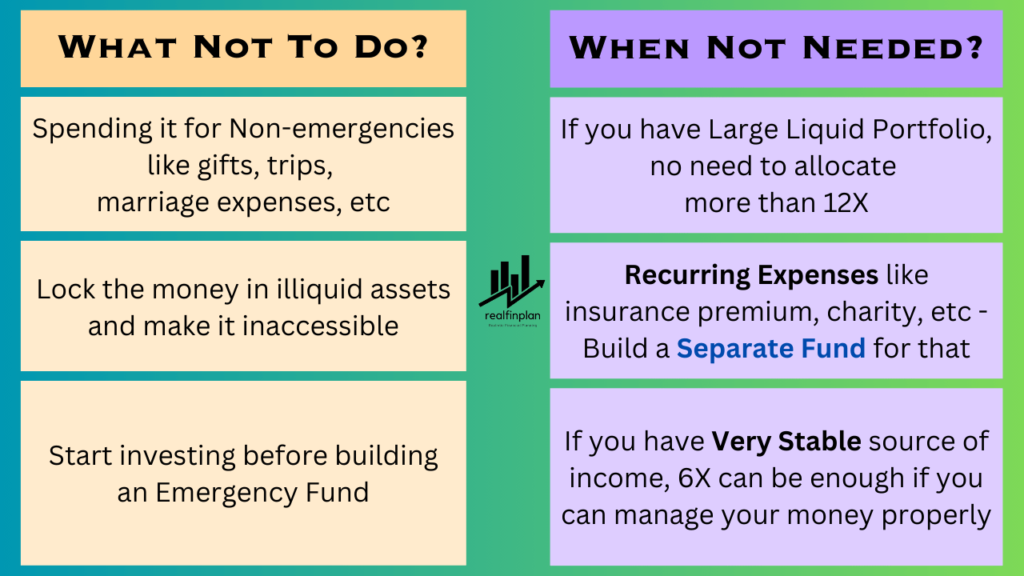

What Not To Include?

- Recurring items like insurance premiums, periodic building maintenance, and charity. You should build a separate fund (aka Sinking Fund) for these kinds of expenses.

- Any kind of non-emergency items like gifts, trips, marriage expenses, etc.

How Much Emergency Fund Should You Have?

This is one of the most important aspects of the emergency fund. The estimation differs from person to person.

- Someone who has faced an emergency gives too much importance to an emergency fund and overestimates the need.

- Those who have not had any kind of financial emergency, underestimate the need and try to maximize the returns for this money.

So, there should be a middle ground. Right? That’s why the general recommendation is six times (6X) of monthly expenses.

You should follow the thumb rule:

- 3X – The minimum fund size to start with, no matter who you are.

- 6X – This is normal for stable Regular Income Categories like salaried persons.

- 12X – This is for irregular income categories like businessmen. This is also recommended in high-risk scenarios (global pandemic, recession, job uncertainty, high medical risk, etc).

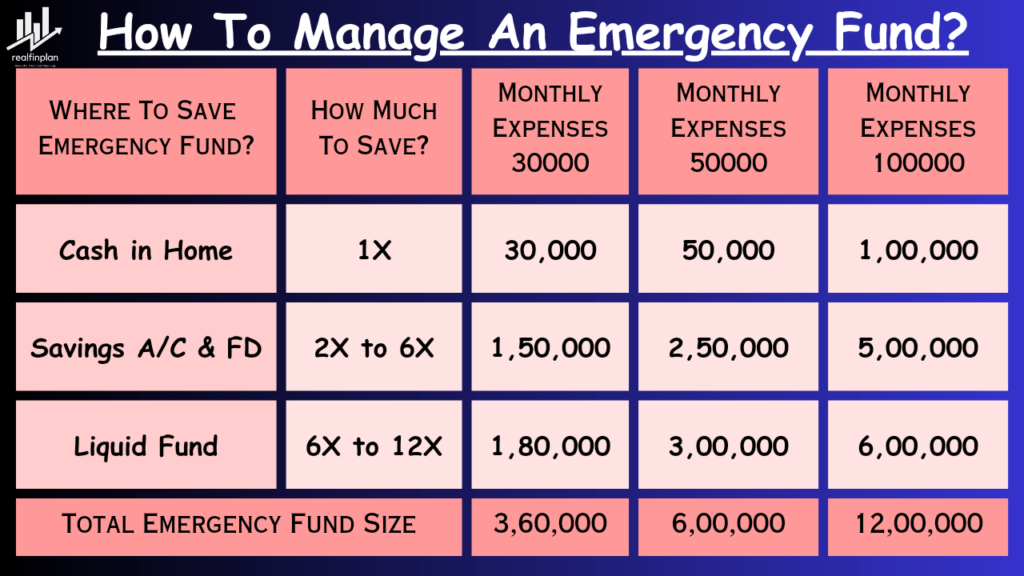

Where To Keep Emergency Fund?

The first thing to keep in mind – the emergency fund needs to be liquid, and immediately available. So that you can easily access your funds during any financial emergency.

So, you should park your money in those assets that can be easily convertible into liquid cash. Do not chase returns here. Also, don’t lock up this money in a way that it’s not available at the time of need. So what are the options?

- Household Cash

- Savings Bank Account (SBA)

- Fixed Deposit (FD), Recurring Deposit (RD), Auto-sweep FD

- Liquid Mutual Funds

If you want to keep your Emergency Fund in Banks

For banks, you can easily go with large banks like SBI, HDFC, or ICICI and always look for banks that offer sweep FDs. But if your bank does not offer sweep FDs, then you can keep some money in a savings account and some in FD.

- All the time look for good ATM coverage.

- Have Net Banking via apps set up on your phone. So that you can access your money anywhere and anytime.

If you want to keep your Emergency Fund in Liquid Funds

If you want to keep your money in a liquid fund then I would suggest you put that money in an Insta-Redemption Liquid fund. It’s a kind of liquid fund offered by various Mutual Fund AMCs.

- Under this facility, investors can withdraw up to ₹50,000 or 90% of the investment amount on any given day through the IMPS facility.

You will get your money in the bank account within 30 minutes. However, I always got my money within 5 minutes. So, this can be a good option to park your emergency fund. Some of the Insta-Redemption Liquid funds (in India) are as follows:

- ICICI prudential liquid fund

- Nippon India liquid fund

- Tata liquid fund

- UTI liquid cash fund

- Axis liquid fund

- Aditya Birla Sun Life liquid fund

- PGIM India liquid fund

where not to keep the money?

Do not keep family gold as an emergency fund. This is not liquid and can lead to losses if the commodity market is turbulent.

Do not use stocks or equity mutual funds for emergency funds. It can lead to huge losses if there is a significant market downturn.

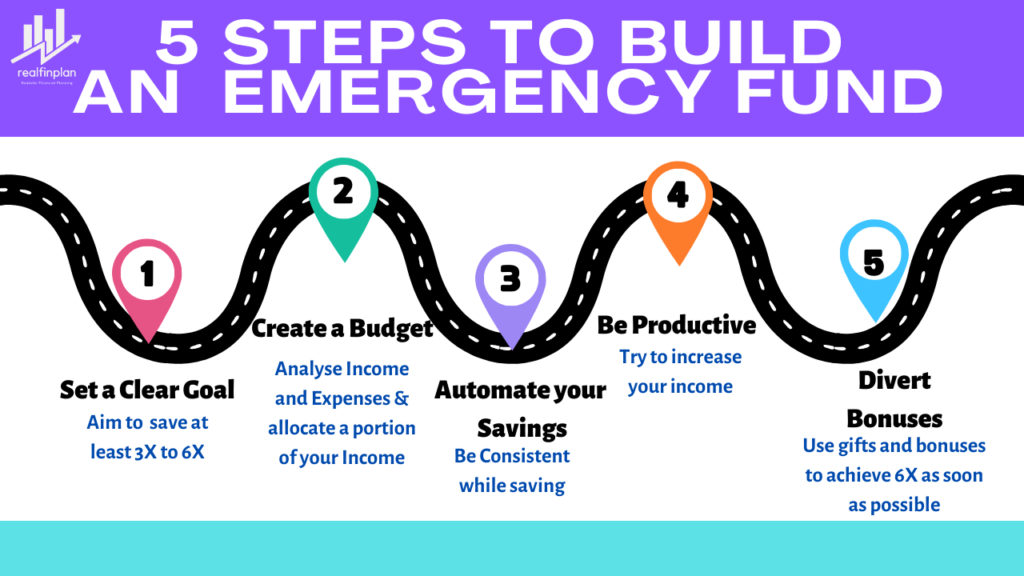

How To Create An Emergency Fund? 5 Simple Steps

Step 1: set a clear goal

Determine how much you need for your emergency fund based on your monthly expenses. Always aim for at least 3 to 6 months’ worth of living expenses.

Step 2: Create a budget

Review your monthly income and expenses. Analyze your spending habits and find areas where you can cut back. Then allocate a portion of your income to your emergency fund.

Step 3: automatic your savings

Always remember, that discipline and consistency is the key to financial success. Set up automatic transfers from your checking account to your emergency fund account.

Do this within 2 to 5 days after getting your salary or income. Make saving a habit. Always save first then spend.

- Don’t follow the wrong equation:

Savings = Income – Expenses. - Always follow: Expenses = Income – Savings.

This will ensure that you remain committed to your saving habit and you consistently contribute to your emergency fund.

Step 4: be productive

Always try to be productive, and try to increase your income. Consider taking on a part-time job or freelancing to boost your income. The extra money you earn, put into your emergency fund to make it 3X to 6X as quickly as possible.

Step 5: Divert bonuses

Whenever you receive unexpected windfalls, bonuses, or gifts, divert all of them into building your emergency fund until you reach at least 6X.

Some Tips and Hacks To Manage Emergency Fund

If you have a loan while building An Emergency Fund

Continue making minimum payments on your loans until you reach 3X. When you achieve 3X, you can increase your loan payments a little until you reach 6X.

- Once your emergency fund is established, focus on paying off debts more aggressively.

what about investing for long-term goals?

Do not invest in long-term goals (> 5 years away), until at least 6X is saved. Once you have achieved that, you can be aggressive towards long-term investing.

A Psychological Hack

You can consider keeping 1 year of children’s school fees separately as FD. This will give you peace of mind that your children’s schooling will not be interrupted due to any kind of emergency.

emergencies vs. non-emergencies: Know the difference

Not every financial setback qualifies as an emergency. Try to understand what are true emergencies, like medical bills, any accident, urgent home repairs, or what we have discussed earlier.

Don’t spend your emergency fund Corpus for any kind of non-emergency such as a vacation, buying a new gadget, gifts, marriage, etc.

Your emergency fund should be reserved for genuine crises. An emergency fund is a kind of insurance policy.

- It’s not for your fun activities. Always avoid spending it on non-emergency purposes.

Refill Your Emergency Fund

When a true financial emergency strikes, don’t hesitate to use your funds. Ultimately that’s the purpose of an emergency fund.

But never forget to refill the emergency fund back to its original level, once you are back on your feet. This ensures that it is ready for the next unexpected event.

A Caution

If you have large liquid portfolios (in stocks, equity, or debt mutual funds), then it makes little sense to exceed 12X as an emergency fund. Then simply you are being too conservative as that excess capital can be used for long-term goals.

What are the 3 questions to ask yourself before you spend your emergency fund?

1. Is It Unexpected?

An emergency fund is your protection against those things you don’t see coming. It’s not for any kind of predictable expenses. You should always be saving for these kinds of expenses separately.

For example, a road accident is unexpected. If your car is damaged you need to pay for repairs. Now if you are using your emergency fund for that, it makes sense.

But for regular car maintenance, like an oil change, a tune-up, replacement of any part, etc, you should not use your emergency fund. Always try to save for these ahead of time, so that you won’t have to put your hands on your emergency fund.

2. Is It Absolutely Necessary?

When you are going to spend your emergency fund, think about whether the bill to pay is a “want” or a “need”. If it’s a “want”, you should not pay for it with your emergency savings.

Do you think that it’s hard to differentiate between a want and a need? But usually, it’s not that difficult.

- If you lose your job, you will need to pay for rent, EMI, and food with your emergency fund.

- But a new TV, a vacation, or a stylish jacket, these things fall under your want. So you should not spend your emergency savings for these kinds of purposes.

Do you know, what is the harder thing? It’s to resist the temptation to deplete your emergency savings for those things you “want”. So, be smart while spending your emergency fund.

3. Is It Urgent?

Always spend your emergency fund on expenses that you need to pay as soon as possible. If it can wait, then you should think of that as a short-term saving goal and save separately for that purpose.

Suppose, your AC is broken in the middle of Summer. Then it’s probably urgent. You can use your emergency savings for the repair of your AC.

But, suppose there is a good deal on your favorite shoes or laptop at a bad time for your budget. You should not use your emergency fund and you should wait and save for it so that you can buy that later.

My Emergency Fund Portfolio Review

Currently, I am maintaining 8X of my monthly expenses. When I came to know about the concept of an emergency fund, I was way behind my target of 6X and didn’t even have 1X. All thanks to my “not needed investing gymnastics” and lack of knowledge.

Gradually I started to save. First, I set my goal to achieve 3X. After achieving 3X, I set my goal to 6X and again achieved it.

In this period of building my emergency fund, I already faced emergency situations 3 times. That’s why it took a lot of time to accumulate adequate funds. Maybe that’s why I increased my Emergency Fund to 8X, knowing that at some point, it will become 6X again with the increase of my expenses.

Emergency Fund Portfolio

- Cash At Home – 1X

- In Bank – 6X: SBA – 2X & FD in that Bank – 4X

- Nippon India Liquid Fund – 2X

Conclusion

Creating an emergency fund is one of the most crucial steps toward securing your financial future. But always remember, an emergency fund is not a luxury, it’s a necessity for safeguarding your financial well-being. Always think in a SMART way to achieve your goal of building a solid Emergency Fund.

It provides peace of mind, helps you avoid debt, and ensures that you have a shield to face any kind of unexpected emergencies. By following our guide, you can build a solid financial foundation that will help you create a secure and brighter future for yourself.

Frequently Asked Questions (FAQs):

What if I can’t save 3 to 6 months’ worth of expenses?

Start with a smaller goal, like 1X, or 2X, and gradually work your way up. Some things take time, no matter how talented or hard-working you are. The key is to start building your fund, no matter how small the initial amount is.

Can I invest my emergency fund?

No. It’s best to keep your emergency fund in liquid and low-risk instruments, like cash and cash equivalents (Savings A/C or FD). You need to ensure that you can access the money quickly as it will be spent in case of emergencies.

Investing it in the stock market or any other volatile assets can be very risky. You should never take any kind of risk while managing your emergency fund.

What if I have multiple emergencies in a short period?

If you spend your funds due to multiple emergencies, focus on rebuilding it as soon as possible. Cut down on non-essential expenses and allocate funds when you have some extra income at some point in time.

How often should I review and adjust my emergency fund?

It’s a good practice to review your emergency fund annually or whenever there is a significant change in your financial situation, like switching your job or an increase in living expenses.

Can I use my emergency fund for planned expenses like a wedding or vacation?

No. The purpose of building an emergency fund is to counter any kind of unexpected or urgent expenses. For planned expenses, create a separate savings fund to avoid spending your emergency fund.

What if I have debt while building my emergency fund?

Continue making minimum payments on your debts while building your emergency fund. Once it’s established, focus on paying off debts more aggressively.

What are the three questions to ask yourself before you spend your emergency fund?

Ask yourself these three questions to make sure you’ve got a real reason to dip into your emergency fund.

1. Is it unexpected?

2. Is it absolutely necessary?

3. Is it urgent?

Which choice or choices best describe the purpose of an emergency fund?

– An emergency fund prepares you for unexpected expenses.

– An emergency fund keeps you from borrowing money from friends and family.

– An emergency fund removes the worry about expenses not in the budget.

How quickly should I aim to build my emergency fund?

Well, the speed varies from person to person and situation to situation. But try to reach your goal as soon as possible. Always remember discipline and consistency is the key.

Is an emergency fund only for individuals or should couples have one too?

Couples should ideally maintain a joint emergency fund to cover unplanned shared expenses and individual needs.

Can I use my credit card as an emergency fund?

It’s true that credit cards can provide temporary relief in case of emergencies. But they often come with high interest rates. If you rely on credit cards, it can lead to debt accumulation.

So, it will be best to have a dedicated emergency fund for such situations.

Should I include regular savings in my emergency fund?

No. Your emergency fund should always be separate from your regular savings. Why? Simple, to prevent unintentional spending.