Welcome to realfinplan! In this article, we will try to understand what is asset allocation, why it’s the best strategy for investment planning, and the most important aspect of portfolio construction.

We have already discussed earlier that Goal-Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. To achieve that target Corpus, you need to have a “need” based Simple And Cost Effective Investment Planning.

If you want to become financially stable and then wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved in it : Sequence of Returns Risk.

- This Sequence of Returns Risk can damage your portfolio and your overall financial well-being at any point of your investment journey. To challenge this and to counter its effects, we need to adopt a proper strategy.

Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

- We have already discussed previously that in our article and I will request the readers to finish that article first and then come here. So, that you can understand things easily: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? 3 Steps To Mitigate Sequence Of Returns Risk

We have also discussed in our previous article about Different Asset Classes and their purpose for investing: What Are Asset Classes? What Are The 2 Asset Classes You Need For Simple Investment Planning?

To know more about Asset Allocation, please dive into our other articles:

- About Common Mistakes to Avoid: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Today, we will discuss what is asset allocation, the best strategy for investment planning, and how Asset Allocation reduces risk, enhances returns, and helps to achieve goals. So, let’s start.

******

In realfinplan, we try to provide realistic, authentic, and free educational content, so that individuals can control their own finances by themselves. I will request the readers

- First to Cover Your Basics To Secure Yourself Financially, then to understand Basics of Saving and Investing.

- Second to Identify your Goals and understand Why do we need Goal Based Investment Planning? Then move forward.

Table of Contents

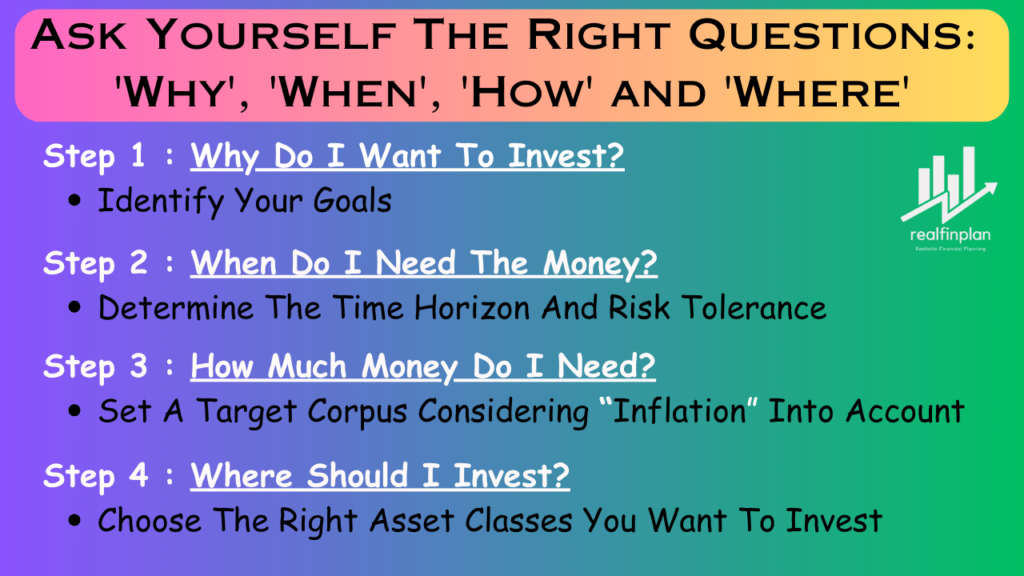

Always Have A Plan Before Jumping Onto Strategy Or Products

When it comes to investing, always have a plan before jumping onto a strategy (Asset Allocation Strategy) or any investment product. Please understand the ‘why’, ‘when’, ‘how’, and ‘where’ of investing.

- Why do you want to invest? Identify your goals

- When do you need the money? Determine the time horizon and risk tolerance

- How much money do you need? Set a Target Corpus considering Inflation into account

- Where to invest? Choose the right asset classes you want to invest

Now, that you have chosen the asset classes to invest in, you can determine the right asset allocation for your goals.

What is asset allocation Strategy?

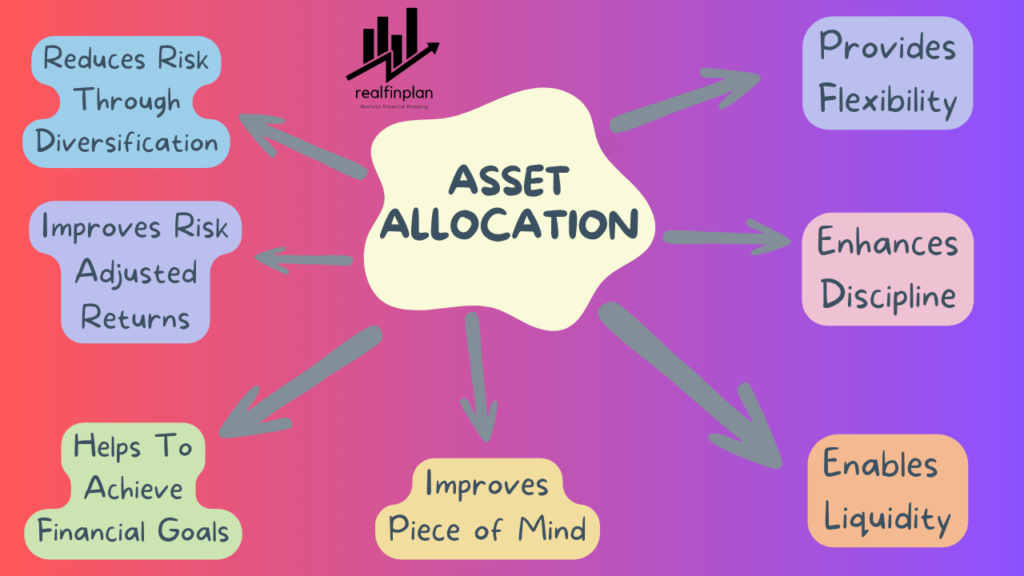

Asset allocation strategy is the process of allocating your investments or dividing your portfolio among different asset classes. These can be Stocks or Equity, Debt or Fixed Income Instruments, Commodities like Gold, Real Estate etc.

Each asset class has its own unique risk and return profile. So if you diversify your portfolio among different asset classes, you can

- Reduce your overall portfolio risk

- Improve your Returns

- Increase your chances of achieving your financial goals

Now, let’s try to understand why asset allocation is the best strategy for our investment planning.

Reason 1: How Does Asset Allocation Help To Reduce Risk?

You may have heard the phrase – “Don’t put all your eggs in one basket”. That means you should never invest all your money in a single asset class. Always diversify your investment in different asset classes. Why? Simple, because different asset classes tend to perform differently under different market conditions.

- For example, when the stock market is down, bonds and fixed-income instruments tend to perform better. So if you have a mix of assets in your portfolio, you can provide a cushion to your portfolio and reduce the risk, by significantly reducing your lost percentage.

Diversification is the key to risk management in your investment planning and Asset Allocation Strategy is the best weapon to counter the risk associated with Equity investing – “Sequence of Returns Risk” aka “Timing Luck”. You should spread your investments across different asset classes. This will minimize your risks. The idea is simple: Do not rely on a single investment to achieve your financial goals.

Now how will you diversify your investment? How many asset classes will you use? After you decide on the asset classes to invest in, what will be the percentage allocation of a particular asset class? – That’s Asset Allocation.

There are various asset classes like equity, debt, gold, real estate etc. We have talked about them earlier. You can use them to diversify your investment. But remember, over-diversification can hamper your financial well-being.

The more asset classes you use to diversify your investments, the more it will increase complexity in your portfolio. It will result in difficulties in managing it. Please understand : Why Investment Planning Should Not Be Complicated And High Cost?

- The simplest way to diversify your portfolio is to use two asset classes. One is “Equity” and the other is “Debt or Fixed Income”.

- These are more than enough to reduce the overall risks of your investment portfolio and to make it low-maintenance to manage. So we will consider that for asset allocation.

You can use Gold or Real Estate as asset classes besides Equity and Debt. But, you don’t “need” them for Goal Based Investment Planning.

- There is a fantastic research-based article in freefincal by our beloved professor Pattu Sir on Gold has Equity like risk and returns like debt: Gold vs Equity (Sensex) 40 year return and risk comparison.

- You can read another article by Pattu Sir about why there is no need for using Real Estate for goal-based investment planning: Five reasons why I will never invest in real estate

An Example:

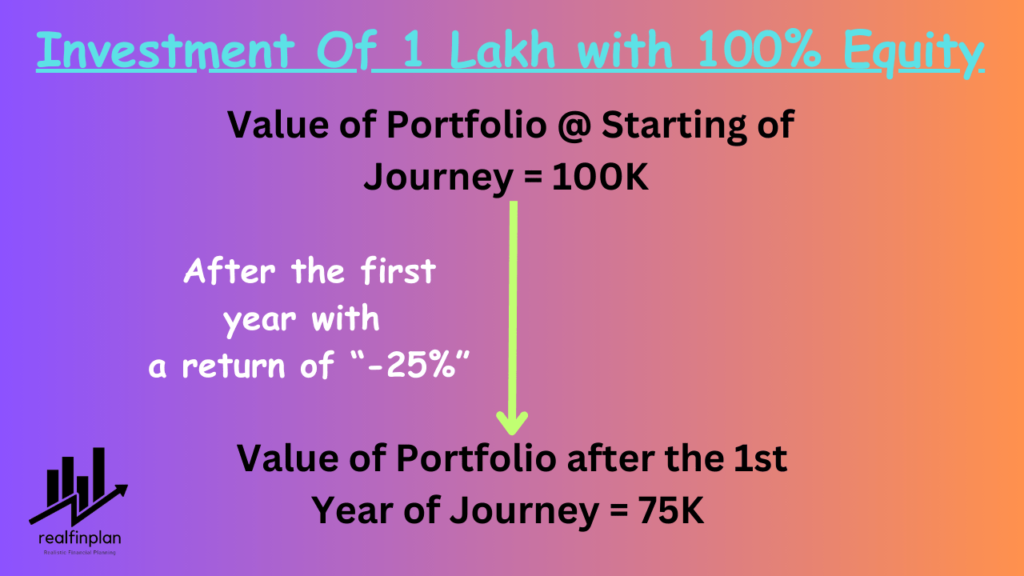

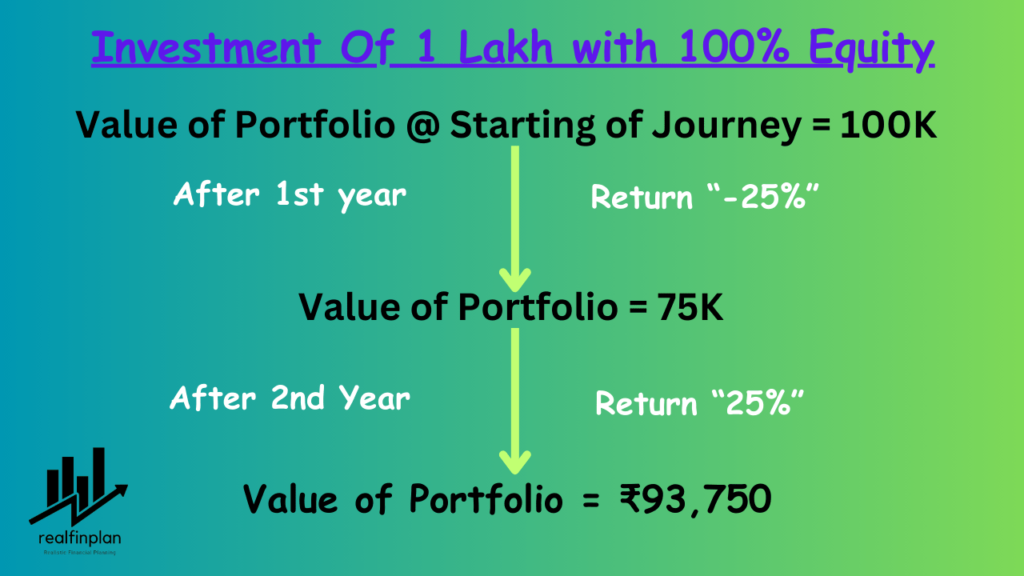

Now, let’s take an example of an investment of 1 Lakh.

If you put 1L in equity and in the very first year you get a return of -25%, your corpus will be reduced to 75K.

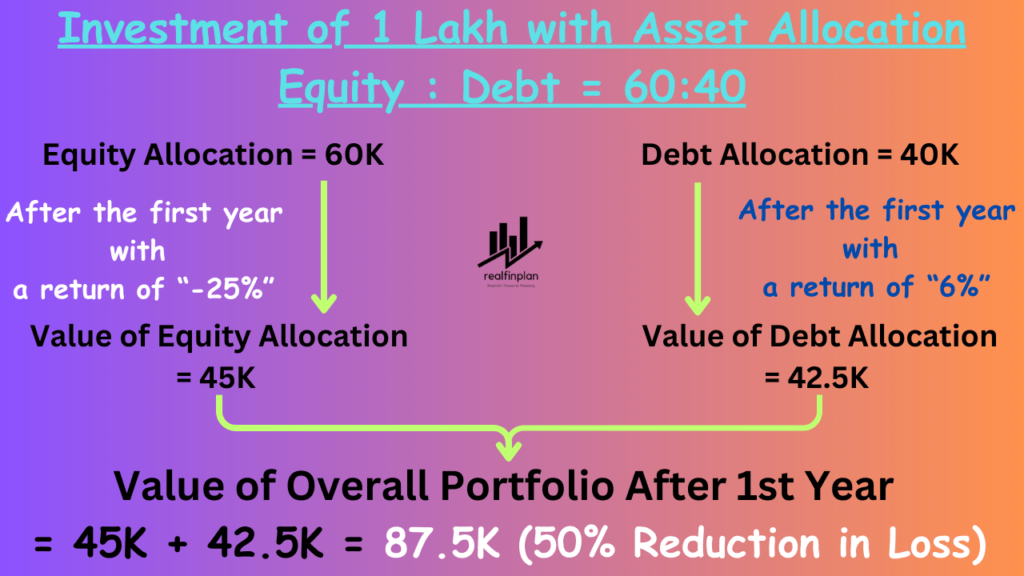

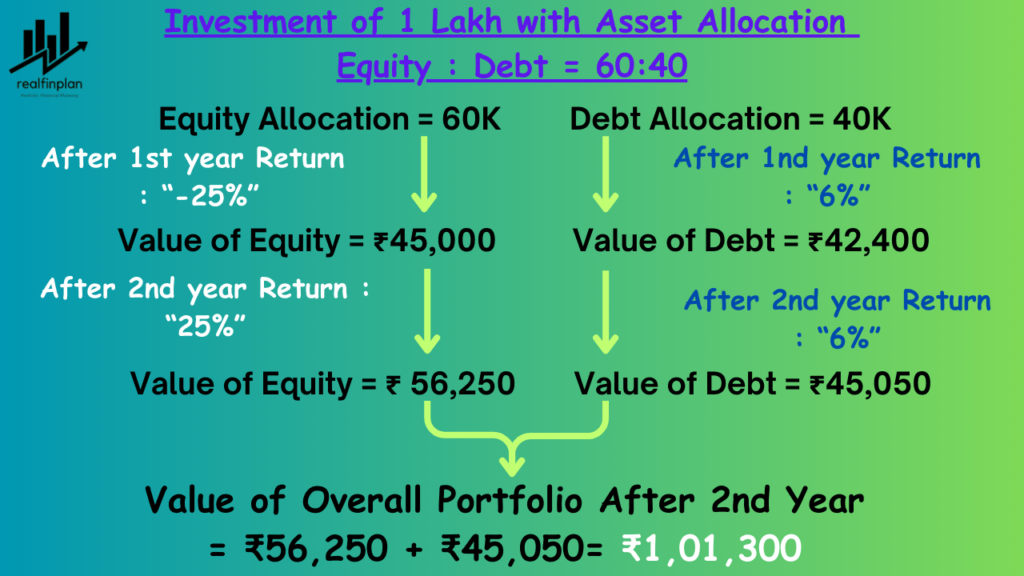

If the goal is equal to or more than 15 years away, you can easily start your journey with 60% equity and 40% fixed income. This 60:40 allocation is largely accepted, tried, and tested. In that case, your 1 lakh will be invested as 60K in equity and 40K in fixed income.

- Now again, think about the first year when you get a return of -25% in equity. The value of 60K in equity will be reduced to 45K.

- However, the remaining 40 K will be increased at the rate of 6% per year (assumption). And the value of your fixed income will be increased from 40K to 42.5K.

- Ultimately your portfolio value will be 45K + 42.5K = 87.5K and your overall portfolio return will be -12.5%.

- See that’s a 50% reduction in your loss. Just by following asset allocation, you can provide downside protection to your portfolio. Just by putting 40% of your money in fixed income, you can significantly reduce your loss percentage in your portfolio.

Asset allocation can help you to reduce the sequence of returns risk in a number of ways:

Provides Downside Protection: We have already seen in the example, how you can provide downside protection to your portfolio if you are investing with an asset allocation strategy.

Reduces Portfolio Volatility: We have already seen in the previous example, how asset allocation can reduce the risk associated with equity investing. The beauty is, this risk reduction is not just limited to 1 year time frame. The concept is true on a daily, monthly, yearly basis, and even for decades. Simply it will reduce your portfolio volatility.

Offers Flexibility: If you ask me, I will say this is the most important advantage of asset allocation. You can tailor your asset allocation strategy on the basis of your risk tolerance and financial goals.

- You can rebalance your portfolio to take advantage of the market swing.

- You can also follow a glide path as an exit strategy.

Reason 2: How Does Asset Allocation Improve Risk-Adjusted Returns?

Look at the previous example again, someone can say that I am talking only about negative things. If positive things happen, it can be a different result. So, Let us take a return of 25% in the first year.

- Investment of ₹ 100000 will become ₹1,25,000 after 1 year for a 100% equity portfolio.

- And investment of 100000 will become ₹1,17,500 after 1 year for a portfolio of Equity : Debt = 60:40

Yes, a 100% equity portfolio will get you more corpus. It may likely generate higher returns over the long term than a diversified portfolio. But, please try to understand that you don’t need to be ready for a good time, but you should always be prepared for the worst time.

- A well-diversified portfolio can provide you with more stability by reducing the loss percentage during any downward market swing.

- Besides this, you will have more control over your investment.

An Example:

Now, if we take a different sequence of returns for a period of 2 years of time, the situation can be very different. Let’s take the first year’s return of “-25%” and the second year’s return of 25%.

Now for a 100% equity portfolio the value of ₹100000 after 2 years will be ₹93,750.

And for a Portfolio of equity : debt = 60 : 40, the value will be ₹1,01,300.

Did you see the magic in the final value of both portfolios? The portfolio with an asset allocation strategy has a higher value. That’s the beauty of asset allocation. That’s how asset allocation improves your risk-adjusted returns.

- This scenario is without rebalancing. If you had rebalanced your portfolio after 1 year (when there was a significant downward market swing), you would have ended with more corpus after the second year.

Remember, investing is not about getting higher and higher returns. It’s about getting optimal potential gains without compromising the consideration of the risk associated with your investment. When it comes to investing, we need to strike a balance between risk and returns. Asset allocation can improve your overall returns without sacrificing the consideration of risk.

It will not only reduce risk in your portfolio but also enhance your risk-adjusted returns. You will be amazed to see the return potential of your portfolio if you invest with an asset allocation. But this will happen only if you are critically disciplined and consistent when it comes to investing. And this is not just a theory. I am telling this from my personal experience.

A real-life example:

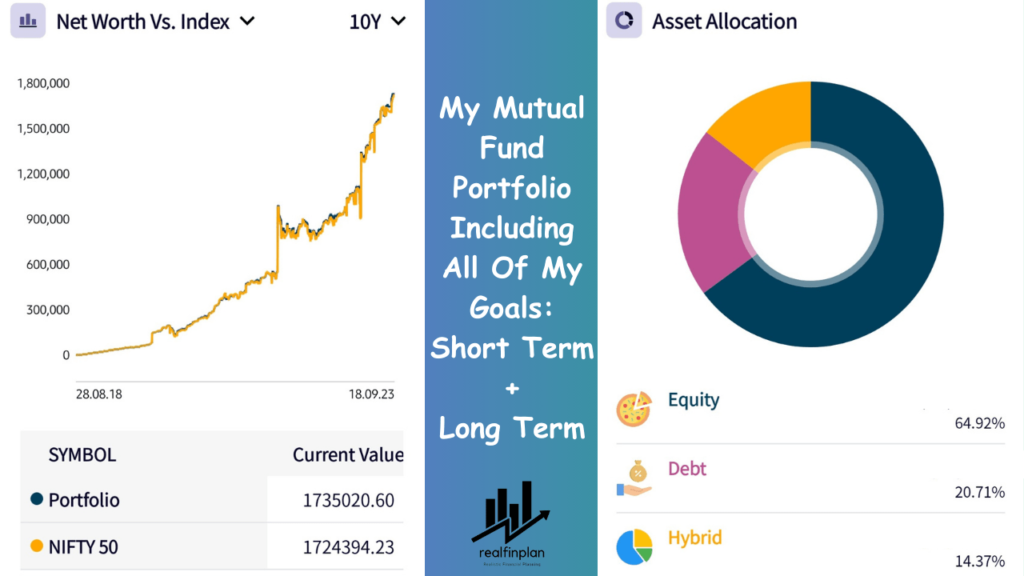

This is my mutual fund portfolio insights including all of my goals, both for short-term and long-term ones. I started my mutual fund investing in 2018 and the insights are up to 18th September, 2023.

On the left side, you can see the comparison of my portfolio value with respect to the Nifty 50 Index.

- This represents the current value of whatever amount I actually invested in various asset classes vs if I invested those particular amounts on those particular dates in the Nifty 50 Index.

And in the right side, you can see the asset allocation of my portfolio. Total equity investment in my portfolio is around 65%.

- In the equity part, there are index funds and one ELSS fund.

The rest is about 35% and are mostly debt funds (liquid fund, money market fund) and hybrid funds (arbitrage fund, conservative hybrid fund).

- If you know the basic categories of mutual funds, you will know that the return potential of these hybrid funds is pretty much similar to the debt funds.

- So, you can think of it as a pure debt portfolio.

*** Later, I will share my portfolio audit, where you will get the details of it ***

Now again if you see the portfolio performance chart (on the left side), my total portfolio value is similar and eventually greater than if my portfolio was a simple Nifty 50 index.

- But only 65% of my portfolio is invested in equity.

- So without taking that much risk, I am getting a similar kind of return to the Nifty 50 index. See, that’s the beauty of asset allocation.

- Asset Allocation not only reduces risk in my portfolio but also enhances my risk-adjusted returns.

Always remember, that returns are unknown and uncertain, so you should not run after them. That’s why I always say: Do not run after Returns, rather chase target Corpus.

I wasn’t sure about this concept at the start of my journey. But, eventually, I understood that returns are just a byproduct of our investing process. The process should be balanced when it comes to risk and return. Asset Allocation strategy is the key and it provides me with a balanced approach to achieving my goal and my target corpus.

- Read this concept in details: Why You Should Not Run After Returns? Rather Chase Corpus!

Simply, you cannot control equity. The outperformance of your portfolio is not in your hands, it will be taken care of by equity itself.

Whereas, providing downside protection to your portfolio is in your hands. Why not try it and mitigate the risk in equity investing? Why not invest with an asset allocation strategy?

Reason 3: How Asset Allocation Helps To Achieve Financial Goals?

Our sole purpose should be to achieve our financial goals. For that reason, your investment strategy must align with your financial goals and risk tolerance with respect to the time horizon. Through asset allocation, you can tailor your strategy to your purposes or goals.

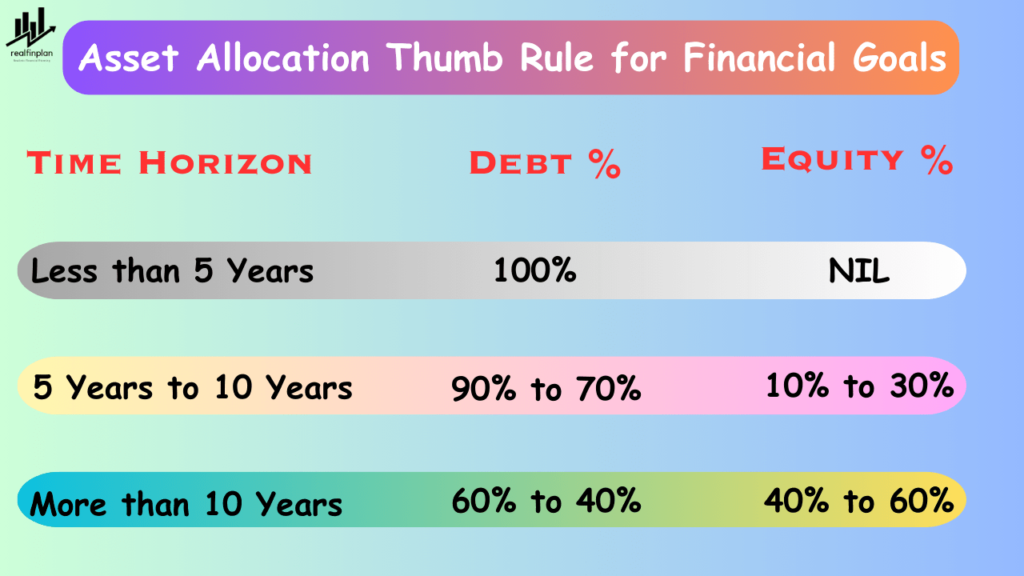

Thumb Rule:

There is no secret recipe to determine the perfect asset allocation for a particular goal. But to make things easier you can follow a thumb rule.

If you have a longer time horizon (more than 10 years) like retirement, child education planning, marriage planning for your child, buying a dream house, etc, those are at least 10-12 years away, you can afford to take on more risk in your portfolio. So, you can allocate a greater percentage of your assets to equity-related investment products. This is because equity has the potential to generate higher returns over the long term.

- Thumb rule – 60% to 40% in debt and 40% to 60% in equity (initial allocation)

But, if you have a shorter time horizon (5-10 years), you may need to be more conservative when it comes to investing. You need to allocate a greater percentage of your assets to fixed-income instruments, bonds, cash, etc.

- Thumb rule – 90% to 70% in debt and 10% to 30% in equity (initial allocation)

And, if your goals are short-term goals (Less than 5 years), you should avoid equity as an investment product for the short term. Read here: Why You Should Not Use Equity For Short Term? Sequence Of Return Risk

- Thumb rule – 100% in debt or fixed income

But please remember, these thumb rules are for initial asset allocation i.e. to start your investment journey. You cannot hold that much equity allocation when you need the money. Otherwise, it would be too risky if the market fluctuates too much. That’s why I always recommend: Asset Allocation Strategy with Regular Rebalancing and a Glide Path.

Use the flexibility of asset allocation strategy. It will empower you to rebalance your portfolio and follow a glide path to achieve your financial goal.

As the goal progresses and market conditions change, asset allocation can shift from your original plan. Regularly rebalancing your portfolio ensures that it stays in line with your investment philosophy, and your plan.

- When there is a significant market swing (upward or downward), sell some winners and buy more of the underperforming assets to maintain your desired asset allocation. This way you can take advantage of the market condition.

Always have an exit strategy for achieving your goal. Without exit strategy you won’t be a successful investor. You should follow a Glide Path.

- You need to gradually de-risk your portfolio by reducing the equity allocation in a step wise manner as the goal nears it’s deadline.

- You need to systematically increase your fixed income allocation to reduce the risk in the portfolio. So that, sequence of returns risk won’t be able to affect your portfolio much.

We have already discussed this concept in our previous article: Sequence Of Returns Risk: How It Can Impact Your Investment In Real Life? How To Reduce It?

Some Other Advantages Of Asset Allocation

Provides Flexibility

Asset allocation is a flexible strategy. You can adjust your asset allocation overtime to meet your needs. You can rebealace your portfolio when there is a significant market swing (upward or downward) to get the benefit of market movements. Also, as the goal nears it’s deadline, you can systematically increase your fixed income allocation to reduce the risk in the portfolio.

- For example, as you get closer to your retirement, you can de-risk your portfolio by gradually reducing your equity exposure and increasing your Debt exposure. So that, you can retire happily.

Enhances Discipline

Asset allocation can help you to stay discipline with your investing. Once you have developed a proper asset allocation strategy for your investment plan, you can trust your investing process. Then you just stick to it and avoid all the noises in the name of information. Always invest with a proper discipline and consistency, no matter what the market condition is.

- Always remember, Discipline and Consistency is the Cornerstone of Financial Planning. If you look at any financially successful person’s journey, you can find differences in investment philosophy and strategy. But they are will be one thing common, that is “discipline and consistency”.

Enables Liquidity

Asset allocation can help you to maintain a liquid portfolio. Why? We need to review our portfolio and rebalance the asset allocation regularly or whenever needed. This enables liquidity in portfolio. This means that you will be able to access your money whenever you need it.

- If you ask me, liquidity is priceless. It’s like my control button. For liquidity, anyday I can overlook other things and even tax implications too. It provides me the flexibility to take advantage of any market situation. It empowers me to regularly rebalance my portfolio. Be it due to any upward and downward market swing or to follow a glide path, anytime I can reduce the risk of my overall portfolio.

- Even liquidity enables the option for me that I can get my money anytime. Be it for my goal or any kind of supreme emergency. Basically, liquidity provides me the peace of mind.

Improves Piece of Mind

Asset allocation can also help to reduce stress levels. Due to flexibility, discipline and liquidity you will feel confident about what you are doing. Knowing that your portfolio is diversified and well managed, you will have peace of mind. And this will enhance your patience in investing which is especially important during volatile market condition.

Also read about: 9 Common Mistakes To Avoid For Asset Allocation Strategy

Frequently Asked Questions (FAQs):

What is the ideal asset allocation for me?

There is no secret recipe for deciding asset allocation. It depends on your financial goals, risk tolerance and investment horizon. You can consider following thumb rule and if you think this as a daunting task, then it’s best to consult a financial advisor to determine the right mix for you.

How often should I rebalance my portfolio?

Rebalancing should be done periodically. You should review your portfolio and rebalance it at least once a year. But if it seems too hectic to you, then set a tolerance limit and rebalance your portfolio when your asset allocation deviates significantly from your plan.

Can I use asset allocation for retirement planning?

Yes, definitely. Asset allocation is so crucial for retirement planning. It helps you to strike a balance between risk and returns. So that your retirement portfolio meets your income needs.

What should I do if my risk tolerance changes overtime?

If your risk tolerance changes, it becomes so important to adjust your asset allocation accordingly. Generally as the goal progresses towards its deadline, your risk tolerance changes and your capability of taking risk reduces.

Always have an exit strategy by following a glide path with step wise reduction in equity allocation. If you find it difficult, consult with a financial advisor to make informed decisions.

Can asset allocation help me during market downturns?

Yes, definitely. A well diversified asset allocation can act as a cushion during the time of market downturns. It can reduce the risk of your portfolio. So that, you won’t incur significant losses.

Should I make changes to my asset allocation based on short term market news?

No. It’s generally not advisable to make hasty changes based on short term market news. Once you have developed a strategy, just stick to it and embrace long term perspective.