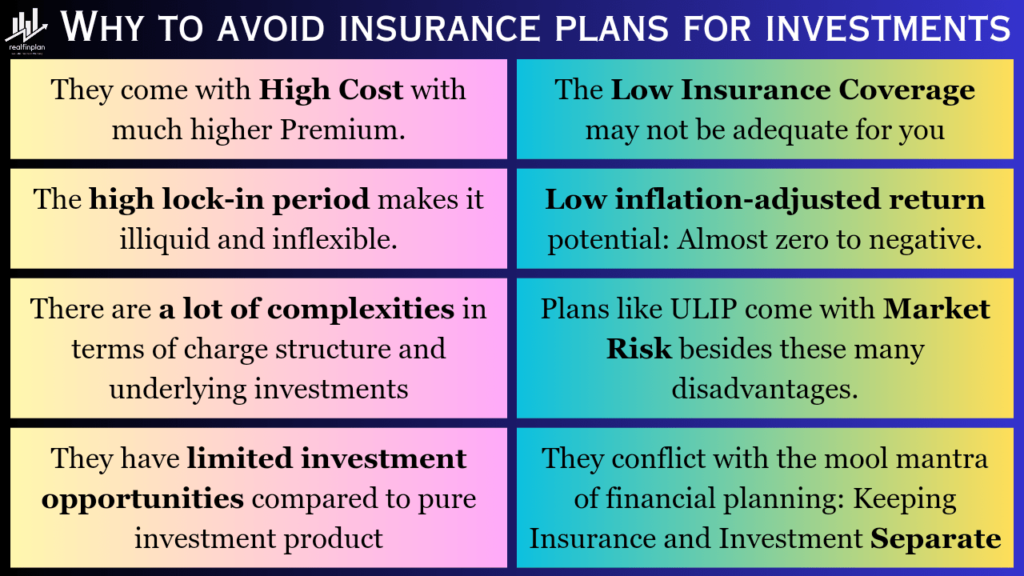

Welcome to realfinplan! In this article, we will try to understand “Why You Need To Avoid Insurance Plans For Investments”. Due to high cost, low insurance coverage, illiquidity, and almost zero to negative inflation-adjusted gains, the use of insurance policies for investment can be a financial disaster.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

- If you want to become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- To challenge this SRR and counter its effects, we need to adopt a proper strategy. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

If you seek people’s knowledge about investing, different people will come up with different suggestions. They would say, do this and do that, etc. But, very few will say about what not to do. That’s why it will be a series about what we need to avoid.

Previously we have already discussed:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023

In this article, we will discuss why you should avoid insurance plans for investment purposes. So, let’s start.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

Why do you need to avoid insurance plans for investment Purposes?

We all love it when we get money, whether we get cashback, discounts, money back, or Returns. This is the same for insurance products too. We think that if we don’t die then our money spent for a pure term insurance is wasted.

Anyone can say: There are a lot of policies that provide guaranteed tax-free returns, like

- Money-back policies

- Endowment plans

- Whole Life plans

- Guaranteed Income Plans etc.

- Why not choose them?

But in reality, you need to get out of the “returns” and “money back” mindset. You need to understand the real purpose of insurance. The thing is financial planning has two main components. Insurance and investment.

Insurance is for minimizing the risk and Investments are for our future needs and wants.

Here are some compelling reasons to avoid insurance policies for investments:

1. Conflicting Objectives:

When an insurance product is providing returns, that’s a mixed product, not pure insurance. Insurance is designed to protect you from financial hardship. Whereas, investments are designed to grow your wealth.

When you mix insurance and investment, you try to achieve two different purposes with a single product. This can be a recipe for disaster as things will be messy and you may not efficiently minimize your risk or meet your needs.

- Why do you need to complicate things? To keep things simple and straightforward, you need to keep them separate as their purpose is different.

2. High Cost & Low Coverage:

These kinds of insurance policies come with a lot of charges like

- Policy Administrative Charges,

- Premium Allocation Charges,

- Mortality Charges,

- High Expense Ratio of fund managers in case of ULIPs etc.

Be it in the initial years or throughout the whole policy period, a significant portion of your premium goes towards the charges. These costs can eat up the overall returns, resulting in lower growth of your capital.

- The most crucial fact is the premium of such policies is so high, still, you won’t be able to get adequately insured.

Let’s assume you are around in your 30s. With a yearly premium of around ₹50K for 20 years in LIC Jeevan Umang (a whole-life policy), you can get only 10L of BSA (Basic Sum Assured).

- Do you really think that amount of insurance is “enough” for you?

- Whereas, in LIC Tech Term (an online pure term insurance policy) you can get a 1CR SA (Sum assured) with around ₹25K yearly.

Always keep in mind, that financial planning should be simple and low-cost. A low-cost pure term insurance policy is the best you can buy to cover life risk.

- Remember, don’t take term insurance beyond your retirement, you don’t need it at that time. By that time you can create enough Retirement corpus to face any kind of financial emergency.

- Also, keep in mind that you need to buy the “regular premium”. It will be fixed for all the years of the term insurance period and will become lesser and lesser due to inflation.

3. Lack of Liquidity And Flexibility:

These policies come with extended lock-in periods. You can’t withdraw money during the entire policy period. Yes, ULIPs have fewer lock-in periods. Yes, in case of any emergency, you can go for partial premature withdrawal.

But that comes with

- Penalty charges

- Surrender charges

- Significant loss of benefits.

It’s your money and they are controlling your withdrawal. There is not much flexibility. That means you won’t be able to put your hands on your money when you need it for other purposes.

- For me, liquidity is precious. I can never risk my money with such illiquid instruments.

4. Low Returns and Inflation Impact:

Endowment plans or similar kinds of products tend to offer lower returns than other lucrative investment opportunities like mutual funds, stocks, bonds, or real estate. Sometimes it can be lower than FD rates.

- So, there is always a risk that your corpus will not be able to outpace inflation.

- It will eat up your money like anything for such a long period of time.

If you want to know this concept of the returns and inflation impact for insurance plans in detail, you can visit this link of ET Wealth Article. The article was written by Yogita Khatri.

5. Complexity And Lack Of Transparency:

Through these plans neither you will be able to be adequately insured nor you will be able to achieve your corpus as they come with almost zero to negative inflation-adjusted return.

Also, there are tons of plans available with different kinds of charges, features, investment options, etc. Also, the investment component of these kinds of insurance policies lacks transparency.

- It’s really hard to evaluate and understand the underlying investments and their performance.

- Be it ULIP or other insurance plans, you may not have full control over how your funds are invested.

The complexity makes it difficult to decide which will suit you. Why do you need to complicate things? Financial planning is all about keeping things simple.

6. Market Risks:

ULIPs invest in the market. So, your investment will also be subjected to market fluctuations. If the chosen fund doesn’t perform for a period of time, then it can negatively impact the overall returns.

- If you wanna change the fund, you may face some charges.

Most of the ULIPs have a history of underperformance, when you compare it with other investment products like diversified equity mutual funds and index funds. Why?

- Because of the high charges and the limitations of investment options. The charges eat into your capital and overall gains.

If you really wanna invest in market-related instruments, then take a pure term insurance and invest the rest in a simple Nifty 50 Index fund, you will eliminate the underperformance risks too. That’s the simplest thing to do.

7. Limited Investment Objectives:

While ULIPs offer a range of investment fund options (equity, hybrid, debt, etc), still they are relatively limited when compared to other investment products like mutual funds. Forget about the other plans like money-back policies, endowment plans, and other insurance cum savings products.

The main mantra of investing is to build a well-diversified portfolio. Use of such insurance plans can restrict the diversification of your portfolio.

- With the help of mutual funds and other pure investment products, you can personalize your investment portfolio as per your needs.

- You will have flexibility, liquidity, and the potential to outpace inflation.

Conclusion

Yes, these insurance plans may come with tax-efficient gains but they come with high cost, low insurance coverage, illiquidity, and almost zero to negative inflation-adjusted gains. Then why go for a mixed complicated product?

- Keep it simple, keep them separate.

A combination of various investment products like equity mutual funds, debt mutual funds, stocks, and fixed deposits, can be better options when it comes to investment planning.

- A good mix of these products can offer better potential for wealth creation over the long term.

- By using pure investment products you can tailor your investment strategy to your risk tolerance and financial goals.

By opting for a pure-term life insurance plan and separate investment products, you can get potentially higher returns and more comprehensive insurance coverage.

Check out our previous “What to Avoid” articles:

- Part 1: Why you should not run after returns? Rather Chase Target Corpus.

- Part 2: Why You Should Not Use Equity For Short-Term? Sequence Of Return Risk

- Part 3: Why Investment Planning Should Not Be Complicated And High Cost? – 9 Important Tips For Simple And Cost-Efficient Investment Planning

- Part 5: Limited Pay Vs Regular Pay Term Insurance: Why You Need To Avoid The 1st One

- Part 6: Term Insurance With Return Of Premium (TROP): The Unpleasant Truth Of Wasting Money In 2023