The PFRDA has issued a new circular stating that now investors can choose up to 3 different NPS pension fund managers for different asset classes. The NPS subscribers most commonly use the equity (E), government bonds (G), and corporate bonds (C) trio. Now, investors can select a maximum of three different pension fund managers for different asset classes.

NPS may be a controversial financial product but also a trendy scheme. Being a central government employee, I have NPS by default. So, I always try to gather information and learn new things about NPS. Previously we have covered the introduction of Penny Drop Verification in NPS (October 2023) and the new NPS Systematic Lump Sum Withdrawal (SLW) Facility.

- NPS Withdrawal Rules Change In October 2023: PFRDA Modifies Withdrawal Exit And Bank Details Update Rules

- NPS Systematic Lump Sum Withdrawal Facility (SLW): New Withdrawal Rules Introduced by PFRDA In October 2023

****************

In realfinplan, we try to provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances by themselves. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

Table of Contents

What are the different NPS pension fund managers available?

Currently, there are 10 pension fund managers available in NPS, they are as follows:

- SBI Pension Fund Private Ltd

- LIC Pension Fund Pvt Ltd

- UTI Retirement Solutions Ltd

- HDFC Pension Fund Co. Ltd

- ICICI Prudential Pension Fund Management Co. Ltd.

- Kotak Mahindra Pension Fund Pvt. Ltd.

- Aditya Birla Sunlife Pension Management Ltd

- Tata Pension Management Ltd.

- Max Life Pension Fund Management Ltd.

- Axis Pension Fund Management Ltd.

What are the different asset classes in NPS?

In NPS, an individual is allowed to invest in the following 4 asset classes:

- Equity (E)

- Government bonds (G)

- Corporate bonds (C)

- Alternate asset classes (A)

What are the different choices for asset allocation in NPS?

Active Choice:

Here the NPS subscriber selects the allocation percentage in different asset classes.

- The investor has the freedom to decide the ratio by allocating funds among the available 4 asset classes.

- The percentage of asset allocation in different asset classes is subjected to their upper limits.

- Like, you won’t be allowed to have an equity allocation of more than 75%.

Auto Choice:

Here your funds are automatically allocated among different asset classes (E, C, and G) in a predefined matrix. The matrix will be based on the age of the subscriber.

- A certain percentage allocation in different asset classes is maintained till the subscriber is 35 years of age.

- Then as the age of the subscriber increases, exposure to equity (E) and corporate debt (C) is gradually reduced, and allocation in government securities or bonds (G) is increased.

Based on the risk appetite of the subscriber, NPS provides three different options available within auto choice.

- Aggressive (LC-75): maximum equity exposure is 75%

- Moderate (LC-50): maximum equity exposure is 50%

- Conservative (LC-25): maximum equity exposure is 25%

What does the new circular state?

As per the new circular released by the Pension Fund Regulatory and Development Authority (PFRDA), now, an NPS subscriber can choose up to 3 different NPS pension fund managers for different asset classes.

Previously, this option to choose multiple pension fund managers was not available.

- Once you select the pension fund manager, the money invested in the NPS in all the asset classes would be handled by that particular pension fund manager.

In simple words, an NPS investor now has the flexibility to pick the top-performing fund manager in each asset class. For instance, you can choose:

- The HDFC pension fund manager for equities

- The SBI pension fund manager for government securities or bonds

- And the ICICI pension fund manager for corporate bonds

Are there any exclusions?

The PFRDA has clarified the following things in the circular:

1. You will have to choose the active choice for asset allocation to use this facility. In auto mode, you won’t be able to this facility.

2. This facility will be available for all asset classes i.e. equity (E), government securities (G), and corporate bonds(C) except for alternate asset classes (A).

3. This flexibility of choosing different pension fund managers for different asset classes is available to the existing NPS subscribers under the NPS all-citizen model Tier-I, NPS Corporate model Tier-I, and Tire-II (all subscribers).

- This means that government employees having Tier-I NPS accounts, cannot avail of this facility. However, if they have a Tire-II account, they can use this facility.

As per the directions issued by the pension regulator, “With the objective to further facilitate NPS subscribers with choice of multiple pension funds with multiple schemes, an additional option of pension funds selection/choice is being made available as under – The facility of selection of multiple (maximum of 03) pension funds (PF) in accordance with the asset classes (except alternate Asset class or Scheme A) is available to the existing subscribers under NPS All Citizen Model (Tier-I), NPS corporate model (Tier-I) and Tier-II (All subscribers).”

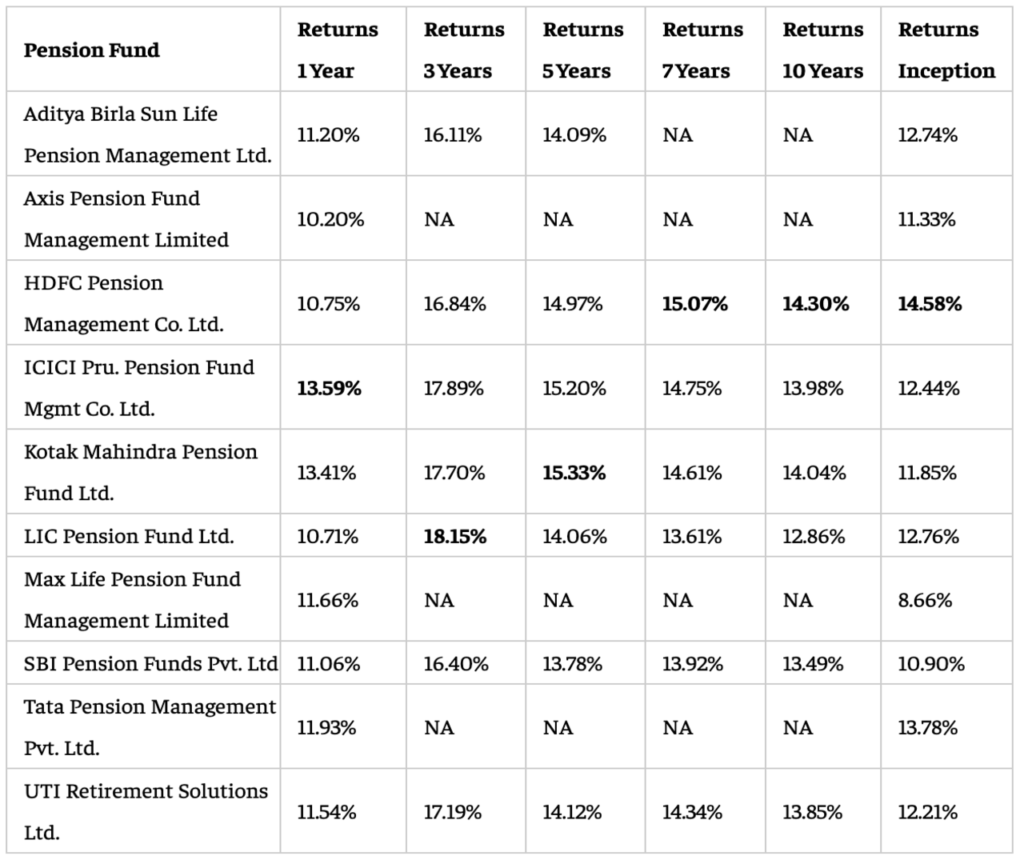

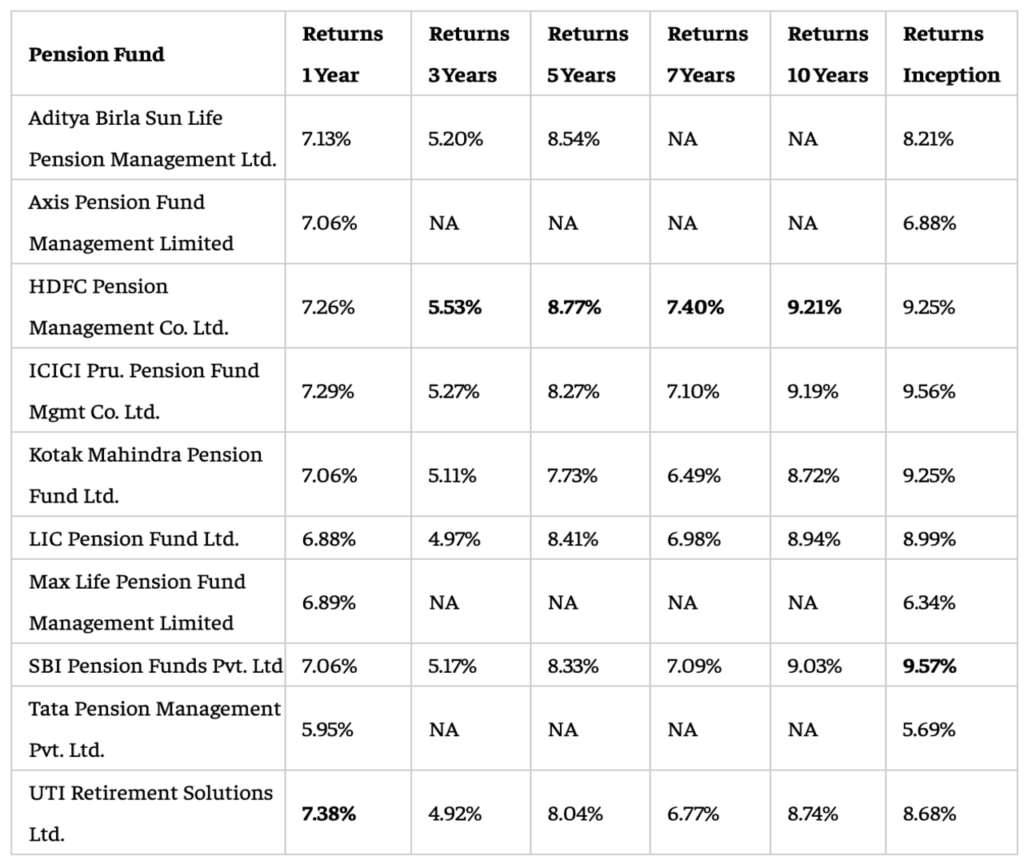

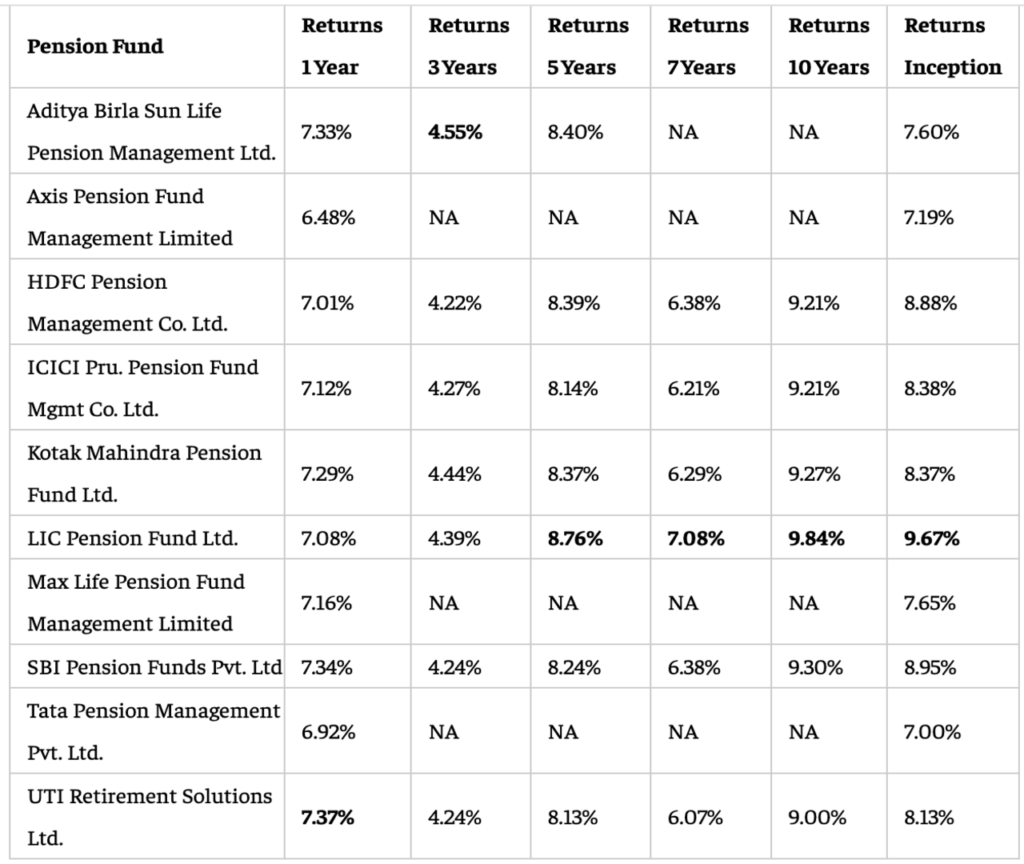

NPS pension fund manager Performance

As per the NPS trust website, the following is the comparison of the returns generated by different pension fund managers (Data Source for image – economic times):

Equity returns as of November 24, 2023

Corporate bond returns as of November 24, 2023

Government Securities returns as of November 24, 2023

Conclusion

If you think from an investment perspective, this facility is a good initiative for subscribers. Why? Because it will provide them the flexibility to choose the pension fund managers as per their performances for different asset classes. This change provides investors with the opportunity to create a more customized portfolio. Also, the performance of pension fund managers will have to be good enough to attract high AUM (asset under management), which is also a good thing.

But, always remember that NPS is primarily for retirement. So, it’s a long-term investment. You should give time to pension fund managers to showcase their performance. Otherwise, unwanted churning of your portfolio may not be beneficial for you in the long run.