Are You Facing a Pension Dilemma regarding UPS vs NPS? Should you stick with the New Pension Scheme (NPS), or should you switch to the newly launched Unified Pension Scheme (UPS)? Are you concerned about your post-retirement income? Do you prefer a guaranteed pension or potential equity market gains? What are the risks and benefits associated with each scheme? These are critical questions for government employees in India as they consider their pension options. Understanding the nuances of both schemes is essential before making a decision. Let’s break it down.

****************

In realfinplan, we provide realistic, authentic, unbiased, and free educational and news content, so that individuals can control their finances. I will request the readers

- First to Cover Your Basics: 3 Simple Steps To Manage Financial Risks For A Secure Future, then to understand the Basics of Saving and Investing: Saving vs Investing: The 2 Habits We Need To Master For A Prosperous Future.

- Second, identify your Goals and understand why we need Goal-Based Investment Planning: Investment Planning: Goal-Based Investing Basics – Why Do We Need It?

- Then move forward.

We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, you can lay a foundation for your investing process through goal-based investing.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR) – Why To Avoid Equity For Short-Term.

- We must adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

****************

Table of Contents

The introduction of the Unified Pension Scheme (UPS) on August 24 by the central government aims to address concerns among government employees about securing their pension income post-retirement. This scheme is available to current subscribers of the New Pension Scheme (NPS), including retirees. The key question is: should you switch from NPS to UPS? Here’s a breakdown of the considerations.

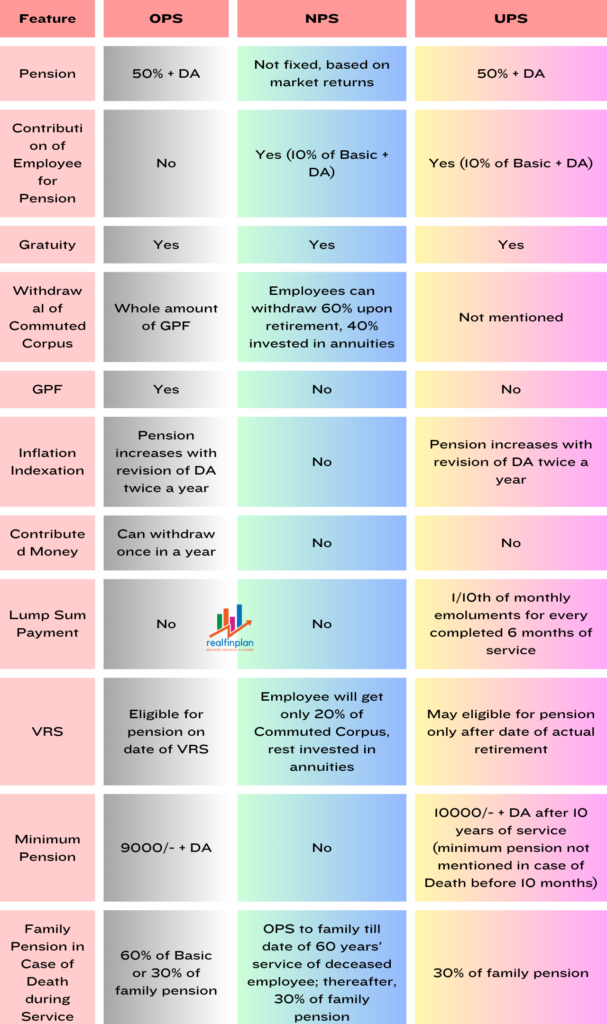

OPS Vs UPS vs NPS: The Basic Differences

UPS vs NPS: Will the UPS be sustainable?

Pension Guarantee:

NPS VS OPS:

- NPS: No

- UPS: Provides a guaranteed pension, offering 50% of the average basic pay drawn over the last 12 months, which could ensure a stable post-retirement lifestyle.

Associated Risk:

- Here, UPS is a clear winner.

Nature of the Pension Scheme

NPS VS OPS:

- NPS: Defined contribution scheme with exposure to market risks, offering potential for higher returns.

- UPS: A “mix” of defined benefits and defined contributions, with a focus on guaranteed returns and reduced risks for the employee. The scheme is inflation-linked, adjusting the pension amount over time.

Associated Risk:

Due to its nature, UPS is a more complicated product than the NPS. I always prefer “Simple” products. It’s easy to understand and implement. Also, there are a lot of questions that are not answered yet.

Tax Implications

NPS VS OPS:

- NPS: Allows for a tax-free lump sum withdrawal of 60% of the corpus at retirement, with the remaining 40% invested in an annuity, which is taxed as per income tax rates.

- UPS: Tax details are still awaited, but pension income is expected to be taxed according to the applicable income tax rates. The taxation of any lump sum payment under UPS is also unclear at this stage.

Associated Risk:

- Due to the limited clarifications, UPS is a complicated product from the taxation point of view.

Government Contribution Structure:

NPS VS OPS:

- NPS: Employees contribute 10% of their basic pay and dearness allowance, with the government contributing 14%.

- UPS: Similar employee contribution as NPS, but the government increases its share to 18.5%. Of this, 8.5% is allocated to a guarantee reserve fund to cover potential shortfalls.

Contribution Debate

- There’s a question of why the government is contributing 18.5%, a higher percentage than employees.

- A more balanced contribution, such as a higher employee percentage and a lower government percentage, could reduce the pension burden of the government.

Risk Management:

- The Unified Pension Scheme (UPS), which integrates features of both defined benefit and defined contribution plans, requires strategic oversight. Contributions come from both the government and employees, with 8.5% of the government’s 18.5% contribution earmarked for a guaranteed reserve fund.

- This reserve is intended to address any shortfalls in meeting pension obligations. Given the long-term nature of pension liabilities and the increasing average life expectancy, regular monitoring is essential to maintain the scheme’s viability.

- Opinions vary on the effectiveness of the UPS, with some viewing it favourably, while others argue that the Old Pension Scheme (OPS) was more advantageous.

- So, strong governance is needed for the investment of funds, particularly for the guarantee reserve fund, to ensure the scheme remains viable without adding extra financial strain on the government.

Investment Options:

NPS VS OPS:

- NPS: Diverse (equity, Corporate bonds, government securities)

- UPS: Primarily government securities

Investment Risk:

- The government may aim to generate returns through prudent investments in stocks and bonds to support annuity payouts.

- This could help make the scheme self-sustaining without relying on higher taxes.

- So, strong governance is needed for the investment of funds, to ensure that through this scheme (10% employees’ contribution + 10% government contribution, remaining 8.5% is for the guarantee reserve fund, not for your pension), the accumulated corpus can provide an inflation-adjusted pension, and remains viable without adding extra financial strain on the government.

Inflation Management:

- Controlling inflation below 5% is crucial for maintaining a sustainable pension system.

- Regular reviews will be necessary to assess and adjust the sustainability of the scheme.

The flexibility of NPS:

NPS offers equity market returns. All thanks to the LC50 & LC25 auto choice options for the Central Govt. Employees. These enable more exposure to equity than the default central govt. scheme where a maximum of 15% is allocated to equity). So, NPS can be a great option for those who believe in India’s growth story and have a long-term investment horizon.

- Later in this article, you will get to know how I use the flexibility of NPS for my retirement planning and how market-related risk can be mitigated through NPS (not fully, but it’s a fantastic strategy).

Lump sum Payment & Employees Contribution:

NPS VS OPS:

In both NPS & UPS, employee’s contribution is the same. 10% of basic + DA. For that, you get a lumpsum amount besides the Gratuity and the leave encashment amount.

- NPS: Allows a tax-free lump sum withdrawal of 60% of the corpus at retirement.

- UPS: 1/10th of monthly emoluments for every completed 6 months of service.

Associated Risk:

In the National Pension System (NPS), the entire contribution (10% from the employee and 14% from the government) is pooled to create the NPS Corpus. This Corpus is then used to provide both a lump sum payout and a pension through annuity payments.

For the Unified Pension Scheme (UPS), 20% of the contribution (10% from the employee and 10% from the government) is used to build the Corpus for pension provision. If this Corpus falls short of covering 50% of the employee’s average basic pay over the last 12 months, the deficit is covered by a guarantee reserve fund, which is built from an additional 8.5% government contribution.

In contrast to the NPS, the UPS functions differently when considering the lump sum payment. Under the UPS, retirees receive a lump sum equal to 1/10th of their monthly emoluments (basic pay plus DA) for every completed six months of service.

Essentially, this means:

- An employee contributes 10% of their salary to the government in 12 installments every year throughout their career.

- In return, they receive only 2 installments for each year of service.

So, where do the remaining 10 installments per year go? They are absorbed by the government, which expects employees to share the burden of inflation-adjusted guaranteed pensions. Under the Old Pension Scheme (OPS), the employee’s contributions were never used to fund pensions.

Now, let’s take an example: If someone retires with a salary of ₹1 lakh per month (basic + DA) after 30 years of service, they would have made 360 installments over their career but would receive only 60 installments back as a lump sum.

- 10% of ₹1 lakh = ₹10,000

- 60 x ₹10,000 = ₹6,00,000

Thus, the employee receives only ₹6 lakhs as a lump sum payment. This amount pales in comparison to the tax-free “60% of the NPS Corpus.” If you are financially savvy and invest that 60% wisely, you can achieve financial stability in retirement.

Provision of VRS:

NPS VS OPS:

- NPS: Employee will get only 20% of Commuted Corpus, the rest invested in annuities.

- UPS: Employee will get the lump sum amount. But, they may be eligible for pension only after the date of actual retirement.

Associated Risk:

When it comes to Voluntary Retirement Scheme (VRS), the Old Pension Scheme (OPS) was the best option. If you took VRS, your pension would begin immediately the next day, along with all other retirement benefits.

In contrast, under the National Pension System (NPS), the situation is different. If you exit the NPS before turning 60, you receive 20% of the NPS Corpus as a lump sum (instead of the usual 40%). The remaining 80% of the Corpus is annuitized to provide your pension.

The Unified Pension Scheme (UPS) has even stricter conditions for VRS. You would receive only the lump sum payment, which, as we discussed earlier, is not substantial.

- Your pension, however, will not start until you reach the official retirement age of 60.

- This can feel like a shackle for employees, potentially preventing them from opting for VRS, as their pension would be delayed until the standard retirement age.

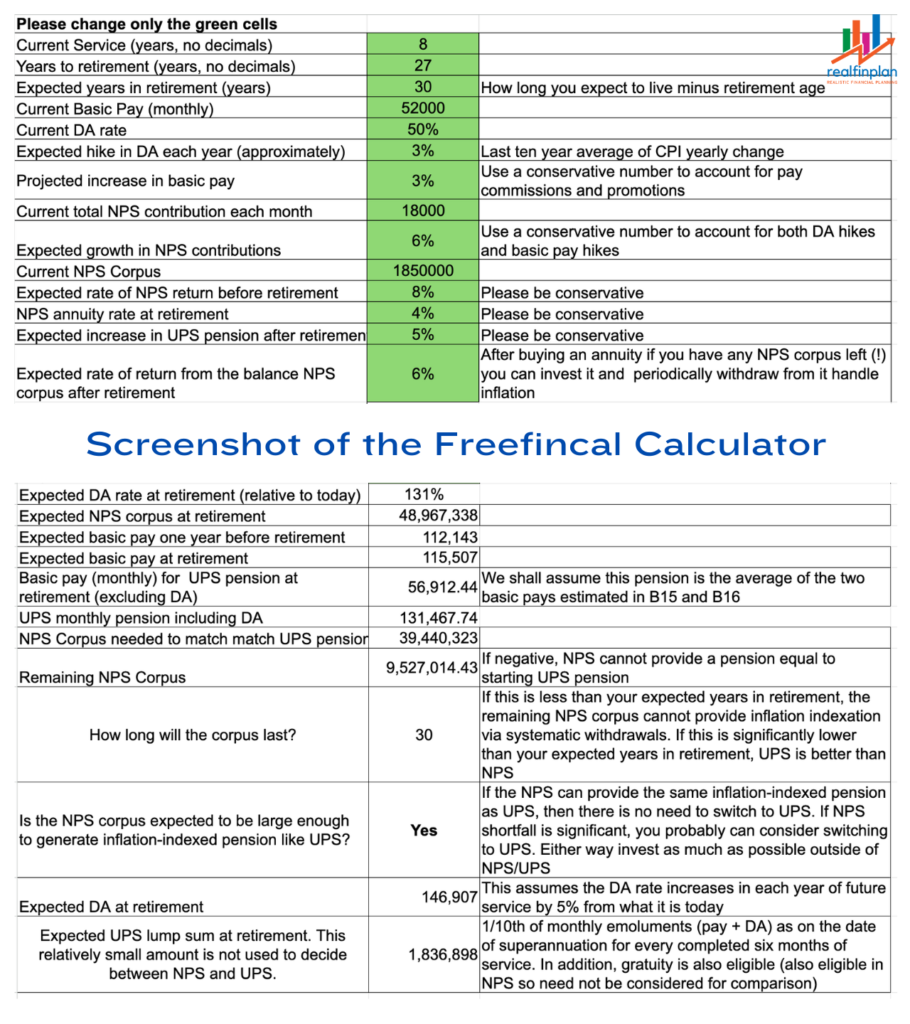

Freefincal NPS Vs UPS Calculator:

This calculator is made by my guru Pattu Sir. You can analyse your current financial situation with the help of it and it can help you with choosing between the NPS and UPS.

The underlying logic behind the Unified Pension Scheme vs National Pension Scheme Calculator

Can your future NPS corpus provide the same pension expected from UPS (with inflation indexation)? The NPS annuity provides part of this pension. Inflation indexation is provided via systematic withdrawals from the balance NPS corpus (if any!).

If the answer is yes, then stay in NPS. If the answer is no, find out how much the shortfall is. For example, you expect to live 30 years after retirement, and NPS can provide an inflation-indexed pension for 29 years. The shortfall (1Y) is small. NPS and UPS are still comparable. If the shortfall is large (several years), UPS is better than NPS.

Caution and Disclaimer: This calculator is based on the initial UPS press release and involves several projections. There may be significant deviations between these numbers and real-life values. This must be treated as a guesstimate. Use with discretion. This calculator may have bugs and errors in understanding. Please check all formulae to see if they make sense.

An Example: Screenshot of the Calculator:

Here is the link to the Calculator: Unified Pension Scheme vs National Pension Scheme Calculator

Should I Switch to UPS from NPS?

As a government employee enrolled in the NPS, I have to carefully consider switching to UPS for my family’s retirement needs. I am also emotionally attached to my NPS as it is the most consistent investment of mine. I have studied a bit regarding the various investment opportunities in NPS. Then I decided to switch to Moderate Auto Choice or LC50 from the Default Central Government Scheme.

My NPS Portfolio: Why Moderate Auto Choice (LC50)?

Retirement as a goal: We have discussed earlier that Goal Based Investment Planning is not just a strategy, it’s more of a mindset shift. It gives you the purpose, the direction, and the momentum in investing. If you are critically disciplined, through goal-based investing you can lay a foundation for your investing process.

- Always remember, the sole purpose of our investing should be to Achieve the Target Corpus of a particular Goal, not a Target Return. And to achieve that target Corpus you need to have a Simple and Cost Effective Investment Planning.

- To become financially stable and wealthy, you will need equity as an investment vehicle. Why? Because Equity has the potential to beat Inflation. But before we invest in it, we need to consider the risk involved: Sequence of Returns Risk (SRR).

- We need to adopt a proper strategy to challenge this Sequence of Returns Risk and counter its effects. Asset Allocation Strategy with Regular Rebalancing and a Glide Path is the key, the best weapon against Sequence of Returns Risk.

I have around 27 years for this goal. So, I have time. Being a central government employee, NPS is mandatory and is my most disciplined instrument with a great Investing CAGR of more than 10% on average since mid-2016. As per LC50,

- Upto 35 years of age – max equity allocation 50% – Rebalancing happens once a year (Birth Date)

- From 36th years of age, equity will reduce by 2% each year till 55 years of age and it will come down to 10% at 55 years of age

- Also, for a moderate auto choice scheme, I won’t have to do anything, no human intervention.

- The equity will systematically reduce with yearly Rebalancing.

- So, it’s ticking all the boxes of the Asset Allocation Strategy with Regular Rebalancing and a Glide Path.

So, for now, my overall NPS is like a balanced hybrid fund and will be a conservative hybrid fund with a gilt majority at later stages. So, I am okay with it.

- All thanks to the LC50 & LC25 auto choice options for the Central Govt. Employees. This enables more exposure to equity than the default central govt. scheme where a maximum of 15% is allocated to equity.

- I opted for Moderate Auto choice or LC50 (HDFC PFM) in June 2022 – Since then XIRR – an 18.5% (from inception it’s 12.5%).

- The only risk is that an HDFC (Equity) fund may or may not be able to beat an index fund. But it doesn’t matter to me. The Asset Allocation Strategy with Regular Rebalancing and a Glide Path is more important to me than beating the index.

- I will be more than happy if I get anything between 7% to 8% from my NPS portfolio.

While I’m emotionally invested in my NPS corpus, the current information, my financial knowledge and situation, and the NPS Vs UPS calculator indicate that it’s the more suitable option for me and my family. Also, NPS offers greater flexibility, allowing me to choose between a pension through RBI Retail Direct Gilt bonds, a retirement bucket strategy, or Systematic Lumpsum Withdrawal.

Decision-Making: NPS vs UPS

The New Pension Scheme (NPS) was introduced as a financially better option compared to the Old Pension Scheme (OPS). Now, the Unified Pension Scheme (UPS) is being seen as a mix of the best features from both OPS and NPS. However, if NPS was meant to improve financial stability, is introducing UPS a step backwards?

NPS as a Better Successor to OPS

Let’s start with the Old Pension Scheme (OPS). Under OPS, employees didn’t have to contribute anything to their retirement savings, but they were guaranteed a pension after retirement. The government paid for the entire retirement cost. The problem was that the government that implemented OPS didn’t have to pay immediately; the cost was deferred until employees retired. This created a burden for future governments, especially as more people retired.

To address this, the New Pension Scheme (NPS) was launched in 2004 after years of discussions between central and state governments. NPS is a defined contribution scheme, meaning both employees and the government contribute to the retirement fund, which is invested in the market. The returns depend on market performance, and there are no guaranteed benefits. This made NPS a better option for managing government budgets and deficits.

Why Was UPS Introduced?

Employees naturally complained when their guaranteed retirement benefits under OPS were replaced with market-based benefits under NPS. For those nearing retirement, the short time for market investments might not provide enough for a comfortable retirement. Also, the risk of a market downturn just before retirement is a concern. Even though NPS automatically shifts investments to safer options as retirement approaches, the risk isn’t completely avoided. Some employees demanded the return of OPS, and a few states agreed.

This led to the creation of the Unified Pension Scheme (UPS), which combines the best features of OPS and NPS. Under UPS, government employees are guaranteed a pension of at least 50% of their last drawn salary. Unlike OPS, where the government pays the entire retirement cost, in UPS, employees also contribute to their retirement fund, and the government adds to it, so future governments don’t bear the entire cost.

Remaining Questions about UPS:

However, there are still some questions about UPS that need clarification. For example, it’s mentioned that of the 18.5% of the basic salary plus DA contributed by the government, only 10% will go to the employee’s individual pension fund, while the remaining 8.5% will go to a separate pool.

- How will these two pools be invested differently?

- What is the default investment strategy?

- Additionally, since UPS is optional, what happens to the NPS fund if an employee switches to UPS?

- Who will manage the UPS? Can it fall under the purview of the Pension Fund Regulatory Authority of India (PFRDA) and be integrated within the existing NPS framework?

These factors could significantly impact the cost to the government at retirement. Clear answers to these questions would make the employees make prudent financial decisions regarding retirement planning.

Expert Opinions

The key decision for employees is whether to switch from NPS to UPS. Expert opinions are mixed (source moneycontrol).

- For NPS:

- Dhirendra Kumar (Value Research) suggests sticking to NPS if you believe in equity market growth and have a long time until retirement (10-20 years or more).

- Piyush Gupta (CRISIL) believes NPS is better for younger employees (20s-30s) due to the potential for long-term growth.

- For UPS:

- Suresh Sadagopan (Ladder7 Wealth Planners) advises those near retirement or seeking guaranteed income to consider UPS.

- Preeti Chandrashekhar (Mercer Consulting) highlights that UPS reduces financial risks since the government bears these risks.

- Financial experts like Pankaj Dhingra, Managing Partner & Co-Founder of FinTram Global LLP, emphasize the importance of aligning your choice with your individual circumstances. Factors to consider include your risk tolerance, long-term financial goals, and desired retirement income. Consulting a financial advisor can be invaluable in tailoring your decision to your unique needs.

To sum-up:

- Younger Employees:

- NPS might be more beneficial for employees in their 20s and 30s due to the long investment horizon and the potential for higher returns from equity investments.

- One can choose the LC50 or LC25 auto choice options for the Central Govt. Employees. This enables more exposure to equity than the default central govt. scheme where a maximum of 15% is allocated to equity.

- Senior Employees:

- Those closer to retirement may find UPS more attractive due to the guaranteed pension and inflation adjustments, providing a stable income post-retirement.

In conclusion, the choice between UPS and NPS should be based on individual circumstances, including age, years of service left, and comfort with market risks. The government is expected to provide more guidance to help employees make informed decisions.

Please read our other articles based on Retirement Planning:

- UPS vs OPS: The 5 Key Differences You Should Know & How it Can Affect the Retirement Benefits

- NPS Withdrawal Rules Change In October 2023: PFRDA Modifies Withdrawal Exit And Bank Details Update Rules

- NPS Systematic Lump Sum Withdrawal Facility (SLW): New Withdrawal Rules Introduced by PFRDA In October 2023

- NPS Pension Fund Manager Choosing Rules Changed By PFRDA In November 2023: Investors Can Now Choose Up To 3 PFMs For Different Asset Classes

Subscribe

Please subscribe to our YouTube Channel here.

Your blog is a beacon of light in the often murky waters of online content. Your thoughtful analysis and insightful commentary never fail to leave a lasting impression. Keep up the amazing work!

Hi Neat post Theres an issue together with your web site in internet explorer may test this IE still is the marketplace chief and a good component of people will pass over your fantastic writing due to this problem

Your blog has become an indispensable resource for me. I’m always excited to see what new insights you have to offer. Thank you for consistently delivering top-notch content!

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do it Your writing style has been amazed me Thank you very nice article

I have read some excellent stuff here Definitely value bookmarking for revisiting I wonder how much effort you put to make the sort of excellent informative website